Are you a business owner feeling overwhelmed by the accounts receivable turnover process? With various customers and paperwork to handle, it can be challenging to keep track of who owes what. Don’t worry—we’ve got you covered! In this blog post, we’ll walk through how to streamline the accounts receivable turnover process so that businesses can better maintain their cash flow. Whether it’s organizing customer records or setting up payment reminders, following these tips will help ensure your business runs more efficiently with fewer problems. Read on to learn more about why and how proper management of accounts receivable is an essential element for success.

What is Accounts Receivable Turnover?

Accounts Receivable Turnover is an important accounting metric which measures how quickly businesses are collecting money owed to them. It measures the ability for a company to collect on its receivables within a given period of time. In addition to being an important management tool for businesses, finance professionals look for an ideal accounts receivable turnover ratio as an indicator of a company’s creditworthiness and cash flow stability.

Since it takes into account all accounts from customers who owe money, accounts receivable turnover also serves as an effective means to measure which well-paying customers are supporting the business and what methods can be employed to improve collections from any delinquent customers.

Why Is It Important For Businesses To Track Their Accounts Receivable Turnover?

Tracking your accounts receivable turnover is a must for any business that wants to remain profitable and keep its financials in order. It is an effective indicator of how quickly customers are paying the company for their services; this provides businesses with valuable insight on areas for improvement and enhances the overall financial well-being of the organization.

By tracking their accounts receivable turnover, businesses can detect whether they are issuing too much credit to customers or if certain processes need to be revised in order to improve payment timing.

On top of this, understanding your accounts receivable turnover also gives you an idea of how efficient your collections activities have been and can help identify problems before they become out of control – allowing you to plan ahead.

By regularly monitoring their accounts receivable turnover, businesses can take proactive measures which will create positive financial outcomes in the long run.

How Do You Calculate Accounts Receivable Turnover?

If you need to calculate the Accounts Receivable Turnover, it’s a fairly straightforward process. First, determine your net annual credit sales. This means taking into account how much money comes in from customers financing their purchases on credit. Next, calculate the average of your Accounts Receivables by looking at your balance sheet.

Then divide your total net annual credit sales with the average of your Accounts Receivables, and voila! You have your Accounts Receivable Turnover! For example, if your business has $10,000 in net credit sales over a three-month period and had an average amount of accounts receivables over that same three-month period of $1,000 then your Accounts Receivable turnover would be 10X.

Keeping track of this metric on an ongoing basis and making sure that it is as accurate as possible is incredibly important as it relates to understanding what progress you have made relative to managing customer credit sales efficiently.

What Factors Affect Accounts Receivable Turnover?

The accounts receivable turnover ratio is affected by several factors. These include:

Customer payment terms:

Customer payment terms refer to the length of time a customer has to pay for goods or services purchased on credit. Shorter payment terms generally lead to a lower accounts receivable turnover ratio as customers are expected to pay more quickly. On the other hand, longer payment terms can lead to a higher accounts receivable turnover ratio because customers take longer to pay invoices.

Customer concentration:

It is another factor that affects the accounts receivable turnover ratio. If a company has only a few large customers, its accounts receivable could be adversely affected if one or more of these customers were to default on their payments. This could lead to a lower accounts receivable turnover ratio.

Sales volume:

The sales volume of a company can also affect the accounts receivable turnover ratio. A higher sales volume generally leads to an increase in the number of invoices generated and thus, to an increase in the accounts receivable turnover ratio. On the other hand, a lower sales volume can lead to a decrease in the number of invoices generated and thus, to a decrease in the accounts receivable turnover ratio.

Collection Policy:

The collection policy followed by a company affects its accounts receivable turnover ratio. Companies with relaxed collection policies tend to have a lower accounts receivable turnover ratio than companies that are more aggressive in their collection efforts. Companies should establish stringent policies and procedures for collecting payments from customers to ensure timely payment of their invoices and increase the accounts receivable turnover ratio.

Credit Risk Management:

As with any business activity, proper credit risk management is essential to maintain a healthy turnover ratio. Companies need to identify customers who are likely to default in their payments and take action accordingly. This includes conducting credit checks on potential clients before extending them credit, setting appropriate credit limits for each customer, and regularly monitoring customer payment histories. By doing this, companies can reduce the risk of bad debts and maintain healthy accounts receivable turnover ratio.

These are some of the factors that play a role in affecting the accounts receivable turnover ratio. Companies should pay attention to these factors and take necessary steps to ensure that their receivables remain in good shape. This will help them maintain healthy financials and increase profitability in the long run.

What Is A Good Accounts Receivable Turnover?

It’s important for companies to monitor their accounts receivable turnover ratio – the rate at which a company collects its average accounts receivable during a set period of time.

Generally, a higher turnover ratio is preferable and companies should shoot for an absolute minimum goal of 1.0 so they can be assured that they are collecting the full amount owed to them at least once in a given period.

Nonetheless, it’s crucial to remain vigilant and keep track of this ratio as it can strongly impact a company’s ability to get paid efficiently.

