If you’re a startup entrepreneur, chances are that you know the importance of understanding profit and loss when it comes to your business. But if you haven’t reviewed net profit margins yet in assessing your success, it’s time to begin! Net profit margin goes beyond simply looking at how much money is coming into a company or going out of it: by measuring how efficiently resources are used to generate revenue, this important metric can help businesses save money while also paving the way for growth. In this blog post, we will take an in-depth look at net profit margin and provide some helpful tips on how startups can maximize this useful figure.

What is Net Profit Margin?

Net Profit Margin is a financial ratio that measures the profitability of a business relative to its total revenue. This ratio indicates how much of each dollar earned by the company is converted into profit. It is a useful tool for investors, creditors, and analysts to evaluate the financial performance of a company. It can help determine how efficiently a company is managing its resources and whether or not it has enough profits to cover its debt obligations. Net Profit Margin can also be used to compare different companies in similar industries and assess their relative performance. In general, higher net profit margins indicate higher efficiency and profitability.

Net Profit Margin is widely used by investors to assess the relative strength of a company and make investment decisions. It can also be used by businesses to compare their performance with other companies in the same industry. Additionally, it is a useful tool for assessing the financial health of a company and understanding its financial position.

Why Is It Important For Startups To track the Net Profit Margin?

Following are the reasons why tracking the Net Profit Margin is important for Startups:

1. It helps startups identify their overall efficiency:

Net Profit Margin is a measure of the company’s overall efficiency and effectiveness in generating profits. Tracking this metric allows the startup to identify areas where they can make improvements, either by cutting costs or increasing sales.

2. It provides an accurate representation of profitability:

Tracking the Net Profit Margin allows startups to have an accurate representation of profitability, as it indicates the amount of profit that is left after taking out all costs and expenses. This measure can help startups make better decisions on how to allocate resources in order to maximize profits.

3. It helps investors evaluate a startup’s success:

The Net Profit Margin is an important indicator of a startup’s performance, and investors use this metric to determine whether or not to invest in the company. A high Net Profit Margin indicates that the startup is doing well financially and has the potential for future growth.

4. It can be used as a benchmark:

Tracking the Net Profit Margin allows startups to compare their performance with other companies in the same industry or sector. This can be used to determine where a startup stands relative to its competition and identify areas for improvement.

Overall, tracking the Net Profit Margin is an important step for startups to ensure that they are operating efficiently and maximizing their profitability. Understanding this metric allows startups to make better decisions on how to allocate resources, and it also helps investors determine whether or not to invest in the company.

By tracking the Net Profit Margin on a regular basis, startups can gain insight into their financial performance and make more informed decisions on how to move forward.

How To Calculate the Net Profit Margin?

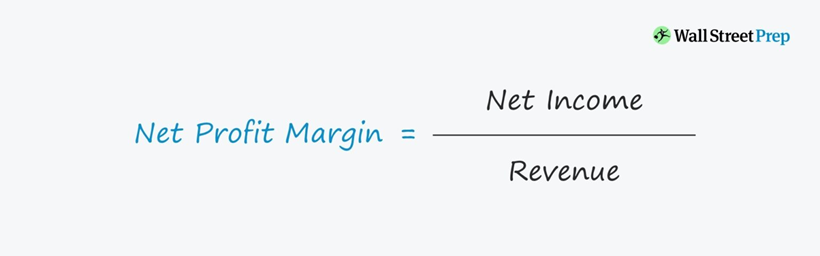

Here is the formula to calculate the Net Profit Margin :

For example, if a company has a total sales of $10,000 and total expenses of $7,500 then the net income would be 10,000-7,500 = 2,500. If the company has revenue of $15,000 then the net profit margin can be calculated as follows:

Net profit margin = Net income/Revenue

Net profit margin = 2,500/15,000

Net profit margin = 0.1667 or 16.67%

Therefore, the company’s net profit margin is 16.67%. This percentage indicates how much of each dollar earned by the business is being put to use as profit and not used in covering expenses.

What factors affect the Net Profit Margin?

The following factors affect the net profit margin:

1. Revenue:

The amount of revenue generated by the company directly impacts its net profit margin. If revenue increases, so too can the net profit margin. Conversely, if revenue decreases, it could lead to a lower net profit margin.

2. Cost of Goods Sold (COGS):

COGS represents the costs associated with producing and selling goods or services. A lower COGS generally leads to a higher net profit margin, while a higher COGS can have the opposite effect.

3. Operating Expenses:

Operating expenses refer to any costs incurred in the day-to-day operations of the business. These include salaries, rent, utilities, and other overhead expenses. Keeping operating expenses low can help increase the net profit margin.

