Are you a business owner wondering what is contribution margin? It’s an important concept to understand for many reasons. Contribution margin helps businesses evaluate the profitability of products, calculate break-even points, and set pricing strategies. Learning how it works can be crucial to driving success in your business. In this post, we’ll discuss everything you need to know about contribution margins including why they’re important, how they are calculated, and how they can be used strategically by businesses to increase profits and grow their bottom line. Read on for an in-depth look at this concept that’s essential for all entrepreneurs!

What is the Contribution Margin?

The contribution margin is a metric that measures the profitability of each product or service sold. It represents the amount of revenue remaining after all variable costs associated with producing and selling the product have been deducted from the sales price of that product. In other words, it’s an indicator of how much profit (or loss) each individual sale contributes to the company’s bottom line.

The contribution margin is often used to determine price, evaluate cost-cutting measures, and understand overall profitability. It can also be useful for profit planning as it allows companies to forecast how much profit each sale may generate.

Why Is It Important For Startups To Track the Contribution Margin?

Contribution margin tracking is important for startups for a few key reasons. some of the reasons include:

1. Knowing the profitability of individual products and services:

This allows startups to identify which products or services are driving their revenue and profit so that they can prioritize resources toward those areas. Having an understanding of contribution margin can also help startups develop pricing strategies for new products or services that maximize profits.

2. Allocating resources appropriately:

By understanding the contribution margin of their products and services, startups can make better decisions on where to allocate resources. This will help them focus on those areas with higher profitability and make sure that any new initiatives are likely to be successful.

3. Planning for future growth:

By tracking the contribution margin, startups can more accurately forecast their financial performance in the future. This will help them plan for expansion, hire the right talent and make sure that their cash flow remains healthy as they grow.

4. Identifying areas of improvement:

Tracking the contribution margin can also help startups identify areas where profitability could be improved, such as by increasing prices or cutting expenses. By doing this, startups can ensure that they are operating as efficiently and profitably as possible.

Overall, tracking the contribution margin is important for startups because it gives them a better understanding of what drives their business and how to allocate resources in the most efficient manner. By doing so, they can ensure that their operations remain profitable in the long run.

How Can You Calculate Your Contribution Margin?

The formula for calculating contribution margin:

The calculation of the Contribution Margin is quite simple, as it is calculated by subtracting all Variable Costs from Revenue. Variable costs are expenses that directly affect revenue and vary depending on production volume, while fixed costs remain unchanged regardless of production volume.

Examples of Variable Costs include the purchase of materials, direct labor, and shipping costs, while examples of Fixed Costs include utilities, rent, insurance, and equipment.

What factors affect the Contribution Margin?

The following factors affect the contribution margin:

1. Price:

The higher the price of a product, the greater its contribution margin will be.

2. Volume:

A higher volume of sales can increase the contribution margin as fixed costs are spread over more units sold.

3. Variable costs:

These costs directly impact how much money is left after deducting them from sales and can affect the contribution margin.

4. Fixed costs:

Higher fixed costs will reduce the contribution margin, as these have to be deducted from the sales amount before calculating it.

5. Competition:

Increased competition in the market can lead to lower prices and hence, reduced contribution margins.

6. Product mix:

A change in product mix can affect contribution margin by increasing or decreasing the number of fixed costs allocated to each product.

7. Efficiency:

Improvements in efficiency can reduce variable costs, thus increasing the contribution margin.

8. Economies of scale:

When production increases and average costs decrease, the contribution margin will also increase due to lower cost per unit.

These factors should be taken into consideration when calculating the contribution margin. It is important to understand how each factor affects the contribution margin in order to maximize profits and minimize losses.

What is a good Contribution Margin?

A good contribution margin is relative and depends on the goals of a business. Generally, businesses aim for a contribution margin of at least 20%, though many businesses strive for higher margins. A higher contribution margin indicates that the company is generating more profit from its sales, which can be used to reinvest in the business and fuel growth.

