How high is your customer churn rate? If you’re not sure, you’re not alone. Many business owners don’t know how to calculate their customer churn rate or what it even means. This guide will define churn and show you how to calculate your company’s churn rate. Plus, we’ll provide tips on reducing your churn rate and keeping more customers coming back for more. Let’s get started!

What Is A Customer Churn Rate?

The customer’s churn rate is a metric used to calculate the percentage of customers who cancel or do not renew their subscription with a company in a given period.

A high customer churn rate can be caused by poor customer service, high prices, or a lack of features.

A low customer churn rate indicates that customers are satisfied with the company and are likely to continue using its products or services.

Customer retention is essential for businesses because it is more costly to acquire new customers than it is to keep existing ones. Think about it like getting a bucket and trying to fill up a bathtub- if the bathtub sinkhole is open, it’s going to take forever to fill the tub to the top! Therefore, businesses should focus on providing excellent customer service and offering competitive prices to reduce the risk of customers lost due to churning.

Why Should Startups Care About Churn Rate?

Startups should care about the churn rate because it represents the percentage of existing customers that cancel their subscriptions each month. You spend money to acquire customers and then they leave you, taking their money with them.

A high churn rate could mean that a startup is actually losing more customers than it is gaining, which is not sustainable in the long term when you inevitably run out of investors’ money!

Additionally, it’s important to remember that acquiring a new customer costs more than retaining an existing one. So, not only will reducing churn help you grow your company, but it will also save you money.

Moreover, a high churn rate can significantly impact a startup’s lifetime value (LTV). You need to compare your customer acquisition cost (CAC) to your LTV to ensure you are building a healthy startup..

To be successful, startups need to focus on reducing their churn rate and increasing their LTV.

Other important reasons churn rates matter include:

- Churn Rate is a leading indicator of customer health

- High churn rates can indicate problems with product-market fit

- Churn rates can be an early warning sign of customer dissatisfaction

- Churn rates can point to marketing or sales problems

- Churn rates can be indicative of poor customer service

- High churn rates can mean you’re losing valuable customers

- A high churn rate may mean you’re acquiring the wrong customers

- Churn rate data can help you prioritize retention efforts

- Low churn rates are a good indication of success

- Reducing your churn rate will improve your bottom line

Annual versus Monthly churn

There are different kinds of customer churn rate that you can track, which includes annual and monthly churn.

Annual churn is the percentage of customers who cancel or do not renew their subscription within a year. Monthly churn is the percentage of customers who cancel or do not renew their subscription within a month.

The main difference between annual and monthly churn is the timeframe in which they are measured. Annual churn is measured over a year, while monthly churn is measured over a month. No shite Sherlock, why does that matter?

Annual churn takes into account all customers who have subscribed over the period of a year, which if you have annual contracts is important to know. Monthly churn only considers those customers who have subscribed within the past month which would skew if you have a lot of annual contracts. As such, monthly churn may not provide a more accurate picture of current customer attrition rates.

