Hiring and retaining talent is hard. Be better

The only Excel model to structure an incentive structure to attract, promote, and retain your most valuable asset. Your team

- Competiton for talent is frankly insane. If you can find them, their options are how they get rich so they need to be motivated

- Most founders just tell lawyers "give me what is normal". How is that good enough given staff are your startup?

- As one founder said "how the heck do founders plan their staff plan without this tool?"

- This is the only ESOP planner in Excel in the world (That's literally the only reason I made it)

Setup and manage your ESOP structure for employee options

Create best in class structure to attract and retain your team through equity participation

Employee option management

An Employee Share Option Plan is how you grant options to your staff and how they vest over time. A more structured plan enables you to communicate a consistent and fair plan your staff can understand and not quibble about. This is the only Excel model which will heolp you set up and run your plan. You will tie this to your cap table and use it to build a hiring plan to negotiate when raising from investors.

Massive and complete

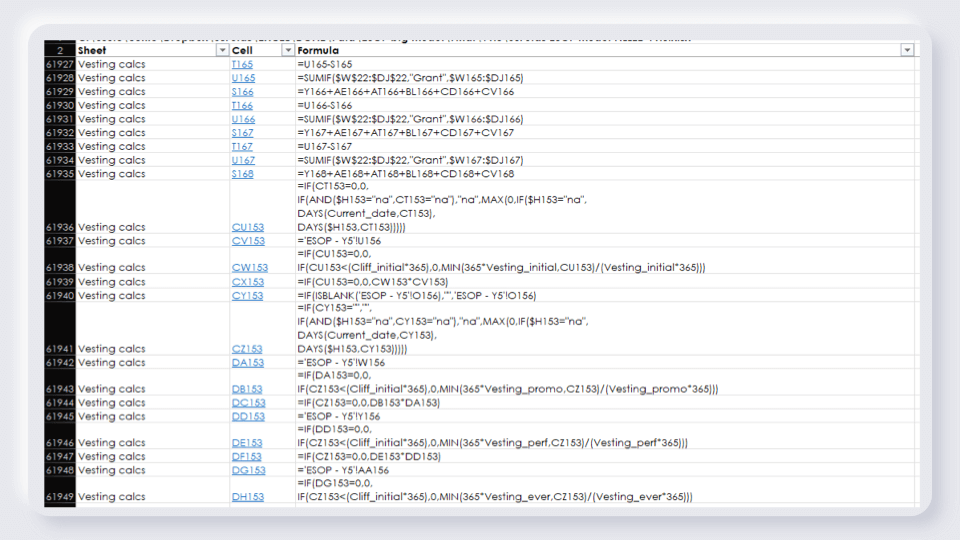

61,947 formulas across 14 sheets to do all the math for you

Heavy lifting done for you

You only need to input your assumptions into the yellow boxes and use the drop down menus. The model is fully integrated across sheets so choose your adventure and my math gives you accurate results

For those that want to impress

Negotiating with investors just got a lot easier. You have the tool to plan exactly what you want to do with your ESOP pool and how large you need to make it. You also have the ability to proactively excite staff to show them what their options are worth now and in the future

This is NOT for wannabees

Anyone can learn to use this tool. It is designed for pro founders though that understand the value of staff equity and want to take it seriously this time. You can do what you didn't know you could do easily now

It is 100% worth every cent

2 reasons: 1/ you couldn't even hire someone to make this, 2/ it's not a model- it's a structured learning process. You need to use it to understand what I'm saying

There are a lot of cool features under the hood

An insightful and useful model needs to work for you, not against you.

My models do require thought on inputs, but I walk you step by step with everything you need to do to support you to derive all the outputs that you need without any coding.

