Are you looking for ways to increase your sales and marketing performance? It turns out that one of the best indicators of success is something a lot simpler: the average number of transactions. By tracking and improving the overall number, you can make sure that buyers are coming back more often, leading to higher returns over time. In this blog post, we’ll explain why tracking average transactions is so crucial when it comes to driving better sales and marketing results – dive in as we go deep into how leveraging data analytics could be transformational for any business!

What Is Average Number Of Transactions?

The average number of transactions is a figure that represents the sum total of all transactions completed over a specified period. It’s an important metric to monitor because it shows how often customers are choosing to purchase items and services – and how frequently businesses are making sales.

Knowing this number helps inform business decisions, as well as strategies aimed at optimizing customer experiences. When the average number of transactions decreases, it’s a sign that something needs to change; conversely, increases in the average can indicate success for any promotions or new offerings available. Assessing your average number of transactions is key to understanding how well your company is performing as a whole!

Why Is It Important For Businesses To Track Their Average Number Of Transactions?

The average number of transactions a business has per month is an important metric to track in order to understand customer buying behavior. Knowing the average number of transactions and how it varies from month to month can help business owners make more informed decisions on inventory, staffing and marketing initiatives.

Additionally, tracking average transactions provides insight into customer loyalty and helps business owners determine which products and services are the most popular with consumers. This data can be used to optimize pricing and product position strategies, as well as aid in forecasting sales in the future.

Accurately tracking your business’s average number of transactions is essential to improving market share and growing profits over time.

How Do You Calculate the Average Number Of Transactions?

Calculating the average number of transactions can be a great way to measure the success of your business. By compiling and analyzing periodical figures, you can see where you have succeeded in increasing customer activity and where there is still room for improvement.

To get started, make sure you have all current data on transactions from each month or quarter. Tally up the total transactions from each time frame and divide it by the amount of time frames that are being studied. This will provide an accurate estimate of how frequently customers are shopping with your business!

Once your average number of transactions is established, you can use it as a benchmark indicator to spur future business growth.

What Factors Affect Average Number Of Transactions?

There are several factors that can affect the average number of transactions. These include the type of business, customer base, payment methods accepted and local competition.

Business Type

Different types of businesses have varying levels of transaction volume due to their products or services. For example, a restaurant will likely have more transactions than a clothing store as customers are more likely to return for multiple meals than clothing items.

Customer Base

The size and demographic of a business’s customer base can also have an effect on the average number of transactions. Businesses with loyal, repeat customers tend to have higher transaction volume than businesses that only attract one-time buyers.

Payment Methods Accepted

The payment methods accepted by a business can also affect the average number of transactions. Businesses that accept multiple forms of payment tend to have higher transaction volumes than those that only accept cash or debit/credit cards.

Local Competition

Depending on the type of business, local competition can be another factor in determining the average number of transactions. Businesses in highly competitive markets often have higher transaction volumes than businesses in areas with less competition.

All of these factors can affect the average number of transactions a business sees, and should be taken into consideration when determining how to best increase sales and maximize profits.

What Is A Good Average Number Of Transactions?

There is no definitive answer to what constitutes a good average number of transactions; it depends on a variety of factors such as the type and size of your operation, the market in which you’re selling, and the types of goods or services you are offering.

When assessing your average number of transactions, consider taking into account both short-term episodic events as well as longer-term customer retention rates. Additionally, evaluating consumer loyalty can shed light on whether those who purchase from you return for repeat business, or if each transaction is unique.

Ultimately, by carefully monitoring long-term metrics and strategies that emphasize customer satisfaction can help ensure a more consistent average number of transactions.

Examples Of Average Number Of Transactions

To look at the clothing store once more, you can use your Average Transaction Value (ATV) of $50 from that Saturday afternoon to set a new ATV goal of $55 for the next week. With the same number of transactions as before, this $5 increase per transaction would bring in an extra $1,000 – meaning your business could make more without relying on any additional customers.

