Net income is one of the most important financial metrics used to gauge the performance and profitability of any business. Whether it’s a small mom-and-pop shop or a large corporation, knowing what your net income is can provide invaluable insights into your financial health. In this guide, we’ll explore what net income is, how to calculate it, tips to improve net income – and much more! So if you’re looking for a comprehensive yet easy-to-understand primer on net income, you’re in the right place. Let’s get started!

What is Net Income?

Net Income (also known as net profit or bottom line) is a financial metric that measures the amount of money a business has left over after all its expenses and costs are deducted from its total revenue. Put simply, it’s the amount of money the company earns after accounting for all other sources of income and subtracting out all necessary costs.

Net Income is often used as a measure of a company’s financial health, as it provides insight into how efficiently the business can generate revenue and manage its expenses. It is also important for investors, who use it to assess whether or not they should invest in a particular company. In short, Net Income can provide valuable information about a company’s performance and its financial position.

Why Is It Important For Startups to track the Net Income?

Following are the reasons why tracking the net income is important for Startups:

1. It helps to understand the overall profitability of the business:

Tracking net income allows startups to measure their progress in achieving profitability, as well as identify areas where they may need to adjust pricing or operations in order to increase profits.

2. It provides an accurate record of performance:

By monitoring net income over time, startups can get a better understanding of their financial performance and use the data to make informed decisions about future investment and growth.

3. It helps inform strategic decisions:

Understanding net income can help startups identify opportunities for further cost savings or revenue generation that may be beneficial in the long term.

4. It can reveal potential problems early on:

Tracking net income provides early warning signs of financial trouble, allowing startups to take corrective action before it’s too late.

5. It reflects the true health of a business:

Tracking net income is a valuable indicator of whether or not a startup is healthy and viable in the long term. This can help companies make better decisions about their future investments and growth strategies.

Ultimately, tracking net income is a crucial part of any startup’s financial management strategy and should not be overlooked. It provides valuable insight into the overall health and profitability of the business, which can help ensure that startups make informed decisions about their future development.

By monitoring net income on a regular basis, startups can get an accurate picture of their financial performance and identify areas where they can make improvements.

How To Calculate the Net Income?

Here is the formula to calculate the Net Income:

Let’s consider an example of a company that has reported pre-tax income of $500,000 and taxes paid of $120,000. The net income for this company can be calculated as follows:

Net Income = $500,000 – $120,000 Net Income = $380,000

Therefore, the company’s net income is $380,000. This means that the company has earned a profit of $380,000 after taxes. This amount can be used to fund operations and pay dividends to shareholders. It also serves as an indicator of how well the business is performing financially.

What factors affect the Net Income?

The following factors affect the Net Income:

1. Operating expenses:

This includes all the costs associated with running a business, such as labor and materials. Operating expenses directly affect net income as they determine how much money is available to be reinvested or distributed as profit.

2. Revenue:

The amount of money a company makes from its sales will directly affect the Net Income. If revenue is low, net income is likely to be lower.

3. Tax Expenses:

All businesses must pay taxes on their profits, which reduces the amount of money available for distribution as Net Income.

4. Interest expenses:

Companies may owe interest on borrowed money or investments, which also affects their Net Income.

5. Depreciation and Amortization:

Companies must spread the cost of an asset over its useful life. This is known as depreciation or amortization, and it reduces net income since these costs are non-cash expense.

6. Non-operating expenses:

These are any costs that don’t directly relate to running the business, such as interest payments on debt. The amount of non-operating expenses will affect the Net Income.

In conclusion, there are several factors that can affect a company’s net income, including operating expenses, revenue, tax expenses, interest expense and depreciation/amortization. It is important for businesses to be aware of these factors in order to maximize their profits and minimize their losses.

What is a good Net Income?

The answer to this question depends largely on the type of business and its size. Generally speaking, a good net income in business would be one that covers all expenses, including taxes and interest payments, while leaving a healthy profit margin. A larger business may have a higher threshold for what constitutes “good” net income due to their larger capital base and greater operational needs.

Ultimately, a successful business should aim to generate profits that are above the industry average and can be used to reinvest in the company’s growth and development. In some cases, businesses may even strive for net incomes that exceed their operating costs in order to maximize shareholder value. Net income is also important to debt holders due to its use in calculating overall financial health and solvency ratios.

Ultimately, having a good net income in business will help ensure the company’s continued viability and growth potential. Also, having a good net income in business is an important component of a successful and thriving operation.

Quotes about net income

- “Net income is the starting point for any successful business.” – Mark Cuban

- “Net income is the true measure of a company’s performance.” – Warren Buffett

- “Net income is more reliable than revenue as an indicator of success.” – Seth Godin

- “The ultimate goal of any business is to achieve profit and net income, not just revenue.” – Robert Kiyosaki

What are the examples of Net Income?

