If you’re a startup founder, then understanding the concept of Revenue Run Rate (RRR) needs to be part of your mentorship and education. Revenue Run Rate is an essential metric for startups; it shows current and potential investors how well the company is doing in relation to its revenue goals, leaves insight into whether strategies are working as expected, drives decisions on resource allocations such as marketing spend, and ultimately provides important clarity about how investments in products or services are performing towards key business objectives. In this blog post we will examine what RRR truly means for startups, why it’s crucial to follow up on RRR trends month-over-month, quarter-on-quarter or year-over-year basis — giving you actionable insights into where money should go now -and what results can be expected by decision makers down the line.

What is Revenue Run Rate?

Revenue run rate is a financial measure that shows the amount of revenue a company would generate if its existing sales levels were maintained for the next 12 months. It allows investors to estimate future revenues based on current performance and provides insight into the potential trajectory of a business.

To calculate revenue run rate, one must take the total revenue generated over a specific period of time, such as a month or quarter, and divide it by the number of weeks or months in that period. The resulting figure can then be multiplied by 12 to get an annual estimate of revenue.

Revenue run rate is a useful measure for investors who are looking to gain insight into the future potential of a business. By comparing current performance with historical trends, investors can make more informed decisions about their investments.

Why Is It Important For Startups to track the Revenue Run Rate?

Following are the reasons why tracking the Revenue run rate is important for Startups:

1. It helps in determining the financial health of your business:

Tracking the Revenue Run Rate allows you to see trends in your cash flow and identify any areas where there may be a need for improvement or adjustment. This information can then be used to make informed decisions about budgeting and resource allocation.

2. It is an important predictor of future growth:

Knowing your current Revenue Run Rate can be an important indicator of how the business may grow in the future. It can provide a guideline for setting realistic goals and expectations for what the company will be able to achieve in order to move forward towards success.

3. It allows you to benchmark performance against competitors:

Tracking the Revenue Run Rate allows you to compare your performance against other companies in the industry. This can be a valuable tool for gaining insights into areas that may need improvement or where there is potential for growth.

4. It helps in developing sound strategies:

Having an understanding of the Revenue Run Rate enables startups to develop effective strategies that are tailored to their specific needs and goals. By closely tracking the rate and understanding its implications, startups can make informed decisions about how to move forward in order to achieve their objectives.

5. It gives an indication of customer retention:

By tracking the Revenue Run Rate, startups can gain important insights into the loyalty and satisfaction of their customers.This information can then be used to develop strategies for increasing customer retention, engagement, and revenue growth

How To Calculate the Revenue Run Rate?

Here is the formula to calculate the Revenue Run Rate:

If a company’s revenue for one quarter (3 months) is $2,000,000 then their annual run rate would be:

Run Rate Revenue (Annual) = 2,000,000 * 4 (quarters in one year)

= 8,000,000.

Therefore the company’s run rate revenue (annual) is 8 million dollars.

Although, it should be noted that the company may not actually realize this level of annual sales since there is no guarantee that sales performance in future quarters will remain consistent at the same level as in the current quarter. The actual annual revenue could be higher or lower than this calculated run rate.

What factors affect the Revenue Run Rate?

The following factors affect the Revenue Run Rate:

1. Pricing:

Different pricing strategies can have a major impact on the Revenue Run Rate. Companies must determine their pricing structure to maximize profits and keep customers loyal.

2. Cost of Goods Sold (COGS):

The COGS is an important factor that affects the Revenue Run Rate as it impacts the company’s ability to generate a profit. Companies must ensure that their COGS is optimized to maximize profits and generate higher Revenue Run Rates.

3. Market Dynamics:

The market dynamics of an industry can have major impacts on the Revenue Run Rate. If there are external factors such as competition or economic downturns, they can influence the company’s ability to generate revenues

4. Sales and Marketing Strategies:

Companies must have effective sales and marketing strategies to generate leads, convert customers, and close deals in order to maximize their revenues.

5. Product/Service Differentiation:

Companies should develop products or services that are differentiated from their competitors in order to stand out from the competition and increase the Revenue Run Rate.

6. Adoption Rate:

Companies must ensure that the products or services they offer are adopted by the right customers in order to increase their Revenue Run Rate.

7. Consumer Spending Habits:

Companies need to understand consumer spending habits in order to target the right audience and maximize their revenues.

8. Geographic Reach:

Companies should focus on expanding their geographic reach by engaging in activities such as international expansion in order to increase their revenues.

9. Brand Reputation:

Companies need to maintain a strong brand reputation by providing quality products or services and engaging with customers in order to increase the Revenue Run Rate.

10. Regulatory Compliance:

Companies must comply with applicable regulations, including those related to data privacy, tax, labor, etc., in order to avoid penalties and fines which can have a negative impact on their Revenue Run Rate.

11. Technology:

Companies need to adopt the latest technological innovations such as artificial intelligence, machine learning, etc., in order to stay ahead of the competition and maximize their revenues

These are just some of the major factors that affect the revenue run rate for companies.

