As a startup, it’s essential to understand net dollar retention- the key financial metric that reveals user loyalty and engagement. It measures how much your customers are spending over time, showing you crucial insights into their buying habits. If you’re serious about getting ahead in the tech world and staying competitive, it’s vital that startups measure their net dollar retention rate to determine growth potential.

In this blog post, we’ll cover everything there is to know about net dollar retention- its definition and importance as well as tips to improve it. With this knowledge on hand, you’ll be able to gain valuable insight into your customer base so you can make informed decisions with confidence!

What is the Net Dollar Retention (NDR)?

Net Dollar Retention (NDR) is a financial metric used to measure the amount of money a company retains from customers after they’ve paid their bills. NDR helps provide valuable insight into how successful a company is in retaining its existing customer base and how well it can acquire new customers.

NDR is an important metric for businesses that rely heavily on repeat customers because it shows how well they are doing in terms of maintaining loyalty and profitability. It also provides a valuable indicator of future growth potential as it indicates whether more money should be put into marketing campaigns or not.

Why Is It Important For Startups To track Net Dollar Retention (NDR)?

Following are the reasons why tracking the Net Dollar Retention is important for startups:

1. Understand the Health of Your Business:

Net Dollar Retention helps startups understand their business health and identify potential areas for improvement. It allows startups to measure customer lifetime value, compare subscription plans, and track customer spending trends.

2. Measure Growth:

Tracking Net Dollar Retention helps startups evaluate their growth rate and determine if they are meeting customer expectations. This data can be used to pinpoint areas that need improvement and make necessary adjustments to ensure customer satisfaction.

3. Monitor Customer Behavior:

Tracking Net Dollar Retention gives startups the ability to monitor the behavior of their customers and see where they are spending their money. With this information, startups can optimize their marketing efforts, implement new strategies, and create more attractive products.

4. Develop a Better Experience:

By tracking Net Dollar Retention, startups can better understand their customer’s needs and develop an improved experience for them. This data allows startups to identify any issues customers are having with their product or service and make adjustments as needed.

5. Increase Customer Loyalty:

Finally, tracking Net Dollar Retention helps startups identify their most loyal customers and reward them for their loyalty. This encourages customer retention and increases the chances that a customer will continue to purchase from a startup in the future.

By tracking Net Dollar Retention, startups can build stronger relationships with their customers and increase long-term success.

How To Calculate the Net Dollar Retention?

Here is the formula for calculating the Net Dollar Retention:

For example, let’s assume in a given month: Starting MRR = $50,000 Expansion = $20,000 Downgrades = $10,000 Churn = -$15,000 The NDR would be calculated as follows: [(50,000 + 20,000 — 10,000 — 15,000) / 50,000] * 100% = 46%

Net Dollar Retention in this scenario would be 46%, indicating that despite some churn and downgrades the company was able to drive expansion month-over-month. This is a sign of healthy growth in the business.

What factors affect the Net Dollar Retention:

Net Dollar Retention (NDR) is affected by several factors, these include:

following factors affect the Net Dollar Retention:

1. Pricing Strategy:

Companies need to consider pricing strategy when calculating their Net Dollar Retention as different price points will have a significant impact on retention. The company needs to assess the customer’s lifetime value at different price points to maximize Net Dollar Retention.

2. Product Quality & Reliability:

Customers are more likely to stay with a company that provides quality products and reliable services. Companies should ensure that their products and services are up to the mark customers are loyal and reduce churn rates.

3. Customer Service:

Providing good customer service is essential for any business as it helps build trust and loyalty. Companies need to ensure that they provide prompt, helpful, and friendly service to their customers to increase Net Dollar Retention.

4. Loyalty Programs:

Companies can create loyalty programs that reward customers for their repeated purchases or regular engagement with the company. Such programs encourage customers to stay loyal and help boost Net Dollar Retention.

5. Brand Image & Reputation:

Companies need to maintain a good brand image and reputation to attract more customers. Customers are more likely to stay with companies that have good brand recognition and a positive reputation.

6. User Experience:

Companies should ensure that their products provide an enjoyable user experience for customers as this will help reduce churn rates. Improving the user experience can help drive customer loyalty, resulting in higher Net Dollar Retention.

7. Promotions & Offers:

Companies can offer promotional discounts, memberships, and other offers to retain customers. Such strategies help bring down customer churn rates and boost Net Dollar Retention.

8. Network Effects:

Network effects refer to the phenomenon where the value of a product increases when more people use it. This can be a powerful tool for companies to retain customers, as more users would mean more value and therefore more incentives to stay with the company.

9. Competitors:

Companies need to be aware of their competition to maintain a competitive edge over them. This helps businesses keep up with changing customer demands and reduce churn rates, resulting in higher Net Dollar Retention.

10. Data Analytics:

Companies should collect and analyze customer data to better understand their customers’ needs and preferences. This can be used to develop targeted strategies that will help retain customers, driving up Net Dollar Retention.

Ultimately, Net Dollar Retention is a key metric for businesses to measure the success of their customer retention efforts.

