Are you a business owner looking for ways to increase the number of accounts receivable? Managing your invoices correctly can be a major factor in increasing profits. This blog post is here to provide helpful tips and advice on how you can improve your accounts receivable and maximize revenue. With these tried-and-tested strategies, managing your invoice process will become easier! Read on and see what methods are available to help establish successful cash flow management today.

What Is Accounts Receivable?

Accounts receivable is a critical aspect of any business. It refers to payments due from customers who have purchased a product or service on credit. In essence, accounts receivable represent an asset in the form of money owed by customers.

Effective accounts receivable management can not only help ensure that your company gets paid for the services and products you provide, but also boost cash flow and reduce the risk of bad debt. Any reliable business needs to establish terms and conditions with their customers that outline payment methods, schedules, applicable fees, etc., in order to ensure proper contracts are maintained and invoices are paid when due.

Keeping up strong accounts receivable management practices will be paramount for businesses looking to maintain financial stability whilst growing their customer base.

Why Is It Important For Businesses To Track Their Accounts Receivable?

Tracking accounts receivable is an essential accounting activity for businesses since it provides essential information about the customers who owe money. It helps ensure businesses receive payment for goods and services on time, giving them valuable cash flow to use for important investments and expenses such as payroll and inventory.

Tracking accounts receivable also allows business owners to take proactive steps to resolve any delinquencies that arise, protecting their profitability and creditworthiness. Along with improving cash flow, tracking accounts receivable makes sure businesses are able to calculate payables accurately and reduce losses due to invoice errors or incorrect billing.

By monitoring their receivables with diligence, businesses can prevent problems while keeping customers satisfied at the same time.

How Do You Calculate Accounts Receivable?

The easiest way to calculate accounts receivable is to add up all the outstanding customer invoices due. This means any unpaid customer invoice should be added together in its entirety, from the first invoice to the last. Ultimately, the sum of all pending customer invoices gives you a concrete number for exactly how much money is owed to your business – that’s what we call accounts receivable. Ensuring proper calculation of accounts receivable will not only give you peace of mind but also allow for more accurate forecasting for your business.

Here’s the formula:

outstanding customer invoice 1 + outstanding customer invoice 2 + … + outstanding customer invoice n = ($)Accounts Receivable

How to Forecast Accounts Receivable?

The day’s sales outstanding (“DSO”) measures the number of days on average it takes for a company to collect cash due from customers that paid on credit. The DSO metric is used in the majority of businesses to project A/R.

The formula for DSO is calculated as follows.

Historical DSO = Accounts Receivable ÷ Revenue x 365 Days

The projected accounts receivable balance is equal to:

Projected Accounts Receivable = (DSO Assumptions Assumption ÷ 365) x Revenue

If the DSO has been increasing over time, that implies your collection efforts require improvement, as more A/R means more of your cash is tied up in operations.

But if DSO declines, that implies your collection efforts are improving, which has a positive impact on your cash flows.

What Factors Affect Accounts Receivable?

Accounts receivable is a critical component of managing cash flow and liquidity for businesses. There are several factors which can affect accounts receivable, including:

Customer Creditworthiness

Customers with good credit histories are more likely to pay their invoices on time, whereas customers with poor credit or those who have previously defaulted on payments may take longer to settle their accounts. A business should always review a customer’s credit history before offering them terms to ensure that any potential receivables can be collected in a timely manner.

Payment Terms

It is important to offer customers terms which are realistic and in line with their payment history. For example, offering more flexible terms such as longer payment windows may increase the likelihood of customers settling their invoices on time. On the other hand, if a business has stricter payment terms then this could discourage customers from paying their invoices and increase the risk of late payments.

Customer Relationships

Having a good relationship with customers is important in managing accounts receivable. If customers are happy with the products or services they have received then they are more likely to pay their invoices promptly, rather than if there has been an issue or dispute. It is therefore important to maintain good customer relationships in order to ensure that customers settle their accounts on time.

Invoice Presentation

The way an invoice is presented can also have an effect on payment times. An invoice should be clear and concise, providing all the information necessary for a customer to make payment. A poorly presented invoice may take longer to be settled, whereas a professional and organized invoice can encourage customers to settle their accounts in a timely manner.

Economic Conditions

Uncertain economic conditions such as recessions or periods of increased inflation can also have an effect on the ability of customers to pay invoices. If customers are struggling financially then they may take longer to pay their accounts, thereby potentially increasing the number of overdue receivables. A business should therefore be aware of any economic changes which could affect their customers’ ability to pay.

A well-managed accounts receivable system is essential in ensuring that customers are invoiced promptly and payments are collected on time. By considering the various factors which can affect accounts receivable, a business can ensure that its customers are able to pay invoices in a timely manner. This will help to maintain a healthy cash flow and maximize the returns on sales.

Mistakes To Avoid When Managing Accounts Receivable

As the person responsible for accounts receivable, it’s essential to avoid making any mistakes that could cost the company money. Here are a few of the most common mistakes to avoid:

Not staying on top of invoices

It’s important to send out invoices immediately after a sale is made. This will help ensure that you get paid promptly. Additionally, follow up with customers who haven’t paid their invoices yet. A polite reminder can often be enough to prompt them to take action.

