Cash balance is an important concept for startups to understand if they want to keep their finances in order. Cash is the lifeblood of a business, and it’s essential that all entrepreneurs create systems around cash flow so they can successfully run their businesses and reach new heights.

But what exactly does cash balance mean? What impacts it? Is there anything startups should be doing differently when managing their cash reserves? In this blog post, we’ll cover the concept of cash balance: by discussing its importance, and outlining key principles of effective management, With these insights, you’ll gain valuable knowledge about ensuring positive cash flow for your own startup- from tracking expenses to investing appropriately- and reduce any risk associated with mingling money.

What Is Cash Balance?

The cash balance in business is the amount of money that a company has in its checking and savings accounts at any given moment. This figure can fluctuate significantly, depending on the cash flow of a business. A company may have a healthy cash balance one month but then find itself in a difficult situation another month if there are not enough incoming funds to cover expenses.

The cash balance is an important indicator of a business’s financial health and impacts its ability to pay bills, make investments, and provide services. It is important for businesses to maintain a healthy cash balance in order to remain viable. This can be done by carefully managing invoices and collecting payments in a timely manner and setting aside money for future expenses. Having a healthy cash balance is crucial for any business’s success.

Why Is It Important For Startups To Track Cash Balance?

Cash balance tracking is important for startups for a few key reasons. some of the reasons include:

1. Monitoring cash flow:

A startup’s ability to manage its cash flow will be a key factor in its success or failure. Tracking the cash balance gives founders insight into how much money is coming in and going out, and helps them make decisions about where they can save funds or invest more effectively.

2. Developing a budget:

Knowing the cash balance helps founders develop a realistic budget for the startup. This allows them to plan for upcoming expenses and ensure that they don’t run out of money mid-way through their projects or initiatives.

3. Avoiding overspending:

Keeping track of cash balances helps startups stay on top of their finances, and avoid overspending. This is especially important for startups with limited funds or tight budgets.

4. Staying organized:

Cash balance tracking helps founders stay organized and ensure that their money is being spent correctly. By tracking cash balances, they can quickly identify where money has been spent and what it was used for.

These are just a few of the reasons why tracking cash balance is important for startups. By staying on top of their finances, founders can ensure that they’re making smart and cost-effective decisions with their resources. This will ultimately help them succeed in the long run.

How Can You Calculate Your Cash Balance?

The formula for calculating cash balance is:

Cash balance = beginning cash balance + cash inflows – cash outflows.

When trying to calculate your cash balance, it’s important to start with the basics. Your cash balance is the amount of money you have in your accounts at any given time. To figure out what this number is, start by looking at the current balances for all of your accounts – such as checking, savings, investments, and other financial accounts. This will give you a good starting point for your calculation.

Next, you need to take into account any cash inflows and outflows that have occurred since the last time you calculated your cash balance. Cash inflows are any money that is coming into your accounts, such as salary payments or investment earnings. Cash outflows are any money that is leaving your accounts, such as bills or expenses.

To calculate your cash balance, simply add together the beginning cash balance and all of the inflows and subtract all of the outflows. The resulting number will be your current cash balance.

By taking the time to calculate your cash balance, you can ensure that you are always aware of the amount of money you have available and make informed decisions regarding your finances.

What factors affect the cash balance?

There are a variety of factors that can affect the cash balance. These include

1. Receipts and payments:

Cash flows in and out of the business can have a significant impact on the overall cash balance. A sudden influx of cash from an unexpected customer payment, for example, could significantly boost the cash position. Conversely, a large, unexpected expense such as an emergency repair bill could quickly deplete the cash balance.

2. Interest rates:

Changes in interest rates can affect both a business’s borrowing capacity and its returns on investments. If interest rates rise, it will become more expensive to borrow money and may reduce the amount of purchasing power that businesses have. Low-interest rates, on the other hand, make it easier to borrow money and may increase overall demand for a business’s products or services.

3. Debt levels:

High levels of debt can divert cash away from operations in order to service the debt payments. This can reduce the amount of money available to pay vendors, staff, and other creditors. Lowering debt levels can help to free up cash and increase the overall liquidity of the business.

4. Economic conditions:

The economic environment in which a business operates can also have an impact on its cash balance, particularly if it is highly dependent on consumer spending or external investments. If GDP growth slows down or consumer confidence weakens, businesses may start to see their cash balance decline as customers reduce spending and investments become more difficult to secure.

5. Accounting policies:

Different accounting policies can also impact the reported cash position of a business. For instance, businesses that use an accrual-based system will typically report higher levels of current assets compared to those using a cash-based approach. This is because accrual accounting recognizes revenue when it is earned, regardless of whether payment has been received, whereas the cash-based approach only records transactions when money actually exchanges hands.

Ultimately, understanding how these factors can influence the overall cash balance of a business is essential for successful financial management. Business owners and financial managers should regularly assess the impact of these factors on their cash balance to ensure that they are able to maintain sufficient liquidity.

What is a good cash balance?

The answer to this question depends on a variety of factors and can vary greatly from one business to another. Generally speaking, a good cash balance in a business is enough to cover both short-term and long-term needs without the need for borrowing or taking out additional loans.

This includes covering expenses such as rent and payroll, as well as having sufficient funds available to invest in growth opportunities and unexpected expenses. The ideal cash balance for your business depends on the size of your organization, the industry you operate in, and your current cash flow and financial reserves.

Ultimately, it is important to ensure that there is enough liquidity to cover the daily operations of your business while also having adequate savings for a rainy day. Having a clear view of your company’s financial situation and cash flow can help you determine the best balance to maintain.

Every company has different needs and goals, so the ideal cash balance should be tailored to the unique needs of each organization.