Quotes about the Net Dollar Retention:

- “The net dollar retention metric is a great way to measure the health of your business and helps you retain more customers over time.” – John Doerr, Entrepreneur

- “Net Dollar Retention measures customer loyalty and speaks to both the quality of service and product offering. A high NDR signals that you have a great customer base who value what you offer.” – Reid Hoffman, LinkedIn Founder

- “Net Dollar Retention is the ultimate measure of customer loyalty and satisfaction over time—it’s one of the most important business metrics.” – Brad Feld, Venture Capitalist

What is a good Net Dollar Retention?

Net dollar retention is a crucial statistic for organizations attempting to achieve hyper-growth and succeed in private equity partnerships or take their businesses public. According to Crunchbase, typically companies that go public have an average NDR of about 107%. Any score above 120% is viewed as excellent; Alteryx and Okta reported net dollar retentions at 134% and 123%, respectively, around the time they went public.

For a good benchmark rate, a net dollar retention of at least 100% is recommended; this indicates that your current total annual recurring revenue (ARR) is equal to or greater than the ARR you had at the beginning of the period. This happens when you can keep your current customers, as well as add cross-sell and upsell motions to increase the subscription costs that your customers pay out when they renew.

In conclusion, net dollar retention is a vital metric for businesses striving for success in their respective industries. Companies should strive to attain a benchmark of at least 100% while seeking even higher scores for maximum success.

What is an example of Net Dollar Retention?

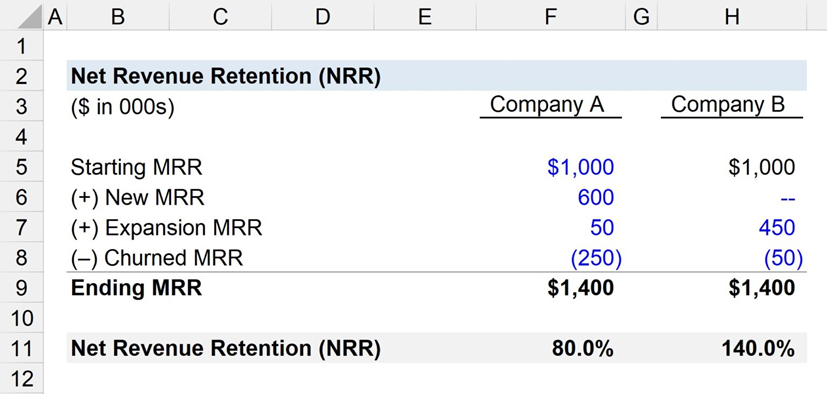

We can compare the net revenue retention of two SaaS companies in the same market – Company A and Company B. Both start with $1 million in MRR, but their financials differ

Company A: Starting MRR = $1 million, New MRR = $600,000, Expansion MRR = $50,000, Churned MRR = –$250,000

Company B: Starting MRR = $1 million, New MRR = $0, Expansion MRR = $450,000, Churned MRR = –$50,000

The ending MRR is the same for both companies: $1.4 million. However, the net revenue retention differs greatly – 80% for Company A and 140% for Company B. This difference is caused by their existing customer base. Company A’s churned MRR is masked by their new MRR, while Company B has a greater expansion MRR and less churned MRR, implying better customer satisfaction.

Company B’s growth is less reliant on acquiring new customers due to their greater expansion MRR and lower churned MRR. This indicates that they are more likely to continue having long-term recurring revenue. Thus, Company B appears to be in a better financial position than Company A.

Tips to Improve the Net Dollar Retention:

Following are some Strategies to Improve the Net Dollar Retention:

1. Increase AOV by Offering Bundles:

Offer your customers bundles of multiple items or services at a discounted rate to increase their Average Order Value (AOV). This will help drive more revenue and create stronger customer loyalty, leading to higher net dollar retention rates.

2. Utilize Upselling Strategies:

Every time a customer makes a purchase, offer them additional products or services that can enhance their experience. This will not only increase their AOV but also drive more revenue for your business.

3. Leverage Loyalty Programs:

Create loyalty programs to reward customers for making repeat purchases over time. Doing this can help convince customers to purchase from you repeatedly, which in turn will lead to higher net dollar retention.

4. Offer Discounts and Promotions:

Encourage customers to come back by offering them discounts and promotions on their purchases. This will incentivize repeat purchases, helping you increase your net dollar retention rate.

5. Improve User Experience:

Focus on improving the user experience for your customers when they shop with you. Make sure your website is easy to navigate, and offer helpful resources such as FAQs and customer support. Doing this will help make the shopping experience more enjoyable for customers and encourage them to buy from you again.

6. Enhance Customer Support:

Make sure your customer service team is available to help customers with their questions or issues. This will show them that you are dedicated to providing them with a great experience, and will encourage them to come back in the future.

7. Offer Subscriptions:

Give customers the option to sign up for subscriptions for your products or services. This lets customers enjoy the convenience of having their purchase shipped automatically each month, making it easier for them to shop with you over time and leading to higher net dollar retention.

By following these strategies, you can help grow your business and increase your net dollar retention rate over time. Doing this will not only lead to more customers but also a stronger customer base that is more likely to stick with you in the long run.

The Bottom Line

Net dollar retention (NDR) is a key metric for any SaaS company. NDR measures how much revenue you’re able to retain from your existing customer base over time and is a good indicator of the health of your business.

By understanding what NDR is, how to calculate it, and what factors influence it, you can make sure that your business is on the right track.