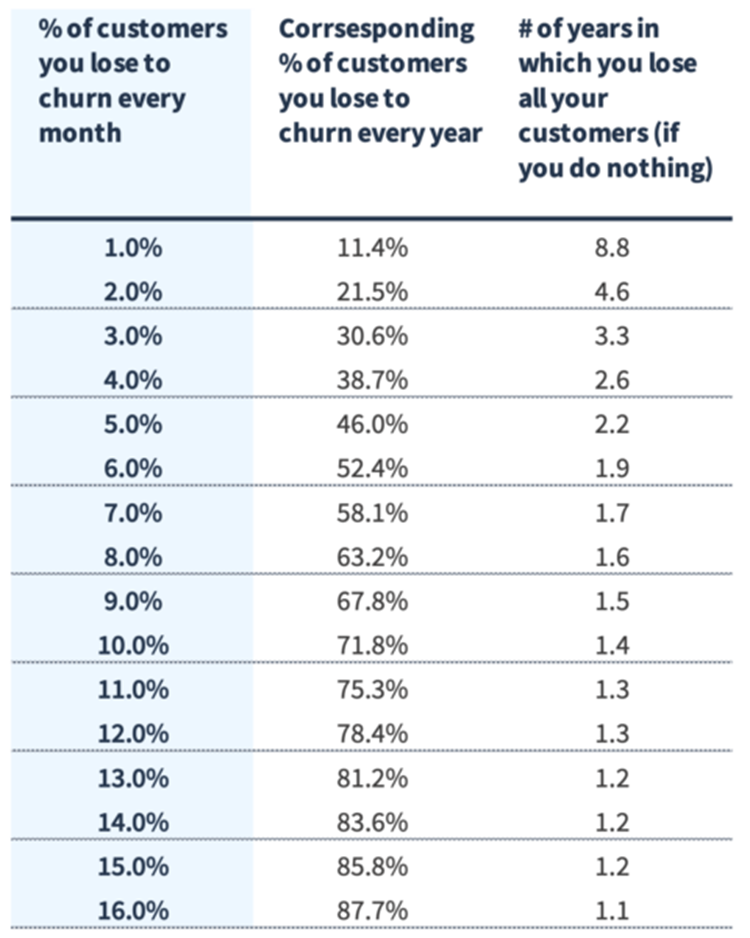

Take a look at this snapshot to see why it can be disastrous to focus too much on just monthly churn. Your monthly churn rates can appear small, but on annual basis, it’s a heck of a lot more than you might have thought!

How To Calculate Churn Rate?

The churn rate is the percentage of customers that stop using your product or service within a certain period. To calculate the churn rate, simply divide the number of churned customers by the total number.

Here’s the formula to calculate the revenue churn rate:

Churn rate = Number of churned customers / total number of customers

Specifically, you want to:

- Pick a time period: monthly, annual, or quarterly.

- Count the number of customers you had at the beginning of the time period.

- Get the number of customers that churned by the end of the time period.

- Then divide the number of lost customers by the number of customers you had at the start of the period (prior to the churn).

- Multiply that number by 100.

For example, if 100 out of 1,000 customers stopped using your product last month, your churn rate would be 10%.

If you have calculated your monthly churn rate, and want to turn that into your annual churn rate you can use this formula:

Annual Churn Rate = (1- (1-Monthly Churn Rate)12)

It’s also important to remember that some level of churn is inevitable and that you shouldn’t strive for a 0% churn rate. A healthy business should have a churn rate between 5-7%.

The Effects Of Churn On A Startup

The churn rate is one of the most important metrics for a startup. It’s a measure of how quickly how many customers are leaving or cancelling your service. A high churn rate can be devastating for a startup because it means losing customers faster than acquiring them. This can quickly lead to cash flow problems and make it difficult to scale.

There are a few things that can cause high churn rates.

- Poor customer service

When customers have a poor experience with your company – whether it’s a customer support representative who is rude or unhelpful or a product that doesn’t meet their needs – they’re more likely to churn.

- Lack of customer engagement

If customers don’t feel like your company is interested in them, they’re more likely to churn. This can be due to a lack of engagement on social media, no personalization of the customer experience, or not enough communication with customers.

- High prices

If customers feel like they’re not getting good value for their money, they’re more likely to churn. This could be due to high prices for products or services, or complex pricing structures that are difficult to understand.

- Bad website design

A bad website design can make it difficult for customers to find what they’re looking for, navigate the website, or complete a purchase. This can lead to churn as frustrated customers give up and go elsewhere.

- Lack of innovation/Exciting new offers

If your company isn’t constantly introducing new products and services, or if the products and services you offer are no longer exciting to customers, they’re more likely to churn. This can be combated by regularly introducing new offerings and keeping things fresh, as well as engaging with customers in order to understand what interests them.”

If you’re experiencing high churn rates, it’s important to take action to improve the situation. Otherwise, you risk losing customers and eventually going out of business.

What Is A Good Churn Rate?

Some people say that a churn rate of 5 percent or less is generally considered good for a startup, but for what kind of startup is a key question as consumer apps and SaaS are different beasts.

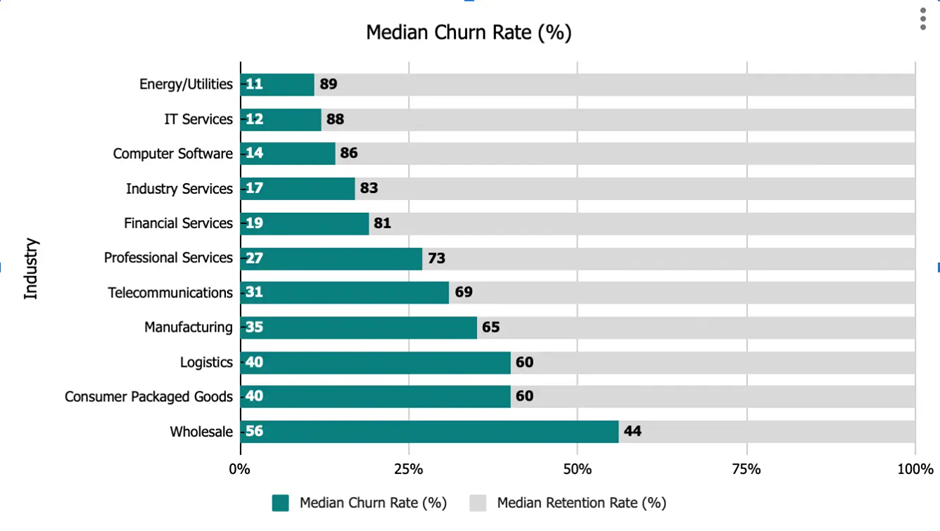

Here are the median customer churn rates by industry in 2022.

