Average Transaction Value (ATV) is the key performance indicator used to measure the success of a company’s transactions, including purchases and repeat sales. Understanding ATV can help you uncover insight into customer behavior, optimize your marketing campaigns for higher orders, drive up revenue and get more out of each purchase. In this complete guide, we’ll explore what Average Transaction Value is, how to find it – as well as why it’s an essential tool for any business owner looking to increase profits! Let’s dive right in and take a closer look at Average Transaction Value – and how understanding its metrics can be used as an effective indicator of financial performance.

What is the Average Transaction Value (AVT)?

AVT is the Average Amount of Money a customer spends with your company. It is a financial metric used to measure the average amount consumers spend per purchase. It’s often used to measure the strength of a company’s sales strategy, helping businesses understand which products their customers prefer and how well promotions are performing.

This metric provides valuable insight into what products and services are in demand, so businesses can adjust their strategies to get the most out of each purchase. Additionally, it can be used as a performance indicator for successful campaigns or campaigns that might need tweaking to be more successful.

Why Is It Important For Startups To track the Average Transaction Value?

Startups need to understand their customer base as well as their product or service offerings to stay competitive and profitable. As such, startups need to track the average transaction value (ATV) to get a better understanding of how much customers are willing to pay regularly.

This information can be used to help strategize pricing models, optimize purchasing flows, and gain market insights. By tracking ATVs, startups have visibility into what is driving customer preference and spending behavior over time.

When coupled with other metrics like customer acquisition cost or lifetime value, this data becomes incredibly powerful in helping businesses make informed decisions about what kind of products or services they should develop and how much they should be charging for them.

How To Calculate the Average Transaction Value?

Here is the formula to calculate the Average Transaction Value:

To calculate the ATV for your business, take the total value of all transactions from a chosen time period (day, week, month, quarter, etc.), and divide it by the total number of transactions made during that same timeframe.

What factors affect the Average Transaction Value:

Average Transaction Value (ATV) is affected by several factors, these include:

Product mix:

The range and type of products customers purchase contribute to ATV figures. Products with a higher price point naturally drive up the average transaction value, while lower-priced items can drag down the figure.

Discounts:

Offering discounts or promotions for certain items or bundles can also increase ATV by encouraging customers to buy more items at once.

A/B testing:

Testing different offers and promotions can help determine which ones are most successful in increasing ATV and help make informed decisions as to how to optimize them further.

Payment options:

Offering multiple payment options such as credit card, debit card or online payments can widen the customer base, thereby increasing ATV.

Target audiences:

Knowing who your target audience is and creating offers or promotions specifically tailored to them can increase the likelihood of higher average transaction values.

Customer service:

Providing excellent customer service helps build trust and loyalty, encouraging customers to make repeat purchases which can ultimately lead to higher ATV.

Shopping experience:

Optimizing the customer’s shopping experience is key in driving up ATV figures. Creating an enjoyable atmosphere, easy navigation and helpful advice can all contribute to a positive customer experience, leading to more sales.

These are just some of the many factors that can affect Average Transaction Value. By understanding and applying the right strategies, businesses can increase their ATV figures and maximize profits.

Quotes about Average Transaction Value:

“The average transaction value is the key to developing a successful business strategy.” – Joe Rogan

“Your average transaction value should be one of the most important metrics you track and understand on an ongoing basis.” – Brian Tracy

“The average transaction value is an indication of how valuable your product or service is to customers.” – Mark Cuban

What is a good Average Transaction Value?

The answer to this question will vary depending on your business model and industry. When calculating Average Transaction Value, it is important to understand what a “good” average transaction value is. Here is the guideline that can help determine what a good ATV looks like for your business.

Generally, an average transaction value that is higher than the industry average indicates a successful business with good pricing strategies in place. Additionally, businesses with high average transaction values tend to have loyal customers who make repeat purchases. Ultimately, a good average transaction value should be determined by analyzing the specific needs of your business and customers.

