Are you a startup founder or entrepreneur trying to figure out how to make your business model work? If so, then you’ve probably heard of the LTV: CAC ratio and what it means for your business. But if you’re like many people, you may wonder what this ratio is and why it matters. This blog post will break down the LTV: CAC ratio and explain why it’s such an important business metric. Stick around for the end, where we’ll also provide tips on improving your LTV: CAC ratio.

What Is LTV: CAC Ratio?

LTV/CAC ratio is a metric businesses use to compare Customer Lifetime Value (LTV) with the costs of acquiring new customers (CAC). In other words, it tells you how much money you can expect to make from a customer throughout their relationship with your company, compared to how much it costs to acquire them in the first place.

A high LTV: CAC ratio indicates that you are generating a good return on investment from your marketing and sales efforts and that your customers are sticking around for the long haul.

On the other hand, a low LTV: CAC ratio could mean that you are spending too much to acquire new customers or that your customers are not staying with you for very long.

Regardless of where your business falls on the spectrum, it is important to constantly monitor your LTV: CAC ratio to make informed decisions about where to allocate your resources.

Why Is LTV: CAC Ratio Important For Business?

LTV: CAC ratio is important for business because it provides insight into the long-term value of a customer and the amount of money a business needs to spend to acquire new customers. The ratio can be used to assess whether a business is sustainable in the long term and whether it is generating enough revenue to cover its costs.

- Helps startups determine how much they can afford to spend on acquiring new customers.

- Can help startups measure the effectiveness of their marketing efforts.

- LTV/CAC can help startups determine how long it will take them to break even on new customers.

- Can help startups decide whether or not to invest in new customer acquisition campaigns.

- Is an important metric for assessing the overall health of a startup.

A high LTV:CAC ratio indicates that a business is generating more revenue from its customers than it is spending to acquire new customers. In contrast, a low ratio indicates the opposite.

Businesses with a high LTV: CAC ratio are more likely to be sustainable in the long term and generate higher profits. Therefore, the LTV: CAC ratio is an important metric for businesses to track and improve.

How To Calculate LTV: CAC Ratio?

Let’s break down the components.

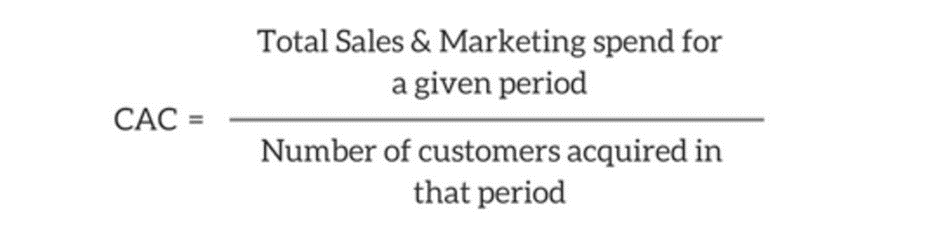

Customer Acquisition Cost

CAC is calculated as the total cost of acquiring customers, divided by the total customers acquired over a given period. The ‘cost’ is your total spend on sales and marketing costs.

For example, if you spend $1000 acquiring new customers and acquire 100 customers, your CAC is $10.

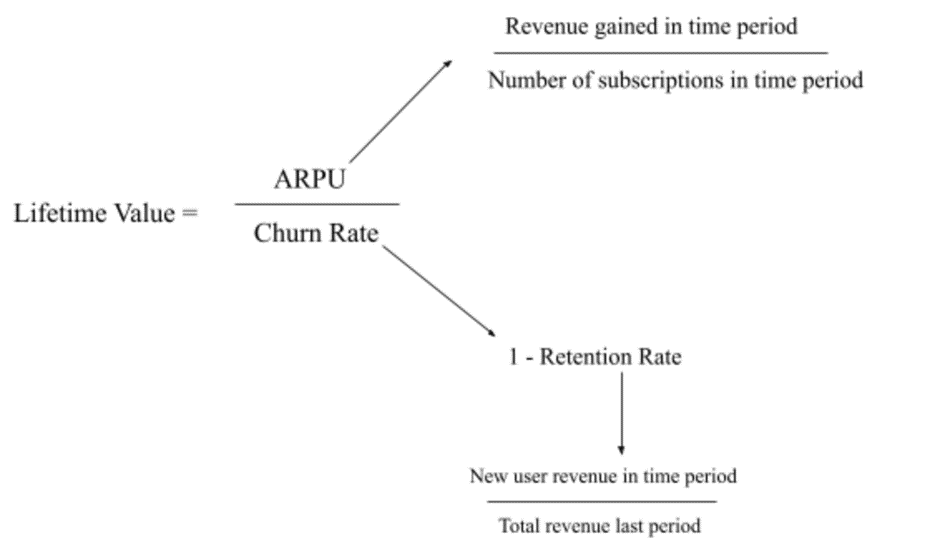

Lifetime Value

Lifetime value is more complicated to calculate consisting of Average Revenue Per User (ARPU) and your Churn Rate.

You can also calculate it as LTV = ARPU * Gross Margin * Average duration of customer contracts.

Calculating CAC-LTV Ratio

Once you have both your CAC and LTV, you can now calculate CAC/LTV. To do that, you divide the lifetime value over the customer acquisition cost.

For example, if a company has an LTV of $100 and a CAC of $50, its LTV: CAC ratio would be 2.0 (100/50).

