Net Burn is a concept that is becoming increasingly important for startups to understand. While it’s easy to focus on our product, sales figures, and marketing strategy, there’s much more we need to take into account when running a successful startup. The term net burn refers to the rate at which money leaves your company: how much you’re spending each month versus how much income you’re taking in. Companies with positive net burn can reinvest profits so they can continue growing without requiring additional capital. On the other hand, companies with negative net burns often find themselves struggling and may even face complete failure if not carefully monitored and managed properly. In this blog post, we will discuss the importance of understanding net burn as well as strategies for optimizing income and expenses so you have a healthy cash flow balance going forward.

What is Net Burn?

A net burn is a tool used by businesses to help them track and measure their cash flow. It is often used to calculate the rate of cash being spent on operations, investments, or other activities within a certain period. Net burn also helps companies forecast future cash needs based on past patterns and current trends in spending.

This information can be useful for budgeting and strategic planning, as well as helping to ensure that a company continues to be profitable. A net burn is an important tool for businesses of all sizes, from startups to large enterprises. It can help them make more informed decisions about their financial health so that they stay competitive and successful in the marketplace.

Why is it important for startups to track Net Burn?

Followings are the reasons why tracking the Net Burn is important for startups:

1. It helps to ensure that the financial resources of the startup are being used responsibly and efficiently:

Tracking the net burn rate helps startups to better manage their cash flow, identify areas where money is being wasted, and make sure funds are being allocated in a way that will maximize returns and minimize losses.

2. It gives an indication of the overall health of the business:

Looking at the net burn rate can offer startups valuable insight into how their businesses are doing financially. It gives a good indication of the company’s financial stability, as well as its capacity to sustain current levels of operation or grow in the future.

3. It helps in planning for new investments and growth:

Tracking the net burn rate can also help startups plan for future investments and growth. By being aware of where the company is burning money, startups can see which areas need more focus or funding to keep growing and remain competitive.

4. It helps to manage expectations:

Tracking the net burn rate can help set realistic targets for financial performance. This is especially important for startups who are trying to secure funding from venture capitalists or other investors, as it can give them an indication of the company’s future and expected returns.

5. It provides a snapshot of progress and performance:

By tracking the net burn rate, startups can keep an eye on their progress and ensure that they are staying on track. This way, they can adjust their strategies quickly to continue growing and achieving their goals.

Overall, tracking net burn is a vital part of ensuring the success of any startup business. It provides valuable insight into the company’s financial health and progress, allowing startups to make informed decisions that will help secure their future.

With the right strategies, tracking net burn can be an effective way for startups to stay on track and reach their goals.

How To Calculate the Net Burn?

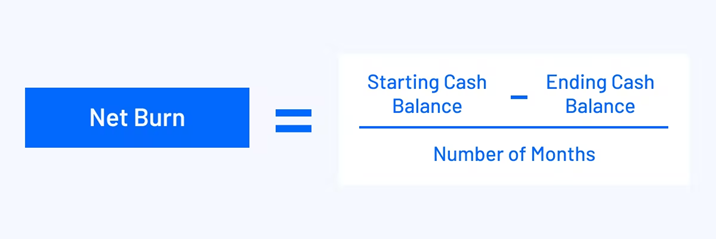

Here is the formula to calculate the Net Burn.

For Example: If your monthly expenses total $10,000 and you generate only $4,000 in revenue, then your net burn amount would be $6,000. This is an indication of how much money you are losing each month as the $6,000 will come out of your cash runway.

Alternative Formula:

Another formula to measure Net Burn is:

For example, if a company had $1 million in cash at the start of the year, and their ending cash balance was $750,000 at the end of 6 months. The net burn for this period would be:

Net Burn = ($1M – $750K) / 6 Months

= $250K

What factors affect the Net Burn?

Net Burn is affected by several factors, these include

1. The rate of burn:

This is the rate at which expenses are being made relative to revenue. A higher burn rate indicates that a company is spending more than it is earning and will lead to a higher net burn.

2. Cash on hand:

Companies with more access to capital can endure larger cash outflows than those with fewer resources. This means that companies with more capital can tolerate higher burn rates for longer periods of time and still remain profitable.

3. Cash flow:

The cash flow into a company is affected by the outflows from expenses, investments, and other expenditures. If a company has a net negative cash flow, then it may need to increase its burn rate to cover expenses to stay afloat.

4. Revenue Streams:

The revenues that a company can generate will affect its net burn. A company with more diverse revenue streams and higher revenues overall can afford a larger burn and remain profitable for longer periods of time.

5. Market Conditions:

The economic conditions of the market can also have an impact on a company’s net burn. For example, if the economy is in a downturn and demand for a company’s products or services is low, it may need to increase its burn rate to stay afloat.

6. Cost Structure:

The cost structure of a company will also play an important role in the net burn rate. Companies with higher fixed costs, such as rent, salaries, and other overhead expenses, will need to make more cuts or increase their burn rate to remain profitable during difficult economic times.

7. Competitors:

The strategies of a company’s competitors can also affect its net burn rate. If competitors can increase their market share with lower prices or better products, then a company may need to increase its burn rate to stay competitive.

8. Investment Opportunities:

Companies should also consider the potential for investments before increasing their net burn rate. Investing in new projects or expanding existing ones can lead to increased revenues and help a company remain profitable despite a higher burn rate.

