In today’s society, it seems as if everyone is aspiring to become a startup entrepreneur. Starting your own company and watching it grow into a successful business is certainly appealing, but many people don’t realize that the path to startup success is not easy. In fact, according to Forbes, 90% of startups fail within the first three years.

So what can you do to increase your chances of success? One crucial factor to consider is your burn rate – or how much money you’re spending versus how much money you’re making. Let’s take a closer look at what burn rates are and how they can affect your startup.

What Is A Burn Rate?

The Burn Rate measures how quickly the cash in your bank account is decreasing which investors care about a lot! There are two types of burn rate you need to keep on top of: gross and net burn.

- Gross Burn Rate is the total amount of cash you are spending every month.

- Net Burn Rate is your gross burn rate but deducts for revenue (so if you are profitable your burn rate is in fact not on fire, so will be a negative number!).

It is generally expressed as a negative cash flow, representing how quickly cash is being spent. However profitable companies have a negative net burn rate because they have higher revenue than their expenses.

A high burn rate can signal that a company is in trouble, as it suggests that it is not generating enough revenue to cover its expenses.

However, burn rates can vary greatly from industry to industry, so it is essential to benchmark a company’s burn against its peers. For example, startups often have high burn rates as they invest heavily in product development and marketing.

Similarly, companies undergoing rapid expansion may also have high burn rates. Startups in SaaS for example are often encouraged to have a high burn rate since most of the investment is spend on marketing, and SaaS has a peculiar return profile.

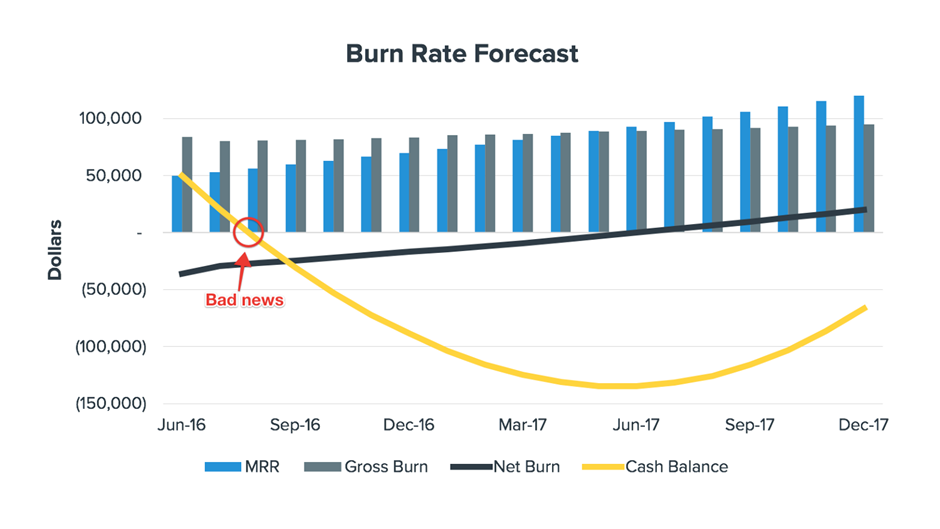

Baremetrics illustrate what the burn rate might look like for a SaaS startup.

Ultimately, the key to sustaining a high burn rate is to ensure that an equally high growth rate offsets it. Otherwise, the company will eventually run out of cash.

How Can You Calculate Burn Rate, And What Factors Influence It?

There are two ways to calculate burn rate: gross burn rate and net burn rate.

To calculate the company’s gross burn rate, simply add all the expenses a company has incurred over a specific period. This could include payroll, rent, advertising, and other operating expenses. You shouldn’t include any exceptionals in the calculations.

To calculate the net burn rate, take the gross burn rate and subtract any revenue generated during that time frame. This will give you the net loss for the period.

Burn rate vs runway

A lot of people get confused by your burn and your runway. Some people might nitpick between “burn” and “burn rate”, but a VC will ask your burn rate and expect a $ number.

Your runway on the other hand is how many months you have before you run out of cash. So cash divided by your gross or net burn tells you the months you have left.

Your gross runway is how many months you have to live assuming that you make no revenue.

- Gross runway = cash/monthly operating expenses

Your net runways is how many months you have to live assuming you generate revenue.

