Tl;dr: You are the real reason founders are not funded in a pitch process. Investors invest in the team. That’s the main reason fouders are turned down.

“It’s not me, it’s you”

– No ex-girlfriend ever

You have heard quotes from VCs (Venture capital) effuse the importance of the team, you know so many companies fail and so many startups don’t get funded. Given the team is so  important, it clearly hasn’t dawned on many to put the two together and realise that the reason startups aren’t funded is you, it is your team. Only, you will never hear that answer.

important, it clearly hasn’t dawned on many to put the two together and realise that the reason startups aren’t funded is you, it is your team. Only, you will never hear that answer.

“I am fond of quoting that about 70% of my investment decision of an early-stage company is the team. My rationale is simple: everything goes wrong and only great teams can respond to competitors, markets, funding environments, staff departures, PR disasters and the like.”

– Mark Suster, Upfront Ventures

This is without a doubt the dirtiest of laundry, the skeleton in the closet no investor wants to, or will ever face up to in public. I say in public because in private, investors talk about it. And I mean a lot. Remember all investors invest in teams, right?

The Venture Capitalist’s job is to say no to you in a pitch process

Dealflow as a badge of honor

VCs brag about how much deal flow they get, they might do this in the hope prospective LPs (Their investors) will think they have great proprietary access, that other investors will think they are popular, or simply they hear everyone else gets so much and think they should say they do too.

That number is typically 1,000 deals a year. Frankly, I think this is BS. I recently read a Series-A focused VC write recently that they look at 1,000 deals a year; there haven’t been a 1,000 Series-A deal in the whole of Asia. But I digress. It’s a lot anyway.

VCs never quite deal with the nature of the job, not being a ‘Yes-man!’

The reality is, regardless of how much deal flow a VC gets, it is a VCs job to say no to almost all of it. It is to say no so many times that they get surprised when they say yes! Clearly, that’s why founders celebrate when they get funded right?

Only when you say no you have to give a reason, right? And therein lies the rub, how do you say no? Are you descriptive, or are you not? What happens if you are, god forbid, honest? What’s the upside and downside? In the same way, doctors don’t like saying the ‘patient is DOA’, VCs don’t like saying no, only they have to do it 10-40x a day.

Getting to ‘no’ isn’t a perfect process in a pitch process

In defense, with all this ‘dealflow,’ it’s hard for a VC to make a perfect call in a 45-minute meeting about the capability of a founder. They have to ‘Blink’ as Malcolm Gladwell puts it. Regardless of how refined their pattern recognition gets, how high their EQ is, no one is so perfect they can make a perfect call. VCs do misjudge people and do so all the time.

The reality is that VCs like to make money, but they hate to lose money. It is simply easier to say no when things don’t feel right.

The bar for great founders to raise VC is higher than anything you have experienced

Founders and the team they build, make or break a startup. Nothing else really matters. Obviously swimming downstream with a big market, the right timing and solving an awesome problem, customers pay for helps push you forward, but a less talented team will still drown a great opportunity like kittens in a bag. Only, what startup thinks they are one of the 99% of unfundable startups?

VCs are liars and delusional too

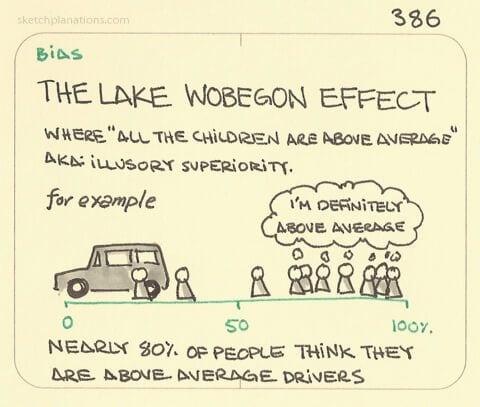

The same thing applies to VCs actually. If a fund isn’t top quartile, they are unlikely to raise their next fund, only have you ever heard a VC say they aren’t a top quartile fund. Ha, never! Do you think they will continue to believe they are above average, of course?

This is the illusory superiority effect. For instance, in a 1977 study, 94 percent of professors rated themselves above average relative to their peers. In another study, 32 percent of the employees of a software company said they performed better than 19 out of 20 of their colleagues. And research has found that people overestimate how charitable they’ll be in future donation drives, but accurately guess their peers’ donations.

Let’s put quite how high the bar for raising fund is, compared to other hard things.

Top MBA programmes

Acceptance rates into top MBA programmes in the USA, such as Harvard and Wharton are low. Graduates and entrants take great pride in that they got into and graduated from these prestigious institutions. Acceptance rates for Harvard are 11.8% and Wharton are 18.7%.