Ultimately, the net burn rate of a company is determined by the combination of these factors working together. Companies need to evaluate their current situation and identify potential risks before increasing their burn rate to ensure their long-term success.

What is a good Net Burn?

Entrepreneurs and experts highly recommend that startups maintain at least twelve months of runway funding at all times. This means that a good burn rate would be approximately one-twelfth of the total available cash. For example, if your startup has $600,000 in available cash, you should aim to keep your burn rate close to $50,000.

Having a comprehensive understanding of the burn rate is important for startups at any stage of development. It will inform how you allocate funds, what your projections look like, when it’s time to seek out investors, and the strategic decisions you make for your business. It is essential to factor in the burn rate when planning the future of your venture.

Step-by-step example of Net Burn?

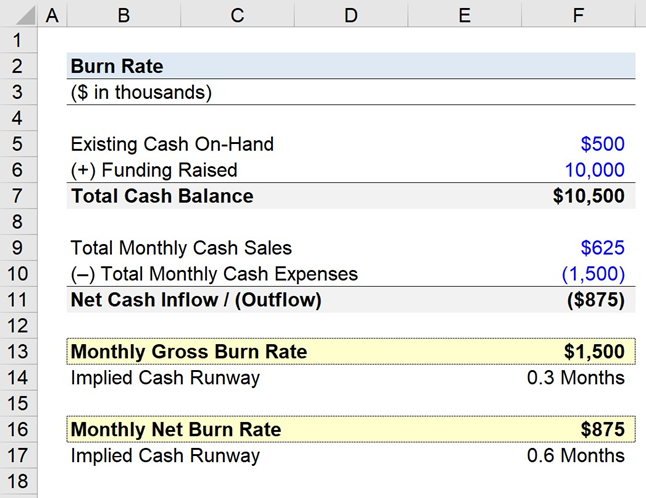

Step 1. Total Cash Balance Calculation (“Liquidity”)

The first step in calculating the cash burn rate is to calculate the “Total Cash Balance,” which is the sum of existing cash on hand plus any funding raised. For this example, we will assume that a start-up had $500K in its bank account and recently raised $10MM in equity financing, resulting in a total cash balance of $10.5MM. This is the assumed cash balance at the beginning of the period.

Step 2. Gross Burn Rate Calculation Analysis

The remaining operating assumptions for this example are that the start-up has monthly cash sales of $625K and monthly cash expenses of $1.5MM. By subtracting the two, we get a net loss of $875K per month. The “Monthly Gross Burn” is calculated by only considering the cash losses, which in this case amount to a loss of $1.5MM each month. If the monthly cash sales were taken into account, we would be calculating the “net” variation.

Step 3. Net Burn Rate Calculation Analysis

The monthly net burn is a straightforward link to the net cash inflow or outflow. By adding the cash sales to the total cash expenses, we get $875K as the monthly net burn. This is the net cash burn rate for this particular example.

Tips to Improve the Net Burn

Following are the ways that businesses can follow to Improve the Net Burn:

1. Set Clear Goals:

Establishing clear and achievable goals will help to focus on the success of the net burn. Make sure each team member is aware of their individual goals and objectives and how they fit into the overall strategic plan.

2. Track Progress:

Develop a process for tracking progress toward achieving your net burn goals. Use metrics to measure progress and compare performance against targets.

3. Monitor Performance:

Regularly monitor the results of your net burn initiatives and make adjustments as needed. Pay close attention to any changes in customer behavior or market conditions that could affect the success of your efforts.

4. Invest in Technology:

Investing in technology can help automate processes and improve efficiency. Additionally, implementing new technologies can help you to better measure and track progress against your net burn goals.

5. Stay Agile:

The business environment is constantly changing, so remain agile and be prepared to adjust your net burn strategy as needed in response to market changes or customer needs.

6. Collaborate with Teams:

Collaborate with other departments or teams within your organization to ensure that each team’s efforts are working together to achieve the desired net burn results.

7. Analyze Data:

Collect and analyze data related to your net burn initiatives to gain insights into customer behavior, market conditions, and more. Use this information to make informed decisions about future efforts.

8. Educate Employees:

Make sure that all employees understand the importance of net burn and how their own efforts can help contribute to a successful outcome. Provide training and resources so that everyone is informed about the best practices for achieving your goals.

9. Leverage Partnerships:

Establishing strategic partnerships with other companies can help to improve your net burn results. These partnerships can provide access to new markets, customers, and technologies, which can help you to achieve success faster.

10. Utilize Automation:

Automating processes wherever possible can increase efficiency and reduce the amount of time spent on manual tasks. Additionally, it can help to ensure that all processes are completed accurately and consistently.

11. Set Targets:

Setting targets for each stage of the net burn process will help to keep everyone on track and motivated. Additionally, it can provide an easy way to measure performance against goals.

12. Measure ROI:

Use metrics to measure the return on investment (ROI) of any efforts related to net burn. This will help to identify areas where changes can be made in order to maximize returns.

13. Measure Success:

Establish metrics to measure the success of your net burn initiatives. Quantify any improvements you make in order to track the results of your efforts over time and compare performance against goals.

The Bottom Line

A startup’s biggest worry should be their “NET Burn.” This is the rate at which they are spending money and not making any back. To keep a close eye on your NET Burn, track two metrics: total cash runway and monthly burn rate.

Your goal should be to increase your total cash runway while decreasing your monthly burn rate. Try these tips to keep your startup afloat and prevent going belly up.