Take control of your startup ownership

The most detailed Excel model to to track financing rounds that you can buy on the internet

- Understanding the effect of multiple funding rounds can get really, really complicated! I could only find simple, free tools online so I made something that could do everything, and now investors, lawyers and financial advisors use it themselves

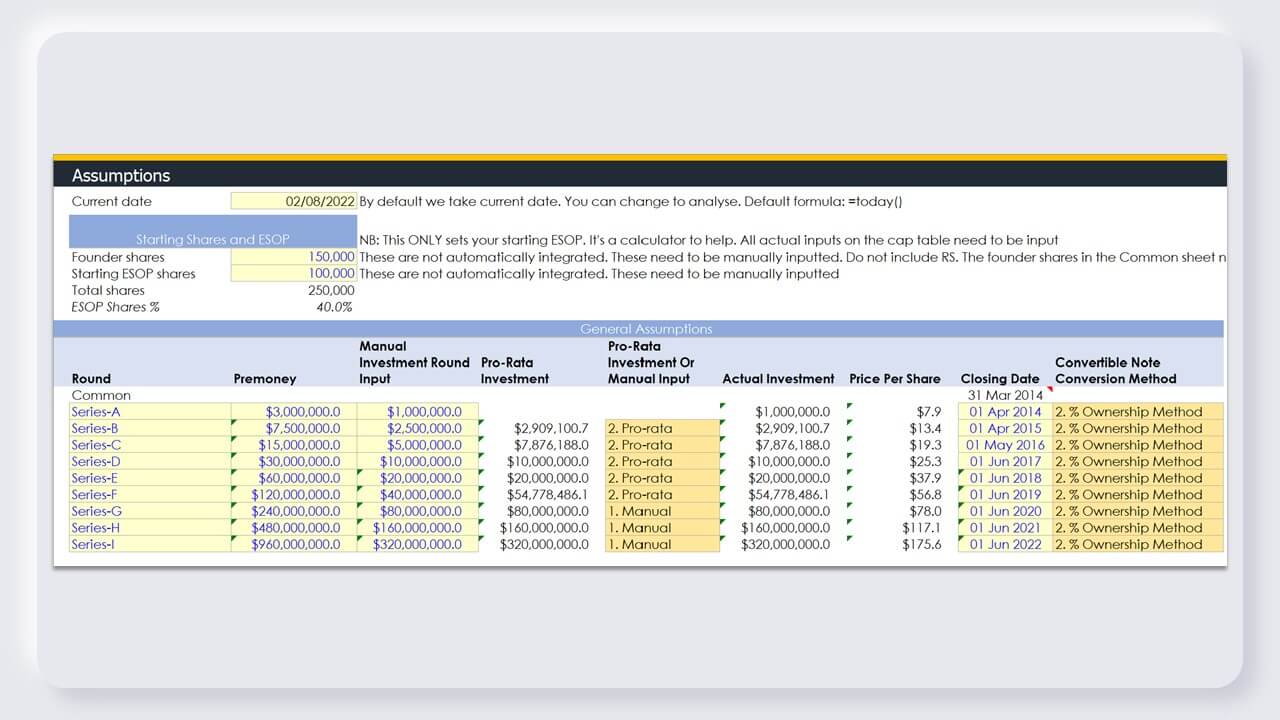

- The model is designed for you to start using at your first round with a convertible note, then to grow with you all the way up to your Series-I round so you don't need to keep paying a lawyer to build out the model for you to save thousands of Dollars

- This powerful model will enable you to evaluate the effect of future fundraises and through waterfall analysis see the returns to investors, founders, and your employees

Setup and manage your startup's capitalisation table

Impress existing and potential investors with how on top of your business you are

Cap table

Who owns what’s in your startup? It is an excel spreadsheet that shows the pro forma ownership of your startup in a ledger at different periods of time. It is a list of the shareholders and how much each person owns. It tells you how much money you will make if you exit, which is what I am sure you want to know!

Massive and complete

28,552 formulas across 23 sheets to do all the complex math for you

Heavy lifting done for you

You only need to input your assumptions into the yellow boxes and use the drop down menus. The model is fully integrated across sheets so choose your adventure and my math gives you accurate results

For those that want to impress

Negotiating with investors just got a lot easier. You have the tool to plan exactly what you want to do with your ESOP pool and how large you need to make it. You also have the ability to proactively excite staff to show them what their options are worth now and in the future

This is NOT for wannabees

Anyone can learn to use this tool. It is designed for pro founders though that understand the value of staff equity and want to take it seriously this time. You can do what you didn't know you could do easily now

It is 100% worth every cent

2 reasons: 1/ you couldn't even hire someone to make this, 2/ it's not a model- it's a structured learning process. You need to use it to understand what I'm saying

There are a lot of cool features under the hood

An insightful and useful model needs to work for you, not against you.

My models do require knowing your inputs, but I walk you step by step with everything you need to do to support you to derive all the outputs that you need without any coding.