What is a good Revenue Run Rate?

A good Revenue Run Rate is one that can be maintained and sustained over time. It should have the potential to increase as well, so that it can generate more profits and help a business continue to grow. If a company has a healthy sales growth rate, strong gross margins, low operating expenses, and high net profit margins then it is likely to have a good Revenue Run Rate.

Generally speaking, companies with a higher revenue run rate are more likely to be successful than those with a lower one. A company’s goal should be to achieve and maintain a high revenue run rate in order to remain competitive and profitable.

Quotes about Revenue Run Rate

- “A well-crafted revenue run rate gives us a glimpse into the future of our business and what we can strive for.” – Jeff Bezos

- “The power of the revenue run rate lies in its ability to show us what success can look like down the road when we put in the effort today.” – Elan Musk

- “Using a revenue run rate to figure out our goals and plans for the future is essential for any business that wants to remain competitive.” – Mark Zuckerberg

What are examples of Revenue Run Rate?

A software startup that has achieved high growth recently reported $2 million in revenue for its last quarter. This startup is now looking to attract venture capital firms and raise capital, and as such must demonstrate their current run rate of revenue which stands at approximately $8 million.

This can be calculated by multiplying the quarterly revenue of $2 million by four quarters. For the run-rate revenue to be deemed credible by investors, however, the company must have a growth profile that is consistent with the projected revenue growth rate – meaning they should have opportunities for increasing their customer count and pricing, as well as market share upside. The software startup in question has thus far demonstrated impressive growth, but must continue to do so in order to meet its revenue targets.

Example 2

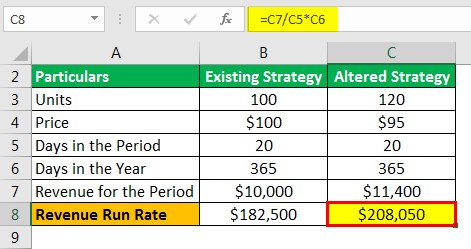

MoveFast Inc., a company that sells fitness wearables, has sold an average of 100 units of its product for $100 in two 20-day periods this year. Its annual target is to reach a revenue of $200,000.

To understand whether the current sales will generate enough income or if lowering the price to $90 and increasing the unit sales by 20% is the better option, MoveFast Inc. has decided to calculate the Revenue Run Rate. Assuming there are 365 days in the year, here is how to do the calculation:

Calculation of Revenue Run Rate of Existing Strategy =$10000/20*365 =$182500

Calculation of Revenue Run Rate of Altered Strategy =$11400/20*365 =$208050

It can be seen that the annual target will not be met with the current strategy, so the altered strategy should be tried. After recalculating the Revenue run rate utilizing expected numbers, it is clear that this strategy could be beneficial for MoveFast Inc., exceeding the annual target.

Tips to improve the Revenue Run Rate

following strategies can help to improve the Revenue Run Rate:

1. Utilize a mix of different marketing channels:

Use a combination of traditional and digital marketing channels such as email, print ads, pay-per-click campaigns, and social media to reach potential customers and increase your brand visibility.

2. Focus on customer retention:

Make sure you are providing an exceptional customer experience that keeps customers coming back. This can include things like providing discounts, free shipping, or special offers.

3. Monitor the performance of campaigns:

Track the performance of your campaigns and adjust them accordingly to ensure maximum ROI. You should also regularly monitor competitors’ campaigns to stay on top of industry trends.

4. Offer rewards for loyalty:

Establish a rewards program for your customers to encourage repeat purchases and loyalty. This can be as simple as offering discounts on future orders or providing exclusive offers through loyalty programs.

5. Leverage artificial intelligence:

Utilize AI-powered tools such as chatbots and machine learning algorithms to help you better understand customer behaviour and automate certain processes such as marketing campaigns, lead generation, and customer segmentation.

6. Focus on upselling and cross-selling:

Boost your revenue run rate by increasing the average order value through upsells and cross-sells. Offer additional products or services to customers based on their interests or past purchases.

7. Keep track of KPIs:

Regularly track key performance indicators such as customer lifetime value and average order value to help you identify any areas that need improvement.

8. Invest in quality content:

Quality content is key for increasing brand visibility and engaging customers. Investing in content creation, such as blog posts or eBooks, can help drive more leads to your website.

9. Leverage data-driven insights:

Utilize data-driven insights from analytics and customer feedback to better understand customer behaviour and optimize your marketing efforts.

10. Monitor market trends:

Keep an eye on industry trends and analyze the performance of competitors’ campaigns to stay ahead of the curve. By monitoring market shifts, you can adjust your strategies accordingly for maximum impact.

The Bottom Line

A startup’s revenue run rate is one of the most important measures of success. If you don’t know your revenue run rate, you can’t make informed decisions about where to invest your limited resources.

Fortunately, calculating your revenue run rate is relatively simple and only requires a few pieces of information. Once you know your revenue run rate, you’ll be in a much better position to grow your business.