In order to find success with your digital marketing campaigns, you need to have a firm understanding of what cost per acquisition is and how it can be used most effectively. With this guide, you should know how to set achievable CPA goals and create ROI-positive campaigns. So what are you waiting for? Get out there and start putting these tips into practice!

What Is Cost Per Acquisition?

The Marketing metric Cost Per Acquisition (CPA) compares the cost of acquiring a new customer to their initial purchase. This can be applied as broadly or narrowly as you want. Still, it’s often used about media spending. It focuses on how much money is spent for each stage, from first contact until reaching someone who has made an ultimate conversion decision with your company’s product/service offerings.

It should also include any additional expenses incurred, such as special offers which may lead them down this path.

How To Calculate Cost Per Acquisition?

There are a few different ways to calculate your cost per acquisition (CPA). The most common method is simply to take your total marketing expenditure for a while and divide it by the number of new customers acquired during that period. This will give you a good baseline for understanding your CPA.

What Is A Good Cost Per Acquisition?

A good cost per acquisition (CPA) varies depending on the industry and business model. Ideally, a good cost per acquisition is 3:1, which means it is almost three times less than the customer’s lifetime value. But if this ratio is 1:1, the cost is more. If you get a higher CPA than the required benchmark, such as 3:1, you need to spend more as you will miss some amazing opportunities.

For example, a B2C company selling products online would consider a lower CPA to be more successful than a B2B company selling services. A high CPA might be acceptable for a one-time purchase but not for a subscription service. It is important to track CPA over time to ensure it is within an acceptable range for your company.

Cost Per Acquisition Example

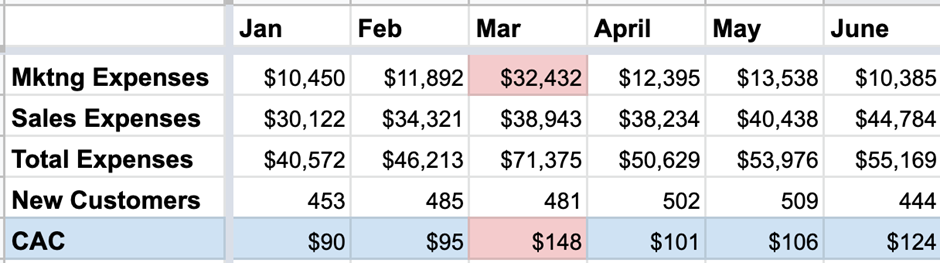

When it comes to predicting the CAC, you should not only consider the marketing spend for a month but also check the customers you acquired.

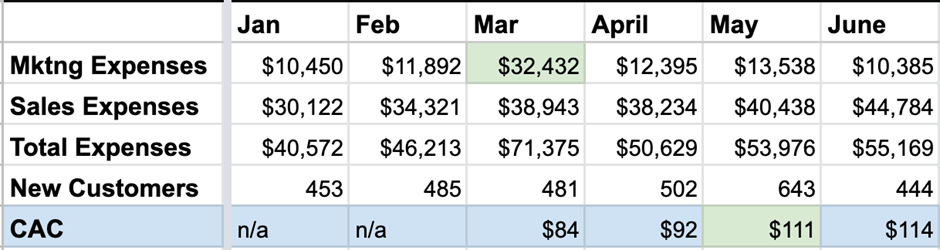

For instance, if you spend plenty of money on marketing to get lots of leads in March but the leads might not convert to consumers till May. So, if you consider the CAC for March, this would have been different. Consider below where the marketing spend increased in March.

Take a look how CAC increases in March however the marketing expense isn’t converting new consumers until April and May. You should know the average time it will take for a lead to become a consumer.

In the example above, CAC is formulated on a 60-day period and the customer acquisition cost generated is $111 CPA.

The Customer Acquisition Cost By Industries

When it comes to good customer acquisition cost by industry, there is a general benchmark. Using multiple industry estimates, here is a complete breakdown:

- Travel: $7

- Consumer Goods: $22

- Retail: $10

- Manufacturing: $83

- Transportation: $98

- Financial: $175

- Marketing Agency: $141

- Real Estate: $213

- Telecom: $315

There is great variance among industries. A good customer acquisition cost is dependent on the vertices the business is in. The CAC depends on different factors such as the sale cycle length, customer LTV, etc.

