TL;DR: Learn how to value a startup. Multiples don’t apply. You need to think about how much you want to raise and get diluted.

You are raising for your startup and have investors interested (or pretending to be). You hear this all the time “what’s your startup valuation.”

That’s a sneaky question. The investor either:

- Wants you to low-ball yourself so they get a good deal

- Save time by figuring out if you have unreasonable expectations on valuation, so there is no point in talking more

But this post is not about why they are asking that question, it’s about why that question does not make sense.

The better question has two parts:

- How much do you need to raise to hit your milestones?

- What dilution are you targeting in this round?

Why startup valuations (at early stage) don’t make sense

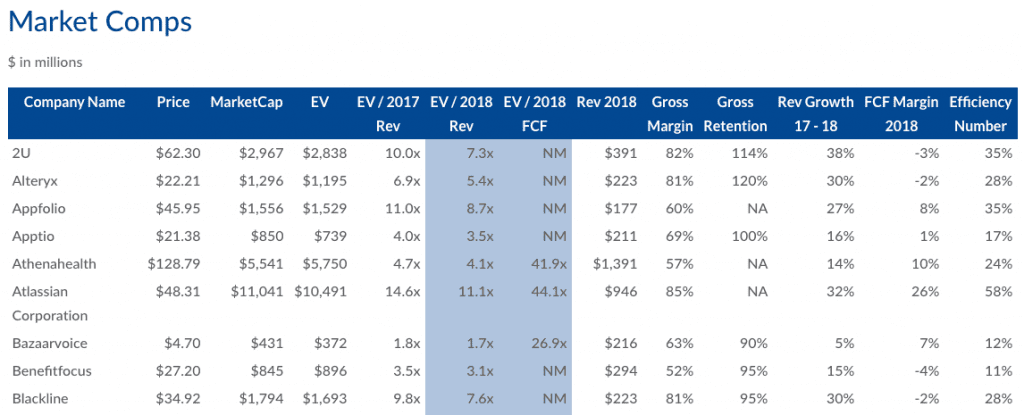

When you are at a later stage, sure there are metrics. Bessemer track public SaaS multiples which can be a benchmark (though need some adjustments). Here is an example of what that would look like:

5x your shite all revenue is shite all.

When you are selling hope and rainbows, you don’t have meaningful numbers. Your startup valuation is based on your potential (and sales ability).

So you need to figure out how to value ‘potential.’ Let’s face it. You can’t.

How to value a startup

There is a formula for valuation. It’s this:

Valuation = Investment / Investor ownership (Dilution)

So if you agree on a valuation of $10m post, your investment is $2m and the dilution is 20%.

You do not want to give up 50% of your startup in one round, right? Yeah, screw that.

But you are happy to give up maybe 20% for the right suitor. Maybe 15% is great, 25% you can live with… but no more.

Now you need money. Your calculation using the free runway calculator is around $2m, but could be more or less. You know what you want.

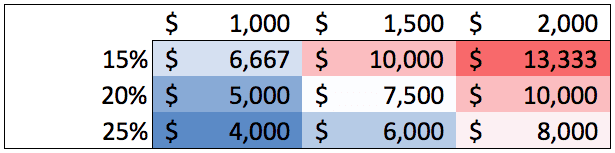

So we can map this out and see a range of post-money valuations (in $000s):

On this basis, your valuation is between $4m and around $13m. That’s a big range.

To tighten this up, we could argue you have more control over how much you raise (unless you are unloved). So you think you can get $2m. Your range is, therefore, $8m to $13m post.

So it seems that startup valuation comes from how much you can raise (limited by the investor market) and what your dilution is (that you accept). It’s an output rather than an input. That’s how to value a startup.

How do you communicate your ‘startup valuation’

“According to our calculator, we need $2m. We are targeting a dilution of around 15%.”

You don’t state your valuation. You let investors do the math themselves.

Stating the dilution and raise allows you to offer clear logic:

- We are willing to accept this dilution as it is what we are comfortable with and it’s in line with the founders I talked to at similar stages to us

- We need this money to achieve milestones

Saying “$13m post” and gazing at the investor and not flinching is like roulette. There is a reason sales guys write down numbers on paper and don’t just say it.

Comments 2

Thanks Alex! It took me years to come around to this realisation. With previous ventures, people would always ask me, “How much money are you asking for, and for how much equity?” That’s a nonsensical, implied valuation. The pragmatic approach as you’ve clearly described it is the only workable way to actually / eventually reach a valuation of a startup in the first instance.

Author

Hey Wil – sorry didn’t respond. Kinda feel people don’t leave comments these days so not on the look for them.

Yes, exactly. I just don’t see how valuation is any more complicated than this simple explanation!

If you’re shite hot startup, well, you just look at your list of term sheets and say “try harder, VC” and you bid up till terms look bad. That’s just not 99% of startups.

If you’re post series-a, ok, multiples of revenue might kick in (for SaaS), but you’ve got the numbers to have a discussion. Still, the above applies as the starting point.

Cheers mate.

Alex