4. Tax Rate:

A company’s tax rate influences its net profit margin, as higher taxes mean less money available for the bottom line.

5. Interest Rates:

For businesses that carry debt, interest rates play a role in determining net profit margins. Higher interest rates can increase operating costs, thereby reducing net profit.

6. Industry Average:

Different industries have different average net profit margins, so businesses must remain competitive within their industry in order to stay profitable and achieve a healthy margin.

7. Leverage:

If a business has access to leverage, such as through debt financing, it can borrow funds at lower interest rates than other forms of borrowing. This can allow for more capital to be made available for investments, resulting in a higher net profit margin.

In conclusion, the net profit margin is an essential measure of profitability that is affected by several factors. By understanding and managing these factors, businesses can maximize their profits and improve their bottom line.

Quotes about Net Profit Margin:

- “Net profit margin is a key measure of success in any business, as it shows how much of every dollar you make goes towards your bottom line.” – Michael Dell

- “A strong net profit margin indicates that the company is well-run and efficient, with the ability to generate profits and grow.” – Warren Buffett

- “Net profit margin is the ultimate measure of how well a business is performing and its ability to generate profits over the long term.” – Jeff Bezos

What is a good Net profit margin?

The definition of a good net profit margin depends on the industry in which you operate and varies from business to business. Generally, a healthy net profit margin is considered to be between 5% and 10%. However, margins can range from 1%-20%, depending on how competitive the market is. High-margin businesses typically have less competition, while low-margin companies tend to be highly competitive.

Additionally, a higher net profit margin indicates that the business is more efficient in generating revenue than paying expenses. In order to increase net profit margins, it is important to focus on reducing costs while also increasing sales and revenue. To improve profitability, companies should strive to eliminate unnecessary expenses and focus on areas where their resources can be best utilized.

What are examples of Net Profit Margins?

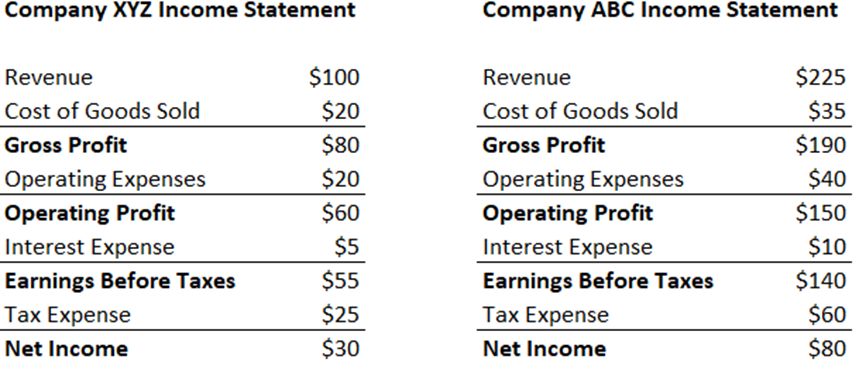

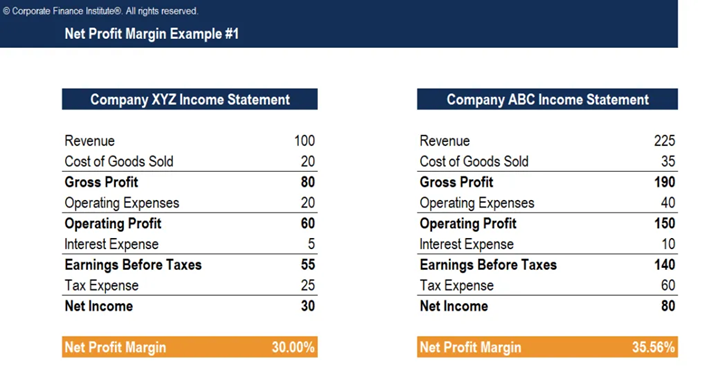

Lets us consider an example of two companies operating in the same industry and compare their net profit margin:

Step 1: Determine the formula for calculating net profit margin.

Net Profit Margin = Net Profit/Revenue

Step 2: Calculate the net profit margin of both companies.

For Company XYZ, their Net Profit Margin is calculated to be $30/$100 = 30%. For Company ABC, their Net Profit Margin is calculated to be $80/$225 = 35.56%

Step 3: Compare the results and determine which company has a higher net profit margin.

Company ABC has a higher net profit margin than Company XYZ.

Conclusion: Company ABC has a higher net profit margin than Company XYZ.

