When starting a business, customer acquisition costs (CAC) are one of the most critical metrics to understand. This guide will help you figure out your CAC and how to lower it. We’ll also cover some tips for increasing sales and growing your business. By understanding and reducing your CAC, you’ll be able to increase profitability and reach your goals faster. Keep reading to learn more!

What Are Customer Acquisition Costs?

Customer acquisition costs (CAC) are the costs incurred by a business to acquire a new paying customer. These costs can include advertising, lead generation, sales commissions, and other marketing expenses.

Businesses with high CACs often have difficulty turning a profit, as they must spend significant resources simply to bring in new business. For this reason, it is important for companies to carefully track their CACs and look for ways to reduce them.

There are a number of strategies that can be employed to lower CACs, such as increasing the efficiency of sales and marketing efforts, targeting high-value customers, and offering discounts or other incentive programs.

By taking steps to lower their CACs, businesses can free up resources that can be used to improve other aspects of their operations.

Importance of Low Customer Acquisition Costs For Businesses

Customer acquisition costs (CAC) are one of the most important metrics for businesses to track. By monitoring CAC, companies can get a better understanding of how efficiently their marketing and sales efforts are generating new customers. This metric is especially important for startups that need to ensure they’re spending their limited resources in the right way.

Low CAC allows businesses to obtain customers more quickly and cost-effectively. When CAC is low, the company can invest in activities that yield higher returns on their investments, such as expanding into new markets or investing in better customer service tools.

In addition to being cost-effective, a low CAC also helps ensure that customers are of high quality. Often, businesses spend too much on acquiring customers who won’t stick around for long or end up not being profitable. By targeting the right customers, companies can increase the lifetime value of their customer base and achieve greater success in the long run.

Finally, low CAC helps create a positive brand image. Companies that are able to acquire customers quickly and at a low cost demonstrate that their products are in demand and that they’re able to provide value to their customers. This makes them appear more attractive to potential customers, which can help drive further growth for the business.

For example, let’s say a company sells a product for $100. They spend $10 to acquire each customer through advertising and marketing. The company makes $50 in profit for each customer that it acquires. In this case, the company’s profit margin is 50%. Now let’s say that the company decreases its customer acquisition costs to $5. The company’s profit margin will now increase to 75%.

So, as you can see, low customer acquisition costs are very important for businesses because they directly impact profitability. By focusing on lowering their CAC, businesses can increase profits and become more sustainable in the long term.

How To Calculate Customer Acquisition Costs?

To calculate CAC, simply divide total sales and marketing expenses by the number of customers acquired. This will give you a clear picture of how much it costs to acquire each new customer.

Here’s the formula:

Total Sales + Marketing Expenses/ Number of customers acquired = CAC

Keep in mind that CAC will vary from business to business, so it’s important to compare your own numbers with industry averages. By understanding your CAC, you can make more informed decisions about where to allocate your resources and how to price your products or services.

What Is A Good Customer Acquisition Cost?

CAC is important for assessing the health of your business, and it varies by industry and tactics used.

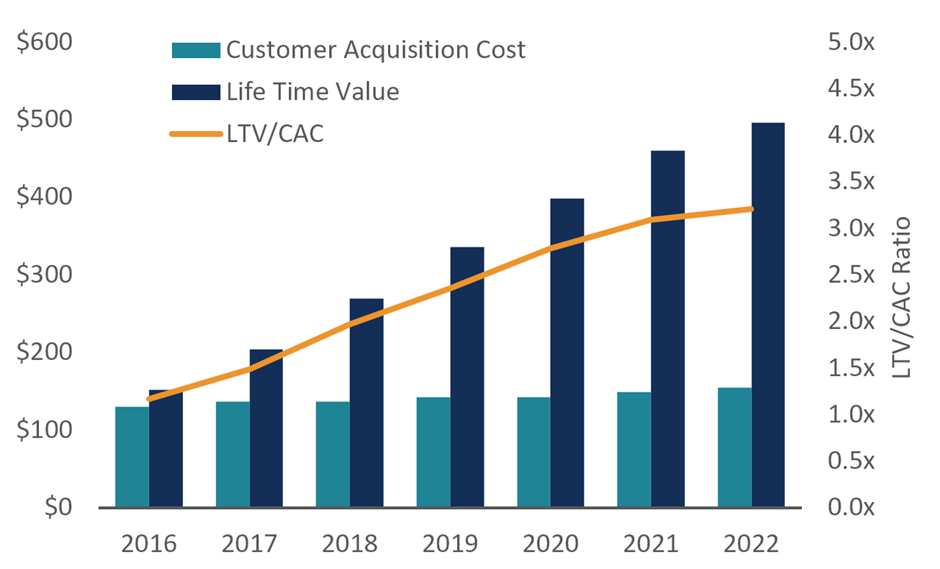

A good way you can benchmark your CAC is by comparing it to your Customer Lifetime Value (LTV). LTV measures how much money a customer is expected to bring to your business during the time they are associated with your business.