Example Of Accounts Receivable Turnover

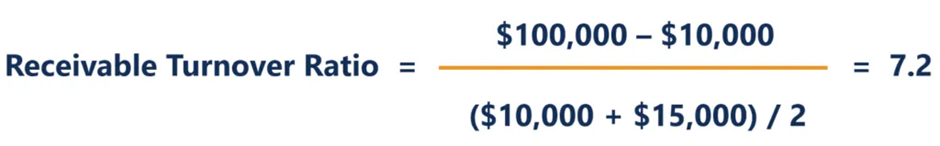

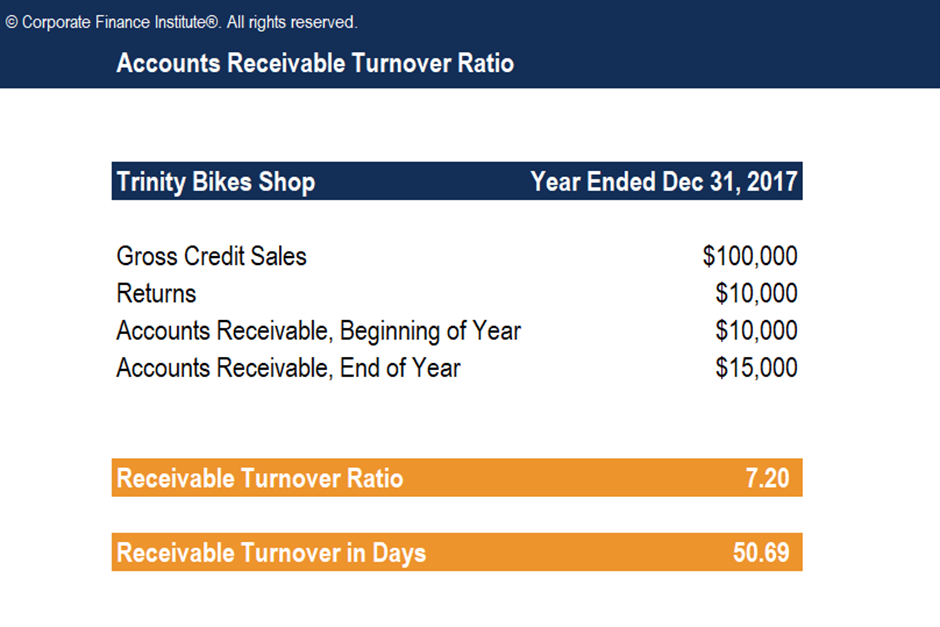

Trinity Bikes Shop is a retail store that specializes in biking equipment and bikes. To help increase their sales, John, the CEO of the company, decided to extend credit sales to all customers. In the fiscal year ended December 31, 2017, gross credit sales totaled $100,000 and returns totaled $10,000. The beginning and ending accounts receivable for the year were $10,000 and $15,000, respectively. John wanted to find out how many times his company collected its average accounts receivable within the same period.

Calculating the Accounts Receivable Turnover Ratio for Trinity Bikes Shop resulted in 7.2 times over the fiscal year ended December 31, 2017. Additionally, the accounts receivable turnover in days was 50.69 days, which indicates how long it takes customers to pay their debts to the store. This figure also reveals whether or not customers are making late payments based on any payment policies that have been established by Trinity Bikes Shop.

By understanding the accounts receivable turnover ratio, John can better assess how successful Trinity Bikes Shop is in collecting payments from its customers and making any necessary changes to its policies. This will help improve cash flow and increase the profitability of the business.

Strategies To Streamline Your Accounts Receivable Turnover Process

Automate your invoicing process

Implement an automated invoicing system that will help you issue timely and accurate invoices to customers. This will help ensure that payments are made in a timely manner, leading to quicker turnover times and higher efficiency for your accounts receivable process.

Monitor aging accounts receivables

Set up regular reports to monitor customer payment status and any overdue accounts. This will help you stay on top of the situation and follow up with customers quickly when payments are delayed.

Negotiate payment terms

Discuss alternative payment options with customers that may be more manageable for them while still providing your company with an acceptable timeline for payment. This might include offering credit terms, early payment discounts or other options that could help you keep your accounts receivable process moving along without hindering customer relationships.

Stay on top of collections

Make sure to stay in touch with customers who are behind on their payments and use this as an opportunity to re-establish a positive relationship while also negotiating a payment plan that works for both parties.

Re-evaluate your process

Regularly review and evaluate your accounts receivable turnover process to identify areas where you could improve performance. This might include making changes to customer credit limits, payment terms, or other operational processes that could help streamline the entire process.

Taking advantage of these strategies can help you create a more efficient and effective accounts receivable process. With the right tools and processes in place, you will be able to maximize your turnover rate and boost profitability for your business.

Conclusion

If you want to learn more about how to streamline your accounts receivable turnover process, reach out to us. We’d be happy to help you get started on increasing your cash flow and ensuring that your customers are satisfied with your invoicing system