Not tracking payments

It’s essential to keep track of all payments made by each customer. This will help you identify any late or missing payments and take appropriate action accordingly. Additionally, tracking payments can help you decide when to offer discounts or other incentives for early payment.

Not using automation

Many software solutions can automate various accounts receivable tasks, such as sending out invoices and reminders, processing payments, and creating reports. Using automation can help save time and improve efficiency.

Not offering payment options

Many customers appreciate having choices when it comes to making a payment. Offer various payment methods like a credit card, PayPal, or bank transfer. This will make it more likely that customers will pay their invoices.

Not staying organized

A well-organized accounts receivable system is essential for keeping track of all the information related to customer payments. Make sure to create a system that works for you and your team, and stick to it religiously. Doing so will save you time and headaches in the long run.

What Is A Good Accounts Receivable?

A strong accounts receivable is essential for any business wanting to maximize its success. Good accounts receivable accounting ensures accurate tracking of all funds that have been earned but not yet paid. It also reiterates the importance of timely collections and can be used to forecast future cash inflow with precision and accuracy.

To achieve good accounts receivable, good record-keeping, as well as organized and efficient billing procedures, are essential. Integrating such procedures into your existing financial processes will ensure that all invoices that need to be paid are paid, which can ultimately secure better credit ratings and increased stability for your business.

Example Of Accounts Receivable

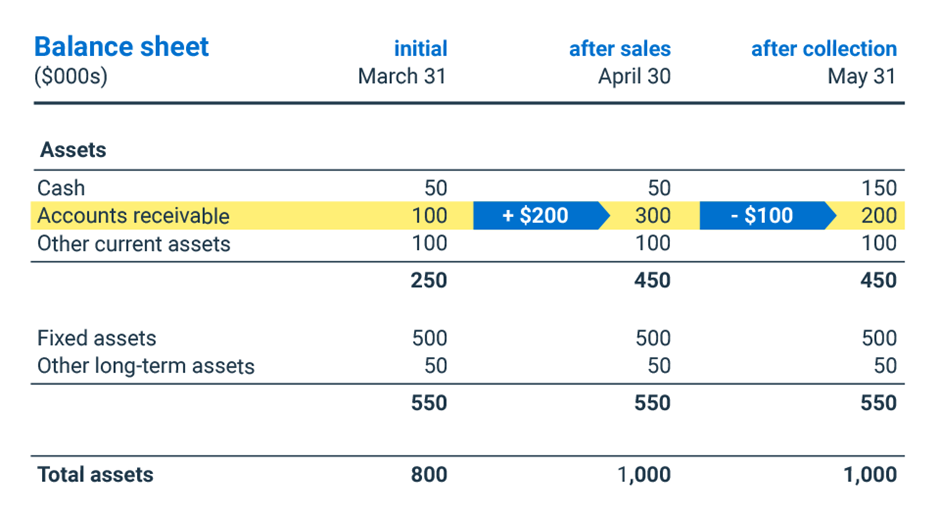

Let’s assume your company has an initial balance sheet, as mentioned below, where the accounts receivable total is $100,000 on March 31st. We will illustrate just the assets components present on the balance sheet.

In April, you record sales on the credit of $200,000. It’s the only transaction of the month. You can then record an increase in accounts receivable from about $100,000 to $300,000. In the chart below, the balance sheet after sales reflects the influence of sales on accounts receivable.

In May, your company collected accounts receivable of about $100,000. For simplicity, it’s the only transaction of the month. You can then record a decrease in accounts receivable from $300,000 to $200,000. The balance sheet after collection shows the influence of the collection on accounts receivable.

Strategy To Improve Your Accounts Receivable

Automate Payments:

Streamline your collection process by automating payments using online payment processing systems or digital invoicing software. This allows customers to make secure, on-time payments with minimal effort from both you and them.

Offer Incentives for Early Payment:

Consider offering incentives such as discounts for early payments or payments made via digital payment platforms. This encourages customers to make timely payments and can help you improve your cash flow.

Negotiate Payment Terms:

Communicate with customers to negotiate flexible payment terms that work for both you and them. Establishing clear expectations upfront will help avoid misunderstandings and late payments down the line.

Establish Penalties for Late Payments:

Establish clear penalties and fees for late payments as an additional way to encourage timely payment. This can help you ensure that customers are making payments when they’re due.

Monitor Your Accounts Receivable:

Staying on top of your accounts receivable is key to managing your cash flow. Regularly review invoices and customer accounts to ensure that payments are being made on time and any discrepancies are addressed quickly.

Follow Up With Customers:

Don’t be afraid to reach out to customers if a payment is late or overdue. Following up with customers in a timely manner will help you to ensure that payments are made when due.

Use Collection Agencies:

If necessary, consider using the services of a collection agency to help you recover overdue payments. Keep in mind, however, that this should be used as a last resort since it can have a negative effect on customer relationships.

Develop Credit Standards:

Establish credit standards for your customers to ensure that they have the ability to pay off their invoices. This will help you avoid taking on too much risk and reduce the likelihood of late payments or bad debts.

Following these strategies can help you improve your accounts receivable process, streamline payments, and reduce late payments.