But generally, anything higher than that and you could be in trouble, as customers are likely to leave your business in favour of a competitor. There are a few things you can do to keep your churn rate as low as possible, including providing excellent customer service, engaging customers and keeping them interested, and offering products and services that are worth the price.

Bessemer Venture Partners says an “acceptable” SaaS churn rate is in the 5 – 7% range annually, depending upon whether you measure customers or revenue. Pacific Crest in their “Private SaaS Company Survey Results” shows 70% of SaaS companies in their survey had annual churn in the < 10% range, with 75% at 5% or below.

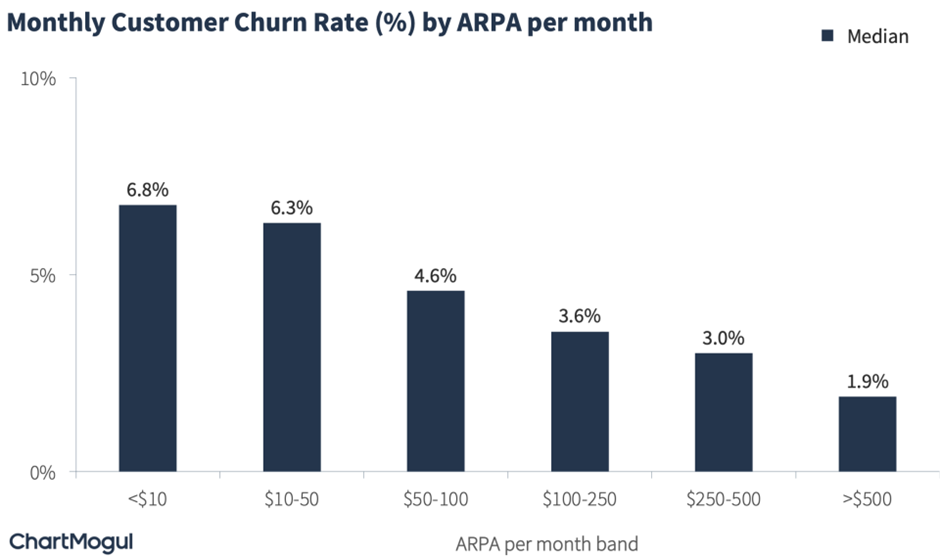

Customer churn rate can vary by a company’s average revenue per account (ARPA) per month. You can see if you have a higher ARPA, your churn rate is expected to be lower.

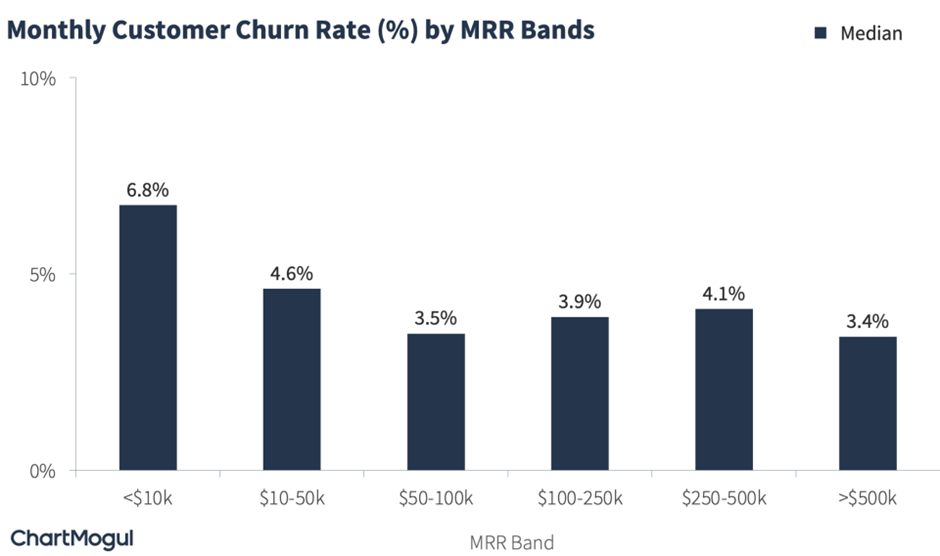

In addition, smaller startups have higher churn!