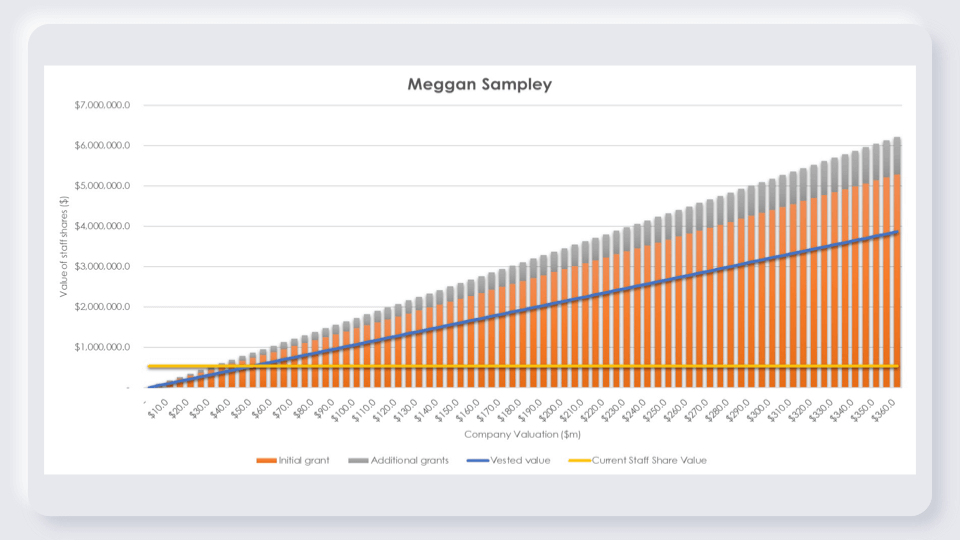

Enage your team by showing them the value of their options

Visualise with staff how much their options will be worth depending on the exit you achieve together

- Clarify what success will mean to them

- Show the $ value of their vested, and unvested options

- Pull up each staff with a drop-down menu

- Visualise how much money employees can make

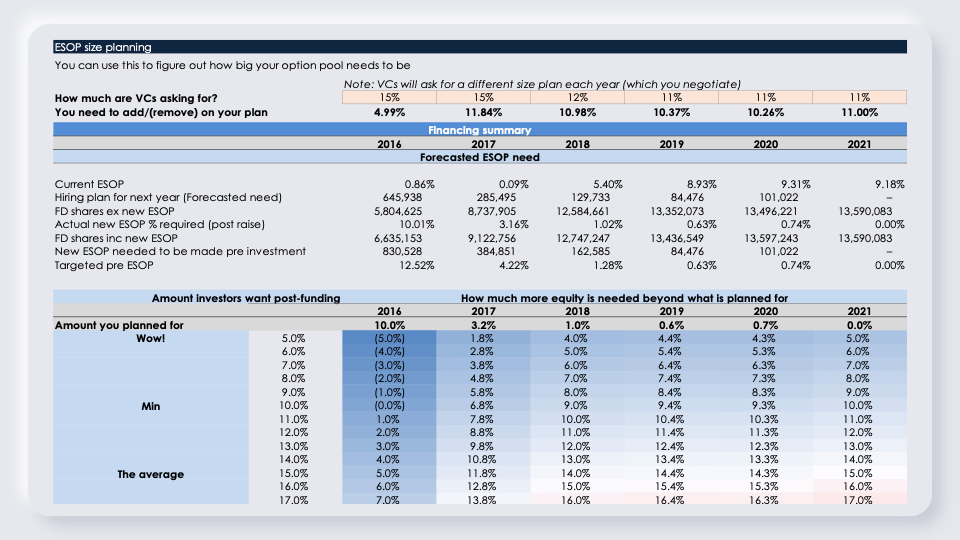

Plan the size of the ESOP you need to make for each round

Create just the plan you need for the stage you are at.