So then what is a good CAC ratio? It is said that an ideal LTV to CAC ratio is 3:1. In other words, for every dollar you spend on acquiring a new customer, you should expect to earn three dollars from that customer over the course of their relationship with your business.

Of course, this is just a general guideline – ultimately, what matters most is that your CAC is lower than your LTV. If it isn’t, you’re losing money on each new customer you acquire, and that’s not sustainable in the long run.

So keep an eye on your CAC and make sure it’s in line with your LTV – it’s one of the most important metrics for assessing the health of your business.

Examples Of Good Customer Acquisition

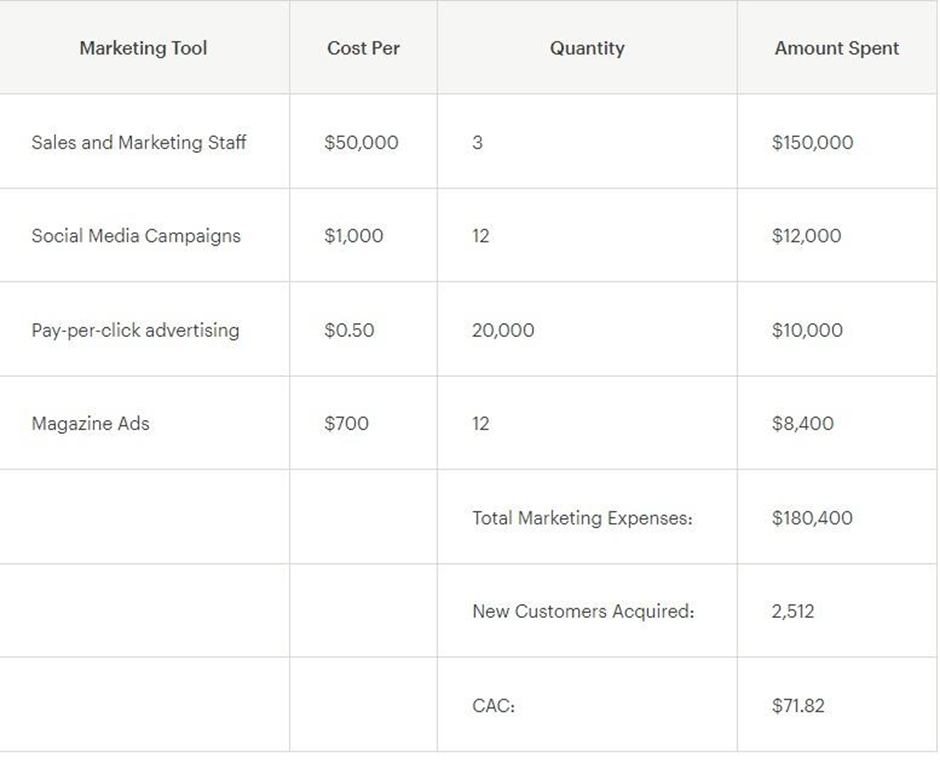

Let’s take an example! Natural Seats uses sustainable resources to build custom furniture and they decide that tracking their spending on acquiring new customers for the period beginning January 1st through December 31st will allow them to calculate an overall customer acquisition cost (CAC).

The process is simple: They consider what expenses were incurred during these twelve months, as well as how many additional clients were brought into fiscal year end with us by November 30th. This way we can see if there’s been any increase or decrease compared side our previous years’ performance!

For example, it was calculated that during Natural Seats’ fiscal year they spent $71.82 on average for each individual who became an investor with them!

LTV/ CAC Ratio

The LTV/CAC ratio compares the value of your new customer over its lifetime which is relative to the cost of acquiring that customer. Companies should aim to find the right balance for this ratio to ensure they’re getting the most out of their financial investments.

Let’s say if the LTV/CAC ratio is less than 1.0 then the company is destroying its value which means they are spending just as much money on attaining customers as they are spending on its products.

However, If the ratio is higher than 3:1 like if it’s 5:1, for example, that means they are not spending enough money on sales and marketing and can be missing out on opportunities to attract new leads. Generally, a ratio of 3:1 is considered good enough.

8 Strategies To Lower Customer Acquisition Costs

As a business owner, you’re always looking for ways to increase revenue and reduce costs. One way to do this is to lower your customer acquisition costs (CAC).