Ways For Reducing Customer Churn Rate

Churn rate is a dreaded metric for any business, as it reflects customers who have left or churned in a given period. To mitigate churn, businesses need to take a proactive churn analysis approach to analyze customer churn rates and reduce customer attrition. There are four key ways to do this:

1. Understand your churn rate:

This includes understanding what revenue churn is, as well as calculating monthly and annual churn rates. This will give you a starting point to assess the churn problem and set goals for improvement.

2. Track the right churn metrics:

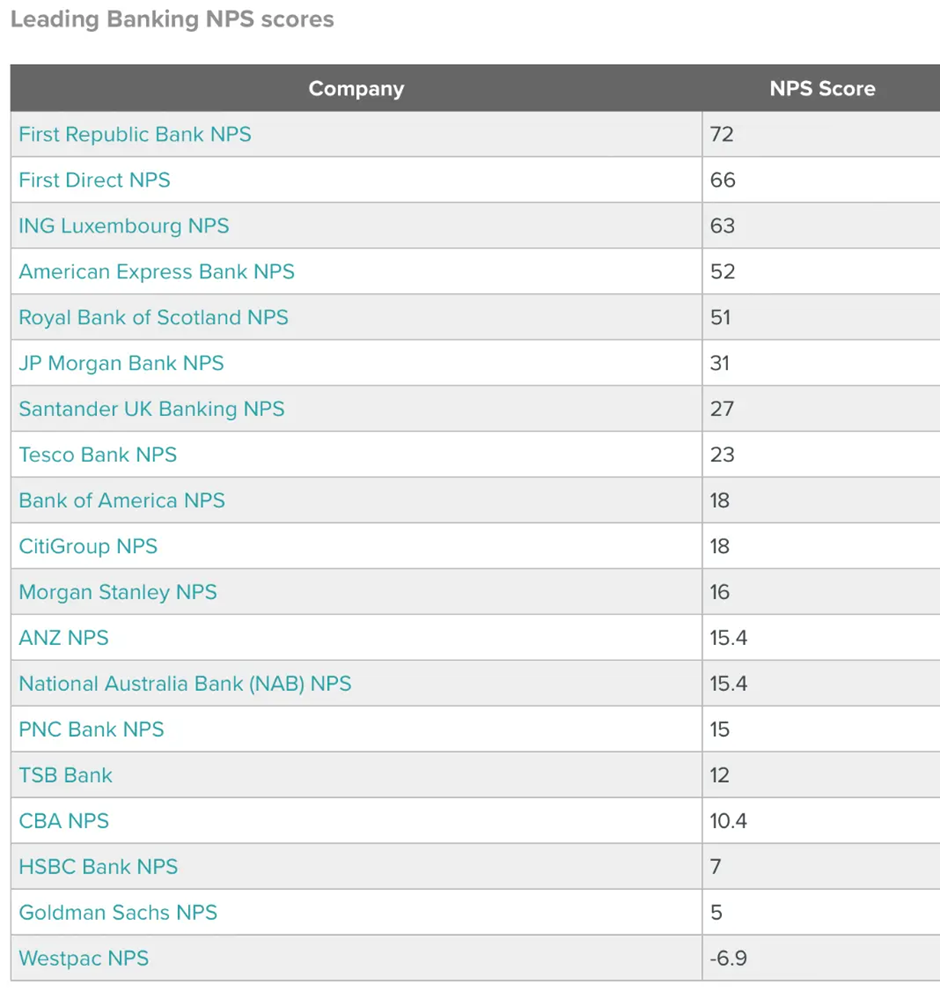

In addition to revenue churn, track other important churn metrics such as customer lifetime value (CLV), customer satisfaction (CSAT), and Net Promoter Score (NPS). These will help you identify early warning signs of churn and take action to prevent it.

Tracking your NPS is a great way to put your churn rate into perspective. Take a look at these banking NPS’. You would expect First Republic to have a lower churn rate than Westpac.

3. Analyze the causes of churn:

Once you understand your churn rate, it’s time to start analyzing the root causes of churn. This could include poor customer service, high prices, lack of features, or competitor Analysis. By understanding the underlying causes of churn, you can put together a plan to address them.

4. Take action to reduce churn:

Finally, once you’ve analyzed the causes of churn and identified areas for improvement, it’s time to take action. This could involve initiatives like implementing customer success management programs, offering discounts, reducing customer acquisition costs or incentives for loyalty, or increasing investment in product development.

By taking these steps, you can start to see a reduction in your number of customers’ churn rate.

Once you understand your churn rates, there are many ways to improve your customer churn rate.

