Have you ever heard of the term “cash runway?” If not, you’re not alone. Although it’s a critical concept for startups, it’s often misunderstood. In this post, we’ll define cash runway and explain how to use it to increase your startup’s chance of success. We’ll also offer tips on keeping your cash runway as long as possible. So, what are you waiting for? Let’s get started!

What Is Cash Runway?

In the startup world, the cash runway is the number of months until the cash runs out. Your cash runway can either be estimated using forecasts, or you can calculate it based on your burn rate. If your business is spending more than it takes in, it is burning cash. Your burn rate is your cash expenses minus cash revenues.

For example, a startup with $1 million in the bank and a burn rate of $50,000 per month has a cash runway of 20 months. Because cash runway is so important for startups, savvy founders and investors closely track how much runway a company has at any given time.

If you talk with an investor, they will simply ask “what is your runway?”. You need to respond in months.

If a startup’s cash runway starts to dwindle dangerously low, it may need to take measures to extend its runway, such as raising more money from investors.

Why Is Cash Runway Important?

Cash runway is important for startups because it shows how much money a company has to spend before it runs out of cash. Represented in months it literally tells you how many months you figuratively have till you are dead!

- It helps to track the company’s growth and profitability. This metric gives insight into whether a business is spending more than it takes in, and can spur corrective action.

- It is an espexcially important metric for startups, as investors closely monitor this figure to track the company’s progress.

- It can help a business determine what margins are comfortable, giving them a better understanding of their financial situation.

- For seasonal businesses, cash runway is an important tool for measuring performance during the slow season.

- A dangerously low runway can imply a startup is about to be insolvent. A healthy cash runway gives startups breathing room to make adjustments and improve their bottom line

For example, if a company’s cash runway is only six months, you may decide to raise money sooner rather than later to avoid running out of cash.

Similarly, if a company has a long cash runway, the owner may choose to invest in growth opportunities or build up cash reserves in case of an emergency.

Ultimately, cash runway is a key metric you need to keep track of to make sound decisions about the future of your business.

How Can Knowing Your Cash Runway Help Your Startup Succeed?

The first step to a successful startup is a great idea. But, as any experienced entrepreneur will tell you, a great idea is only the beginning. To enable your startup to succeed, you need the financial backing to live enough to see it through to get to profitability or an exit. That’s where the cash runway comes in.

Several factors go into calculating cash runway, including your money in the bank, your net burn rate (the rate at which you’re spending money), and your expected revenue. If you’re not sure how to calculate your cash runway, several online resources can help.

Once you know how much time you have, you can start making plans to ensure your startup succeeds. For example, if you have a limited time, you may need to focus on generating revenue quickly rather than on long-term growth.

Conversely, if you have a longer cash runway, you may be able to invest more in marketing or product development. No matter your situation, understanding your cash runway is an essential part of ensuring the success of your startup.

The three financials you as a founder need to be keeping on top of to manage your cash runway

Most businesses have to generate positive cash flow from operations to survive over the long haul (AKA bootstrapping). This is especially true for companies in the startup phase. Even well-established businesses can encounter cash flow problems that require attention. To keep things running smoothly, it’s essential to understand the 3 functions of runway cash flow.

Operating Cash Flow

This is the cash that your business generates from its day-to-day operations. It includes revenue from sales, customer reimbursement, and interest on invested funds. Operating cash flow is essential because it shows whether your business is generating enough cash to cover its expenses. If your business isn’t generating enough operating cash flow, it will eventually have to resort to other funding sources to stay afloat.

Capital Expenditures

The second type of runway cash flow is capital expenditures. This is the money that your business spends on major purchases, such as new equipment or real estate. Capital expenditures are essential because they can help your business grow and expand its operations. However, they can also strain your business’s cash reserves if they’re not carefully managed.

Financing Activities

The third type of runway cash flow is financing activities. This is the money your business raises by borrowing or selling equity. Financing activities can be a good way to raise capital for expansion or other major projects. However, they can also strain your business’s cash flow if not carefully managed.

How Do You Calculate Your Startup’s Cash Runway Period?

To calculate the cash runway, you need to know three things:

- the starting cash balance,

- the burn rate, and

- the projected raising capital.

The starting cash balance is how much money the startup has in the bank at the start of the period. The burn rate is the rate at which the startup is spending money. This can be expressed as a monthly or annual figure. The projected raising capital is how much money the startup expects to raise during the measured period. This can come from investors, loans, or other sources.

Once you have these three figures, you can calculate a few different cash runway metrics which will give you the number of months or years the startup has to operate before it exhausts its resources.

The basic formula is:

Cash Runway = Total Cash / Burn Rate

As things stand you can calculate your runway based on gross and net burn rates. These will tell you how long you have to live dependent if you can rely on your revenue or not.

You can find your company’s burn rate by looking at your past financial statements. You can also estimate your burn rate for future months by using forecasts. Once you have both pieces of information, plug them into the cash runway formula to get a better idea of how long your business can last without running out of cash.

If you don’t understand gross and net burn, I have a blog on that metric. You can read that here: Burn rate.

Next, you can then plan what your runway will be if you raise new funds. In that, you are calculating how much the new investment plus your existing cash reserves will take you till you need to raise again, given you are default dead without profitability.

What is a good cash runway?

If you are profitable you have an infinite runway! That’s obviously the best outcome, however, a lot of startups choose to not be profitable because they are more focused on growth. Many larger companies have the option to be profitable.

When you talk about a good cash runway, typically you talk about this in terms of how much money you are raising and the expenses you intend to incur. So if you raise $20m and you blog $1m a month, well your runway with the investment is going to be 20 months.

Typically startups should aim for 18 months runway with a new investment so they have a full year to execute and 6 months to raise a round to play this game again.

