CAC Ratio- is an important financial metric that can make or break a business. It’s the one factor that investors and venture capitalists use to decide whether they should invest in your company or not. But have you ever thought, what if there was a better way to calculate CAC Ratio? What if we were able to combine different metrics, resulting in a more accurate picture of how efficient our customer acquisition strategies are? Well, here it is- The Blended CAC Ratio! A complete guide for understanding and calculating blended CAC Ratios accurately for any organization. If you want to take your company’s performance to the next level by improving its growth strategy via smarter investment decisions, then this guide is a must-read for you!

What is the Blended CAC Ratio?

The blended CAC ratio is a tool used to measure the combined cost of customer acquisition over a set period. It takes into account both marketing and sales expenses, allowing you to assess the total cost of acquiring customers. This ratio is especially important for startups and businesses that are new to the market, as it can help them assess their marketing strategy, identify areas of improvement and adjust accordingly.

This metric can be incredibly useful for businesses that are looking to optimize their customer acquisition strategies and drive down costs. By understanding your blended CAC ratio, you can identify areas that need improvement and adjust your strategy accordingly. With the right approach, you can ensure that your customer acquisition costs are in line with industry benchmarks and maximize the ROI of your efforts.

Why is it important for start-ups to track the Blended CAC Ratio?

Following are the reasons why tracking the blended CAC ratio is important for start-ups:

1. Helps in understanding the effectiveness of customer acquisition channels:

Tracking the blended CAC ratio helps start-ups to identify which customer acquisition channels are working best for them and which ones require improvement. This allows start-ups to focus their resources on the most effective channels and maximize their ROI.

2. Improves sales forecasting accuracy:

Tracking a blended CAC ratio enables start-ups to have a better understanding of their customer acquisition costs, which in turn helps them to accurately forecast their sales. This helps them plan better and allocate resources accordingly.

3. Increases chances of success:

By tracking their blended CAC ratio, start-ups can identify potential problems with their customer acquisition process and take action accordingly. This can help them reduce their customer acquisition costs, boost their ROI, and increase their chances of success.

4. Increases investor confidence:

Tracking the blended CAC ratio allows start-ups to show potential investors that they have an organized approach to customer acquisition and are successfully reducing it over time. This increases investor confidence in the business and its prospects for success.

5. Helps to identify customer lifetime value:

Tracking blended CAC ratio helps start-ups to gain a better understanding of their customer’s lifetime value, which is important for making effective marketing and customer acquisition decisions. By tracking this metric, start-ups can optimize their campaigns and target the right customers to ensure a strong return on investment.

Overall, tracking the blended CAC ratio is essential for start-ups to get an accurate picture of their customer acquisition costs, accurately forecast their sales, identify potential problems with their customer acquisition process, and increase investor confidence. This can help them maximize their ROI and ultimately lead to greater success.

How to Calculate the Blended CAC Ratio?

Here is the formula to calculate the Blended CAC Ratio:

To calculate your blended CAC ratio, add up all of your sales and marketing expenses (excluding salaries and overhead costs) for a certain period. Then, divide that number by the total number of new customers acquired during that same period. The resulting number is your blended CAC ratio.

What factors affect the blended CAC Ratio:

The Blended CAC ratio is affected by several factors, these include:

1. Product Development Cost:

The cost of developing, launching, and maintaining a product is an important factor affecting the blended CAC ratio. If the development cost is higher, then it would be difficult to recover those costs through customer acquisition alone.

2. Target Audience Size & Reachability:

To achieve a lower CAC ratio, it is important to target the correct audience. For example, targeting a niche market can result in a higher conversion rate and hence e lower CAC ratio.

3. Advertising & Promotion Costs:

The cost of advertising and promotion plays an important role in influencing the blended CAC ratio. Customer acquisition campaigns must be well-planned to maximize the impact while containing costs.

4. Average Order Value:

A higher average order value can help to reduce the blended CAC ratio. This is because a limited amount of acquisition cost will be spread over a larger number of customers, resulting in a lower CAC ratio per customer.

5. Conversion Rate:

The conversion rate plays an important role in determining the blended CAC ratio. A higher conversion rate means more customers are being acquired at a lower cost, resulting in higher overall profits and lower costs per order.

6. Customer Retention Rate:

Having a high customer retention rate is essential for achieving low CAC ratios. Customers who are retained generate repeated revenues, which helps to offset the initial acquisition cost and further lowers the blended CAC ratio.

7. Customer Lifetime Value:

A higher customer lifetime value can also help to reduce the blended CAC ratio by spreading out a fixed amount of acquisition cost over a larger number of customers and orders. This helps to ensure that companies can invest in acquiring new customers while still maintaining a healthy profit margin.

By considering the factors mentioned above and making appropriate changes in strategy, companies can improve their blended CAC ratio and increase overall profits. This is essential for achieving long-term success in the highly competitive markets of today.

What is a good Blended CAC Ratio:

A “good” blended CAC ratio is Customer acquisition campaigns must ben costs divided by the number of customers acquired in a given period. Ideally, this ratio should be less than three. This means that for every dollar spent on acquiring new customers, you should receive at least three dollars in return.