- Net runway = cash/(monthly operating losses- monthly revenue)

Either equation will give you a number in months such as 7 months.

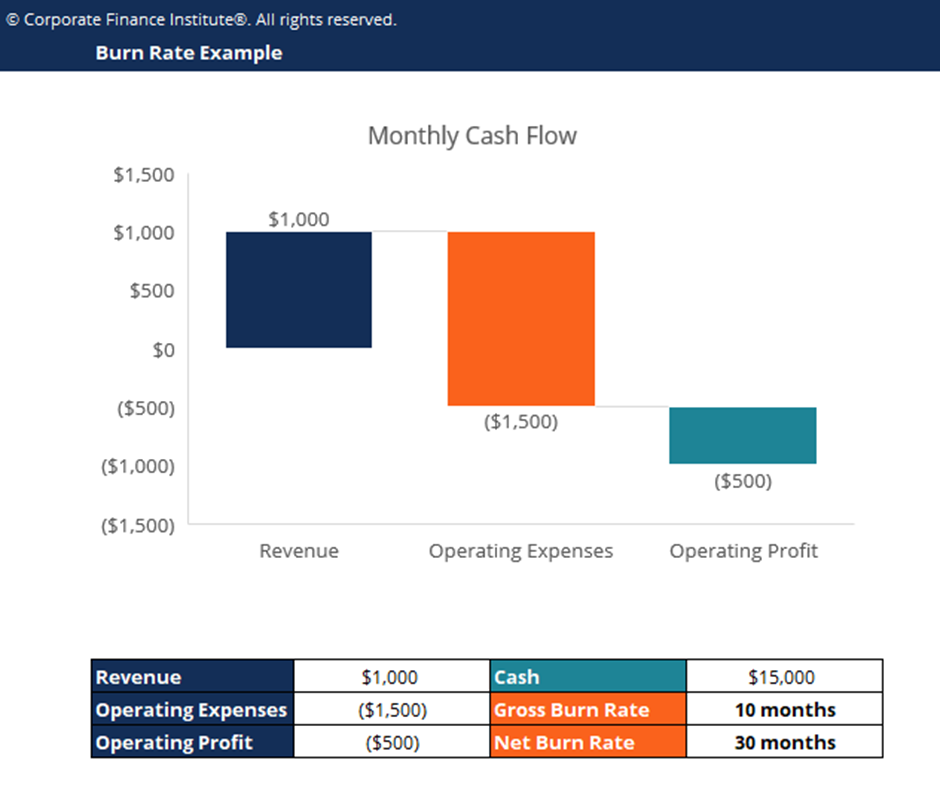

An example of someone confused is the Corporate Finance Institute which shows an image of Net Burn, but then shows gross and net runway as burn rates.

Frankly, these terms are not IFRS/GAAP so there is no one legally defining them, they’re just how founders and investors colloquially communicate.

Why Should Startups Care About Burn Rates?

As a startup founder, one of your primary concerns should be ensuring you have enough cash to keep the business going. Your burn rate can give you a clear understanding of how much money you’re spending and whether this is long-term sustainable, particularly if you are depending on fundraising to keep cash in the bank.

If your burn rate is too high, it could put your business at risk of running out of cash. On the other hand, if your burn rate is too low, it could mean you’re not investing enough in growth. Either way, monitoring your burn rate closely and making changes where necessary is essential. That’s because raising more capital despite cash loss can be disastrous.

Another reason startups should care about their burn rates is that it can give them insight into their funding needs.

If you know how much money you’re spending each month, you can more accurately estimate how much funding you’ll need to keep the business afloat. This information can be beneficial when seeking investment from venture capitalists or angel investors.

By monitoring their expenses and understanding their funding needs, startup founders can put themselves in a strong position to take their businesses to the next level.

