Net MRR churn is a hot topic among growth-minded businesses today as they think critically about their customer lifecycle and how to reduce it. It’s an important metric because time is money—and the longer customers stick around, the larger their Lifetime Value (LTV) potential becomes. If you’re not familiar with what net MRR churn is or why it matters, you’ve come to the right place! In this blog post, we will discuss all things related to net MRR churn: understanding what it means, finding ways to improve Net MRR Churn, and more. Keep reading if you’re curious to learn more about improving your company’s bottom line by monitoring its net MRR churn rate.

What is Net MRR Churn?

Net MRR Churn is the process of calculating and understanding the amount of revenue lost or gained due to customer actions in a specific period. It is measured as a percentage of total recurring revenue that was lost or gained over a certain period. This metric provides valuable insight into how effective your business’s retention efforts are, as well as whether or not your sales team is successfully acquiring new customers.

Net MRR Churn can also help you to identify areas where improvements need to be made and growth opportunities. By monitoring this metric over time, you will have a better understanding of how well your business is retaining customers, as well as which activities are helping or hindering its performance. Net MRR Churn can also be used to measure the success of marketing campaigns, as well as the effectiveness of new product launches.

Why Is It Important For Startups To track the Net MRR Churn?

Following are the reasons why tracking the Net MRR Churn is important for Startups:

1. Establishes a baseline:

Tracking the Net MRR Churn helps you to get an understanding of how well your startup is performing over time. It allows you to create a baseline or benchmark that can be used to measure your progress and set goals for future growth.

2. Identifies problem areas:

By tracking the Net MRR Churn, you can easily identify areas where your startup is lacking and take corrective action to address the problem. This includes addressing customer complaints, improving user experience, or making changes to your product or service.

3. Sets goals:

Tracking the Net MRR Churn allows you to set realistic goals for growth that are achievable in a short period of time. This helps you to focus on what matters most when it comes to growing your startup and getting to profitability.

4. Improves customer retention:

Tracking the Net MRR Churn helps you better understand why customers are leaving and where improvements can be made to increase customer retention. This allows you to make changes that will help keep your customers loyal and engaged with your business.

5. Enhances decision-making:

Knowing the Net MRR Churn rate gives you valuable insights that can help you make better business decisions. With this data, you can determine when to invest in growth initiatives or focus on improving customer retention. This helps ensure that you are taking the right steps for long-term success.

6. Helps with forecasting:

Tracking the Net MRR Churn helps you to estimate future growth and potential revenue. With this data, you can create forecasts that give you an accurate picture of how your startup is likely to perform in the coming months or years. This will help you make better-informed decisions when it comes to budgeting and resource allocation.

Ultimately, tracking the Net MRR Churn is important for startups because it provides insights into how well they are performing and what steps need to be taken to ensure future success. With this data, you can make smarter decisions that will help you reach your goals promptly.

How To Calculate the Net MRR Churn?

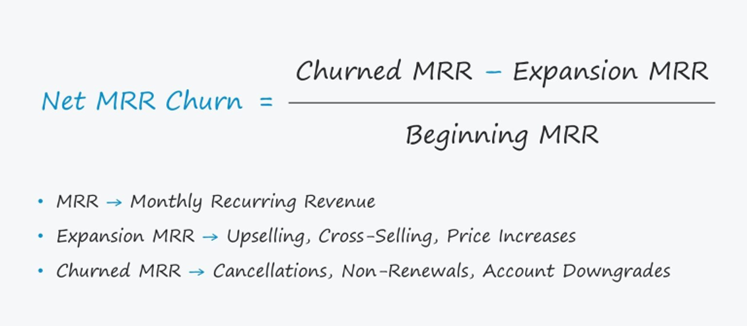

Here is the formula to calculate the Net MRR Churn:

For example, if a company has an MRR of $100 at the beginning of the month and churns $30 in MRR while also expanding $10 in MRR, then their Net MRR Churn is

Net MRR Churn = ($30 – $10) ÷ $100 = 0.2 or 20%.

This means that the company experienced a net MRR churn of 20% in the month.

What factors affect the Net MRR Churn?

The following factors affect the Net MRR Churn:

1. Customer Retention Strategies:

Companies often employ customer retention strategies, such as loyalty programs and discounts, that can reduce the churn rate by making customers more likely to stay with the company.

2. Product Quality:

High-quality products are much less likely to experience high levels of churn, since customers who use them find value in the product and are more likely to stick around.

3. Customer Support:

Customers who feel supported by the company they’re using, either through solid customer support or even just a quick response time to their questions, are more likely to remain loyal customers and less likely to churn.

4. Competitive Pricing:

Prices that are too high can drive away customers, while prices that are too low can hamper profits. Companies should strive to balance pricing in order to maximize revenue and minimize churn.

5. Communication:

Companies should keep customers informed about changes, updates, or features that affect their usage of the product. Regular communication with customers is important for fostering a sense of connection and loyalty, which will help reduce churn.

6. Product Ease of Use and Accessibility:

Customers should be able to use a product or service with ease if they are to remain loyal customers. Companies should strive to make their products easy to understand, navigate, and access so that customers can get the most out of them without issue.

7. User Experience:

A good user experience is essential for keeping customers engaged with a product or service. Companies should strive to create an enjoyable user experience that makes them want to come back and use the product or service again.

8. Technology:

The latest technological advances can help make products more efficient and engaging, which will reduce churn as customers get more out of their usage of the product or service. By staying up to date on the latest technology, companies can ensure that their products and services remain competitive in the market.

