A company’s current accounts receivable can be one of the most essential and beneficial assets a business has. In fact, many businesses would only be able to function with the money from their current accounts receivable. So how can you ensure your accounts receivable work for you and not against you? Check out our guide for everything you need to know!

What Are Current Accounts Receivable?

Current accounts receivable are the amount of money a company owes its customers for goods or services delivered or used but not yet paid for.

This can be one of the most important pieces of information on a company’s balance sheet, as it can give insights into how well the business manages its cash flow.

While accounts receivable can represent an important source of short-term funding for a business, it is also important to keep tabs on how much is outstanding, as this can impact the company’s bottom line.

Given the importance of current accounts receivable, it is not surprising that many businesses have dedicated staff responsible for tracking and collecting payments.

How To Calculate Current Accounts Receivable?

Businesses can use many methods to calculate their current accounts receivable. The most common method is the “ageing of receivables.” This involves listing all outstanding receivables in chronological order.

From there, you simply add up all of the receivables that fall within the current accounting period. So, if you’re using a monthly accounting period, you would add up all of the receivables from the past month. This method is simple and easy to understand, making it a popular choice for businesses of all sizes.

Here’s the formula:

outstanding customer invoice 1 + outstanding customer invoice 2 + … + outstanding customer invoice n = ($) Current Accounts Receivable

However, it’s important to note that the ageing of the receivables method needs to consider the time value of money. As a result, some businesses choose to use a more sophisticated method, such as the discounted cash flow method.

This method considers the time value of money, resulting in a more accurate calculation of current accounts receivable.

Whichever method you choose, it’s important to stay consistent from one accounting period to the next. This will help create an accurate financial picture for your business.

How to Forecast Accounts Receivable

The day’s sales outstanding (“DSO”) measures the number of days on average it takes for a company to collect cash due from customers that paid on credit. The DSO metric is used in the majority of businesses to project A/R.

The formula for DSO is calculated as follows.

Historical DSO = Accounts Receivable ÷ Revenue x 365 Days

The projected accounts receivable balance is equal to:

Projected Accounts Receivable = (DSO Assumptions Assumption ÷ 365) x Revenue

If the DSO has been increasing over time, that implies your collection efforts require improvement, as more A/R means more of your cash is tied up in operations.

But if DSO declines, that implies your collection efforts are improving, which has a positive impact on your cash flows.

Accounts Receivable vs. Accounts Payable

When a startup owes money to its suppliers, these are accounts payable [ADD LINK to accounts payable]. Accounts payable are the opposite of accounts receivable- your suppliers owe you money.

As an example, Company A services Company B and sends a bill for the services. Company B owes them cash, so it records the invoice in its accounts payable software. Company A is waiting to receive the funds, so it records the bill in its accounts receivable.

Current Accounts Receivable Example

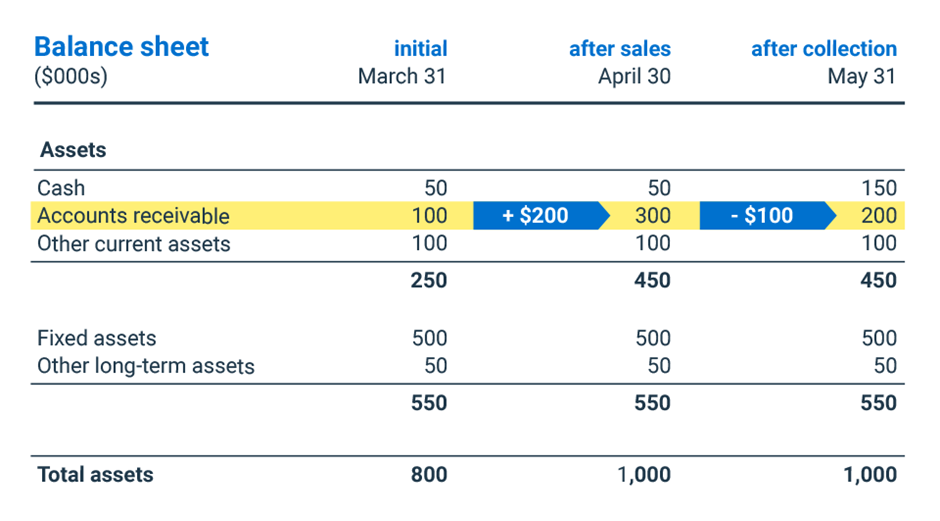

Let’s assume your company has an initial balance sheet, as mentioned below, where the accounts receivable total is $100,000 on March 31st. We will illustrate just the assets components present on the balance sheet.

In April, you record sales on the credit of $200,000. It’s the only transaction of the month. You can then record an increase in accounts receivable from about $100,000 to $300,000. In the chart below, the balance sheet after-sales reflects the influence of sales on accounts receivable.

In May, your company collected accounts receivable of about $100,000. For simplicity, it’s the only transaction of the month. You can then record a decrease in accounts receivable from $300,000 to $200,000. The balance sheet after collection shows the influence of the collection on accounts receivable.