- Compare what investors are asking for against the size of your current ESOP

- Plan your ESOP over 5 years and see the potential impact

- Build your hiring plan to negotiate with VCs so you avoid unnecessary dilution

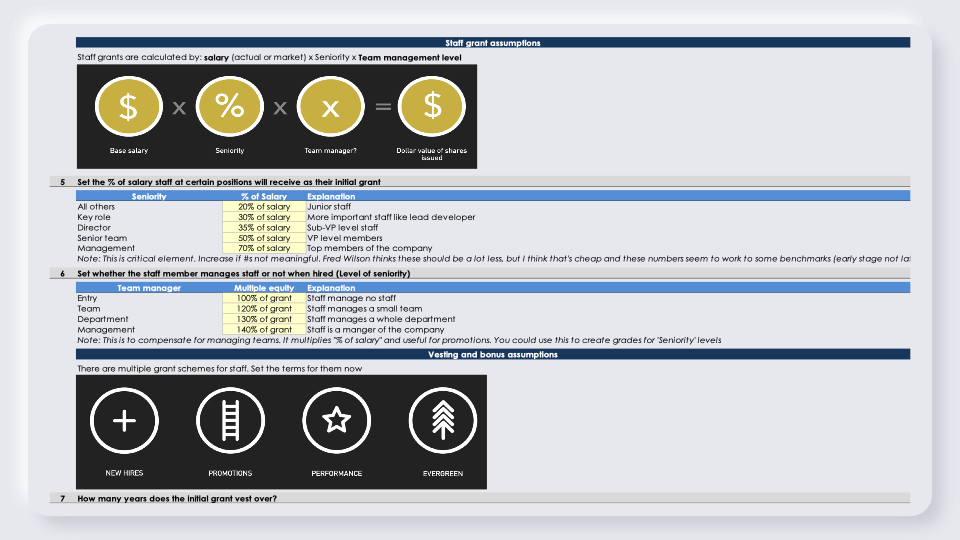

Create a structured ESOP in simple steps

Follow steps to create a program based on VC best practice

- Create a professional program without much thought

- Market assumptions pre-selected for you to use (if you don't know better)

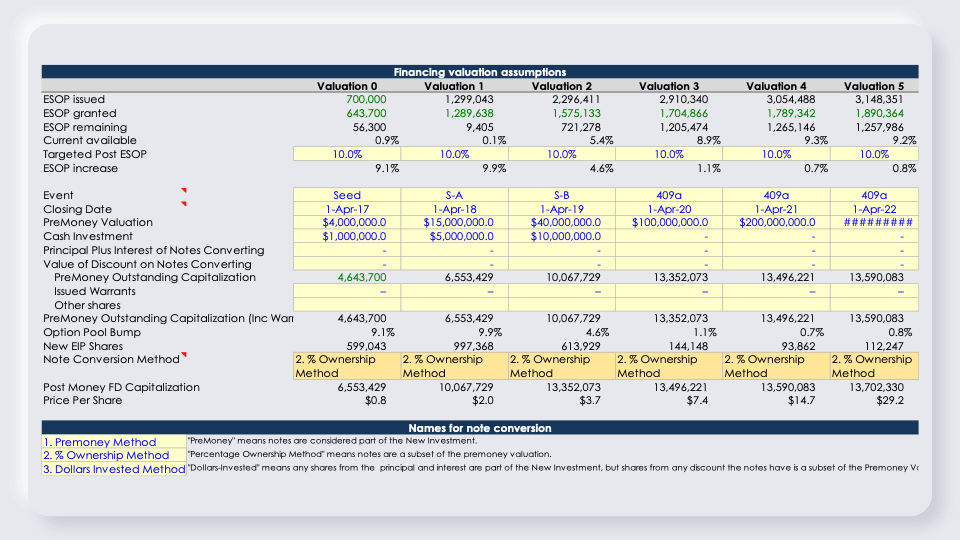

Run scenarios to see the potential impact of funding rounds on dilution

See the how potential rounds could impact you.

