Are you struggling to keep track of your customer churn rate? Do you want to better understand its impact on your business? If so, understanding gross churn rate is crucial. Gross Churn Rate is an important metric that pinpoints the total number of customers stopped doing business with a company during a given period. It can help businesses pinpoint areas that need attention and make decisions about product investments, marketing strategies, pricing models, customer service programs and more. In this blog post, we’ll look at what gross churn rate really means for businesses and how it can give companies the insights they need to stay competitive in today’s ever-shifting markets. So brace yourself – here’s everything you need to know about Gross Churn Rate!

What is Gross Churn Rate?

Gross Churn Rate is a way to gauge the amount of lost revenue due to customers who have decided not to renew their subscriptions or explicitly canceled their service. By keeping track of the Gross Churn Rate, businesses are able to observe consumer trends and gain valuable insights into how they can keep their customers coming back. Staying on top of this turnover metric will help companies maximize profits while continuing to understand and meet the needs of their consumers.

Why Is It Important For Startups To Track Their Gross Churn Rate?

The ability for any startup to accurately track its gross churn rate is paramount for understanding and growing the business. Without the knowledge of how many customers are leaving, a startup cannot hope to measure its customer retention or gain insight into their development and marketing strategies.

The Gross churn rate captures a snapshot of how much a business needs to focus on retaining existing customers and can be used as an indicator of overall financial health. Additionally, tracking the gross churn rate of your startup over time will help you detect changes in your customer base and lead to better-informed decisions about product development, marketing, partnerships and more.

Taking stock of your gross churn rate today is an essential part of managing any successful startup – make sure it’s part of your regular business assessment routine!

How Do You Calculate Gross Churn Rate?

Calculating your company’s Gross Churn Rate is an incredibly important and useful metric to examine. It helps you gain insight into customer retention, so that you can make meaningful changes in order to sustain or increase the number of customers your business has.

A Gross Churn Rate is calculated by taking the total number of customers lost during a given period, divided by the total number of customers at the beginning of that same period. For example, let’s say your company had 100 customers at the start of March and ended with 80 by April; this means that 20 customers were lost between March and April and you would calculate your Gross Churn Rate for that month as 20/100 = 0.20 or 20%.

Keeping track of this rate over time gives valuable insights into customer trends, allowing you to make decisions about how to improve customer satisfaction – thus boosting your overall success!

What Factors Affect Gross Churn Rate?

Gross churn rate can be affected by a number of different factors, including:

Customer Service:

The quality of customer service is a major factor in determining churn rate because it directly impacts the experience customers have with the company or product. Poor customer service can lead to dissatisfaction and prompt customers to look elsewhere for their needs. Improving customer service by responding quickly to complaints, addressing customer concerns promptly, and offering good value for money will help keep customers engaged and reduce churn.

Product Quality:

The quality of a product or service is another factor that can influence the gross churn rate. Customers are more likely to stick with a company if they are satisfied with the product they receive. If the quality of the product is poor or does not meet expectations, customers are more likely to leave for a competitor. Ensuring that products meet customer needs and expectations is essential in keeping customers satisfied and reducing gross churn rate.

Competition:

The presence of competition can also affect gross churn rate. If customers have many options to choose from, they may be more likely to switch companies in order to get the best value or a better product. Companies should strive to offer competitive prices, good quality products and services, and excellent customer service in order to keep customers loyal and reduce turnover.

Technology:

The rate of technology adoption also affects churn rate, as customers may choose to switch companies if newer technology is available elsewhere that offers more features or better value than their current product. Companies should keep up with the latest industry trends in order to remain competitive and retain customers.

Overall, understanding the factors that can affect churn rate is important in order to provide customers with the best possible experience and reduce turnover. By addressing customer needs, providing quality products and services, staying competitive, and keeping up with technology trends, companies can reduce their gross churn rate.

What is A Good Gross Churn Rate?

A good gross churn rate varies depending on the type of business you’re targeting. For instance, SaaS companies that target small businesses should aim to have a 3-5% monthly churn rate, while companies targeting larger enterprises must have an even lower churn rate, ideally less than 1% monthly.

According to a study conducted by Recurly, the average churn rate for B2B businesses is 5%, while B2C businesses typically have a slightly higher chrun rate of 7.05%. Keeping your churn rate in check is vital for the success of your business and understanding the ideal gross churn rates per market can help you achieve that goal.

Example of Gross Churn Rate

Let’s take an example from the Shopify post to illustrate the calculation of gross churn rate.