Example 2:

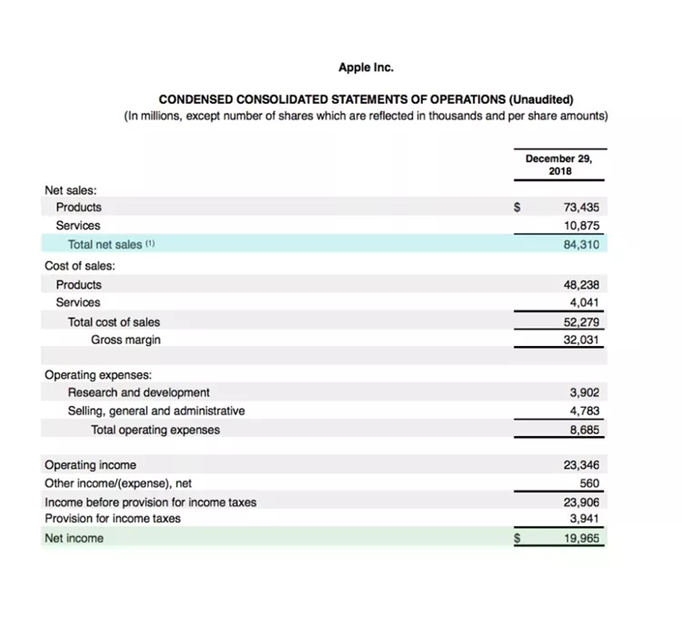

Apple Inc. reported a net profit margin of 23.7% for the quarter ending Dec. 29, 2018. This figure was calculated by dividing its net income of $19.965 billion by its total net sales of $84.310 billion. For every dollar in sales generated by Apple, the company kept just shy of 24 cents as profit. This figure was revealed by the company’s income statement, where total net sales were highlighted in blue and net income was highlighted in green.

Net sales or revenue for the period was $84.310 billion. Net income was $19.965 billion. Total net sales are used as the top line for companies that have experienced customer returns of their merchandise, which are deducted from total revenue.

The impressive net profit margin of 23.7% is a testament to Apple’s strong performance during the quarter. It shows that the company was able to effectively manage its costs, making sure that it maximized profits while still providing quality products and services to its customers. With this strong financial performance, Apple is in a good position to continue its success into the future.

Tips to improve the Net Profit Margin

Following strategies can help to improve the Net Profit Margin:

1. Increase Revenue:

Increase revenue by expanding the customer base and launching new products or services. This can be achieved through effective marketing campaigns and promotions

.2. Reduce Expenses:

A company should evaluate its expenses regularly to determine if any unnecessary costs can be eliminated to reduce spending. Potential areas for cost reductions include salaries, insurance premiums, and material costs.

3. Increase Prices:

Companies can increase prices for their products or services to boost revenue and net profit margin. However, this should be done carefully so that it does not have a negative impact on the customer base.

4. Increase Efficiency:

Companies should strive to improve production processes and the delivery of services so that costs can be reduced and profits increased. Automation, process optimization, and new technologies can all help to reduce expenses.

5. Outsource Non-Core Activities:

Companies should consider outsourcing activities that are not related to their core operations to reduce overhead costs and free up resources for more profitable activities.

6. Cut Unprofitable Operations:

Companies should evaluate their operations and determine which activities are not generating a positive return. These activities should be eliminated to improve the net profit margin.

7. Improve Cash Flow Management:

Companies can improve cash flow management by collecting payments faster, reducing debt levels, and improving the efficiency of capital investments.

8. Enhance Pricing Strategies:

Companies should review their pricing strategies to maximize profits. This can be done by setting prices that are competitive with market rates and offering discounts or promotional activities when appropriate.

9. Negotiate Supplier Agreements:

Companies should negotiate supplier agreements to reduce material costs and take advantage of bulk purchasing options.

10. Review Tax Planning Strategies:

Companies should review their tax planning strategies to ensure they are taking advantage of available deductions and credits. This can help to reduce the amount of taxes owed and improve the net profit margin.

These strategies can help to improve a company’s net profit margin and provide the resources needed for future growth and success. Companies should evaluate their operations regularly to identify areas for improvement and ensure that resources are being used efficiently. By following these tips, companies can increase profits and achieve long-term success.

The Bottom Line

Your net profit margin is one of the most important numbers in your business- it tells you how much profit you’re making after taxes and all expenses are paid. If your net profit margins are low, it’s time to take a close look at your expenses and see where you can cut back.

Keep in mind that while the gross profit margin is important, it’s not the only number you should be looking at when assessing your business’s financial health. Make sure you understand all of the metrics that matter so you can make informed decisions about where to invest your time and money