Businesses today are constantly looking for ways to increase their revenue, generate more leads, and optimize processes. But perhaps the biggest challenge they face is how to grow a reliable source of recurring income. That’s where committed monthly recurring revenue (CMRR) comes in: it’s a key indicator of business health and growth that you can’t afford to ignore. In this blog post, we’ll discuss why CMRR is so important for businesses as well as some strategies for growing your own CMRR quickly and reliably. Read on to learn more!

What Is Committed Monthly Recurring Revenue?

Committed Monthly Recurring Revenue, or CMRR, is the portion of subscription revenue companies recognize as recurring each month. Typically, it excludes non-recurring revenues, even if they are on a revenue recognition schedule.

However, there isn’t a universal set of criteria that determine which subscriptions should be included in CMRR; often the consistency of subscription behavior can contribute to determining if a variable fee can be called “committed”. This makes CMRR an important metric for SaaS companies to understand and track their expected future revenues.

Why Is It Important For Startups To Track Their Committed Monthly Recurring Revenue?

Knowing and measuring your Committed Monthly Recurring Revenue (CMRR) is essential for startups. It’s an important metric to track given that it determines the future revenue predictability of a business.

By tracking CMRR, businesses can better understand opportunities such as increasing their average revenue per user, gaining new customers, identifying which products are more successful than others and accurately estimating future cash flow and growth.

Tracking CMRR also helps businesses avoid getting too optimistic about what their actual income will be for the upcoming months, eliminating the risk of running out of cash or overestimating their financial prospects. As startups need to focus on efficiency in order to stay competitive in today’s market, tracking CMRR is key to planning effective strategies for growth and success.

How Do You Calculate Committed Monthly Recurring Revenue?

Calculating Monthly Recurring Revenue (MRR) can be a daunting task, especially if you’re unfamiliar with the metrics involved. However, the Committed Monthly Recurring Revenue (CMRR) equation breaks it down in an easy-to-understand format that anyone can comprehend.

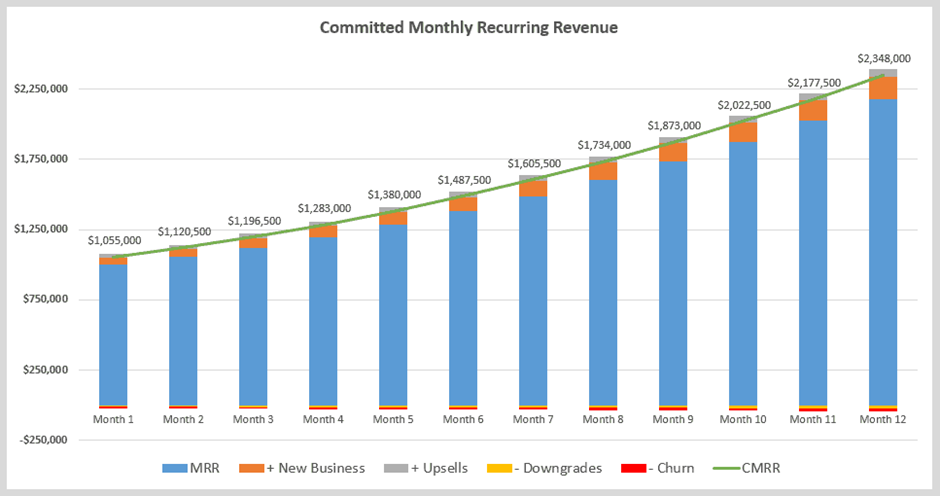

CMRR requires five variables: MRR, New Bookings, Churn, Downgrades and Upgrades. MRR includes revenue from all recurring services whereas New Bookings refer to net new services purchased by customers. Churn is the percentage of revenue lost by canceled services; Downgrades are when customers decrease their subscription and Upgrades are increases when customers choose higher priced subscriptions.

As an example, if your starting MRR is $1000, you add a net new sale of $200 dollars and then lose $100 dollars due to churn which would bring your final CMRR up to $1100 dollars.