- Quickly input 6 years of funding rounds to plan your future

- Do both priced and convertible rounds

- Time based math enables you to understand exact situation

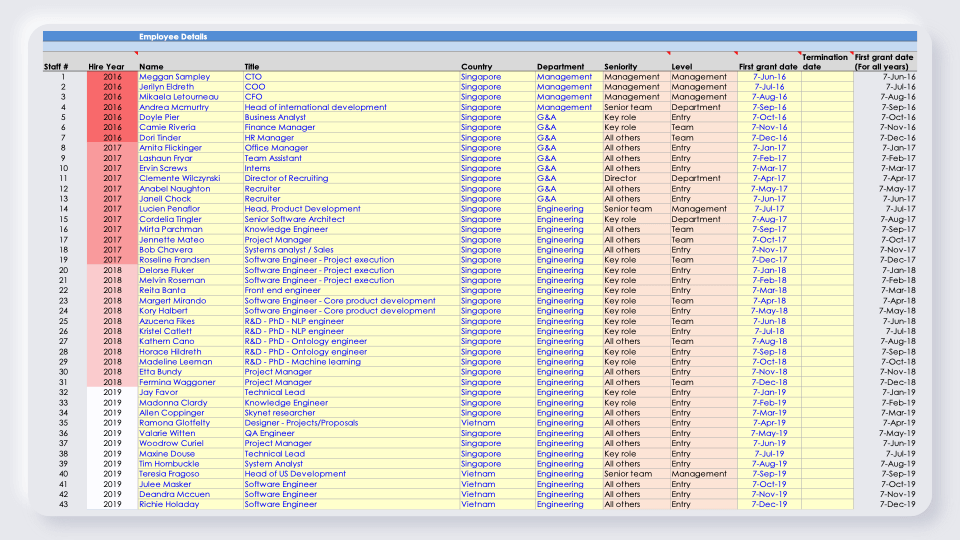

Maintain staff in one sheet and the model populates automatically across sheets

Model is structured to be simple to use and maintain with conditional formatting built in.

- Maintain current and terminated employees

- Set up starting grants to all staff

- Track up to 150 staff

Track ESOP year on year for 5 years

The model is designed to be easy to understand and be as consistent as possible to avoid mistakes.

- Each year has one sheet for annual planning

- Consistent structure to understand and track your structure

- Easily understand who was awarded what kind of grant

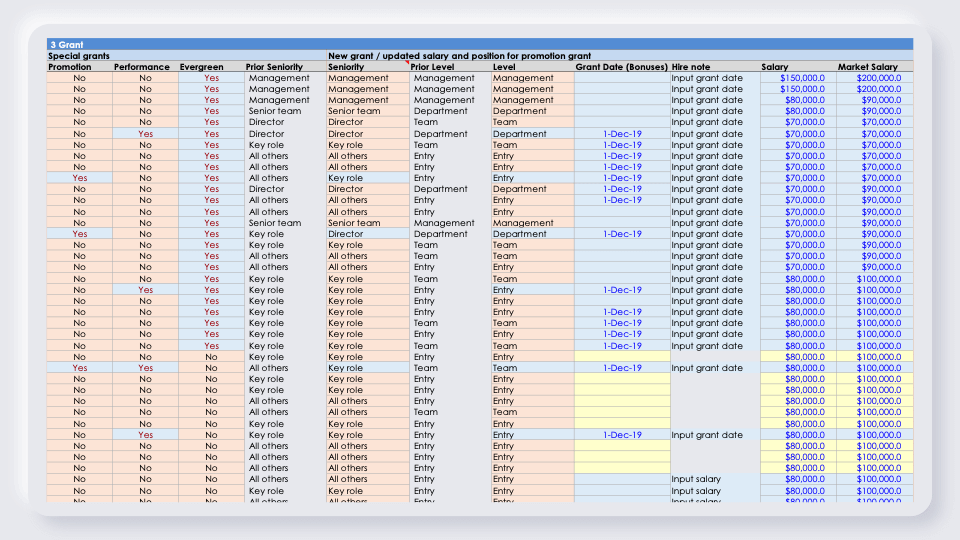

Grant performance and retention schemes with drop down menus

I've modeled this to be ridiculously simple to use once you understand the foundational concepts.

