Tl;dr: This is a simple accretion dilution model template excel model to quickly calculate if an acquisition will create value for a public company (or not)

As a public company executive, or banker trying to make a buck for a prospective client, you are always thinking about increasing shareholder value. Why? Well, senior leadership’s bonuses are frequently linked to it, as often are egos.

Large companies are often faced with a big question – how to grow! Same as a startup ironically, though they have the benefit of having 1/ cash on their balance sheet (burning a hole in their pocket) and, 2/ publicly traded shares with which to use. When faced with growth questions, buy often becomes a hot agenda topic.

But if you do a big deal or go on a shopping spree of smaller deals, the only question that should matter is: does this make the company more valuable relatively.  This is done by doing an accretion dilution analysis.

This is done by doing an accretion dilution analysis.

Accretion dilution analysis

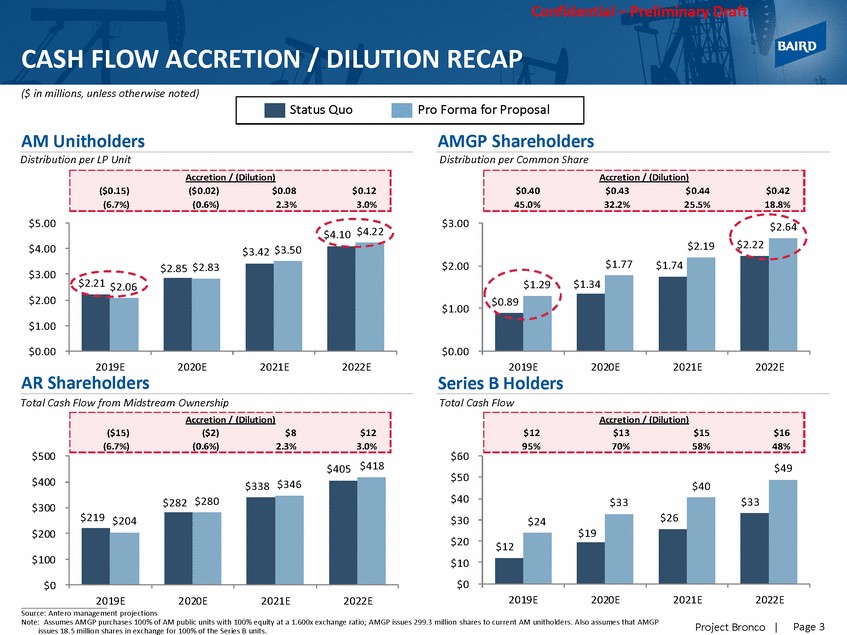

Accretion/dilution analysis tries to answer an important question when it comes to corporate acquisitions – does the deal create or destroy value for shareholders of the buyer? It shows this numerically.

The accretion/dilution analysis is typically undertaken by analysts at an investment bank (and presented by the MDs), or wonks in a corporate development team. In more nerdy terms, it’s a type of M&A financial modelling performed during the pre-deal phase to evaluate the effect of the transaction on shareholder value and to check whether EPS for buying shareholders will increase or decrease post-deal.

Um. EPS? That’s your earnings per share. It’s a really critical number public execs, analysts and shareholders track.

Like everything in life, it’s not theoretically hard to figure out if you have the right tools and the inputs to hand. You can make this as complicated or simple as you like. I like simple.