A higher ratio may indicate that the company is investing too much in customer acquisition, and may need to adjust its strategy. It’s important to note that this ratio can vary between different industries and markets, so what may be considered a good ratio for one business may not apply to another. Ultimately, it’s up to the individual business to determine its own acceptable CAC ratio.

What are the examples of blended CAC ratios?

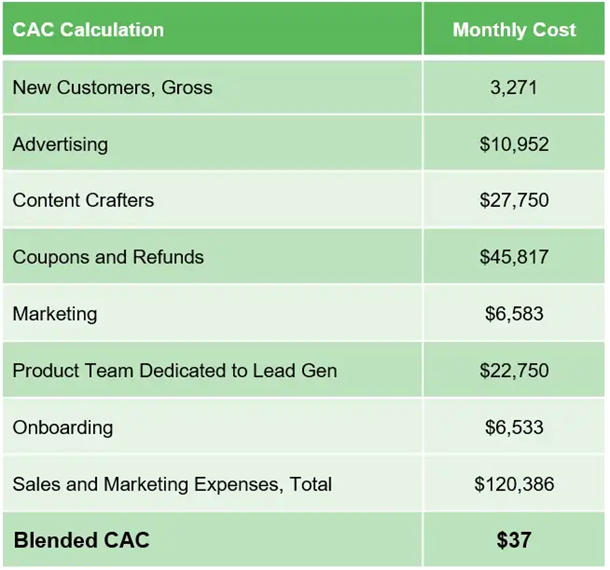

Buffer does not have a dedicated sales team and only one of the company’s employees is employed as a full-time marketer. However, since Buffer’s blog serves as an important customer acquisition resource, we should include the salaries of their “Content Crafters” in our numerator calculation. Furthermore, we estimate that there are four members of their product team that are responsible for their lead generation tool, Pablo. All refunds, coupons, and onboarding expenses should also be factored into the equation.

Here the blended CAC ratio is calculated by:

$120,386/ 3271

= $37

The estimated CAC for Buffer appears to be suspiciously low, as the Gross Profit based payback time would only be approximately three months. This could be explained by their early stage of development, where their main customer acquisition channel is yet to reach its full potential.

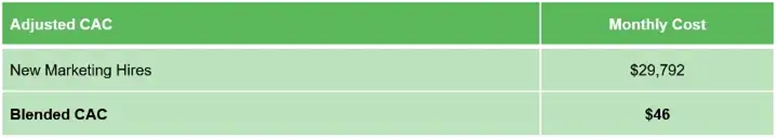

In addition, Buffer does not employ sales representatives or invest heavily in paid advertising, both of which indicate that their CAC is likely to increase going forward. If we factor in Buffer’s four open marketing and business development positions, the CAC would climb to $46 with a payback time of four months.

This is more in line with the median value of five months reported by the Pacific Crest SaaS Survey, for companies that use Internet Sales as their primary acquisition channel.

Tips to Improve the Blended CAC Ratio:

following tips help to improve the blended CAC ratio:

1. Analyze customer lifetime value:

It is important to understand how much you are spending on acquiring each customer and how long they stay with your business. Knowing the total cost of acquisition (CAC) and the average time that customers remain loyal to your business will help you determine whether or not your CAC is sustainable in the long run.

2. Monitor customer retention:

By monitoring customer retention, you can quickly identify any churn risks and take the necessary steps to retain more customers. This will help reduce your CAC and ensure that you are spending money wisely on acquiring new customers.

3. Use a blended CPA model:

A blended CPA (Cost Per Acquisition) model combines both organic and paid advertising efforts to determine the most effective way of reaching out to customers. This can help you lower your CAC since you will be able to track exactly how much you are spending on each method of customer acquisition.

4. Focus on user experience:

A good customer experience is essential to ensure that your customers stay loyal to your business. Make sure that you are constantly refining and improving user experience by using customer feedback, surveys, or other tools to understand the needs of your customers better.

5. Automate marketing activities:

Utilize automation techniques such as email marketing and social media management to reduce manual labor costs associated with customer acquisition activities. This will help you minimize your CAC and free up valuable resources that can be used to improve other aspects of your business.

6. Optimize ad campaigns:

Constantly evaluate and optimize the performance of your ad campaigns in order to maximize ROI. Look for ways to reduce expenses while maintaining efficiency and effectiveness, as this will increase the profitability of your campaigns and reduce your CAC.

7. Leverage referral programs:

Referral programs are a great way to acquire customers at a lower cost than traditional advertising strategies. By offering incentives to existing customers for referring new customers, you can increase word-of-mouth marketing organically without spending extra money on promotional activities.

8. Experiment with different channels:

Don’t rely too heavily on one channel for customer acquisition. Try different strategies such as content marketing, influencer outreach, paid search, and display ads to determine which ones yield the best results for your business.

By following these tips, you can significantly improve your blended CAC ratio and ensure that you are spending money wisely on acquiring new customers. These strategies will help you acquire more customers at a lower cost, which in turn can lead to higher profits for your business

The Bottom Line

The blended CAC ratio is a powerful metric that can help SaaS businesses of all sizes track their customer acquisition efforts and make sound decisions to improve their business. By understanding the components of the blended CAC ratio and how it works, you’ll be in a much better position to use it effectively in your own business.