To succeed, companies must ensure that their LTV: CAC ratio is greater than 1.0. This means they are generating more revenue from each customer than they spend to acquire that customer.

If your LTV: CAC ratio is less than 1.0, you’re losing money on each customer, and you need to either decrease your acquisition costs or increase your revenue per customer.

What Is A Good LTV: CAC Ratio?

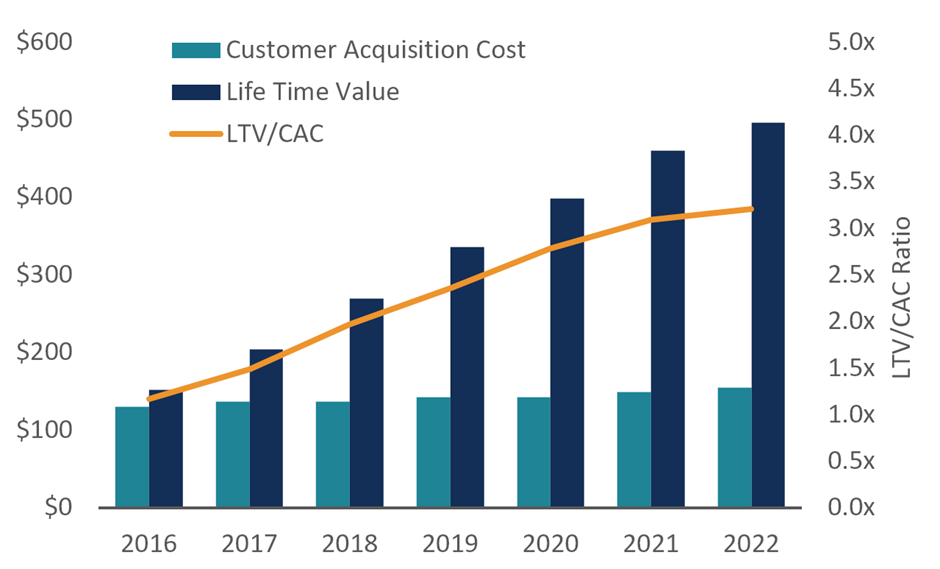

A company’s LTV: CAC ratio is one of its most important health measures. A high LTV: CAC ratio indicates that a company is effectively acquiring new customers and retaining them over the long term. This is a key driver of sustainable growth.

There is no magic number for a “good” LTV: CAC ratio, as it will vary depending on the industry and business model. However, as a general rule of thumb, a ratio above 1:1 is considered healthy, while anything below 1:1 is cause for concern.

Generally speaking, a ratio greater than 3:1 is considered good but that’s only sometimes the case. Of course, these are just rough guidelines – ultimately, it’s up to each company to determine an acceptable LTV: CAC ratio for their specific situation.

LTV: CAC Ratio Example

A SaaS company spends $30,000 on a paid search campaign and acquires 300 new customers. The monthly recurring revenue per customer is $100, and the direct cost of filling each order is $50. The company retains 20% of its customers per year.

Customer contribution margin = $100 – $50 = $50

LTV = $50 / (1 – 20%) = $250

CAC = $30,000 / 300 = $100

LTV/CAC ratio = $250 / $100 = 2.5x

In this case, the ratio is lower than 3:1, and the company might want to consider ways to improve customer retention or increase the monthly recurring revenue per customer.

How To Monitor Your LTV: CAC Ratio In Real-Time?

There are a few different systems that SaaS companies can use to track their LTV/CAC metric. One system is MixPanel, which is a web and mobile analytics platform. Another system is Kissmetrics, which is an analytics and marketing platform. These are just a couple of examples, and there are many other systems that SaaS companies can use to track their LTV/CAC metric.

Ways To Improve LTV: CAC Ratio For Your Business

LTV: CAC ratio is a key metric for any business, especially SaaS and e-commerce businesses. It tells you how much revenue you can generate for each customer acquisition cost. There are many ways to improve your LTV: CAC ratio, and we’ve compiled a list of the most effective ones.

Increase your prices

If you want to increase your LTV: CAC ratio, one of the simplest ways to do it is by increasing your prices. This will obviously result in fewer customers, but each customer will be worth more to your business. Of course, you must ensure that your prices are still competitive and that your product is still seen as a good value proposition.

Offer discounts and promotions

Discounts and promotions are a great way to increase your LTV: CAC ratio. By offering a discount on your product or service, you’re essentially increasing the value that each customer brings to your business. This is a great way to attract new customers and keep existing ones loyal.

Improve your product or service

Improving your product or service is another excellent way to increase your LTV: CAC ratio. By offering a better product or service, you’re increasing the value that each customer brings to your business. This is a great way to attract new customers and keep existing ones loyal.

Increase your customer retention rates

Another great way to increase your LTV: CAC ratio is by increasing customer retention rates. The longer customers stay with your business, the more value they bring. Therefore, anything you can do to increase customer retention will positively impact your LTV: CAC ratio.

Increase your upsell and cross-sell rates

If you want to really maximize your LTV: CAC ratio, you need to focus on increasing your upsell and cross-sell rates. The more additional products or services you can sell to each customer, the higher their LTV will be. This is a great way to increase the revenue that each customer brings to your business.

By doing all these things, you’ll be able to generate more revenue for each customer, resulting in a higher LTV: CAC ratio.