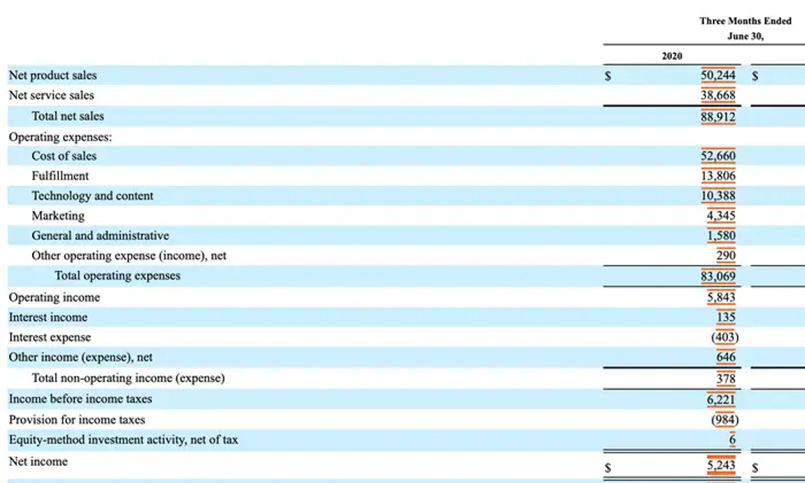

The net income of Amazon can be calculated by subtracting total expenses, including the cost of goods sold, from their revenue. Total revenue includes all sales and income which are listed as millions.

Specifically, the equation for net income is Net Income = Revenue – Cost of Goods Sold – Expenses.

In Amazon’s statement of operations, the total revenue is listed as 89,296 which includes 88,912 for total net sales, 378 for total non-operating income, and 6 from equity method investment activity (net of tax). Furthermore, the total expenses including the cost of goods sold are 84,053 which comprises 83,069 for total operating expenses and 984 for provision for income taxes.

By subtracting the total expenses from the revenue, a net income of 5,243 is achieved which can be seen on the bottom line in their statement of operations.

By following this calculation, it is easy to see how Amazon’s net income is determined. The key equation used to calculate the net income is Revenue – Cost of Goods Sold – Expenses. With this information, it is possible to understand how Amazon’s statement of operations works and what its bottom line looks like.

Example 2:

Coca-Cola recently reported its financial results for the month ending April 2, 2021. Total revenue for the period was $9 billion, with interest income of $66 million and equity gains of $417 million. The company incurred expenses totaling $3.3 billion, including administrative costs of $2.7 billion, interest payments of $ 442 million, taxes of $508 million, and operational costs of $124 million.

After taking into account all expenses, the company’s net income for the period was determined to be $5.709 billion.

This figure was calculated using the following equation:

Gross income ($9 billion + $417 million + $66 million) – Expenses (2.7 billion + $442 million + $508 million + $124 million) = $5.709 billion (Net income).

So the Net Income is 5.709 billion dollars.

Tips to improve the Net Income

following strategies can help to improve the Net Income:

1. Cut Costs:

One of the most effective strategies to increase net income is to reduce costs across all areas of the business. Look for ways to trim expenses in marketing, production, labor, and other areas. Eliminating unnecessary spending can free up more cash that can be used for other initiatives or reinvested back into the company.

2. Boost Revenues:

Increasing revenue is the other side of the equation. A company can do this through a number of strategies, including increasing prices on products and services, targeting new markets, or launching additional products or services. It’s important to also look for ways to increase efficiency in sales processes, as well as find ways to get and keep customers coming back.

3. Monitor Cash Flow:

Cash flow can make or break a business, so it’s important to track cash flow closely. Analyze the company’s financial statements and operations regularly to identify any areas of improvement in collections and expenses, as well as analyze trends that could impact net income.

4. Invest in Technology:

Automation can simplify and streamline processes, freeing up employees’ time to work on higher-priority tasks. Utilizing technology can also help to increase efficiency, reduce waste and improve accuracy. Investing in the right technologies can pay off in improved net income over time.

5. Increase Prices for Products and Services:

Sometimes, increasing prices is necessary to improve net income. When examining price increases, look for ways to add value to the product or service before making any changes. This can help justify the increase and keep customers from going elsewhere.

6. Review Debt Agreements:

Taking a close look at loan agreements and other debt commitments can help to reduce costs associated with these obligations. Refinancing, renegotiating, or restructuring debt can lower interest payments and free up cash flow. This can have a positive effect on net income.

7. Create Strategic Partnerships:

Reducing costs while increasing sales is an ideal combination for improving net income. Strategic partnerships with other companies offer an opportunity to expand a company’s reach with minimal cost. This type of partnership can help the company access new markets and customers, which could mean more revenue and higher net income.

By utilizing these strategies, companies can take steps to improve their net income and become more profitable in the long run. It’s important to remember that a successful net income improvement strategy requires careful planning and monitoring.

Making changes that have too big of an impact could backfire, so it’s important to test out any changes before full implementation.

The Bottom Line

Is your company or organization struggling to bring in new clients and generate more revenue? If so, you’re not alone. Many businesses are in the same boat. The good news is that there are some simple steps you can take to increase your net income. By following the tips outlined in this blog post, you’ll be on your way to generating more revenue and improving your bottom line.