Here’s the formula:

CMRR = MRR + New Bookings + Churn + Downgrades + Upgrades

What Factors Affect Committed Monthly Recurring Revenue?

Many factors can affect CMRR, such as customer churn, upsells, and down sells. Companies should be aware of these elements when tracking their CMRR figures to accurately evaluate the health of their subscription business.

Churn rates illustrate the rate at which customers are leaving service. A high churn rate corresponds to a lower CMRR because fewer customers are committing to the service and paying subscription fees.

Upsells, or additional sales of goods or services that increase the overall value of a customer’s existing subscription, can directly impact CMRR as more people commit to higher tiers of subscriptions with more features.

Downsells, on the other hand, are purchases of lower-valued goods and services that replace existing subscriptions. These can have a negative impact on CMRR if they cause customers to move from higher-value subscriptions to lower-value ones.

Finally, it is important for companies to understand how their customer lifetime values (CLV) affect CMRR. CLV is the total amount of money a customer will spend on their subscription over its lifetime; a higher CLV indicates that customers are more likely to remain committed to the service, leading to a higher CMRR.

By understanding how these factors affect CMRR, companies can ensure that they have an accurate view of their subscription business and can make informed decisions about the future of their service.

Value Of CMRR

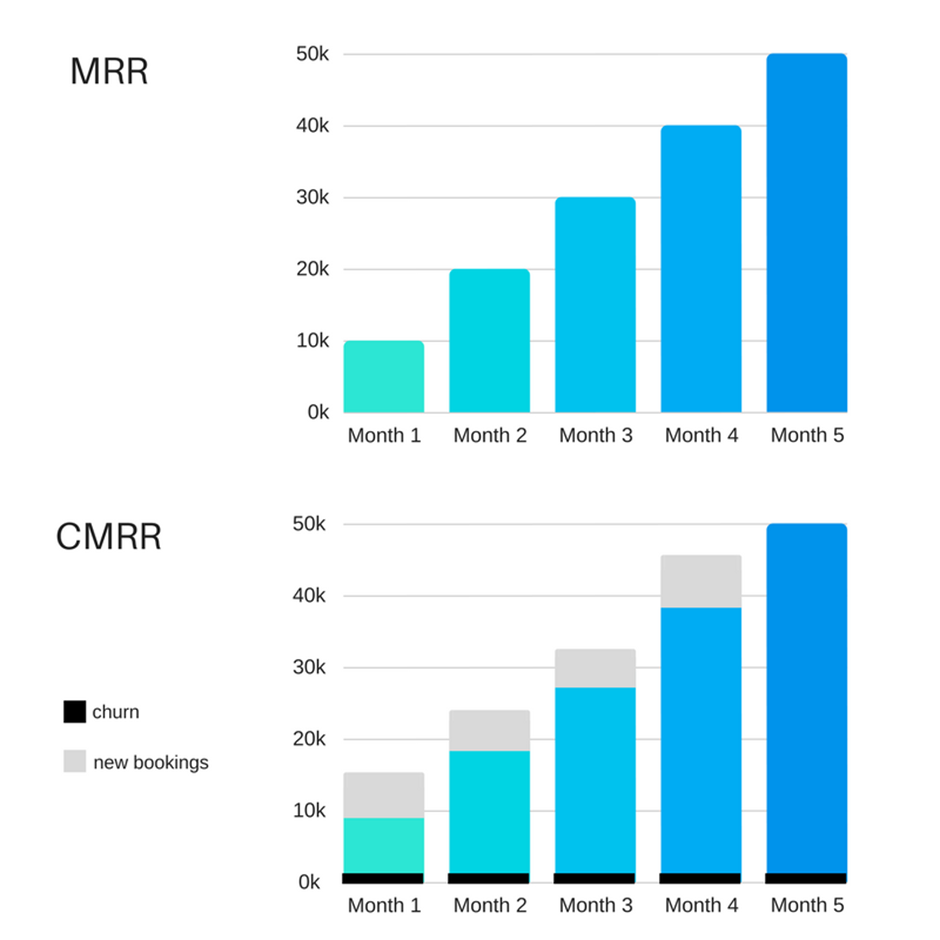

While MRR is a helpful metric for understanding your revenue growth, it doesn’t consider the impact of churn, upgrades, or downgrades. For this reason, CMRR (committed monthly recurring revenue) is often used in place of MRR when forecasting income. Visualizing CMRR shows the importance of accounting for churn, new bookings, and downgrades.