- Grant promotion, performance, and evergreen incentives annually

- Drop down No to Yes and the math for your scheme is automatically applied

- Salary changes can be input and all the math is applied as needed

Heavy lifting done for you

The model was a lot of work! But I've tried to hide as many formulas as possible to not overwhelm you to leave you to only see outputs and inputs.

- 61,947 formulas do all the calculations for you

- Just fill in assumption boxes and review the outcomes

- Completely open model, you can check all the formulas

Excel

Unlocked

Integrated

- Excel financial model

- Built for PC and Mac

- Not for Google Sheets

- Entire model is editable by you

- Nothing is locked or restricted

- Fully integrated model

- Each sheet acts as a module connected to each other which update immediately

Updates

No modeling needed

Easy to maintain

- Model is updated with new features

- I'll email you updates when they're done

- Everything works out of the box

- Just input your assumptions

- Designed to be easy to as you need

- Add new hires, update annual plans

Support

Make Plans

Scenarios

- If you're really stuck, ping me an email or catch me if I'm online and I'll help you figure out what to do for free

- You can hire me per hour if you need a lot of help on whatever it is you need

- Develop a hiring plan and see how many options you need to create and what is left to issue to existing and new hires

- Run scenarios to see the potential impact of funding rounds on dilution

FOR ALL TYPES OF STARTUPS

Model designed to work with literally any company that offers options to staff

"Equity ownership is not only important for aligning incentives between founders and investors, but crucially it drives alignment across the entire organization."

Luciana Lixandru, Sequoia Partner

It's worth the price to have one thing in your life that is absolutely perfect.

2 pricing options

Get a filled in model or the filled in model + a blank version of the file.

Filled in model

Filled in + blank

- The base model has been populated with numbers so you can see how it works

- You can edit it however you want

- This version comes with 2 Excel files

- In addition there is a blank version of the file with no assumptions in it to save you time

Quick walkthrough

Here's me explaining the video fairly briefly and pretending to enjoy it

The step by step ESOP template guide

To make it easy to use this model, I mapped out how to use the ESOP example step by step in this presentation. You’ll have your kick ass ESOP plan up and running in no time!

Free training video

This is a detailed guide on how to use and fill in the ESOP model

Who the heck is hawking me a financial model!?

Hey! It's me Alexander Jarvis. I like Excel and I love solving hard things.

- I'm the #1 seller of startup financial models in the world

- Worked in M&A (Lazard financial institutions group)

- I intimately know startup and what VCs care about having done both for over 10 years

- TEDx, Top Quora Writer, accelerator mentor, fund advisor etc

- I don't like bragging, so just read my blog and download free tools to see if I know what I'm talking about

Want to know more?

Let's run through details and answer your FAQs

Details on the model

FAQ

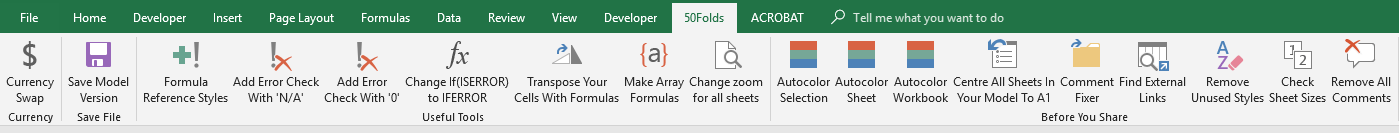

Want this model in a different currency? Now you can!

Convert all currencies in the model into one of 17 different currencies with a button mash

This model uses formatted currencies in $ (Why I use US Dollars). I often get asked if it is available in other currencies such as €? So I made an Excel PC addin to do that (It was hard!)

At the press of a button you can now convert the model into 17 different currencies. You just need to purchase the productivity addin.