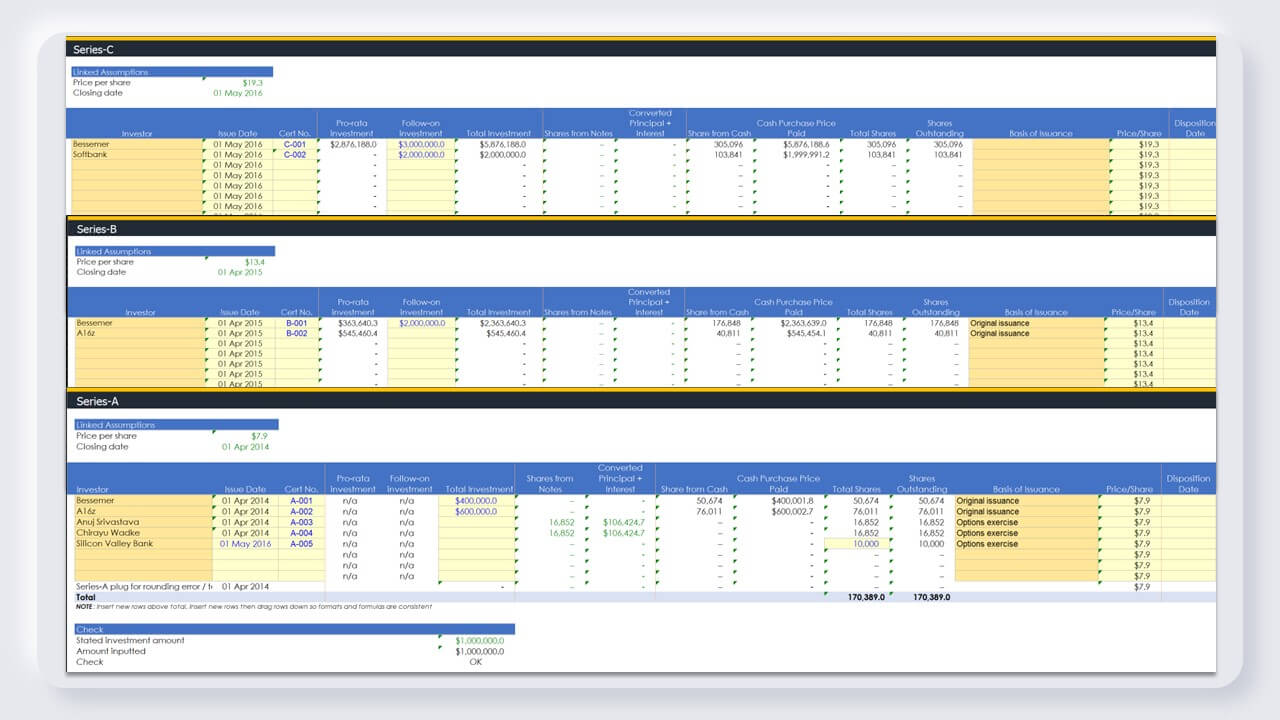

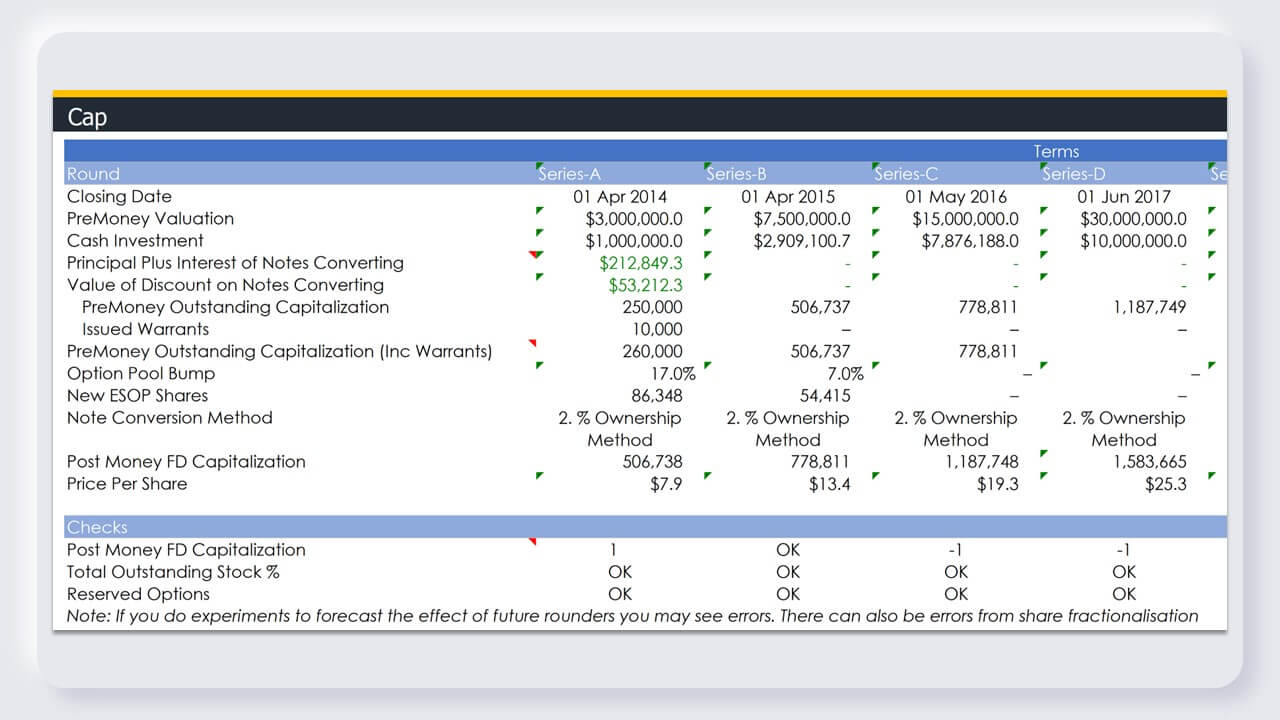

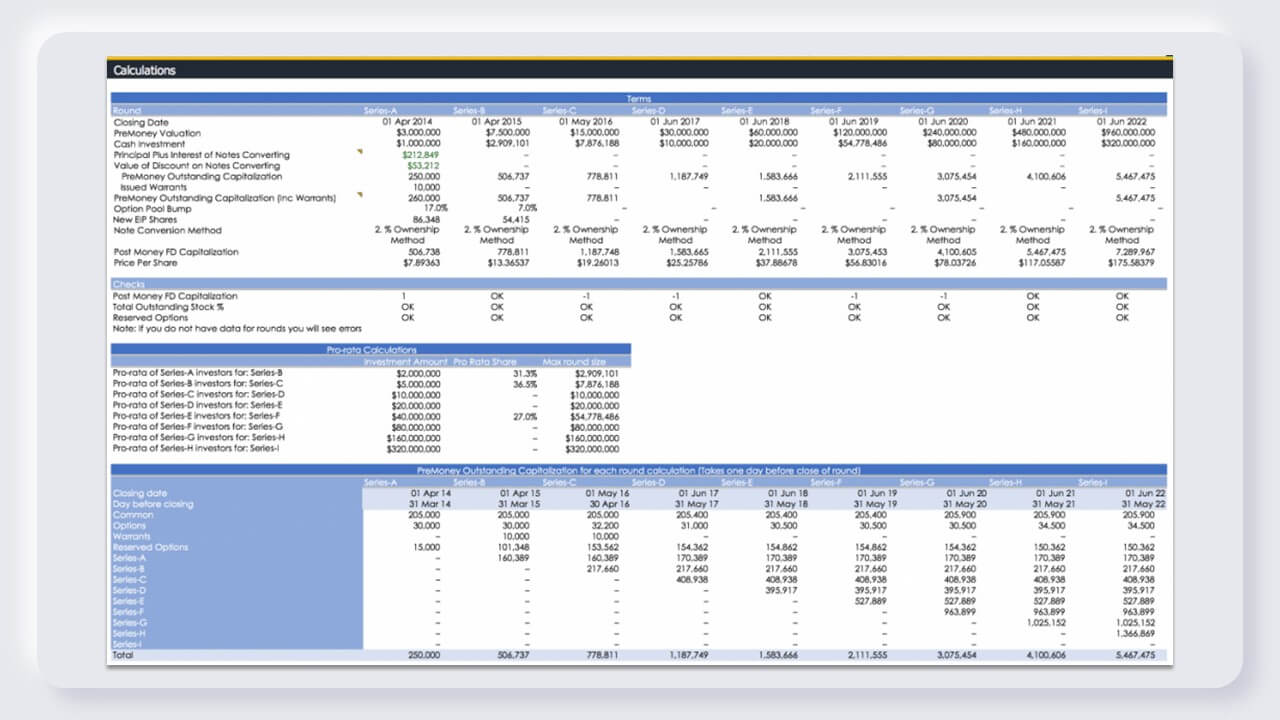

Multiple funding rounds

- Every sheet, from common to preference series and warrants and options have their own sheet

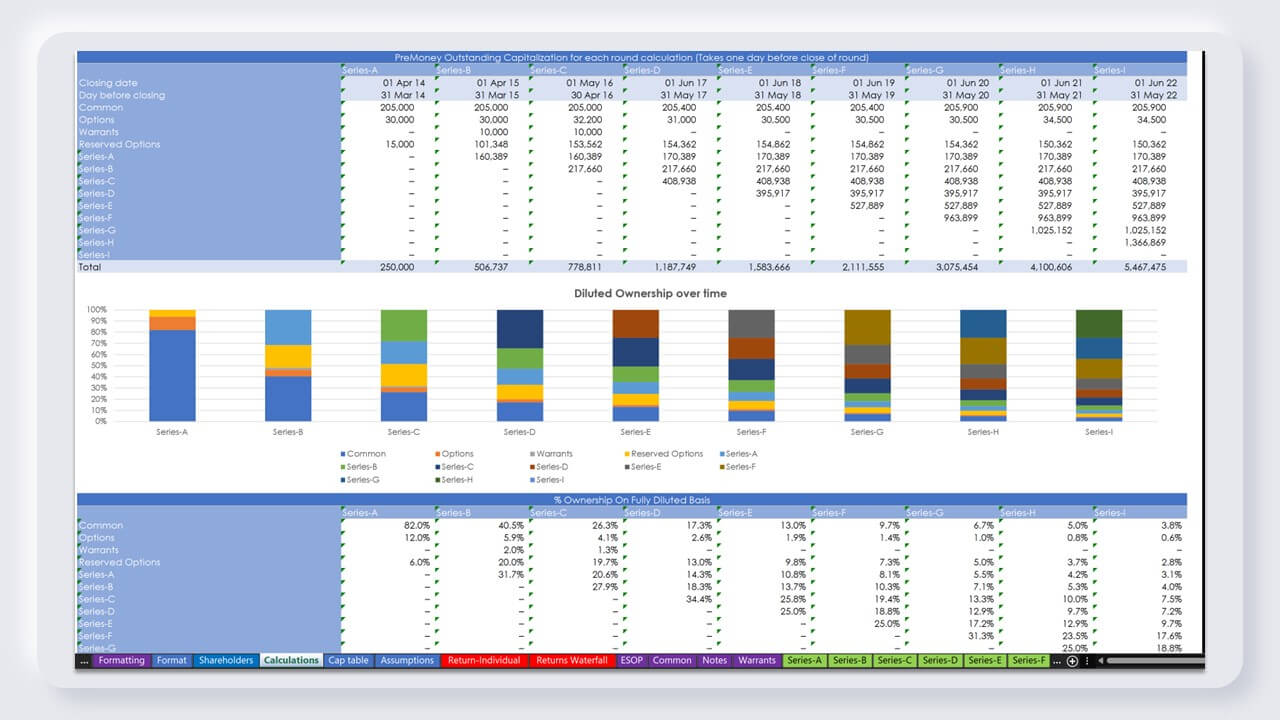

- You can do as many convertible notes as you want. Once you start doing priced rounds you can track more rounds that wound be needed. There are unique sheets from series-A to Series I, to illustrate granular insights and total visibility.

- All the ledgers present in the capitalization table sheet have a consistent format. You only need to pick their name from a drop-down list to add new staff/investors.

- There are capitalization tables for common (the starting sheet) up to series-I. I made sure that you will be able to cover as many rounds as possible!

- If you do a series-aa, no worries, it’s just another class of share. The model allows you to have 9 series of preference share, on top of common types. That’s a lot!