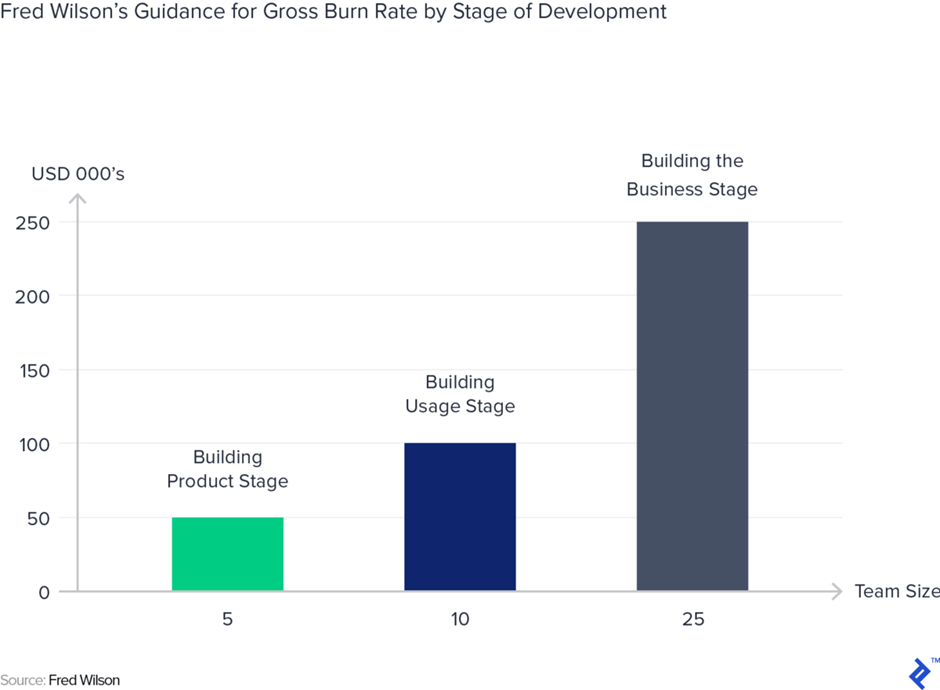

Fred Wilson shares some of his wisdom on how much a startup might be spending at different stages of building a startup.

What Is A Good Burn Rate?

There is no good or bad burn rate. It always depends.

Generally, a good burn rate is how a company spends its cash balance to sustain its operations and grow its business. Aggressive investors might prefer to see a high burn rate as it indicates that the company is investing aggressively in its future growth, but it really depends on how capital efficient they are.

As a result, companies need to strike a balance between investing in their future and maintaining a healthy cash reserve. An average burn rate will vary depending on the industry and stage of development. Still, generally speaking, investors prefer to see companies with a burn rate of around 10-15% which assumes they have a runway from the investment of 18 months.

Some Common Mistakes That Lead To High Burn Rates For Startups

Many startups raise venture capital to fund their operations, but if they are not careful, they can quickly burn through this capital and find themselves in financial trouble. Another mistake that leads to high burn rates is failing to capture market share.

Startups often invest heavily in marketing and sales to gain customers, but if they do not have a strong product or service, they will quickly lose these customers to their competitors.

Finally, startups often make the mistake of taking on too much debt. Venture debt can be a great way to finance growth, but if a startup takes on too much debt, it can become difficult to service this debt and survive financially. By avoiding these mistakes, startups can ensure they can achieve long-term success.

How Can You Reduce Your Burn Rate And Extend Your Cash Runway?

If you’re a startup founder, one of the most important questions is probably, “how can I reduce my burn rate and extend my runway?” After all, having a long runway is essential for giving your startup time to grow and achieve profitability. Fortunately, there are a few different ways to do this.

If you’re a startup, one of the most important things you can do is focus on reducing your burn rate. Doing so will give you a longer runway and more time to achieve your goals. There are a few things you can do to reduce your burn rate:

- Review your expenses and see where you can cut back.

- Raise additional funding to give you more runway.

- Focus on revenue-generating activities to help offset your costs.

- Make sure you clearly understand your cash flow so you can make informed decisions about how to best use your resources.

If you focus on how much cash flow you should have, you’ll give yourself a better chance of success in the long run.

Conclusion

A startup’s burn rate is the speed at which it spends funds to sustain itself. A high burn rate can be dangerous for a startup because the company is running out of money quickly and will need to find more funding sources soon.

However, a low burn rate can also be problematic because it may indicate that the company is not growing fast enough. The ideal burn rate for a startup is somewhere in the middle: not too high and not too low.

Understanding how to calculate and manage your startup’s burn rate can help ensure its long-term success. Thanks for reading!