- Improve customer service

When customers have a poor experience with your company – whether it’s a customer support representative who is rude or unhelpful or a product that doesn’t meet their needs – they’re more likely to churn. Improving customer service can help to reduce churn rates by ensuring that customers have a positive experience with your company.

- Increase customer engagement

If customers don’t feel like your company is interested in them, they’re more likely to churn. This can be due to a lack of engagement on social media, no personalization of the customer experience, or not enough communication with customers. Increasing customer engagement can help to reduce churn rates by showing customers that you care about them and want to keep them as customers.

- Lower prices

If customers feel like they’re not getting good value for their money, they’re more likely to churn. This could be due to high prices for products or services, or complex pricing structures that are difficult to understand. Lowering prices can help customers feel like they’re getting a better deal, and this may lead to reduced churn rates.

- Improve website design

A bad website design can make it difficult for customers to find what they’re looking for, navigate the website, or complete a purchase. This can lead to churn as frustrated customers give up and go elsewhere. Improving website design can help reduce churn rates by making it easier for customers to interact with your company online.

- Introduce new products and services regularly

If your company isn’t constantly introducing new products and services, or if the products and services you offer are no longer exciting to customers, they’re more likely to churn. Introducing new products and services regularly can help keep things fresh and interesting for customers, which may lead to reduced churn rates.

Tools To Measure Customer Churn Rate

There are a few different ways to measure customer churn rates and others to dig into how it is manifesting in your startup which will vary spending if you are a SaaS or ecommerce company. One common method is to calculate the number of customers who cancel their subscription or membership over some time. Another way to measure churn is to look at the number of customers who fail to purchase during a specified period. Additionally, you can track the number of customers who contact customer service to cancel their service or request a refund.

Here are five ways you can think about tracking your customer churn rate.

- Compare churn rates over time: Tracking churn rates over time can help you to identify whether your churn rate is increasing or decreasing, and this information can help you to determine whether your current churn prevention strategies are effective.

- Use churn prediction models: Churn prediction models can help you to estimate how likely it is that a customer will churn in the future, which can help you to focus your efforts on retaining high-risk customers.

- Identify churners using customer data: By analyzing customer data, you can identify which customers are most likely to churn and focus your efforts on retaining them.

- Use churn indicators to track churn progression: Churn indicators are factors that may indicate that a customer is at risk of churning. Tracking these indicators can help you to intervene before a customer actually churns.

- Analyze customer feedback to determine churn causes: By analyzing customer feedback, you can gain a better understanding of what causes customers to churn and work to address these issues.

Each method has its advantages and disadvantages, so it is important to use all the means possible to get a broader comprehension so you can take appropriate actions. Whichever method you choose, monitoring your customer churn rate is essential for keeping your business healthy and prospering.

Well, there must be web tools to help me track my users automatically I hear you thinking! There are a lot of tools to measure your customer churn rate. Here are 5 popular ones that you can try using in your startup.

- Google Analytics

Google Analytics is a free web analytics service that allows you to measure your website traffic and see how customers are interacting with your website. You can use Google Analytics to track how many visitors are coming to your website, where they’re coming from, and what pages they’re visiting. This information can help you to understand which areas of your website are most popular and where you need to make improvements.

- KISSmetrics

KISSmetrics is a paid web analytics service that helps you to track your website’s customer behaviour and measure churn rates. It allows you to see how many customers are visiting your website, how often they’re returning, and how much revenue they’re generating. This information can help you to understand which customers are most valuable to your business and identify those who are at risk of churning.

- Mixpanel

Mixpanel is a paid analytics platform that helps you to measure customer engagement and track churn rates. It allows you to see how many active users you have, how often they’re using your product, and how likely they are to churn. This information can help you to identify which features of your product are most popular and keep users engaged with your product.

- Lucky Orange

Lucky Orange is a paid web analytics tool that helps you to understand how customers are using your website. It tracks mouse movement, clicks, scrolls, and form submissions, so you can see what pages customers are spending the most time on and what actions they’re taking on your website. This information can help you to improve your website’s design and keep customers engaged with your content.

- Hotjar

Hotjar is a paid web analytics tool that helps you to understand how customers are using your website. It records customer behaviour on your website, including mouse movement, clicks, scrolls, and form submissions, so you can see what pages customers are spending the most time on and what actions they’re taking on your website. This information can help you to improve your website’s design and keep customers engaged with your content

The Bottom Line

In conclusion, customer churn sucks- don’t let customers leave if you can! By understanding what causes customers to leave and taking steps to prevent it, you can work to decrease your customer churn rate and build a more profitable startup.