Growth never comes easy, especially in the business world. If you want to continually increase your success and profitability then it is essential to understand how to boost your annual contract value (ACV). Whether you’re a seasoned entrepreneur or just starting out on your own, increasing ACV can help ensure sustained growth for the long-term. In this blog post, we will discuss some key strategies and tips on how to effectively maximize ACV – delving into everything from creating upsell opportunities to managing negotiations more efficiently. Read on to learn more about maximizing your annual contract value!

What Is Annual Contract Value?

Annual contract value, abbreviated ACV, is a common metric used to understand the success of customer relationships. It designates the average annualized revenue that companies collect from customer contracts and is a key indicator of customer loyalty.

Additionally, examining ACV helps business owners identify trends in customer spending habits. By getting an understanding of how customers are paying for their service or product over time, companies can adjust their strategies and offerings to meet customer needs and boost loyalty.

ACV provides customers with positive experiences by keeping them engaged with the company, thus making it an important measure of customer satisfaction.

Why Is It Important For Businesses To Track Their Annual Contract Value?

For businesses, it is vitally important to track their annual contract value as it gives them an understanding of how much money they are making in the current financial year. This crucial data informs decisions on matters such as marketing strategies, budgeting and staff training.

From a strategic point of view, tracking annual contract value clears the way for businesses to adjust their operations accordingly, allowing them to capitalize on opportunities at the right times and manage any potential issues before they become too big.

Lastly, tracking this information also helps businesses when forecasting future employee needs and resource and service requirements so that all departments have the necessary support.

How Do You Calculate Annual Contract Value?

Calculating Annual Contract Value (ACV) is an important part of understanding the financial impact of a signed agreement. To determine ACV, first look at the Total Contract Value (TCV), which indicates the full amount of money that will need to be paid over the course of the contract. From there, subtract any one-time fees associated with the contract, then divide that number by the length of time in which you’ll be paying out the TCV – essentially breaking it into smaller chunks.

For example, if you have a three year contract for $7,000 USD with a $1,000 one-time fee included, your annual contract value would be ($7000 – $1000) / 3 = $2,333 USD. Knowing your annual contract value can help you accurately plan and stay on budget when dealing with multiple contracts.

What Factors Affect Annual Contract Value?

When it comes to determining the annual contract value, there are several factors that need to be taken into consideration. The size of the company or organization is a major factor as larger companies tend to have higher annual contracts than smaller ones. This is due to the size of their operations and budget, which can be more difficult for smaller companies to support.

The type of services being offered and the duration of the contract are also major factors that impact annual contract value. Services that require a higher level of expertise or more advanced technology may command a higher price, while longer contracts tend to have larger values. The scope of work, complexity and availability of resources can also affect the amount of money charged for a contract.

The geographic location of the project is also an important factor in determining annual contract value. Companies located in densely populated areas often have higher costs associated with their contracts due to higher labor and overhead costs, while those located in less populated areas may be able to get by on lower amounts. Demand for services as well as local competition may also influence the amount of money charged for a contract.

Finally, the reputation and experience of the contractor can play a role in setting the annual contract value. Contractors with extensive experience and good track records may be able to secure higher prices due to their expertise and quality of work, while newer or less experienced contractors may need to settle for lower prices in order to secure work.

Overall, annual contract value is determined by a variety of factors and should be carefully considered before entering into an agreement. Taking the time to understand what affects annual contract value can help ensure that both parties get the best return on their investment.

What Is A Good Annual Contract Value?

A good annual contract value is one that optimizes long-term profitability by ensuring the best possible terms are negotiated with partners while minimizing any potential risks over the lifetime of the contract. It should also be flexible enough to adapt with any changes in market conditions or customer needs, mitigating risk and maximizing returns on investments.

The most important factor when determining a good annual contract value is making sure the terms are mutually beneficial for both parties involved. An ideal outcome would have each party realizing maximum value from their side of the agreement. In order to achieve this, clear communication and considerable time for research and negotiation are key.