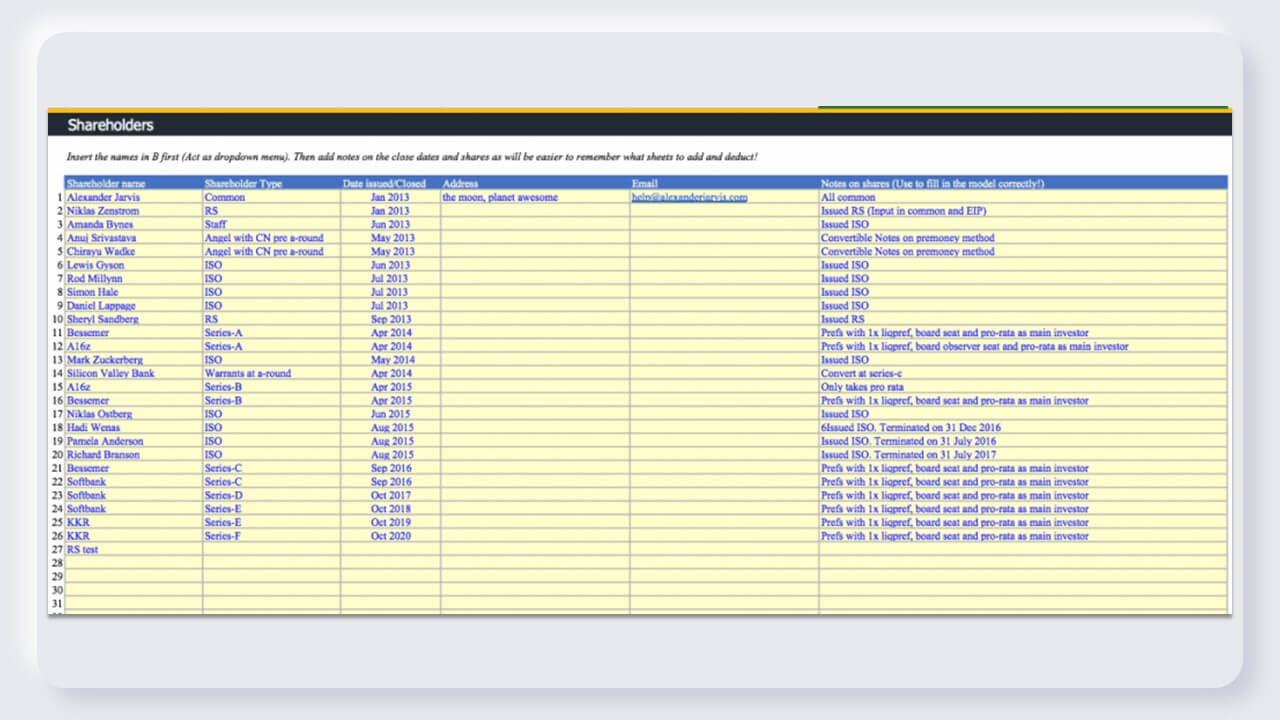

Manage all your shareholders from one sheet

- Input each and every investor in one sheet. Keep track of all key details regarding their investment and terms. This will serve to drive the entire model to ensure that the sheets serve as an index to have total consistency across the model

- You can use this sheet to track emails, addresses, and make notes on the investor terms so you can keep on top of who has what without then digging into sheets

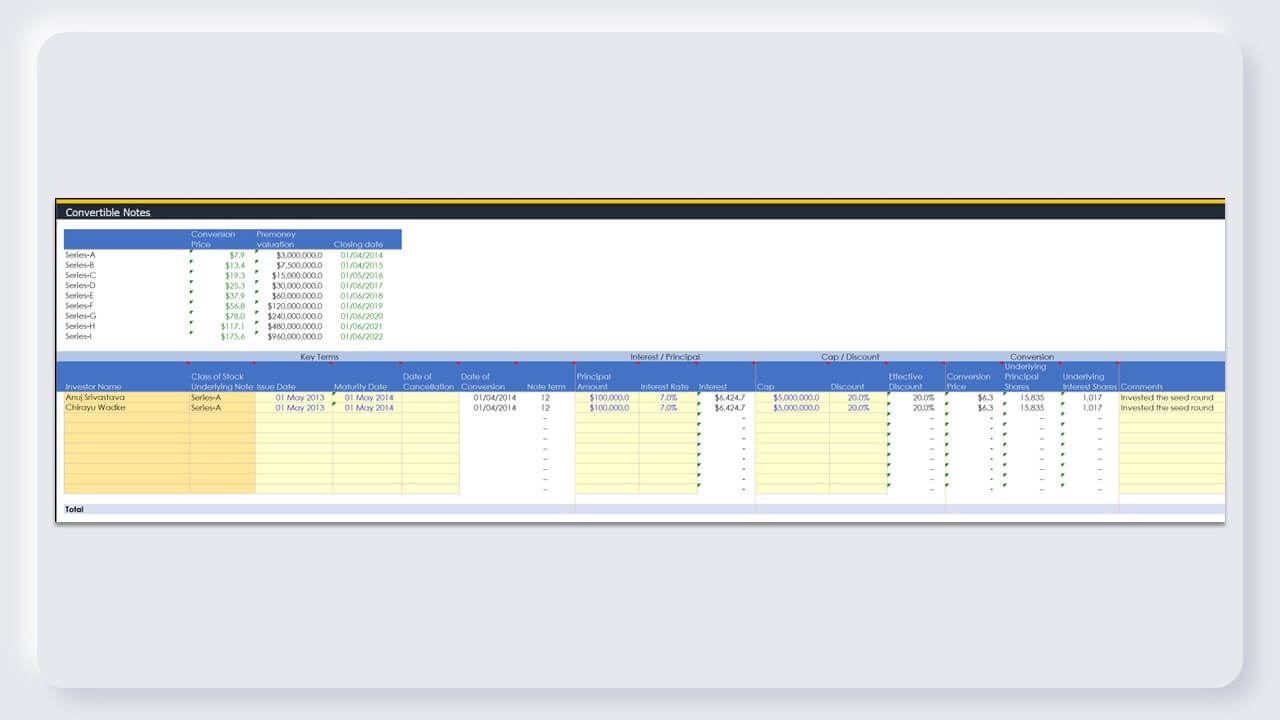

Manage convertible notes

- Have multiple convertibles for each class of underlying note

- Set issue and maturity dates. Cancel notes. Set the principal and interest rate, as well as discount and cap.

- See effective discount rates, conversion price, underlying principal shares and interest shares. Comment as you need to track any changes as they happen.

Enable investors to do their pro-rata with a drop down

- A cool thing I built in the model is the ability to press a button and automatically pro-rata investors. This is really handy if you want to run some scenarios about what might be left in a competitive round. Normally, that would involve a load of manual inputs, which would take time to do. In this model it’s as easy as clicking yes or no in a dropdown

- This will automatically feed into each of the cap sheets where calculations are done for you

- Two columns across cap sheets highlight if investors do pro-rata and follow-on investment

- For the next round you can insert whether an investor has ‘majority investor rights‘ and if they ‘participate‘ for their pro-rata.

