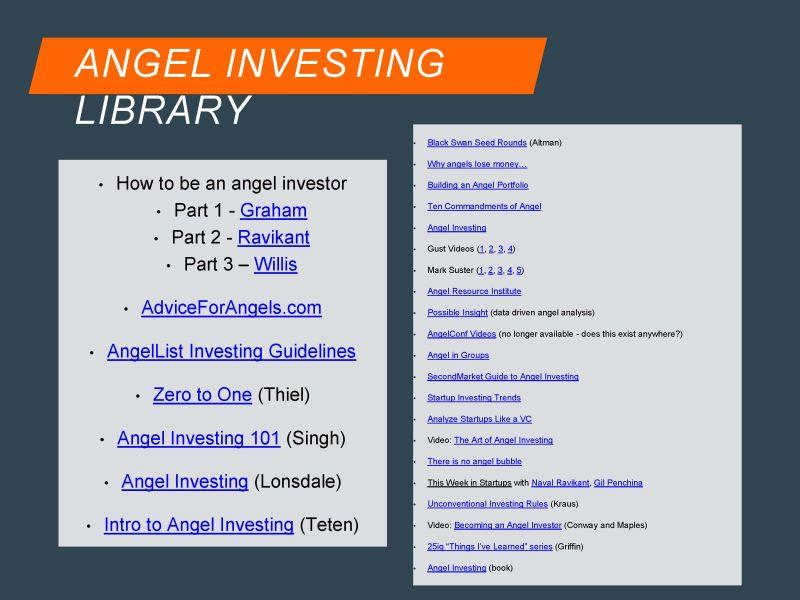

Many years ago, when I started figuring out my head from my foot in startup land, like many people in the late 2000s I read venturehacks, an angel investor and startup blog (when AngelList was not much more than a mailing list). There was some great knowledge (still applicable) and today, I revisited the site and came across an angel investor presentation might gain some basic 101 knowledge from.

It’s only 30 slides and it is 101 knowledge to be clear, but if you have not invested in a startup yet, there are some of the key points any new angel needs to be cognizant of.