Factors That Affect Cost Per Acquisition

Several factors can influence the cost per acquisition for a business:

The Type Of Product Or Service Being Offered

Some products and services are more expensive to produce or acquire than others, so they will naturally have a higher cost per acquisition.

The Price Of The Product Or Service

Obviously, the higher the price of the product or service, the higher the cost per acquisition will be.

The Demand For The Product Or Service

If there is high demand for a product or service, businesses will be willing to pay more to acquire customers because they know they can sell the product or service at a higher price. On the other hand, if there is a low demand for a product or service, businesses will be less willing to pay a high cost per acquisition because they may have difficulty selling the product or service.

The Competition For Customers

If there is a lot of competition for customers, businesses will have to spend more on marketing and advertising to attract customers, increasing their cost per acquisition. On the other hand, if there is little competition for customers, businesses can save on marketing and advertising costs, lowering their cost per acquisition.

The Efficiency Of The Marketing And Sales Process

Suppose a business has an efficient marketing and sales process. In that case, it will generate more sales with less money spent on marketing and advertising, lowering the cost per acquisition. On the other hand, if a business has an inefficient marketing and sales process, it will spend more on marketing and advertising without generating as many sales, which will increase the cost per acquisition.

The Economy

In general, when the economy is doing well, businesses have more money to spend on marketing and advertising, which can lead to a higher cost per acquisition. However, during economic downturns, businesses may have to cut back on marketing and advertising spending, which can lead to lower acquisition costs.

The Seasonality Of The Business

Some businesses experience higher demand during certain times of the year than others, leading to higher acquisition costs. For example, businesses that sell products or services for Christmas may have a higher cost per acquisition in December than in January.

The Size Of The Target Market

The larger the target market, the more money a business will have to spend on marketing and advertising to reach those customers, which can lead to a higher cost per acquisition. On the other hand, if a business has a small target market, it may be able to reach all of its potential customers with less money spent on marketing and advertising, which can lead to a lower cost per acquisition.

The Type Of Customer

Some customers are more valuable to a business than others, so businesses may be willing to spend more to acquire those customers. For example, businesses may be willing to pay a higher cost per acquisition for customers who are likely to make repeat purchases or high-value customers.

CPA vs. LTV

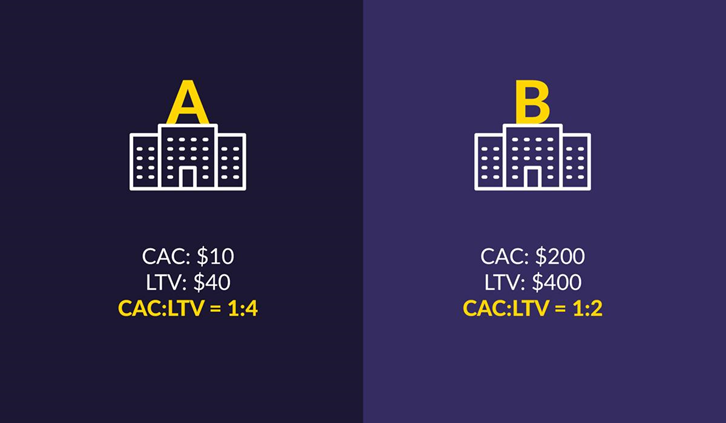

The customer acquisition cost will tell whether the business will succeed or not. But if the CAC is higher than the LTV, then businesses will not succeed. Let’s take an analysis.

Analysis 1:

- Company A’s CAC is $45 and LTV is $40. So, if these companies become really popular, the company won’t work unless these metrics change.

- It is essential to know that higher LTV than CAC, the company’s revenue will increase quickly.

Analysis 2:

- Company B LTV is $400 compared to A. Company A only spends $10 on customer acquiring whereas Company B spends almost $200.

The CAC: LTV ratio states that company A will scale twice as quickly.