When assessing CMRR, you can see how new bookings and churn affect your curve. This example shows that even with positive growth, many who try to use MRR to predict income may be unpleasantly surprised if they have not taken into account any potential downgrading of services. To ensure accuracy, CMRR is essential in forecasting the future income of a business.

What Is A Good Committed Monthly Recurring Revenue?

Good committed monthly recurring revenue (also known as CMRR) is an essential performance metric for businesses, providing information about their financial health. It is the sum of a company’s subscription plans for a particular month, typically preceding their actual sales.

As customers commit to subscribing to products or services over a specific period of time, CMRR helps forecast future income for the business.

A good committed monthly recurring revenue grows steadily over time and reflects fairly predictable income that businesses can rely on—making it one of the most important metrics to understand when evaluating your business goals and success.

Example Of Committed Monthly Recurring Revenue

For instance, If today is May 15th, CMRR can help build on your previous MRR figure of $500K from April. This would take into account any new orders, add-ons, downgrades, and cancellations that have been received by your sales and accounting teams but have yet to flow through revenue in your financials.

For those who invoice annually, the same methodology can be applied by taking your base ARR (such as April’s MRR number annualized) and adding in known bookings and churn. In this case, CARR would represent an exit rate indicating how much new business you have going forward.

Strategy To Increase Committed Monthly Recurring Revenue

Analyze your existing customer base:

Start by identifying the customers who are engaged with your product or service, and how they interact with it. This could include analyzing their usage patterns, looking at feedback on user surveys or reviews, and talking to them directly. You should also analyze why certain customers leave your service in order to better understand customer needs.

Create customer loyalty programs:

Offer customers incentives to stay with your service and upgrade their subscription plans — such as discounts, early access to new features, or additional customer support. When customers feel appreciated and valued by your company, they are more likely to stick with you for the long term.

Focus on customer retention:

Customer retention should be one of your top priorities when it comes to increasing CMRR. Develop strategies and tactics to retain customers, such as providing helpful resources, offering personalized services, or hosting events for existing customers.

Automate onboarding processes:

Set up automated processes for customers to get set up on your service quickly and easily. By streamlining the onboarding process, you can increase customer satisfaction and reduce churn.

Leverage marketing campaigns:

Use targeted marketing campaigns to reach out to potential customers and educate them about your product or service. Give them an incentive to sign up for a subscription by offering discount codes or free trials.

Encourage upgrades:

Offer customers the option to upgrade their subscription plans for additional features and benefits. Give them reasons why upgrading is worth it, such as access to more content or better customer support.

Collect feedback:

Keep an open line of communication with your customers by constantly collecting feedback from them. Not only will this help you continuously improve your service, but it will also ensure that customers feel heard and appreciated.

Make use of data:

Analyze customer data to understand usage patterns, identify areas for improvement, and develop strategies to increase CMRR over time. You can also use the data to target specific customer segments or offer personalized experiences.

By following these strategies, you can increase your committed monthly recurring revenue and improve the loyalty of your customers. Take a data-driven approach to better understand customer needs and develop tactics that will help grow your business.

Conclusion

Committed monthly recurring revenue is one of the most important aspects of running a successful business. It gives you a more predictable income, which can help you better manage your expenses and grow your company. Additionally, it provides customers with peace of mind knowing that they will continue to receive their product or service each month without having to worry about renewing their subscription. Lastly, it helps to build loyalty among your customer base, as they are more likely to remain committed to your company if they feel like they are receiving good value for their money. If you’re not already incorporating some form of monthly recurring revenue into your business model, now is the time to start doing so!