Examples Of Annual Contract Value

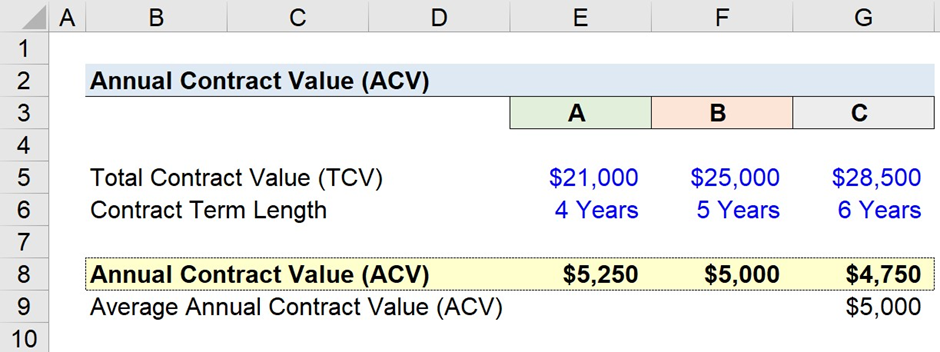

The SaaS startup has three customers – A, B, and C – each with its own contract that provides a Total Contract Value (TCV) and a term length. To calculate the Average Annual Contract Value (ACV) of all these contracts, we need to divide the total TCV by the total contract length. For example,

Customer A has a TCV of $21,000 and a term length of 4 years, so the ACV is calculated as $5,250 ($21,000 / 4 years).

Similarly, Customer B has a TCV of $25,000 and a term length of 5 years, so the ACV is calculated as $5,000 ($25,000 / 5 years).

Finally, Customer C has a TCV of $28,500 and a term length of 6 years, so the ACV is calculated as $4,750 ($28,500 / 6 years).

When we add all three ACV values together, the sum is $15,000. Dividing this sum by three gives us a total average ACV of $5,000.

This is an attractive value to customers since longer contracts offer more benefits at a lower cost. The total ACV is a great way for SaaS startups to understand the value of their customer relationships and ensure that they are providing clients with the best possible experience over time.

Strategies To Increase Annual Contract Value

Offer a discount if the customer agrees to commit to a longer-term contract:

A great way to increase annual contract value is to offer customers a discount on their services if they agree to sign up for a longer-term commitment. By offering this incentive, businesses can increase the amount of money they bring in each year while also locking in a customer for a longer period of time.

Develop packaging options:

Another effective way to increase annual contract value is to offer customers various package options. By creating different tiers or packages, businesses can showcase the different benefits and features that come with each option, allowing customers to choose the package that best suits their needs and budget.

Offer incentives for renewing contracts:

Businesses can also incentivize customers to renew their contracts by offering them discounts, additional services, or other perks if they agree to sign up for another year. This strategy helps increase the annual contract value by ensuring that customers stay with the business, while also rewarding them for their loyalty.

Leverage upselling techniques:

Upselling is a great way to increase annual contract value by offering customers additional services that are related to the services they’ve already purchased. Businesses can increase their revenue by convincing customers to purchase these add-ons, which will boost the total value of their annual contract.

Subscription-based pricing models:

Subscription-based pricing is a great way to increase annual contract value because it allows customers to purchase services on an ongoing basis and pay for them in installments. This approach provides businesses with consistent revenue that can help them plan for the future.

By utilizing these strategies, businesses can increase their annual contract value and ensure they are stay profitable. By providing customers with various options and incentives, businesses can create a win-win situation that is beneficial for both parties. ˙

Conclusion

If you want to increase your annual contract value, the best place to start is by segmenting your market and understanding what each type of customer values. From there, you can price your products or services in a way that meets the needs of each segment while still allowing you to make a profit. By following these steps, you’ll be on your way to increasing your annual contract value and growing your business.