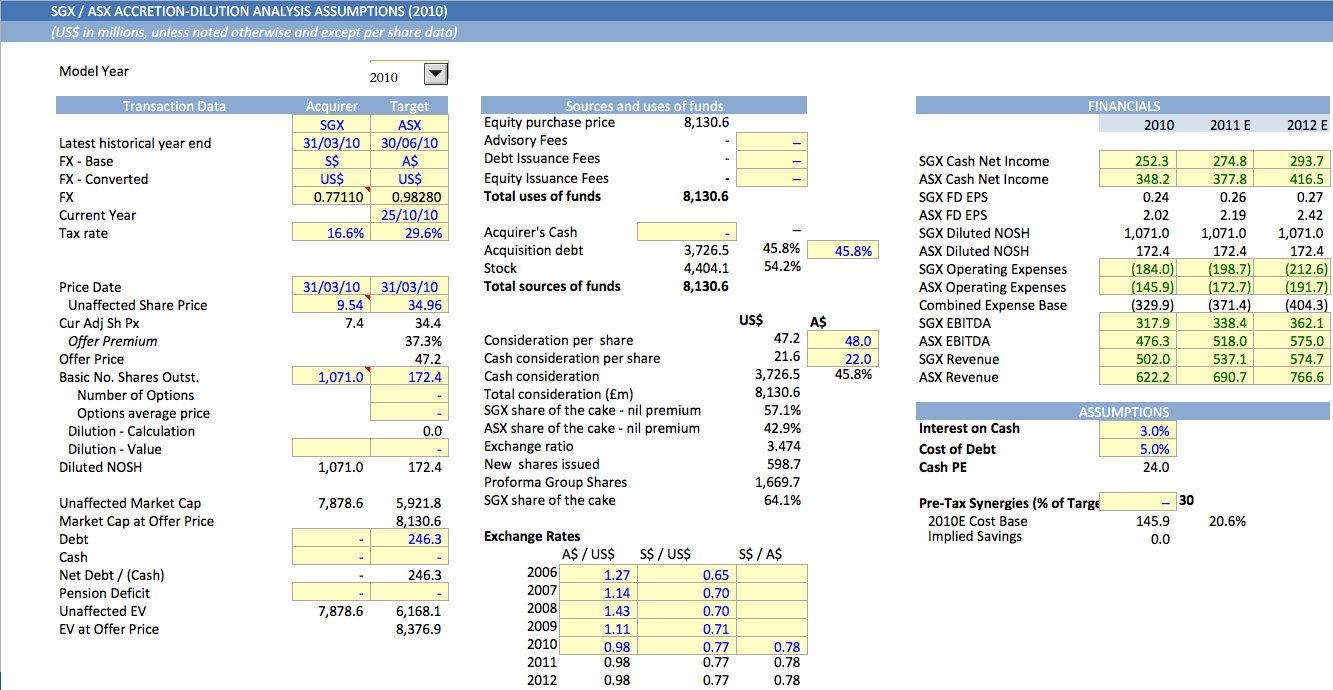

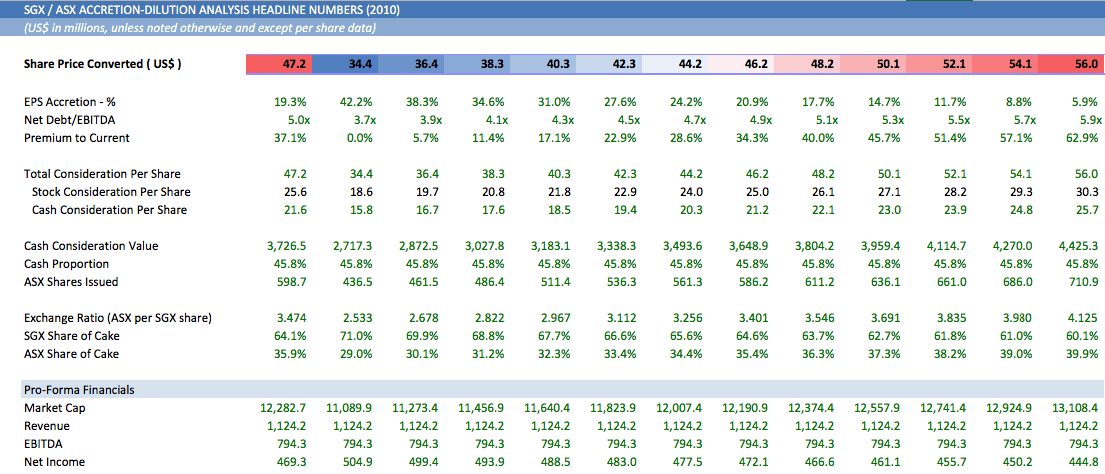

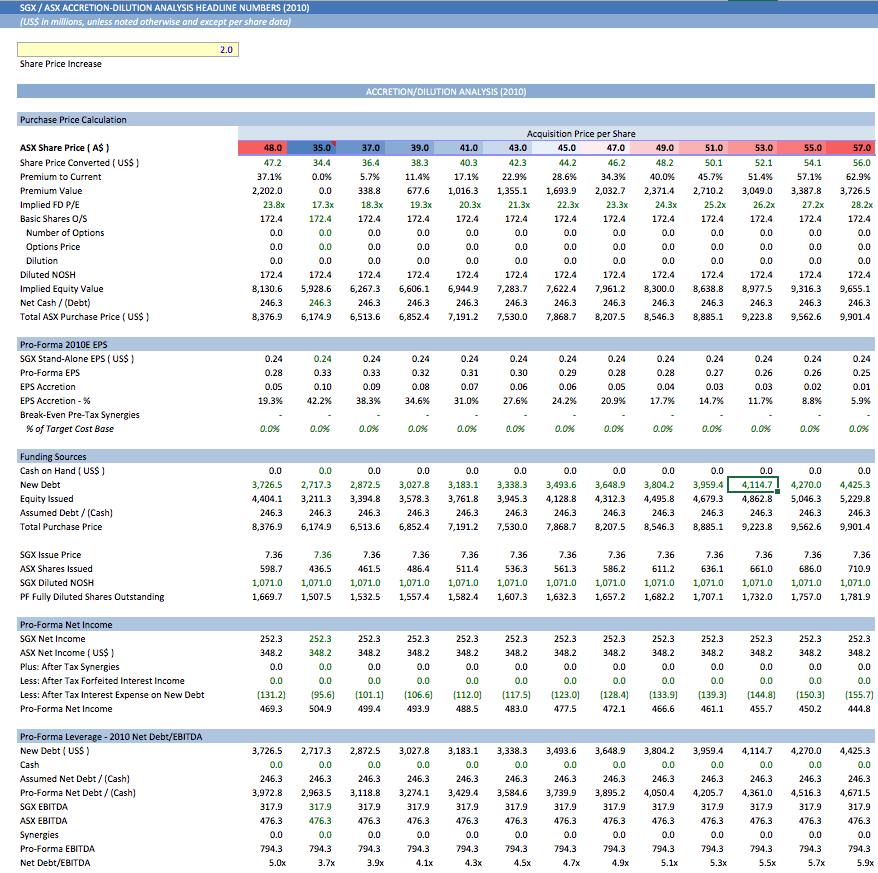

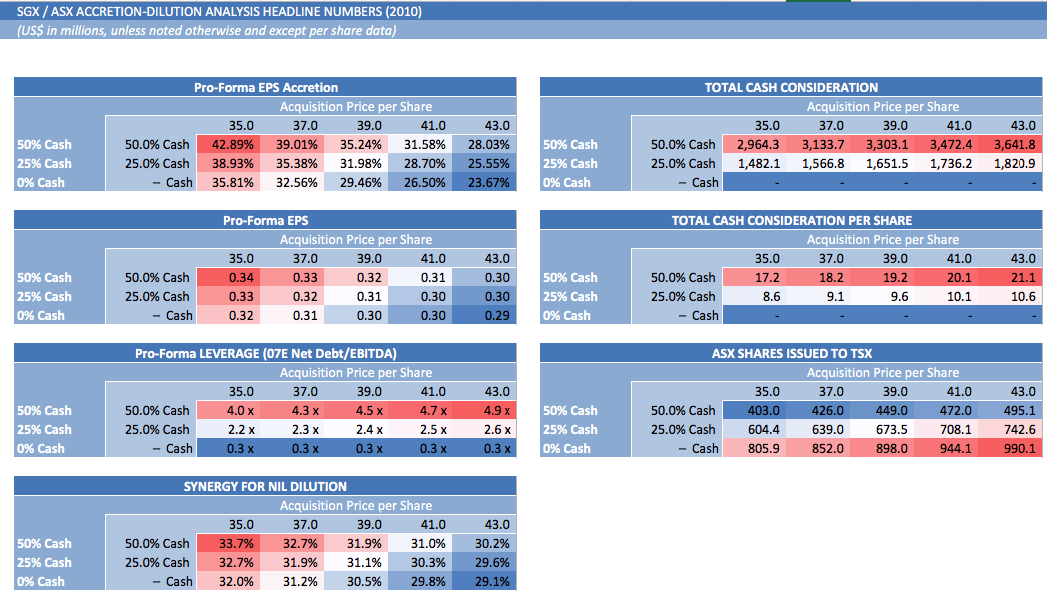

The accretion dilution template

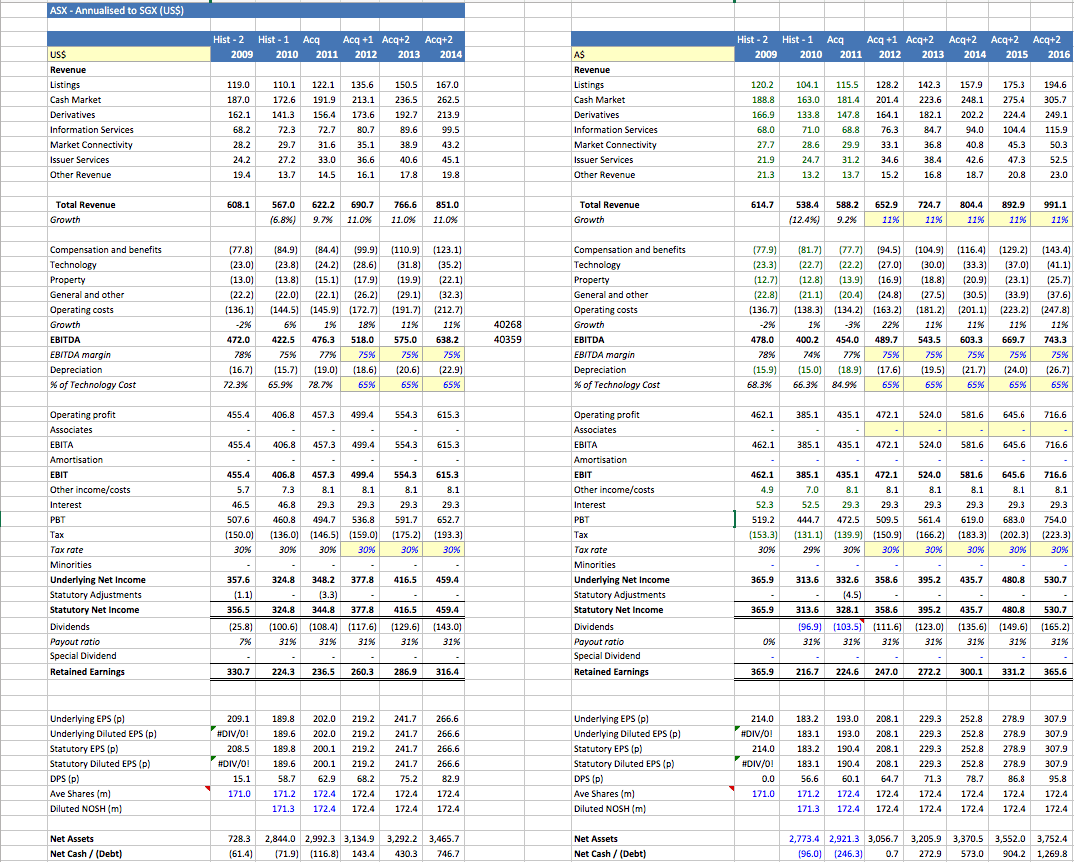

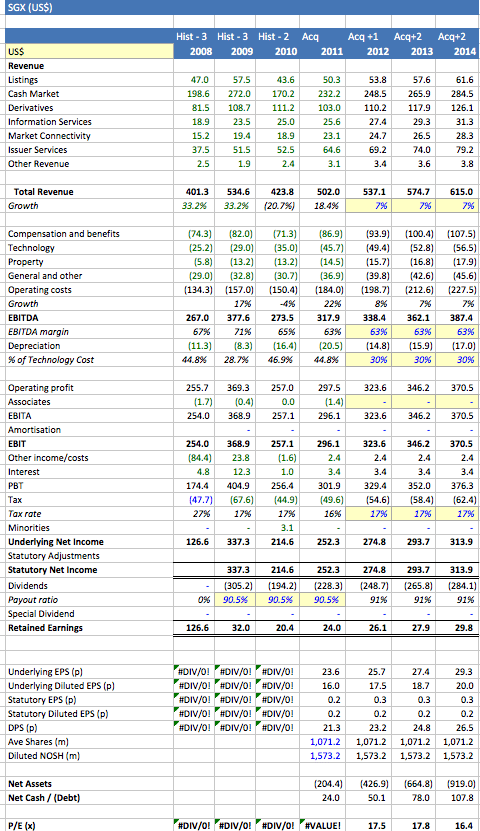

This is a simple model I did years back for fun whilst making a template to look at the effect of the SGX (Singapore stock exchange) acquiring the ASX (Australian stock exchange). It was in the news in 2010, so it seemed like something contemporary to base the template on. The proposed merger failed (Called a merger, but it was an acquisition) but the model has been hidden in Dropbox for a long time.

Like the Debt Capacity Calculator, this is a simple model to do a quick and dirty to share internally and get an initial impression. This is normal behaviour and a typical (thankless) task for juniors in M&A. Now, the models which get used surely get larger, but not that much more (I’ve worked briefly on exchange acquisition which died).

This model will be of use to:

- founders of reasonably sized startups that want to pitch themselves to a larger public company (there are some smaller listed companies, particularly on the ASX) and know what the potential impact of the exit would be to the acquirer

- analysts in banks that want to steal something they can use as a base, and maybe get a few learnings on exchanges (though this model is light for that purpose)

- anyone who wants to learn about excel. There are some cool little learnings to pick up like how to put tables on a separate sheet to the calculations

Slides of the accretion dilution model excel template

See real example of accretion/dilution slides

I pulled together the world’s largest collection of investment banking presentations to see for free.

If you want to see how accretion/dilution slides are actually presented in real investment banking presentations, you can check them out here.

Investment Banking Slide Examples of Accretion Dilution

Download the accretion dilution model

Comments 2

I’d be very interested to see your model.

Author

Charley-

It’s freely available for you to access.

Alexander