9. Market Trends:

Keeping track of changes in the industry is important for predicting and managing churn rates. Companies should identify emerging trends that could lead to increased or decreased customer churn so they can adjust strategies accordingly.

10. Data Analysis:

Analyzing churn data can help companies to identify patterns and trends in customer behavior so they can adjust their strategies to reduce churn rates. By taking a close look at their churn data, companies can better understand what’s causing people to leave and make the necessary changes to retain existing customers.

These factors are all important to consider when looking at the Net MRR Churn.

What is a good Net MRR Churn?

Good Net MRR Churn is a measure of how much revenue is lost each month due to customers canceling their subscriptions or downgrading their plans. It’s typically expressed as a percentage and calculated by subtracting the new monthly recurring revenue (MRR) from the existing MRR and dividing that result by the existing MRR.

A low Net MRR Churn means that your customers are sticking around and not canceling their subscriptions or downgrading their plans. A high net MRR churn rate indicates that you’re losing a lot of revenue due to customers leaving.

Quotes about Net MRR Churn

- “Net MRR Churn is a way to measure the effectiveness of our customer satisfaction efforts and make sure we’re providing value that keeps customers around.” -John Doe, CEO

- “We chose Net MRR Churn as an important metric for measuring our product success because it reflects how well our product is being adopted and used in the market.” -Jane Smith, COO

- “Net MRR Churn is a key indicator of customer loyalty and ongoing retention. We use it to measure how well our customer service team is doing and to ensure that we’re meeting our customer’s needs.” -Chris Johnson, Head of Customer Service

What are examples of Net MRR Churn?

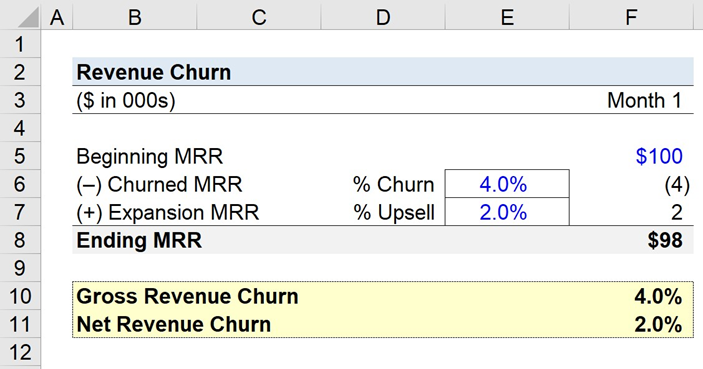

In January 2022 (Month 1), the beginning MRR for a SaaS company was $100,000. The churned MRR for this month – as caused by downgrades and cancellations – was 4% of the beginning MRR, or $4,000. On the flip side, the expansion revenue of the company was assumed to be 2% of the beginning MRR, equal to $2,000.

After netting out the expansion MRR against the churned MRR, we are left with a net change to MRR of $2,000. The rate of this net revenue churn is 2%, which was calculated by dividing the net churn by the starting MRR. This shows that the negative impact of losing $4,000 from cancellations and non-renewals was offset by gaining $2,000 in upsells for January.

Example 2:

The initial Monthly Recurring Revenue (MRR) was $50,000 and there was $4,000 worth of contract cancellations and downgrades. However, two customers upgraded to premium plans, resulting in an increase of $2,000 for the company’s MRR. This means that their net MRR churn rate for the month was 4%: ($4,000 – $2,000) / $50,000 x 100 = 4%.

Tips to improve the Net MRR Churn

The following strategies can help to improve the Net MRR Churn:

1. Analyze customer behavior:

Understanding customer behaviors and analyzing what triggers churn can help companies to identify potential issues and opportunities to act before customers leave.

2. Improve customer experience:

Companies should strive to improve the quality of their products, services, and overall user experience in order to reduce churn rates.

3. Offer better pricing and packages:

Companies should consider offering more competitive pricing packages, such as discounts for long-term customers or extra features for those who are likely to stick around.

4. Enhance customer communication:

Regularly engaging with customers promptly can help keep them informed about new features, updates, and promotions that may encourage them to stay with the company.

5. Improve customer onboarding:

Companies should focus on providing an easy and enjoyable onboarding experience for new customers to ensure they are engaged from the start.

6. Offer rewards programs:

Rewards programs, such as loyalty points or discounts for renewals can be a great incentive for customers to stay with a company longer.

7. Monitor customer feedback:

Companies should set up systems to regularly collect customer feedback and analyze it for trends. This can help determine what customers are looking for to make improvements that can reduce churn.

8. Invest in customer success:

Providing ongoing support and guidance can help ensure customer success, which often leads to longer customer retention rates.

9. Focus on customer retention:

Companies should create strategies and initiatives to focus on customer retention. This may involve providing additional resources, such as training or discounts for renewals, which can help keep customers happy with the product or service.

10. Invest in Customer Relationship Management (CRM) software:

Utilizing CRM software can help companies track customer interactions and gather insights into customer behavior which can aid in churn prevention.

By following these tips, companies can improve their Net MRR Churn and increase customer retention.

The Bottom Line

startups need to keep a close eye on their Net MRR Churn. A high rate of churn can be an early sign that your product isn’t meeting customer needs, or that your business model is unsustainable.

If you see your churn rate rising, take action immediately to address the problem. By understanding and monitoring your Net MRR Churn, you can make sure your startup stays on track for long-term success.