Here are the currencies you can use with the macro:

| Currency list | The format you will see |

| EUR | € |

| USD | $ |

| GBP | £ |

| YEN | ¥ |

| INR | ₹ |

| Krone | kr |

| BAHT | ฿ |

| RUB | ₽ |

| Peso | ₱ |

| BRL | R$ |

| RM | RM |

| Rp | Rp |

| HKD | HK$ |

| ILS | ₪ |

| KPW | ₩ |

| RMB | ¥ |

| CHF | CHF |

Part of the productivity addin

All my favourite hacks and time saving tools in one place

More than likely, you aren't a huge Excel nerd like me, so you probably don't know about macros? These are hacks to make modeling in Excel much more faster and less painful. I love them!

I've been making models for years, so you can be sure I know what is useful and what is not. I decided to not just make the currency conversion macro, but add in all my most used hacks. You just hit a button and it will do handy things.

What can you do?

- Automatically format your cells so they have 'investment banking' standard black, blue and green

- Change the zoom and cell position of every sheet so it looks great when others read it

- Save a backup of your model (v1, v2, v3) at the push of a button so you never get a corrupt model

- Add error checks to your formulas

- And a whole bunch of other nerdy things you'll understand when you are making models yourself!

NOTE:

- Currency conversion only works on 50Folds models. It won't on any other model (My code looks for certain cells... There is a hack- ask if you want to know)

2 pricing options

Get a filled in model or the filled in model + a blank version of the file.

Filled in model

Filled in + blank

- The base model has been populated with numbers so you can see how it works

- You can edit it however you want

- This version comes with 2 Excel files

- In addition there is a blank version of the file with no assumptions in it to save you time

Purchase guide and note

Let's just get clear so you know how it works and what to expect

Buying models

Getting the model

- Payment and delivery of the model is 100% automated!

- It's hosted on SamCart and payment is via Stripe (Secure)

- There are no refunds. These are digital goods you can't return

- If you have questions ask me first in the chat or via email

- If you aren't sure if this is the right model for you, ask me!

- After you buy you get confirmation emails from SamCart

- Delivery of the model is automated

- Note: I don't know why, but occasionally it can take an hour

- The file comes in a zip file. You need to unzip it (e.g. WinZip)

- If you're really stuck, ping me an email or via chat box!

Comments 8

Alexander, do you have a legal template for this? Lawyers are expensive and it would be helpful to get a template that a lawyer can tune?

Author

Justin – Since we are talking legal ownership, you would want to account for this in a cap table. I have one that I’ll try get done. This is for having a solid overview and for planning purposes, but I wouldn’t use it as a legal document.

HI Justin, very nice and comprehensive model! Saved me weeks thank a lot!

Have a question: We closed a Series A Prefered at a valuation of $47M, share price $56. A couple month later we did a 409a and it come in at a equity value of common of $15M and a shareprice of common of $11. Which should I use? Should I exclude the preferred shares from the shares amount? What shoudl I input in Assumptions D114

Author

Hi Matias –

Justin asked a question too…

Thanks for the feedback 😉

You did a raise and the valuation of the PREFERENCE shares was set at a price of $56.

If you did a 409A valuation for the COMMON with the goal of setting a strike price for options, which requires the FMV of a price per share of common stock, then the price for the common shares is $11.

Institutional fundraising are done through a different class of stock (PREFERENCE) with better rights.

Your 409A valuation firm basically said there is a difference between the two types of classes of share to justify a lower valuation for the common (and hence the strike price of the options) than what the investors paid for the preferred.

The one you care about for the strike price for your staff is therefore $11.

Hello.

I am interested in writing guest post for your blog. Are you currently accepting

guest post.

Regard’s Angela. For a guest post.

Author

Alma- I haven’t allowed any guest post to date. I only will post high-value content for startups and investors and not some rubbish for backlink purposes.

Alexander

Thanks for your post.

Author

Thanks Qasim