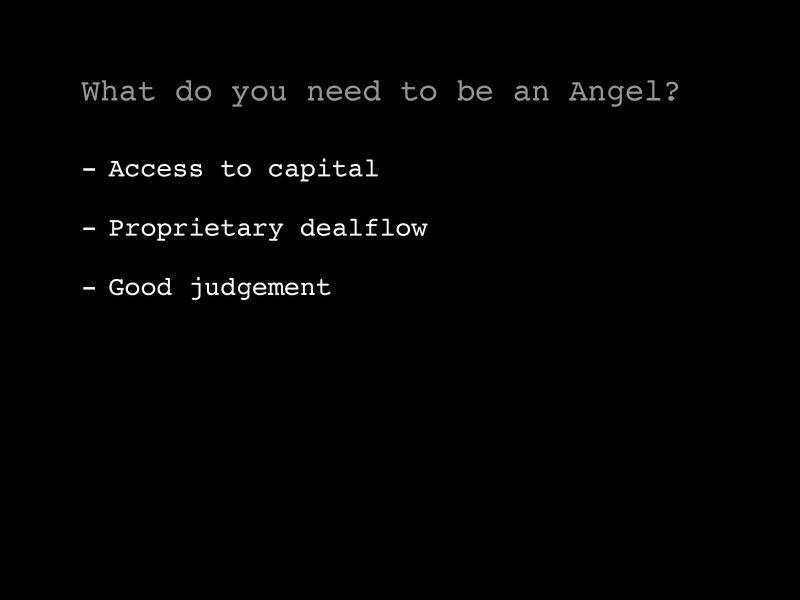

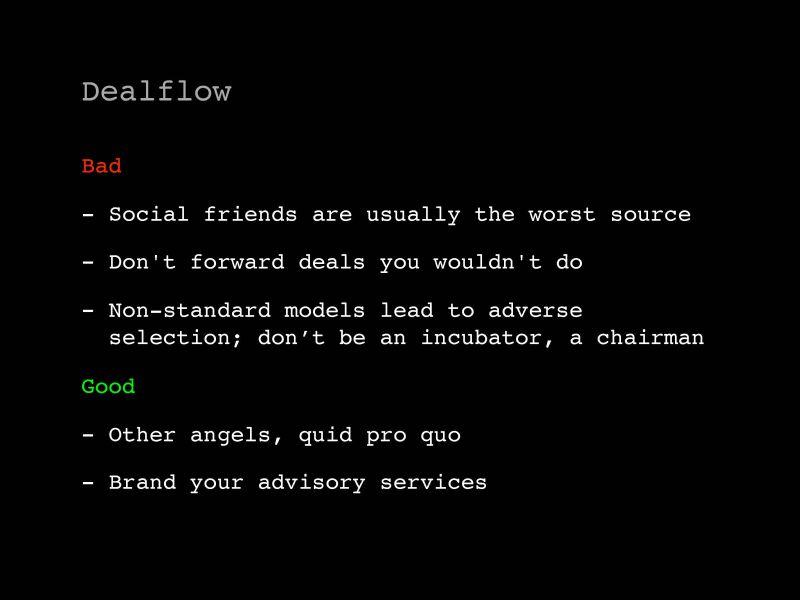

The key learning points

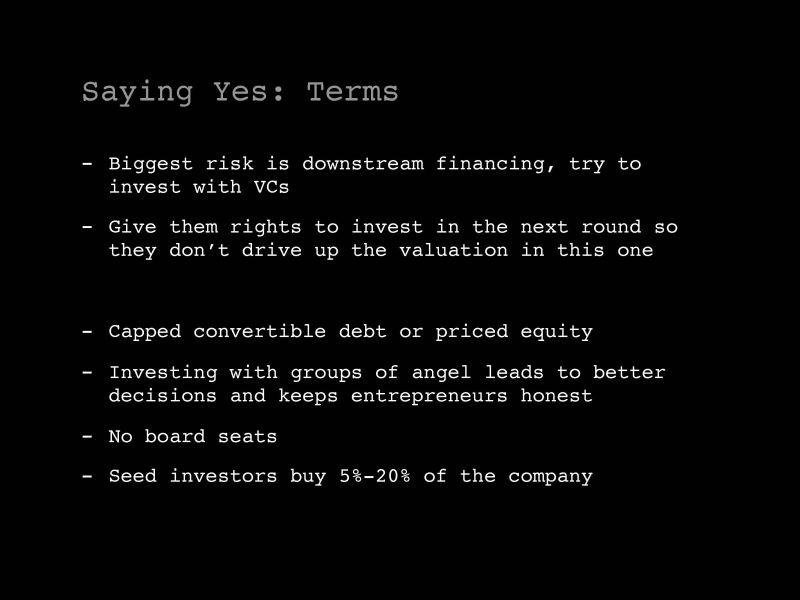

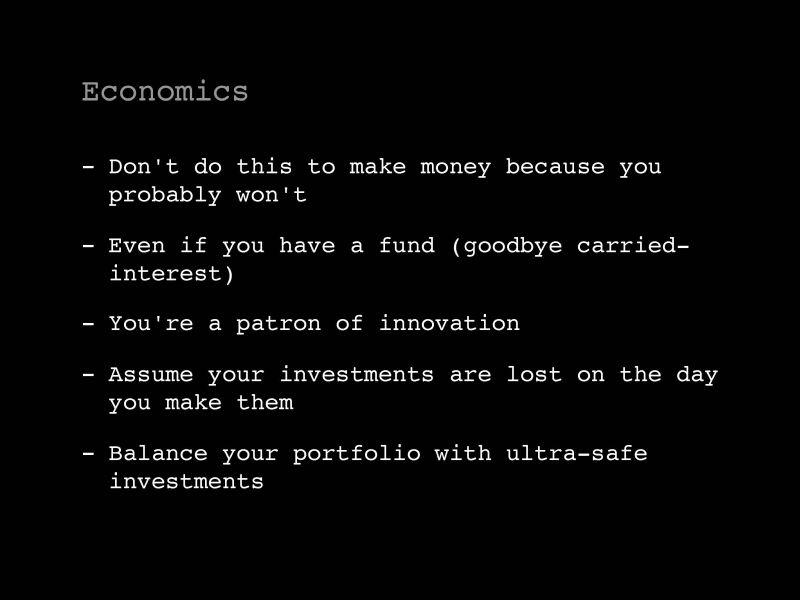

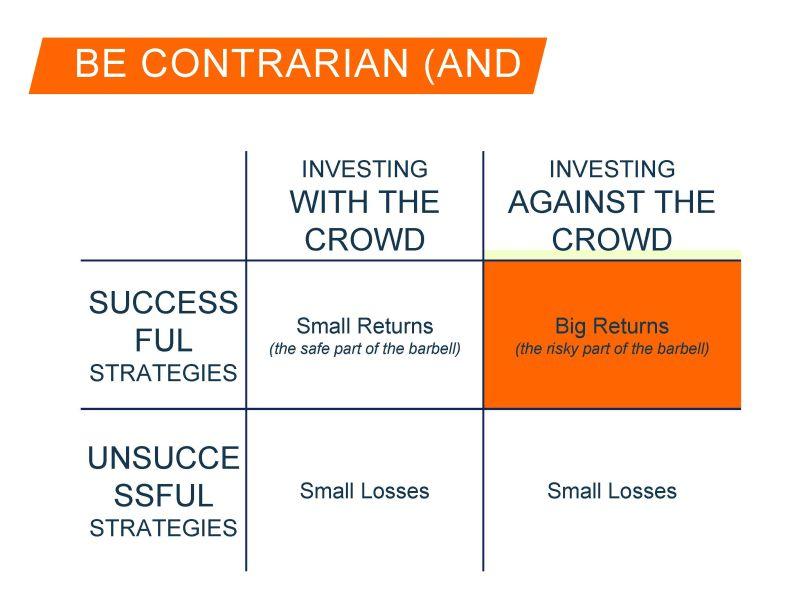