What are examples of a cash balance?

If you want to track your cash balance and determine how much money you’ll have at the beginning of the next month, it is essential that you use a cash flow statement. To illustrate this, let’s say your business began the month with $1,000 in its account and generated $300 through sales. You also made a sale worth $1,200, with the payment expected in two months. Lastly, you spent $1,500 during the month.

Using the accrual accounting method, your balance sheet will show that the business’ overall value is still $1,000 at the start of the next month. This is because the cash balance is calculated as follows:

$1,000 (cash balance) = $1,000 (beginning cash balance) + $300 (sales) + $1,200 (accounts receivable) – $1,500 (expenses).

However, the cash flow statement will reveal that the account is actually overdrawn. To prevent this from happening, it is important to reduce expenses and increase sales.

By monitoring the cash balance in this way, you can invest in opportunities while also having enough money to pay your bills. This will help simplify complex financial transactions and ensure that your business remains in a strong position.

Benchmark data for Cash Balance:

The JPMorgan Chase Institute released its inaugural report on the small business sector, which takes a close look at cash inflows and outflows, as well as account balances. The findings reveal that most small businesses have insufficient cash reserves to provide a cushion in the event of economic hardship or other disruptive events.

Data from more than 470 million transactions made by 597,000 small businesses from February to October 2015 was used in this analysis and indicates that only half of all small businesses have enough cash stored to cover 27 days of their usual outflows.

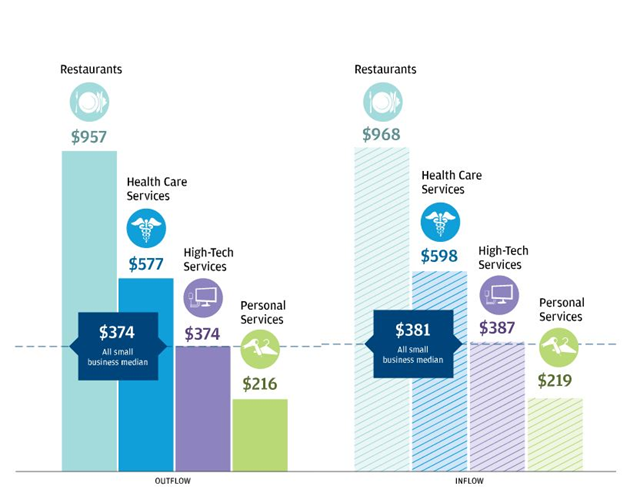

The typical small business sees an average of $374 in daily cash outflows, and $381 in daily cash inflows, though there is a large difference between and within industries.

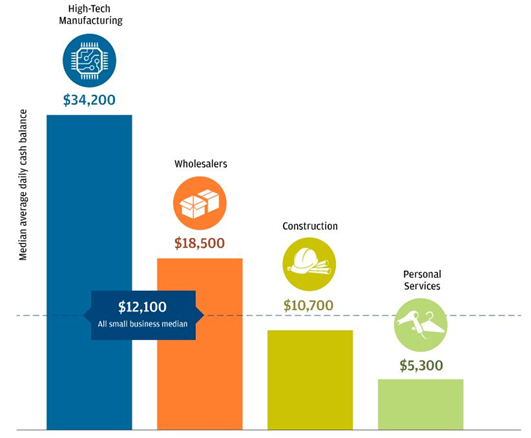

The median small business has an average daily cash balance of $12,100, with significant variances between and within industries.

Tips to improve cash balance

following are the tips to improve cash balance:

1. Analyze Your Cash Flow:

The first step to improving your cash balance is to understand where and how money is flowing in and out of your business. Take a look at your income statement and analyze the sources of revenue, as well as the different categories of expenses that you incur every month. Understanding what drives changes in your cash balance will help you create a plan for improving your cash balance.

2. Cut Unnecessary Expenses:

Once you’ve identified the major sources of cash flow, look at ways to trim expenses in order to save money and increase your cash reserves. For example, analyze areas like employee benefits, office supplies, travel costs, and other overhead items to identify opportunities to save.

3. Increase Cash Revenues:

To improve your cash balance, it’s important to find ways to increase the amount of money coming into your business. Seek out new clients and customers who can pay for services or products upfront with cash, look for additional revenue streams such as royalties from intellectual property, and find ways to increase the efficiency of your sales process.

4. Improve Cash Management:

Proper cash management is essential for creating a healthy cash flow. Create systems and processes to ensure that you’re collecting payments from customers on time and tracking any expenses that have been incurred but not yet paid. You may also want to consider negotiating longer payment terms with suppliers or invoicing customers at the start of a project, rather than at its completion.

5. Utilize Short-Term Financing Options:

If your cash flow needs a boost, there are short-term financing options available such as business lines of credit or merchant cash advances that can help you get the funds you need. These options are generally easier and faster to acquire than traditional business loans and can be a great way to bridge the gap between cash inflows and outflows during periods of low cash flow.

6. Invest in Cash Management Software:

Taking the time to implement cash management software can be an invaluable tool for improving your cash balance. It can streamline your accounts receivable and accounts payable processes, help you identify cash flow trends that can inform better decision-making, and provide an easier way to track your overall financial performance.

By following these tips, you should be able to improve the cash balance of your business and ensure that it’s running smoothly. With a better understanding of your cash flow, you can make smarter decisions about where and how to use available funds.

Wrap Up

A company’s cash balance is one of the most important indicators of its financial health. Startups need to be especially mindful of their cash flow and make sure they have a solid understanding of how to manage it.

By following the tips in this post, startups can get a handle on their cash flow and keep their business on track. Do you have any other tips for managing cash flow? Share them in the comments below!