What are examples of an Average Transaction Value:

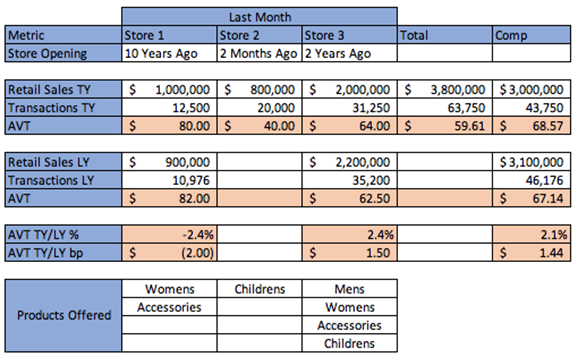

Let us consider an example of 3 stores. Suppose we want to calculate the Average Transaction of the stores in the last month so we can compare it with Last Year’s (LY) Average transaction Value.

By using the formula:

AVT = Retail Sales / Transactions

For Store 1 we get

$1,000,000 / 12,500 = $80.00

For store 2 we get

$800,000/ 20,000 = $40.00

For store 3 we get

$2,000,000/ 31,250= $64.00

Bench Mark Data for Average Transaction Value:

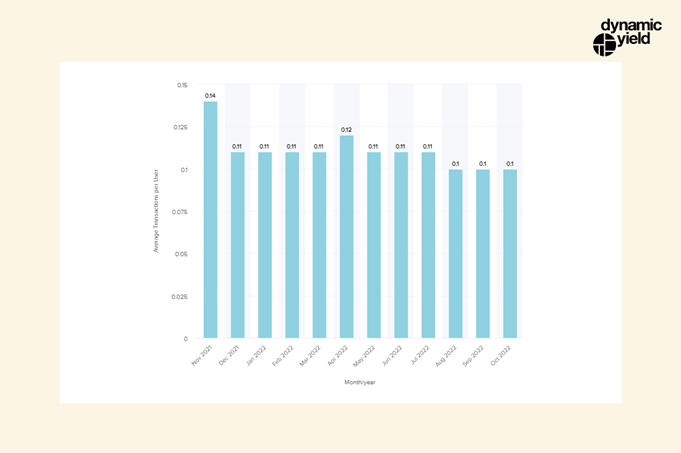

In October, the average number of transactions per user for Food & Beverage was highest at 0.37, a 17.65% increase from September. Out of all sectors, transactions per user for Food & Beverage were highest with an average of 0.32 over the past 12 months and Luxury & Jewelry had the lowest average of 0.07.

When looking at regions, EMEA had the most transactions per user on average (0.12), followed by the Americas (0.11) and APAC (0.06). In terms of device type, the desktop was responsible for 0.18 of ATPU, with tablet representing 0.15 and mobile for 0.08.

Tips to Increase the Average Transaction Value:

Following are some Strategies to Increase the Average Transaction Value:

Offer More Expensive Options:

Adding higher-priced products or services to your offerings can help increase the average transaction value of customers who buy from you.

Bundle Products and Services:

Offering bundled packages of goods and services is a great way to encourage customers to buy more and increase their total spending in one purchase.

Upgrade Discounts:

Give customers the option of upgrading their purchase for a discounted price, allowing them to get more value for their money.

Cross-sell and Upsell:

Recommend additional products or services that are related to their current purchase, such as accessories or upgrade packages.

Free Shipping:

Offering free shipping can increase the average transaction value, as customers are more likely to buy more if they don’t have to pay for delivery.

Product Recommendations:

Implement automated product recommendation systems that suggest items based on a customer’s past purchases or preferences.

Email Marketing:

Send emails with personalized offers and discounts to encourage customers to purchase more from you.

Free Samples:

Give away free samples of your products or services to provide potential customers with a taste before they buy.

Payment Plans:

Offer payment plans and subscription services to make it easier for customers to purchase higher-priced items over time.

Loyalty Points & Rewards:

Give customers loyalty points or rewards for purchasing from you, which can be used towards future purchases.

Free Gifts:

Include gifts in customers’ orders to encourage them to buy more and increase their average transaction value.

By implementing some or all of these strategies, you can help boost the average transaction value and make your business more profitable over time.

The bottom line

In conclusion, understanding your customer’s purchasing behavior is essential to increase your Average Transaction Value. There are several ways to do this, and we’ve outlined some of the most effective methods in this guide.

By applying these methods, you can be sure that you are making the most out of every transaction and increasing your profits. Thanks for reading!