Deal with your ESOP

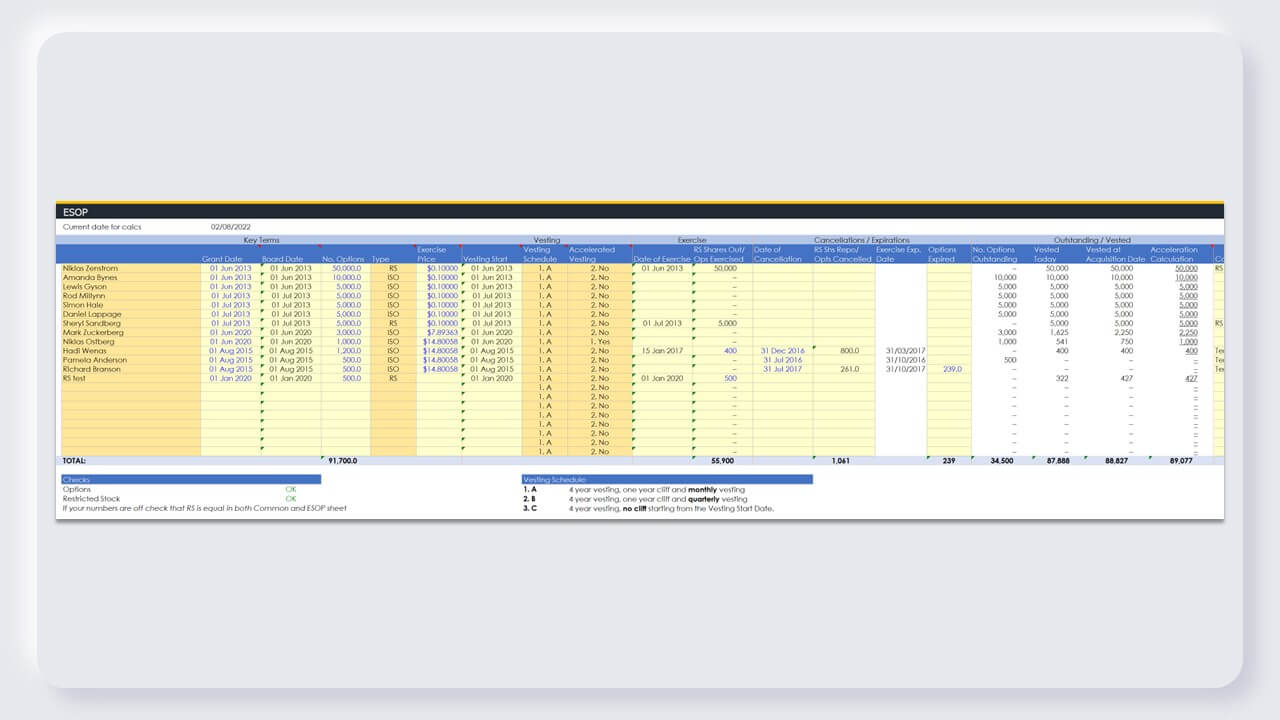

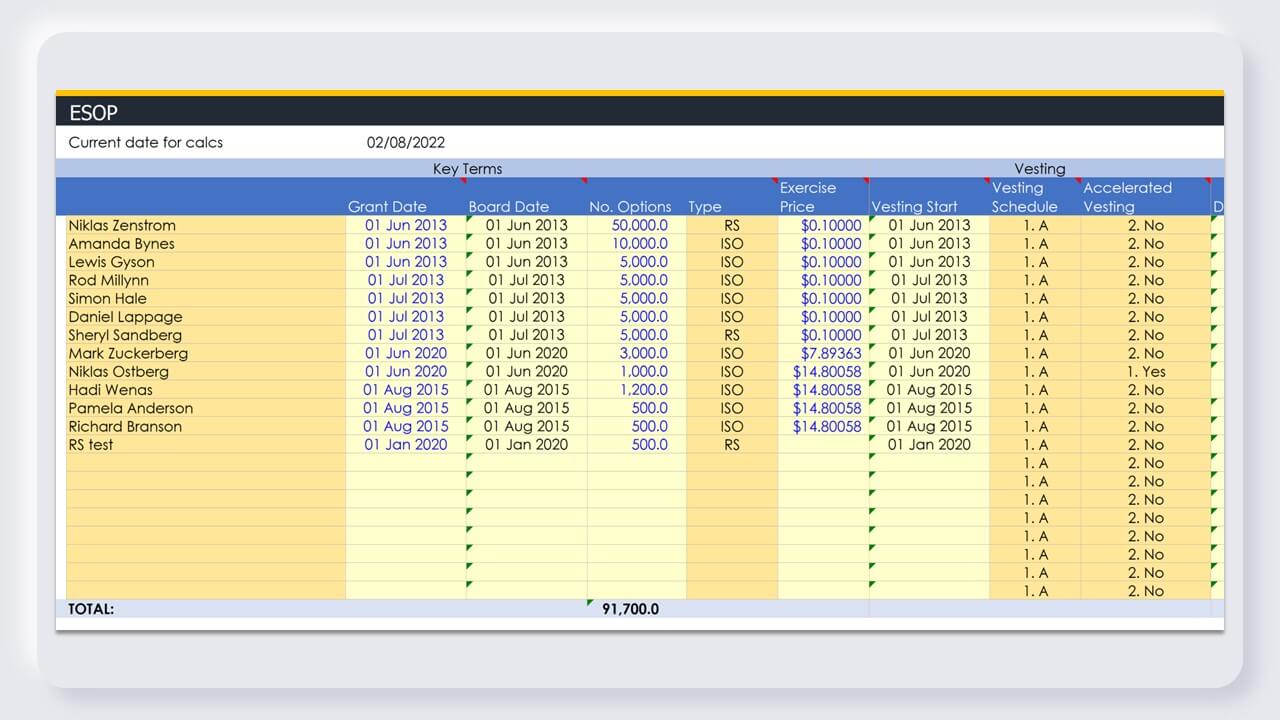

- Track each staff member in your ESOP with name, grant date (and add board approval date!), number of options, type of option, exercise price and vesting start date

- Model accounts for three types of ESOP: RS, ISO, and NSO

- Set 3 of the most common vesting schedule with drop-down (4y monthly, 4y, quarterly, and 4y no cliff)

- Set whether options have accelerated vesting at the exit with dropdown

- Track exercise and keep on top of cancellations, repurchases, and expiration

- See the status of outstanding options, current vesting, vested at the acquisition date, and the acceleration calculation (as applicable)

Accommodate different vesting schedules and even accelerated vesting

- The model has built-in three vesting schedules to pick from (you can build your own if you do something weird). I’ve built the three most common options down (4y monthly, 4y, quarterly, and 4y no cliff)