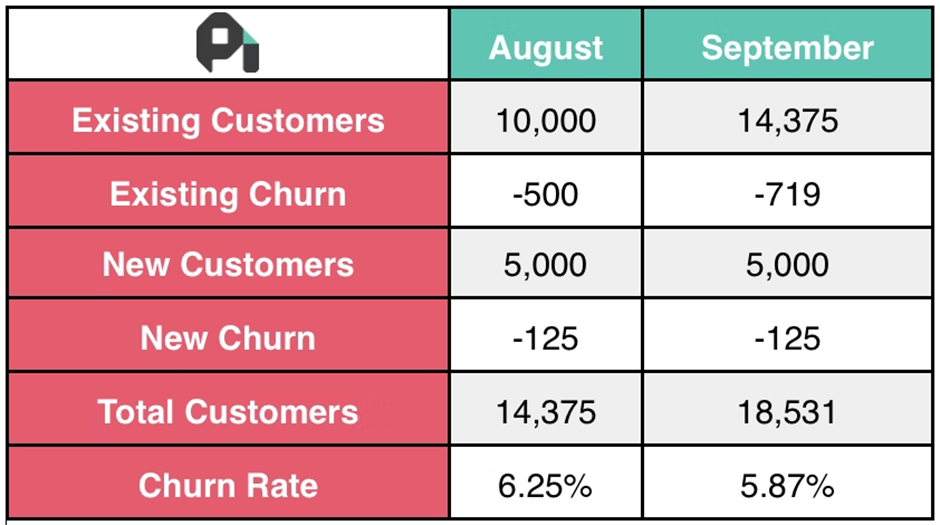

Begin by calculating your churn rate for August: start with 10,000 customers at the beginning of the month and lose 500 (5%) of them as well as acquire 5,000 new customers who 125 (2.5%) churn out. This gives you a churn rate of 6.25%.

625 / 10,000 = 0.0625

Now let’s look at churn rate for September: you have 14,375 customers to start the month and observe the same behavior as before – 5% (719) of existing users churning, 5,000 new customers joining and 2.5% (125) of those customers churning. Your simple churn rate for September comes out at 5.87%.

844 / 14,375 = 0.0587

Surprise – the numbers don’t match up! Even though the underlying behavior is the same – 5% of existing customers and 2.5% of new customers churning – you are getting two completely different churn rates. It looks like your churn rate has gone down, but in reality high growth has distorted the calculation.

In August, 125 churned customers were added to the numerator but the 5,000 new customers that joined didn’t get added to the denominator – which means that the churn rate is artificially high. When you have less growth, the effect is less pronounced.

Strategies to Decrease Gross Churn Rate

Strategies to reduce gross churn rate include:

Establish effective customer onboarding:

Ensure that customers understand the value of your product or service as soon as they sign up. Provide clear instructions on how to best utilize your product, and link them with support resources if they need help. Make sure you have easy-to-follow steps to make their usage experience smooth and enjoyable.

Offer discounts and incentives:

Give customers an incentive to stay with you by offering discounts or credits when they renew their subscription. This could be a percentage off the total cost, free services, or other rewards that will make them feel valued as customers.

Increase customer engagement:

Develop strategies to increase customer engagement with your product or service. This could be through regular emails, website content, or even hosting events to help customers get the most out of their subscription.

Monitor customer feedback:

Regularly monitor feedback from customers about your product or service to identify areas that need improvement. Respond quickly and positively to any negative comments or issues so customers feel valued and appreciated.

Stay on top of customer service:

Make sure your customer service is prompt and that all inquiries are answered in a timely manner. This could be through email or phone support, or even live chat. Your customers should feel like they matter and have their questions answered quickly.

Encourage customer referrals:

Ask existing customers to refer your product or service to their friends and family. Offer rewards or discounts for successful referrals so that customers are incentivized to share the good word about your business.

By following these strategies, you can reduce gross churn rate and ensure customer loyalty in the long term. This will help your business thrive and make sure customers continue to stay with you.

Conclusion

If you’re working in the SaaS industry, then it’s critical for you to understand and keep track of your company’s gross churn rate. By taking into account both voluntary and involuntary churn, you can get a clear picture of how well your business is retaining customers. Additionally, by segmenting your gross churn rate data, you can identify areas where improvement is needed. Although it may seem daunting at first, calculating and tracking your gross churn rate is essential for the success of your business. With this complete guide, you should now have all the information you need to get started.