There are a number of strategies you can use to lower your CAC. Here are 8 of the most effective:

Use Content Marketing

Content marketing is one of the most effective ways to lower your CAC. By creating and distributing relevant and valuable content, you can attract more prospects and convert them into customers with less effort and expense.

Implement an Inbound Marketing Strategy

Inbound marketing is another cost-effective way to generate leads and convert them into customers. By creating helpful content and making it easy for prospects to find it, you can attract more visitors to your website and convert them into leads with little or no paid advertising.

Use Social Media Marketing

Social media marketing is a powerful way to reach new prospects and connect with existing customers. By creating and sharing engaging content, you can build relationships, drive traffic to your website, and generate leads at a fraction of the cost of traditional marketing methods.

Optimize Your Website for Lead Generation

Making sure your website is optimized for lead generation is essential to lowering your CAC. Make sure your website is easy to navigate, has clear calls to action, and contains forms that make it easy for visitors to request more information.

Use Paid Advertising Carefully

Paid advertising can be an effective way to reach new prospects, but it can also be expensive. When using paid advertising, be sure to target your ads carefully to reach your ideal audience, and track your results so you can determine your return on investment.

Leverage Referral Programs

Referral programs can be an effective way to lower your CAC by getting customers to help you generate leads. Offer incentives for customers who refer new prospects, and make it easy for them to share your information with their friends and followers.

Conduct Effective Market Research

Before launching a new marketing campaign, take the time to conduct effective market research. This will help you understand your target market and develop strategies that are more likely to reach them at a lower cost.

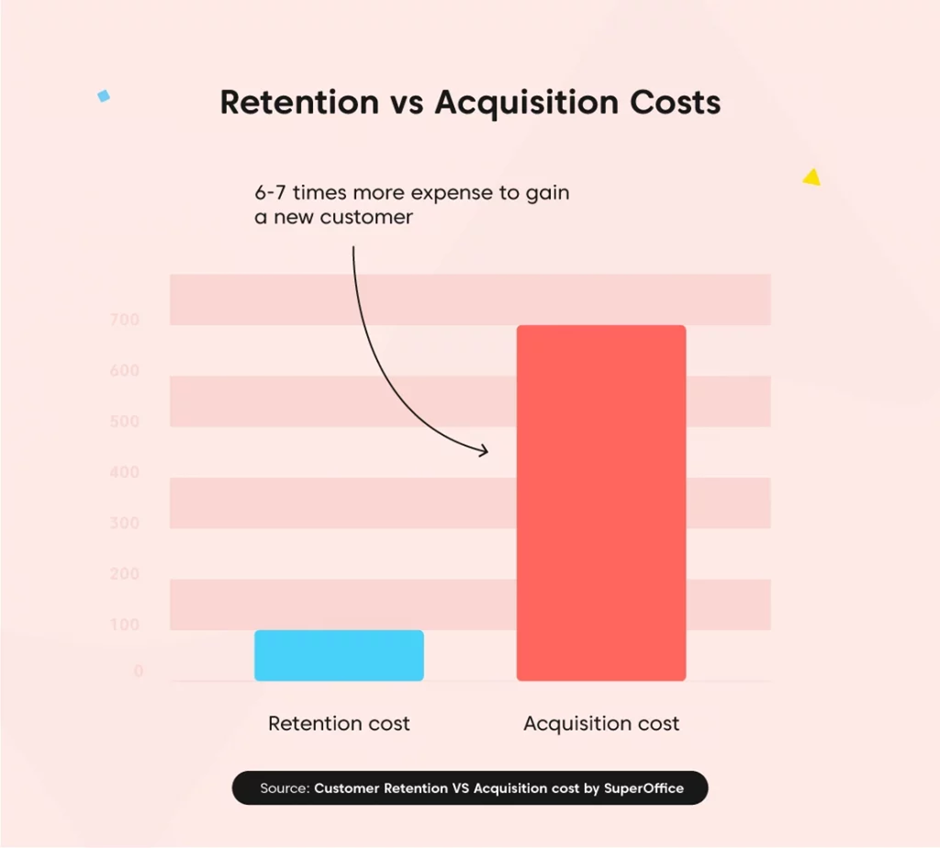

Focus on Customer Retention

Finally, don’t forget about the value of customer retention. It costs far less to keep a customer than it does to acquire a new one, so focus on providing outstanding customer service and creating loyalty-building programs.

By using these strategies, you can lower your CAC and increase your profitability. For more tips on how to grow your business, be sure to sign up for our free newsletter.

Wrap Up

If your customer acquisition costs are through the roof, it’s time to take a step back and reevaluate your strategy. This guide provides you with everything you need to know about CAC so that you can keep your business sustainable in the long run. So what are you waiting for? Start reading and learn how to get those acquisition costs under control!