Contribution margin ratio is an important concept that may seem complex but can be quite straightforward. It’s a key measure that reflects the core profitability of each product or service offered by a business and serves as an aid to understanding overall financial health. By taking into account both variable costs and fixed costs associated with making a sale, this measure helps identify if the cost structure of goods and services is sustainable in balance with their revenue stream. To find out more about the contribution margin ratio, its uses, calculation, and meaning- read on!

What is the Contribution Margin Ratio?

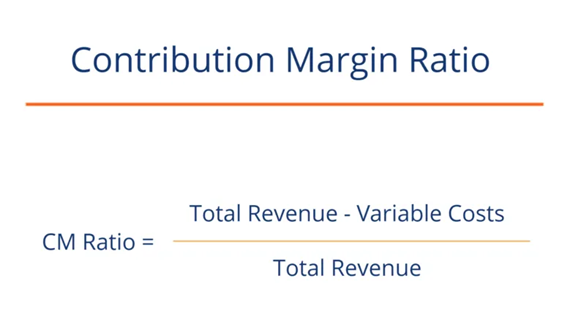

The Contribution Margin Ratio (CMR) is a financial ratio that measures the amount of income left over after all variable costs have been paid for. It is calculated by dividing the total contribution margin by total sales revenue and expresses the percentage of each sale that contributes to fixed costs and profits.

This ratio can be used to evaluate how efficiently companies can generate profits from sales. It can also be used to compare the performance of different business units or products within the same company. The higher the ratio, the more profitable a business is in relation to each sale made. CMR is an important indicator of a company’s profitability and should be monitored regularly by managers and investors.

With this information, companies can make informed decisions about pricing, production levels, and marketing strategies. The Contribution Margin Ratio is an extremely useful tool for companies to measure their performance and identify opportunities for improvement.

Why Is It Important For Startups To Track the Contribution Margin Ratio?

Contribution margin ratio tracking is important for startups for a few key reasons. some of the reasons include

1. Improved Profits:

The contribution margin ratio helps businesses to understand their true profits and potential losses. This allows startups to be proactive in managing expenses and improving profitability.

2. Budgeting and Planning:

Understanding the contribution margin ratio can help startups to better budget resources, track costs and plan for future growth. By understanding the metrics associated with the contribution margin ratio, startups can adjust their strategies and operations to maximize profits.

3. Cost Control:

Having a clear understanding of the contribution margin ratio allows startups to identify and control costs associated with various areas of operations. This will help them to ensure that they are always optimizing resources and minimizing expenses.

4. Investment Decisions:

Knowing the contribution margin ratio helps startups to make decisions when considering investing in new projects or products. By understanding the variable costs associated with the project, they can be sure to maximize the return on investment and minimize risk.

5. Competitive Advantage:

Being able to accurately measure and track the contribution margin provides startups with a competitive edge. This enables them to analyze their profitability more accurately and make more strategic decisions that could give them an advantage over other competitors in the market. Having a better understanding of their operating costs gives startups an opportunity to adjust pricing and marketing strategies to gain an edge in the market.

Overall, tracking the contribution margin ratio is essential for any startup looking to optimize profitability and create a successful business. By understanding the metrics associated with this ratio, startups can better manage their costs and make smarter decisions.

With increased awareness of the contribution margin ratio, startups can be confident that they are making the best investment decisions and improving overall profitability.

How Can You Calculate Your Contribution Margin Ratio?

The formula for calculating the contribution margin ratio:

For example, let’s say a company produces products with a total revenue of $800 and variable costs of $300. The contribution margin ratio would be calculated as follows:

Contribution Margin Ratio = ($800 – $300) / $800

= 0.625

In this example, the company’s contribution margin ratio is 0.625, which means that 62.5% of their total revenue is left to cover fixed costs and contribute to profits after variable costs are taken into account.

What factors affect the Contribution Margin Ratio?

The following factors affect the contribution margin ratio:

1. Fixed Costs:

Fixed costs, such as rent and salaries, do not change with the number of sales or production. When fixed costs are high, the contribution margin ratio will be lower.

2. Variable Costs:

Variable costs, such as materials and labor, vary with production or sales volume. When variable costs are high, the contribution margin ratio will be lower.

3. Price:

The price at which a product is sold can have a large impact on the contribution margin ratio. A higher price allows for a higher contribution margin ratio, while a lower price reduces it.

4. Product Mix:

Different products have different cost structures and therefore affect the contribution margin ratio. If a company sells products with low contribution margins, the overall contribution margin ratio will be lower.

5. Volume:

The volume of sales or production affects the contribution margin ratio as well. When there is an increase in sales or production, the contribution margin ratio can be improved.

6. Unit Costs:

The cost of producing each unit affects the contribution margin ratio. When unit costs are high, the contribution margin ratio will be lower.

7. Discounts and Promotions:

Offering discounts or promotions can reduce the price of a product, which in turn lowers the contribution margin ratio.

8. Operating Efficiency:

A company’s operating efficiency is affected by its ability to minimize costs while maximizing sales. When operating efficiency is high, the contribution margin ratio will be higher.

These are just a few of the factors that can affect the contribution margin ratio. It’s important for companies to understand these factors in order to properly manage their operations and achieve desired results.

What is a good Contribution Margin Ratio?

A good Contribution Margin ratio is one that meets your specific business goals. Generally, a higher Contribution Margin ratio means more profit per unit sold, so it can be beneficial to strive for a high ratio. However, a lower Contribution Margin may also work if you need to make large investments upfront in order to produce the product or service.