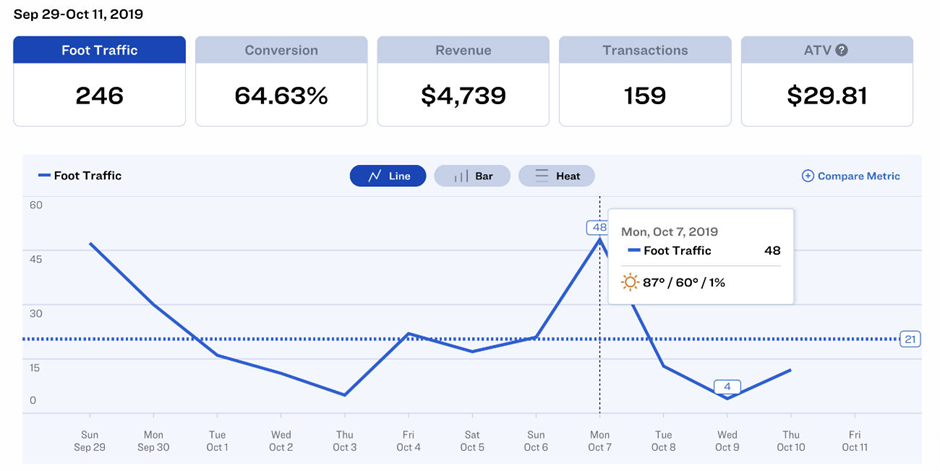

For a more in-depth analysis of your customer base, it’s best to look at both ATV and foot traffic data. According to a 2011 study, an extra unit of average traffic per hour can increase sales volume by $9.97 – so if you notice that your store has high foot traffic without any corresponding increase in conversion rates or ATV, it’s time to consider making some improvements.

To make the process easier, you can invest in advanced people counters like Dor’s thermal foot traffic counter. Their API can be easily integrated with your existing POS system to give a consolidated view of foot traffic data, conversion rates, and ATV information. All this on one dashboard screen.

Strategies To Increase Your Business’s Average Number Of Transactions

Provide Exceptional Customer Service:

Providing personalized service that exceeds customer expectations is key to increasing the number of transactions per customer. Be sure to train your staff on how to effectively handle customer inquiries and build relationships with customers so they can trust in your business for reliable products and services.

Encourage Loyalty Programs:

Loyalty programs can be a great way to incentivize customers to keep coming back for more. Offer rewards such as discounts, bonus points or free gifts that encourage customers to make multiple purchases from your business.

Create Special Offers and Deals:

Offering special deals on certain products or services is an effective way to get customers to buy more. Consider bundling items together, offering discounts or free shipping, or providing limited time offers to encourage customers to make multiple purchases.

Use Digital Marketing Strategies:

Utilizing digital marketing strategies such as email campaigns and social media can be a great way to spread the word about your business and its offerings. Make sure to craft campaigns that target potential customers who may be interested in buying from your business and then tailor them to their needs.

Offer Subscription Services:

Offering subscription services for products or services is an effective way to get customers to keep coming back for more. Consider creating a subscription plan that allows customers to purchase products on a regular basis or receive discounts for signing up for a subscription.

Focus on Quality:

Offering quality products and services is essential for getting customers to make multiple purchases from your business. Make sure to focus on delivering exceptional customer service, as well as ensuring your products are reliable and of the highest quality. Doing so will help boost customer loyalty and trust in your business.

Make It Easy To Make Purchases:

Making it easy for customers to make purchases will encourage them to buy more often. Consider offering multiple payment options, providing streamlined checkout processes, and making sure all information is easily accessible on your website or store. Doing so will make it easier for customers to make purchases and increase the number of transactions.

By following these strategies, you can effectively increase your business’s average number of transactions per customer. Doing so will not only help to boost revenue and profits, but it will also help to build customer loyalty and trust in your business

Conclusion

Uderstanding average number of transactions is crucial for sales and marketing as this metric defines how many times your customers are willing to buy from you. It also helps identify whether your business model is sustainable in the long run. If you want to improve your sales, focus on improving customer LTV by providing them with more value each time they purchase from you.