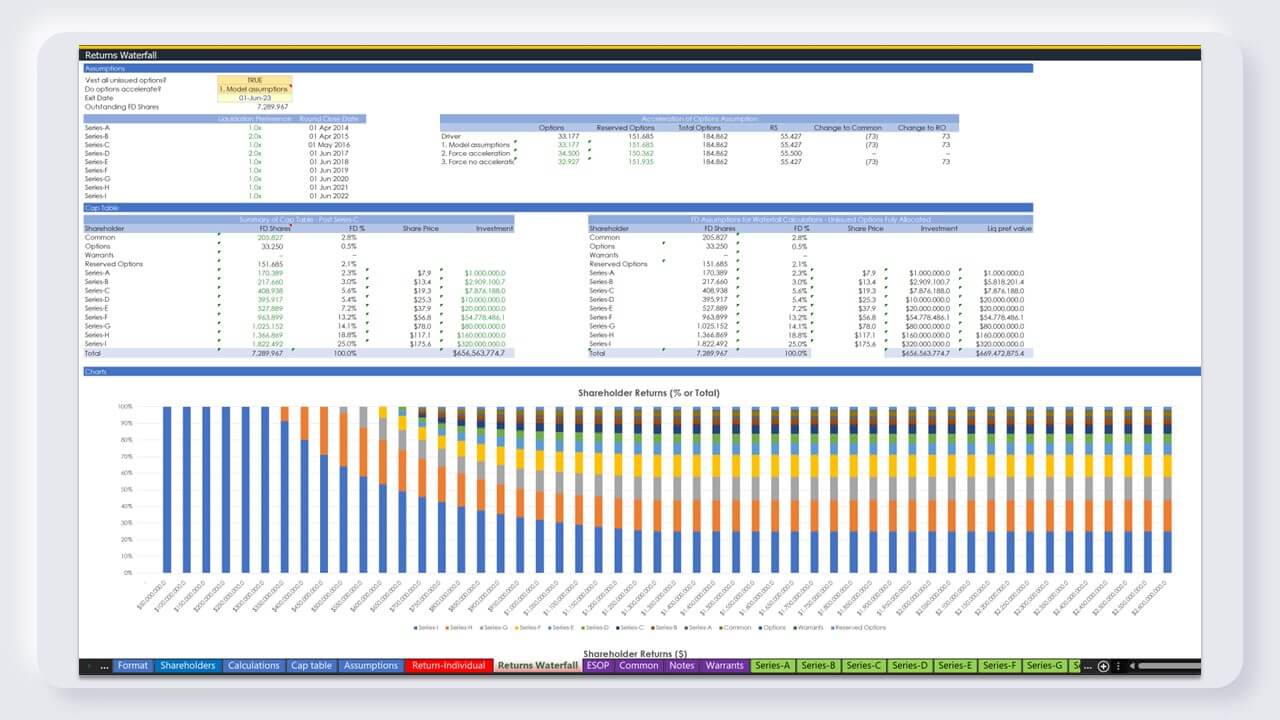

- Acceleration of options can be an important consideration to your staff. The model allows you to control what happens in a change of control. The returns waterfall lets you override the model assumptions with full and no acceleration… just in case an acquirer wants to screw your terms (which happens)

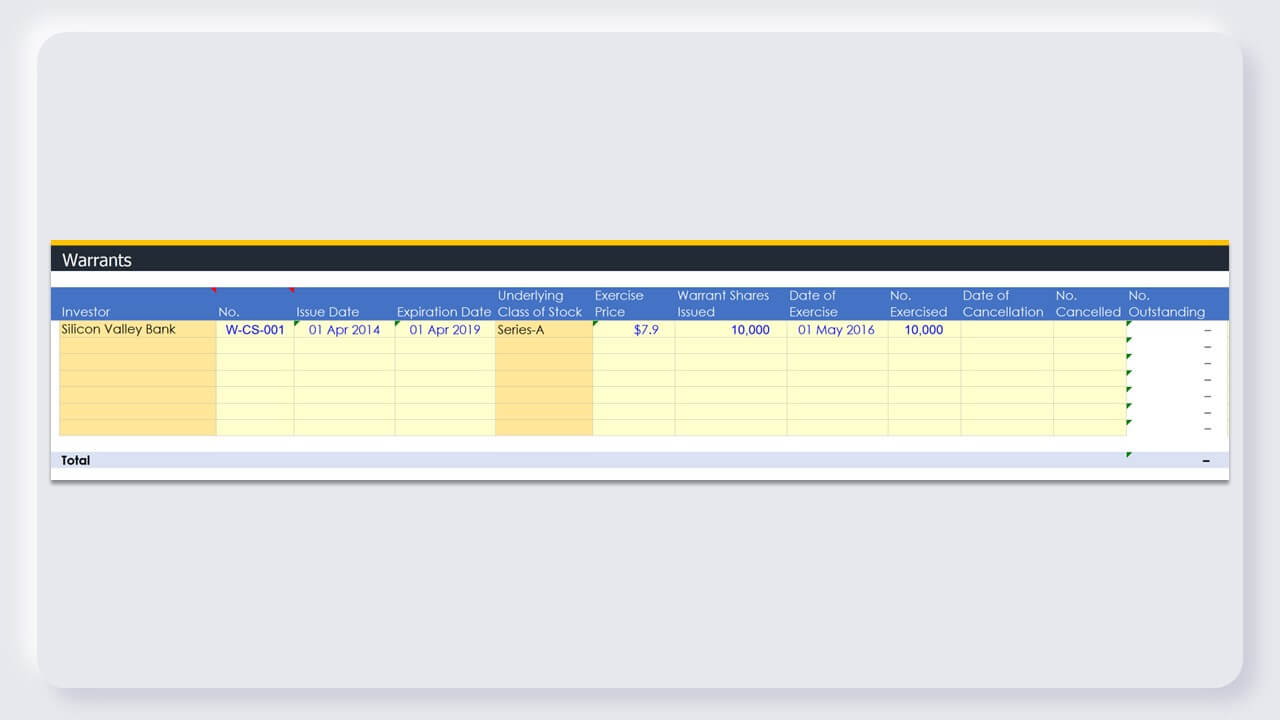

Deal with warrants

- Track each issue number and date as well as expiration date. Know which warrant is linked to each underlying class of stock.

- Set exercise price, shares issues, date of exercise, what is exercised, whether you cancel (and how much) and comment on each transaction.