Top accelerator programmes

Acceptance rates into top accelerators are far lower than MBA programmes. The model works by processing as many companies as possible in each batch, so they actively want companies in their programme. The acceptance rates in these programmes are pretty low. For Tech Stars it is between 1 and 2% and Y-Combinator is around 2%.

VC funding

At Harvard, you are paying THEM a few hundred K and they turn away applicants all the time. To get into Harvard for an MBA you need a pretty stellar background, top grades in undergrad, work experience at Lazard or McKinsey. Don’t even get started with the GMAT…

Accelerators put far less capital into a founder than a typical VC does, and they invest in a lot of startups.

So what do you think the ‘acceptance rate’ for a VC should be? Where do you think the bar should be set for a VC to commit a million dollars? I would think pretty high, only my guess is that most founders, be it in their nature or not, would rather take a bet on getting funded than getting into Harvard.

I have friends that have tried raising money in Asia and failed, then applied to Y-Combinator (And got in). I have friends who have tried setting up VC backed startups and then going to Harvard as a backup. This clearly doesn’t make sense and is probably the reason VCs get more pitches than Harvard gets applications.

Founder as a VC game

“Do you want to play a game?”

Let’s play a game. You earn $1m in savings over the next 20 years of your life, scraping by, saving every penny. Now a kid in sneakers rocks up and asks for you to give him all your savings for an ‘idea’ he has. How do you respond and what would it take for you to part with that money?

Well, that is a binary, single-play game with no alternative options, so let’s assume two people pitch you at polar ends of a bell curve in terms of capability with a plausible pitch, ceteris paribus.

Person A

Awesome. Track record of excellence and over-achievement. Best Uni, best internships, top investment bank being promoted a year early. Started a company and sold it to Google. Got in touch with you by some high-profile friends you have.

Person B

Sucky. Scrapped through a third-rate Uni with no work experience and now has an ‘idea;’ his first one. Ever.

And the lucky winner in the pitch process is?

Which one do you want to give your $1m to? The answer is implicitly rhetorical to any logical person that doesn’t hug trees.

Now, I invite you to my office and have Person A and B wait in the reception room. I call in each person individually in succession and you have to tell one person you are going to help them achieve their dreams and the other that you are going to shatter theirs.

What are you going to tell person A and person B?

My bet it will go a little something like this:

Person A

You are awesome and I love your idea, I want to work with you. Let’s do it!

Person B

I discussed it and I don’t feel it is right for me right now. I don’t feel the market is big enough, the timing isn’t quite right. It just isn’t an area I feel comfortable with. I wish you the best though. LJBF.

This is exactly the reason no investor will ever tell you no for the real reason. It sucks, to be honest. It sucks to say no.

Why logical VCs give a nice reason for no or no reason for no at all in a pitch process

Let’s assume you have $2m now and can make two investments at any point in time you like; would you give $1m to Person B as well? Probably not, right? But if you are an avid reader and understand game theory and option pricing theory, you know the value of options and waiting for more information.

At this point in time, with the information you have, with your read of the team, you don’t want to give the cash to Person B. What happens if you read Person B wrong in your short meeting and in 6 months time they start growing like Slack, knocking it out of the park!

Crap, you said no and told the founder you thought they weren’t capable as a person- you can’t go back and try to get back in the deal, that would just be way too awkward. But wait, you didn’t tell the founder you think he doesn’t cut muster, you spin him some BS answer that allows you to come back to him in 6 months and get into the deal! Boom!

Investors will never tell a founder they aren’t AAA as it is illogical in terms of game theory and optionality. They say no now but create an option to invest in the future again when the time has moved on and there is more information. The investor has the option to ‘call’ and buy into the founder again, albeit at a different valuation. Cool beans.

A different approach to saying no, being honest (selectively)

I would never tell a founder they aren’t great, at least intentionally; though some may take it thusly. I will give harsh feedback about things they can improve personally such as reading up on certain things, or that how they are approaching things is completely wrong and if they did x they might have more success.

There is no point in telling a horse they are a zebra as they can’t remove their stripes (e.g. That they aren’t intelligent), but you can teach a horse how to drink from the water (e.g. learn how to write a pitch deck).

I will provide real and actionable feedback, assuming the founder appeared to be receptive to listening and learning. Why? Because if the founder takes it on board:

- They are the kind of person I would like to work with. It’s a pre-selection process as I believe the best founders take every insight as an option to improve their business (Note: be a filter, not a sponge)

- I might invest in them if they fix it and improve (i.e. become investable)

- The founder, assuming my feedback makes sense (I think it does, but I am frequently wrong) has the potential to not waste their time and be more successful which is important to me since I know how hard startup is

- Almost no other investor ‘keeps it real’ and I believe founders recognize that fact

To illustrate this point, I received an email from a founder that got back in touch with me after a first meeting a few months later that started with this:

“Hey Alexander,

I created this for the investors who I’m in talks with currently. I thought I should reach out to you. Since you guys gave me a genuine reason for a “No” in the past and not some random bullshit.