Mistakes To Avoid When Managing Accounts Receivable

As the person responsible for accounts receivable, it’s important to avoid making any mistakes that could cost the company money. Here are a few of the most common mistakes to avoid:

Not staying on top of invoices

It’s important to send out invoices immediately after a sale is made. This will help ensure that you get paid promptly. Additionally, follow up with customers who haven’t paid their invoices yet. A polite reminder can often be enough to prompt them to take action.

Not tracking payments

It’s essential to keep track of all payments made by each customer. This will help you identify any late or missing payments and take appropriate action accordingly. Additionally, tracking payments can help you decide when to offer discounts or other incentives for early payment.

Not using automation

Many software solutions can automate various accounts receivable tasks, such as sending out invoices and reminders, processing payments, and creating reports. Using automation can help save time and improve efficiency.

Not offering payment options

Many customers appreciate having choices when it comes to making a payment. Offer various payment methods like a credit card, PayPal, or bank transfer. This will make it more likely that customers will pay their invoices.

Not staying organized

A well-organized accounts receivable system is essential for keeping track of all the information related to customer payments. Make sure to create a system that works for you and your team, and stick to it religiously. Doing so will save you time and headaches in the long run.

Tips For Collecting Payments From Clients Quickly And Efficiently

If you own a business, you know that one of the most important things to keep track of is your accounts receivable. This is the money that is owed to you by your clients. Here are some tips for collecting accounts receivable quickly and efficiently:

Keep track of who owes you money

This may seem like an obvious tip, but it is important to keep a running list of who owes you money and how much they owe. This will help you stay organized and track who to contact when it comes time to collect.

Contact your clients regularly

Once you have a list of who owes you money, contact them regularly. This will remind them that they owe you money and prompt them to pay.

Send invoices regularly

In addition to contacting your clients, make sure to send invoices regularly. This will help them track what they owe and remind them to pay.

Be polite but firm

When contacting your clients about money owed, it is important to be polite but firm. You want to remind them of their obligations without being overly aggressive.

Offer incentives for early payment

You may want to offer incentives for early payment to encourage your clients to pay their invoices quickly. This could include a discount or some other type of incentive.

Use a collection agency.

If you have clients who consistently don’t pay their invoices, you may want to consider using a collection agency. This is the last resort, but it may be necessary to get your money.

Following these tips, you can collect your accounts receivable quickly and efficiently.

The Benefits Of Using An Accounts Receivable Management Software

Here are some of the key benefits that you can enjoy when you choose to use an accounts receivable management system:

Improved cash flow:

With an accounts receivable management system, you can easily track and manage your invoices as well as keep track of payments made. This helps to ensure that you receive timely payments from customers and avoid any late payment charges or other penalties associated with unpaid invoices. Additionally, the software can be used to automatically generate reminders to customers that have overdue invoices, helping you to get paid faster.

Automated processes:

An accounts receivable management system can automate many of the tedious tasks associated with managing invoices such as data entry, reconciling payments and more. By automating these processes, you can save time and reduce errors, which ultimately leads to improved efficiency and accuracy.

Increased visibility:

An accounts receivable management system provides you with real-time insights into your business’s performance. You can easily access data such as customer invoices, payments, overdue balances, and more. This information can help you make better decisions about how to manage your accounts receivable process.

Reduced costs:

By using an accounts receivable management system, you can reduce the amount of time and resources needed to manage your invoices. This ultimately leads to significant cost savings in terms of labor and materials as well as improved customer satisfaction due to increased accuracy and prompt payment processing.

Overall, an accounts receivable management system can help you streamline and automate your invoicing process, giving you greater visibility into your business’s performance. By using this type of software, you can reduce costs associated with managing invoices and improve cash flow. Ultimately, this leads to increased efficiency and customer satisfaction which results in a more profitable business.

How To Set Up A System For Tracking Accounts Receivable?

Any business that sells products or services on credit needs to have an accounts receivable (A/R) system to track customer payments. An effective A/R system can help you keep tabs on who owes you money and when they are scheduled to make payments. This, in turn, can help you manage your cash flow and avoid being blindsided by a sudden drop in revenue.

Setting up an A/R system is relatively simple and only requires a few steps.

- First, you must list all the customers who owe you money. This list should include the customer’s name, contact information, the date of the sale, the invoice amount, and the payment due date.

- Next, you will need to set up a method of tracking payments. This can be as simple as maintaining a spreadsheet or using accounting software.

- Finally, you will need to establish a billing and collections process. This should include sending invoices regularly and following up with customers who are late on their payments.

Taking these steps ensures that your business has a well-organized system for tracking accounts receivable.

Wrap Up

Late payments are a burden on businesses of all sizes. By automating your accounts receivable process, you can free up time and resources to focus on other business areas. In addition, you’ll have peace of mind knowing that your invoices will be paid on time, every time.