Detailed to level of warnings for fractional shares

- The math is impeccable to the level of tracking as to whether on a price per share level shares will be purchased on a fractional level (and you can track this is a dashboard)

- Adjust to ensure that the full investment is made in return for equity transference

Designed to be simple to use

- It’s a huge cap table, but I invested a lot of time figuring out how to make it as simple to use as possible and remove any potential for duplicate fields

- Effective use of drop-down menus with a centralised shareholder sheet so you can intuitively use and populate the model and ensure consistency

- Structured so you logically use Excel to copy/paste and make things happen

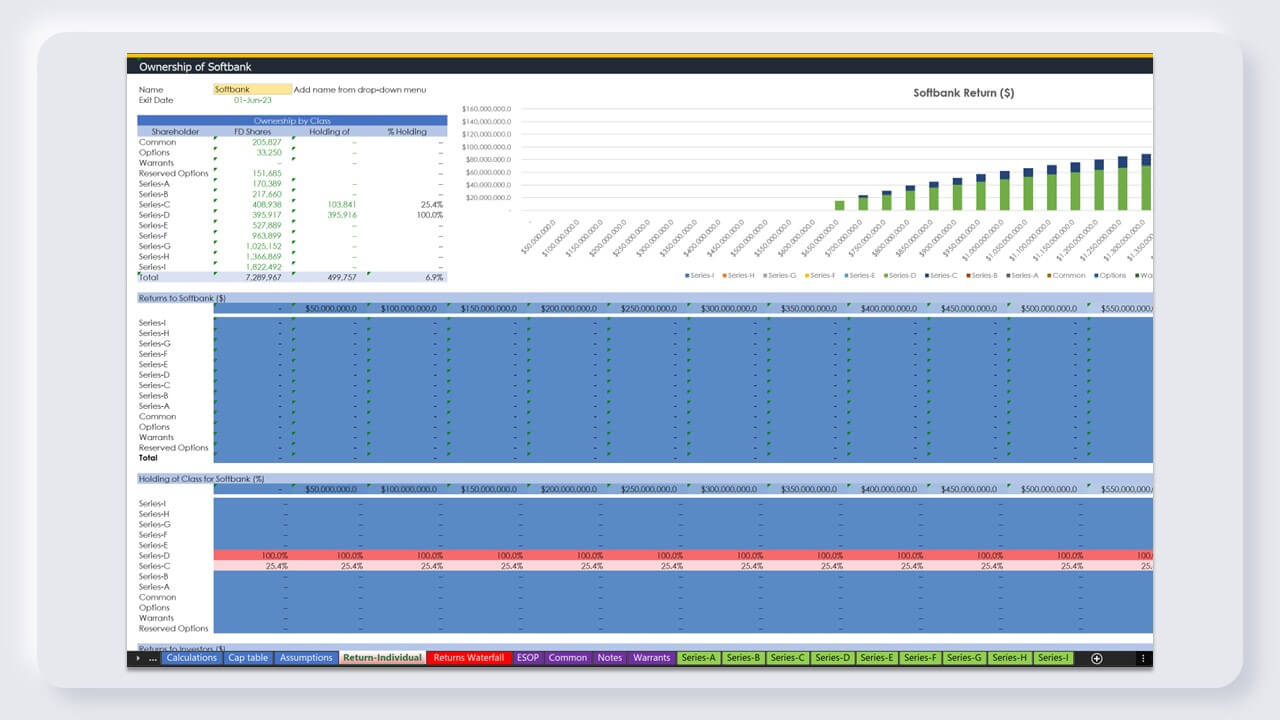

Individual return analysis

- Select anyone on the cap table in a dropdown and instantly see their exact return profile

- See returns with each class of stock they participated in across a range of values you can define to see all the possible outcome scenarios at exit

- Zoom into the $ returns, the holding for each class of stock, and the total returns to all shareholders

Returns waterfall analysis

- 546 rows of granular waterfall analysis

- Follow the conversion math for each and every round from series-I (as applicable) all the way down to convertible notes and common

- Visualise when liquidation preferences are overcome so common gets paid!

- Define an exit value range with a central value and increments to see 53 potential outcomes scenarios and how they will affect the return profile of each round (with charts)

- Decide whether to vest all unissued options and whether options will accelerate at acquisition with a 2 drop downs

- Set an exit date to see the effect of an outcome on currently vested options and convertible notes

Detailed tracking of dilution over time

- The calculations continue, giving you a round by round overview or who owns what by class of share on a fully diluted basis. Everything will add up to 100%

- Outputs provided in a table and in charts

Check out a brief overview of using the model

Excel

Unlocked

Integrated

- Excel financial model

- Built for PC and Mac

- Not for Google Sheets

- Entire model is editable by you

- Nothing is locked or restricted

- Fully integrated model

- Each sheet acts as a module connected to each other which update immediately

Updates

No modeling needed

Easy to maintain

- Model is updated with new features

- I'll email you updates when they're done

- Everything works out of the box

- Just input your assumptions

- Designed to be easy to as you need

- Add new hires, update annual plans

Support

Track funding

Exit analysis

- If you're really stuck, ping me an email or catch me if I'm online and I'll help you figure out what to do for free

- You can hire me per hour if you need a lot of help on whatever it is you need

- See the effect of lilquidation preferences, plan rounds with pro-ratas

- See the potential returns to every class of shareholder across a range of value to understand exit opportunities

FOR ALL TYPES OF STARTUPS

Model designed to work with literally any company that raises funds

"Equity ownership is not only important for aligning incentives between founders and investors, but crucially it drives alignment across the entire organization."

Luciana Lixandru, Sequoia Partner

It's worth the price to have one thing in your life that is absolutely perfect.

2 pricing options

Get a filled in model or the filled in model + a blank version of the file.

Base model

With returns analysis

Free training video

This is a detailed guide on how to use and fill in the ESOP model

Who the heck is hawking me a financial model!?

Hey! It's me Alexander Jarvis. I like Excel and I love solving hard things.

- I'm the #1 seller of startup financial models in the world

- Worked in M&A (Lazard financial institutions group)

- I intimately know startup and what VCs care about having done both for over 10 years

- TEDx, Top Quora Writer, accelerator mentor, fund advisor etc

- I don't like bragging, so just read my blog and download free tools to see if I know what I'm talking about

Want to know more?