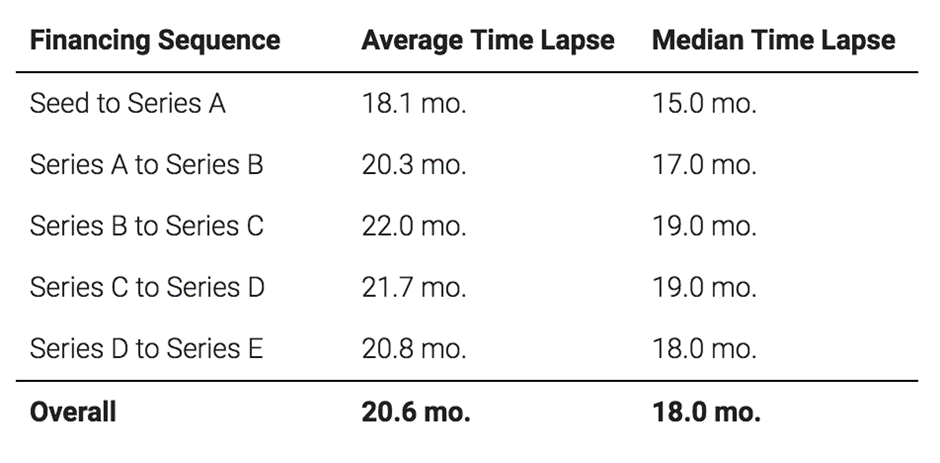

An analysis of venture capital funding data shows that my max 18 months is actually on the lower end.

The analysis asserts founders raise for 18-21 months of runway. On average, the longest time-lapse was 22 months between Series B and Series C rounds. Early-stage startups between seed and Series A seem to go for the 18 months of the runway which makes sense given the amount of cash they are getting vs the dilution.

Some Common Mistakes Startups Make When It Comes To Their Cash Runway

Starting a business is no small feat. In addition to the countless hours of planning and work that go into getting a new venture off the ground, startups also need to be mindful of their financial situation.

- Not accounting for seasonality: A cash runway can be shorter during the slow season for a business. This is normal and should be accounted for in your planning.

- Not understanding your burn rate: If you don’t understand your burn rate, you won’t be able to accurately calculate your cash runway.

- Underestimating expenses: It’s easy to underestimate how much cash a business will need to operate each month. Founders often underestimate how much cash they will need to keep the business running, and this can shorten their cash runway.

- Not forecasting revenue accurately: Forecasting revenue is difficult, but it’s important to do it as accurately as possible when calculating your cash runway. Overestimating revenue can lead to a longer runway than necessary while underestimating revenue can lead to a shorter runway.

- Not having a backup plan: Even if you do everything right, things can still go wrong. It’s important to have a backup plan in case of unexpected expenses or a decrease in revenue. This could include having a cash reserve or tapping into other sources of funding like investors or lines of credit.

- Failing to account for one-time expenses: One-time expenses like investments in new technology or marketing can significantly impact your cash flow runway.

- Ignoring cash reserves: Having cash reserves on hand can help you extend your cash runway in a pinch.

- Not planning for bumps in the road: Even the most well-planned businesses will face bumps in the road. Anticipating and planning for these bumps can help you avoid running out of cash.”

One common mistake that startups make is underestimating the importance of their cash runway. A startup’s cash runway is the amount of time it has to achieve profitability before running out of money. For many ventures, this window is incredibly tight.

Venture capital firms are typically only willing to provide funding for a limited time. If a startup doesn’t meet its milestones, it can be difficult to secure additional financing.

As a result, startups must clearly understand their cash runway from the outset. By being aware of the timeframe in which they need to achieve profitability, startups can make better use of their resources and improve their chances of success.

5 examples of startups that failed because they ran out of cash

Startups don’t die. They run out of cash. Here are examples of startups that seemed to be stars, but failed due to cash.

- Homejoy: Homejoy was a home cleaning startup that shut down in 2015 after running out of cash.

- Jawbone: Jawbone was a consumer electronics company that filed for bankruptcy in 2017.

- Beepi: Beepi was an online car marketplace that shut down in 2016.

- Zirtual: Zirtual was a virtual assistant company that went bankrupt in 2015. They blamed their CFO for not doing their calculations properly!

- Yerdle: Yerdle was an online second-hand marketplace that shut down in 2018.

Some Tips For Increasing Your Startup’s Cash Runway

You want to extend your startup’s runway as much as possible, and there are a few different ways to do this.

- Negotiate better terms with suppliers: Try to get discounts for paying early or in bulk.

- Streamline operations: Cut down on unnecessary spending and processes.

- Reduce employee costs: Evaluate your staffing needs and look for ways to reduce costs.

- Renegotiate leases: If your business is leasing office or storage space, see if you can negotiate a lower rate.

- Invest in technology: Invest in software and hardware that will save you money in the long run.

- Cut back on marketing expenses: Be strategic about how you spend your marketing dollars.

- Offer incentives for early payment: Offer customers a discount for paying their bills early.

- Raise prices: If necessary, adjust your prices to reflect the true cost of doing business.

- Find new sources of revenue: Explore new product lines or services that could bring in additional revenue streams.

- Get creative: There are always ways to reduce expenses or bring in more revenue – it just takes some creativity and perseverance

Extending your startup’s cash runway is essential for its long-term success, so it’s worth figuring out how to do it.

Wrap Up

In short, if you want to increase your startup’s chance of success, then focus on improving your cash runway. With a longer ending cash balance, you’ll have more time to achieve key milestones and reach profitability. And while it may be difficult to lengthen your runway at first, it’s definitely doable with creative thinking and hard work. So don’t give up, keep working towards extending your cash runway, and watch your startup’s chances for success increase.