Below is a quick update on our current status.”

Whether I like the founder’s startup is irrelevant, I simply love this founder because he simply ‘got it.’ It also reiterates the point of this post, that the vast majority of VCs do not give real feedback to founders in a pitch process.

I typically read all the content on the internet on the blogs I am writing to ensure what I put out is actually value add. I found a comment on the whole 1 related articles on this topic I could find, from 6 years ago that supports my position in a blog by Jeff Bussgang:

“If it’s the team I think you should say so.

My last startup failed to make waves. It was the team. I think some of the investors that turned us down (before we got a small VC investment) did so because of the team.

Only later did I learn via a third party that was one of the reasons at least one investor passed.

But no-one told us that. We learned the hard way, after blowing through a lot of money and wasting a lot of time and energy.

Please, please tell entrepreneurs if it’s the team – “guys, this is a pass from us, we just don’t think the team is right”. You can go into detail – experience, team dynamic, whatever.

But sometimes it takes outside voice(s) to point out what you’d think would be obvious to a dysfunctional founding team 🙂

And early stage team is still something that can be addressed – there’s always one founder (possibly two) that will take that and fix it, even if it means another founder gets a bruised ego.”

The reality founders should face which will make them rich (possibly)

Most ‘founders’ should instead be employees, early ones. An uninvestible founder per se could be an amazing employee.

The first 100 employees of Facebook will make more money than the CEOs of 99% of most startups. Secretaries of some firms that go public make more than a million dollars, which is more than most startup founders can claim to making.

When I was a junior banker, one of our clients was fond of saying this:

“I have made the most millionaires in the City of London.”

He was clearly talking about employees.

What Asia needs is not more average startups, but more exceptional ones that really can make us proud. That means the average quality needs to be higher.

Conclusion on why founders are not funded

You wouldn’t give person B $1m of your hard earned cash and you wouldn’t tell them they aren’t AAA. So why would you think an investor wouldin a pitch process?

There is no upside in VCs being overly honest about a founder or startups’ shortcomings unless that is their brand, they comprehend the logic (my logic) and actually care about founders.

But more than anything, no VC will ever say ‘it’s you,’ but really it is you. As we started this blog “70% of the investment decisions is the team,” which implies 70% of the time a VC says no is because of the team, AKA you.

Investing in a startup and founders is fundamentally a matter of conviction and seeing something no other investor sees. I think this story is telling:

A founder pitches 30 VCs and 29 pass. One says yes. The founder thinks that one VC is brilliant, the other 29 VCs think he is an idiot.

That’s an interesting thing to lament upon. That one VC is an idiot in social circles until the founder proves them all wrong on behalf of that lone wolf. Though the funny thing is, a successful VC has to be both right and non-consensus, so what their peers think shouldn’t matter.

Respectfully speaking, if you as a founder are not cut out for the job, the only thing you can do about it joins another startup, and really if you pick the right business, you might do very well out of it. In Silicon Valley, developers make their millions by jumping on the right ship at the right time and rising with the sea. At least that’s what some guys I met at a bar in Palo Alto told me.

VCs want and have to do great deals. If they think you are the ‘prom queen’ they will chase you down. So if you haven’t heard back from an investor, don’t take it personally, chances are it’s only you are the reason founders are not funded. That’s how the pitch process works.

Comments 6

haha … good one Mr Jarvis … 🙂

Amen brother. VCs are liars. https://acrowdedspace.com/post/28387488539/vcs-are-liars-and-so-am-i. I’ve become a little better at this issue, but it’s still very difficult to give accurate, useful, constructive feedback..

Hi Alex,

How have you been?

Time and again, there is a thought that comes to my mind; why is it that most entrepreneurs direct all their focus and energy on funding? Why focusing on building something valuable and remarkable is an underappreciated approach? When the ultimate milestone should be to transform a(founder himself) to a team into a scalable business model.

It is the strong belief of the Entreprenuer[s] backed by the innovative idea inception and implementation that results in a positive outcome which is valuable for all. Yet, when I look around, I am not really able to locate such Entrepreneurs.

What do you think? How is the ecosystem around you?

Looking forward to hearing from you.

Thanks,

Satya

Author

However it has happened, the startup world has turned into something cool to do. VC is something that is an entitlement to pay salary while people have a bit of fun and dabble in the game.

I know it is not perfect, but frankly, people should bootstrap and if they get fit and grow crazy, then you should get funded. It’s also easy to get funded then.

So TOTALLY !

If it is a Super Idea, one should be able to Bootstrap it and make money doing that by getting better funding terms.

Bootstrapping is what Entrepreneuship is all about and it is much easier Today than in the 90’s.

Author

Karl – bootstrap founders are the future