Additionally, a higher contribution margin can help protect the business from fluctuating costs or market changes. Ultimately, a good contribution margin is one that meets the goals of the business and helps it achieve its long-term objectives. It’s important to note that margins do not always have to be high in order for a business to be successful.

What is an example of a Contribution Margin?

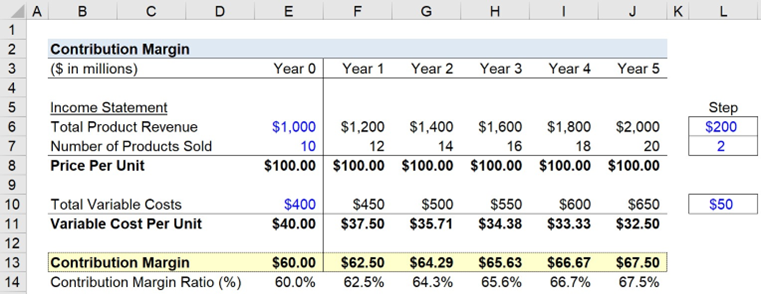

Step 1. Income Statement and Unit Economics Assumptions

To begin our simple exercise, we’ll need to list out the model assumptions for our hypothetical company. As of Year 0, the first year of our projections, this company has a total product revenue of $1m and 10k products sold. The total variable costs are $400k. We can calculate the price per unit by dividing the total product revenue by the number of products sold, which results in $100.00.

Additionally, we can find out the variable cost per unit by dividing the total variable costs by the number of products sold, resulting in $40.00. For Year 1 and onward, we will assume that the total product revenue will increase by $200k each year, the number of products sold will increase by 2k per year, and total variable costs will increase by $50k

Step 2. Contribution Margin Calculation Example

Now, we can calculate the contribution margin (CM) for each projected period. To calculate the CM, we will simply subtract the variable cost per unit from the price per unit. For instance, in Year 0, using the above assumptions, we can calculate the CM as follows: Price Per Unit of $100.00 minus Variable Cost Per Unit of $40.00 equals a Contribution Margin of $60.00.

Tips to improve the Contribution Margin:

Following tips help to improve contribution margin:

1. Analyze Expenses:

The first step to increase the contribution margin is to analyze and reduce unnecessary expenses. Evaluate every expense item in your budget and identify which costs can be eliminated or reduced without affecting profitability.

2. Increase Prices:

Raising prices can also help boost your contribution margin, especially if you’re stuck in a competitive market. Determine the maximum price customers are willing to pay and set prices accordingly.

3. Review Staffing:

Excess staffing can drive up labor costs and reduce profit margins, so review your personnel budget regularly to identify opportunities for staff reductions or improved efficiency.

4. Analyze Product Mix:

Take time to analyze your product mix to identify which products or services are providing the most profit margin and focus on maximizing those.

5. Increase Productivity:

Improving employee productivity is another way to increase contribution margins. Invest in staff training, processes and tools that help speed up production cycles without decreasing quality.

6. Streamline Operations:

Streamlining operations can help reduce expenses while improving efficiency. Consider outsourcing or automating certain tasks, such as bookkeeping and customer service, to reduce overhead costs.

7. Improve Quality:

Offering higher-quality products can lead to greater sales and more revenue, which will increase your contribution margin. Make sure you’re constantly working to improve the quality of your goods and services.

8. Analyze Your Customers:

Keeping a close eye on your customer base can help you identify any opportunities to increase sales or lower overhead costs associated with serving them.

By taking these steps, you’ll be well on your way to increasing your contribution margin and boosting profits. Regularly assessing the effectiveness of your strategies and making changes as needed will also help you continue to build a successful business.

The bottom Line

In order to make a contribution margin analysis, you need to understand your fixed and variable costs. Once you have determined your break-even point, you can start to look at ways to increase your sales. The contribution margin is a powerful tool that can help you to boost your profits and grow your business.

If you want to learn more about how to use the contribution margin in your business, we can help. Our team of experts are ready and waiting to partner with you to create a stellar SEO or marketing plan that drives sales by considering how your customers think. Which of these cognitive neuroscience principles have you applied to increase your product sales online?