Let's run through details and answer your FAQs

Details on the model

FAQ

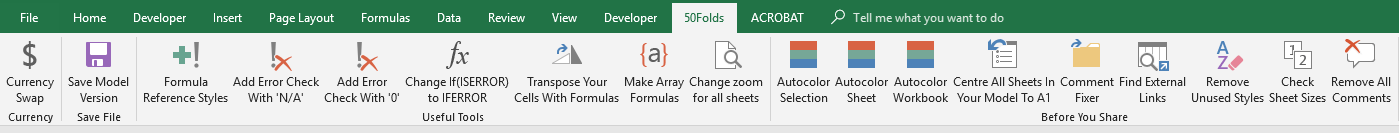

Want this model in a different currency? Now you can!

Convert all currencies in the model into one of 17 different currencies with a button mash

This model uses formatted currencies in $ (Why I use US Dollars). I often get asked if it is available in other currencies such as €? So I made an Excel PC addin to do that (It was hard!)

At the press of a button you can now convert the model into 17 different currencies. You just need to purchase the productivity addin.

Here are the currencies you can use with the macro:

| Currency list | The format you will see |

| EUR | € |

| USD | $ |

| GBP | £ |

| YEN | ¥ |

| INR | ₹ |

| Krone | kr |

| BAHT | ฿ |

| RUB | ₽ |

| Peso | ₱ |

| BRL | R$ |

| RM | RM |

| Rp | Rp |

| HKD | HK$ |

| ILS | ₪ |

| KPW | ₩ |

| RMB | ¥ |

| CHF | CHF |

Part of the productivity addin

All my favourite hacks and time saving tools in one place

More than likely, you aren't a huge Excel nerd like me, so you probably don't know about macros? These are hacks to make modeling in Excel much more faster and less painful. I love them!

I've been making models for years, so you can be sure I know what is useful and what is not. I decided to not just make the currency conversion macro, but add in all my most used hacks. You just hit a button and it will do handy things.

What can you do?

- Automatically format your cells so they have 'investment banking' standard black, blue and green

- Change the zoom and cell position of every sheet so it looks great when others read it

- Save a backup of your model (v1, v2, v3) at the push of a button so you never get a corrupt model

- Add error checks to your formulas

- And a whole bunch of other nerdy things you'll understand when you are making models yourself!

NOTE:

- Currency conversion only works on 50Folds models. It won't on any other model (My code looks for certain cells... There is a hack- ask if you want to know)

2 pricing options

Get a filled in model or the filled in model + a blank version of the file.

Base model

With returns analysis

Purchase guide and note

Let's just get clear so you know how it works and what to expect

Buying models

Getting the model

- Payment and delivery of the model is 100% automated!

- It's hosted on SamCart and payment is via Stripe (Secure)

- There are no refunds. These are digital goods you can't return

- If you have questions ask me first in the chat or via email

- If you aren't sure if this is the right model for you, ask me!

- After you buy you get confirmation emails from SamCart

- Delivery of the model is automated

- Note: I don't know why, but occasionally it can take an hour

- The file comes in a zip file. You need to unzip it (e.g. WinZip)

- If you're really stuck, ping me an email or via chat box!

Comments 18

the box says ii is to purchase the pitch deck template. Where is the cap sheet stuff? Pricing, etc.

Author

Thanks for letting me know Steve. It all works. I just forgot to change the part of the code which says ‘pitch deck’ to cap table.

I have just bought the $100 cap table. Our convertible note, from an accelerator, defines a set amount of ownership (8%) after the A round – there is no cap/discount rate. How does your model account for this, how do I input the date?

Author

Hi Seth- That’s not normal. Frankly, 8% after the A round is taking the piss!

Well now, it effectively acts like a CN since there is no ownership.

At series A you would be calculating the ownership on a ‘Percentage ownership’ dilution basis, whereby I presume the founders take all the dilution of the note.

For simple purposes, you could treat them the same as the A investors so your pre is fixed but the amount of dilution is higher. So if you sell 20% it looks like you sold 28%.

derr bollocks

Author

Lol. Thanks

Hi Alexander, we are an Australian based company and all our numbers are AUD / A$ will this work for us? do we just use the USD$ or will that not work? I see you have BRL/R$ so am thinking a straight swap may not work

Author

Just leave as Dollars. Same crap, you just AUD. You can either add in headers it’s AUD, tell people it is, or just let Aussie investors assume the model you are giving them is in local which is sort of logical.

The macro just does superficial formatting. It doesn’t change the whole thing to some FX rate. That doesn’t make sense. Just pick a currency and use it.

I have a blog about that: https://wordpress-153384-440792.cloudwaysapps.com/use-dollars-in-your-startup-especially-for-your-financial-model/

Alexander we use google sheets will your template still work if we upload and convert into a google sheet are will key things break?

Author

I do nothing in GDocs unless collaboration is the key. I have an OKR tool for that.

I have never tested. I just would never do a model in GDocs.

Hi Alex, Thank you for your leadership on this impressive work. My quick comment on this, at this stage in the game, I feel engagement and collaboration are keys to success, transparency, and effectiveness. Something like the financial model still requires collaboration between Exec Leadership Team, Board, investors. Is it safe to assume this and the Enterprise Fundraising Model would not work in Google Sheets if purchased? Thank you and happy holidays, Best, Mustafa

Interested in learning how cap tables are built and the various scenarios, events, rights, preferences etc.

Author

Urmi – Basics of the model are here: https://wordpress-153384-440792.cloudwaysapps.com/what-is-a-cap-table-and-other-important-questions/

I don’t have bogs on stuff like events and rights atm. There are a lot of blogs which have this content. Don’t know if it is worthwhile me focusing on this or not?

Thank you very much for this information, how can I get your old cap table model, you mention that it is free, but I don’t know where I can see it, I really appreciate your help. best regards

Author

Under free tools/ dilution. Have too many so had to start grouping.

https://wordpress-153384-440792.cloudwaysapps.com/ultimate-startup-cap-table-and-return-analysis-template/

Is there a way to modify this to account for a complex LLC waterfall and take into considerations built in gains, 704c allocations, hurdles, profit interests etc.

Author

Seth- Sure. It’s an open excel file. If you know how to do all that cool, it’s just a lot of modeling to add in those features, right? If you edit pls share with me so I can add that for everyone to benefit!

How much would it cost to have you convert our existing cap table to the premium version format >100 investors, multiple classes of stock, convertible debt. Doing a recap now with a down round. Happy to talk on phone.