Ultimately, the Contribution Margin ratio should be tailored to your business objectives and budget. For example, if you are planning to launch a new product, you may want a higher Contribution Margin in order to cover research and development costs.

On the other hand, if you already have an established product that is selling well, a lower Contribution Margin could still be beneficial if you want to drive more sales volume. Ultimately, the right Contribution Margin ratio can vary widely depending on your goals and resources. It is important to consider all of these factors when determining your optimal target.

What are examples of a Contribution Margin Ratio?

The Contribution Margin (CM) ratio for a company can be calculated by subtracting its cost of goods sold, variable expenses, and any other costs from its total revenue, then dividing the difference by the total revenue.

For example, if a company has revenues of $50 million, its cost of goods sold is $20 million, marketing costs are $5 million, product delivery fees are $5 million and its fixed costs are $10 million, then its Contribution Margin dollars would be calculated as follows: CM Dollars = $50M – $20M – $5M – $5M = $20 million.

The Contribution Margin ratio is then found by dividing the CM Dollars by the total revenue: CM Ratio = $20M / $50M = 40%. It is important to note that fixed costs are not included in the formula, however, it must be taken into account to ensure that the CM dollars are greater than the fixed costs, as this will indicate if a company is operating profitably.

Example number 2

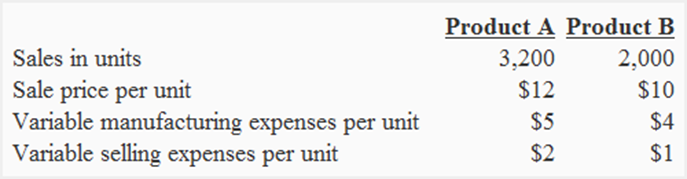

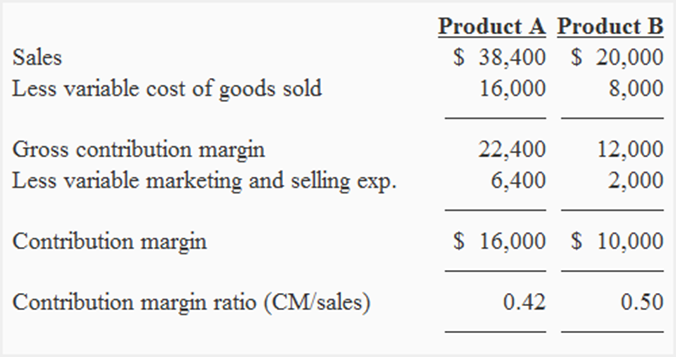

The Monster company produces and sells two products. Over the past six months, they have incurred total fixed expenses of $60,000, split between 50% manufacturing costs and 50% marketing/administrative expenses. Analysis of the sales and expenditure data reveals which product has a higher contribution margin ratio: there were no beginning or ending inventories.

Product A has a contribution margin ratio of 0.42 (or 42%), whereas Product B has a higher contribution margin ratio of 0.5 (or 50%). This indicates that Product B will be more effective in covering fixed expenses and generating profit compared to Product A.

Tips to improve the Contribution Margin Ratio:

The following tips help to improve the contribution margin ratio:

1. Increase Selling Price:

Increasing the selling price can help increase the Contribution Margin Ratio as it will directly impact on the sales revenue which in turn increases the contribution margin ratio.

2. Reduce Variable Cost:

Managing and reducing variable costs incurred for producing a product or service is important to ensure that more of its total revenue remains as a contribution margin.

3. Increase Efficiency:

Improving efficiency and productivity helps reduce the cost of production while increasing output, which can be achieved by automating processes or using technology which in turn increases the Contribution Margin Ratio.

4. Analyze the Product Mix:

Analyzing the product mix helps identify the products with higher contribution margins so that

more effort can be focused on those products and their sales.

5. Improve Quality:

Improving the quality of the product or services may help increase demand, resulting in more revenue and thus higher Contribution Margin Ratio.

6. Promote Products:

Properly promoting the products or services helps drive up demand which increases sales and consequently enhances the Contribution Margin Ratio.

7. Increase Volume:

Increasing the production volume can result in cost savings due to economies of scale which directly impacts on Contribution Margin Ratio.

8. Reduce Fixed Costs:

Analyzing and reducing fixed costs helps increase the Contribution Margin Ratio as it reduces total costs incurred while maintaining the same level of sales revenue.

9. Focus on Profitable Customers:

Targeting and focusing more effort on profitable customers helps increase sales to those customer groups and thus increases the Contribution Margin Ratio.

10. Increase Customer Retention:

Increased customer retention results in higher sales from existing customers which boosts the Contribution Margin Ratio. Implementing customer loyalty programs can help achieve this result.

These tips can help improve the contribution margin ratio and consequently the overall profitability of a business. Implementing strategies to reduce costs, increase efficiency, and optimize product mix can help maximize profits.

Additionally, increasing customer retention and promoting products in order to drive sales is also important for achieving higher contribution margins. Taking these steps should lead to an improved contribution margin ratio and ultimately better business performance

The Bottom Line

The contribution margin ratio is a simple and powerful tool that every business owner should understand. By calculating the contribution margin ratio, you can quickly see how much revenue is available to cover fixed costs. This helps you make informed decisions about pricing, product mix, and other important strategic decisions.

Additionally, if you’re ever in a situation where you need to reduce your costs rapidly, the contribution margin ratio provides a roadmap for which areas will have the biggest impact on your bottom line. Do you use the contribution margin ratio in your business? How has it been helpful?