- Barbell Strategy: Don’t commit more than you can afford to lose (View angel as charity).

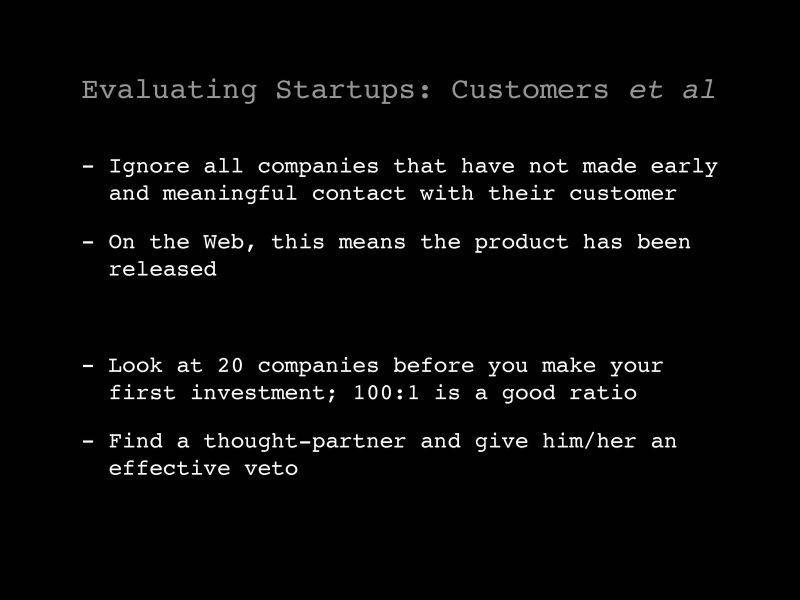

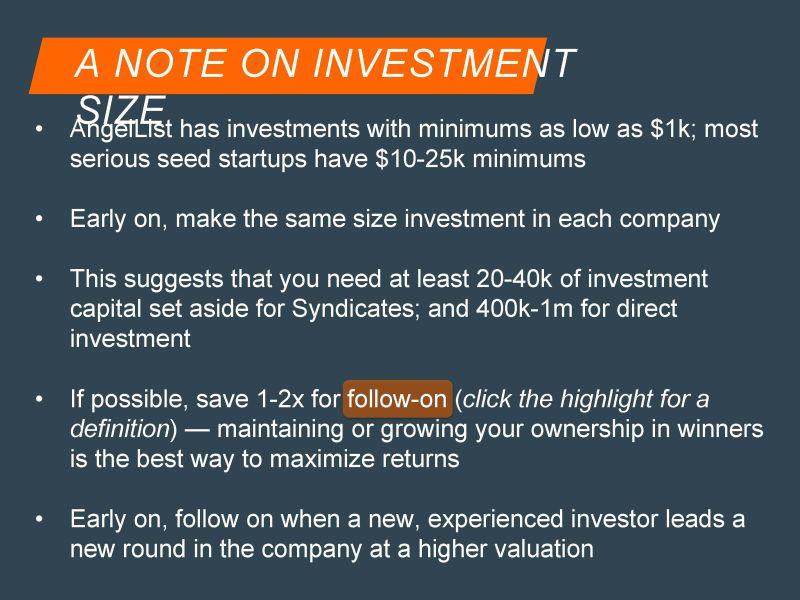

- Large Portfolio Commit: to doing many investments (Statistically you need 20 to break even).

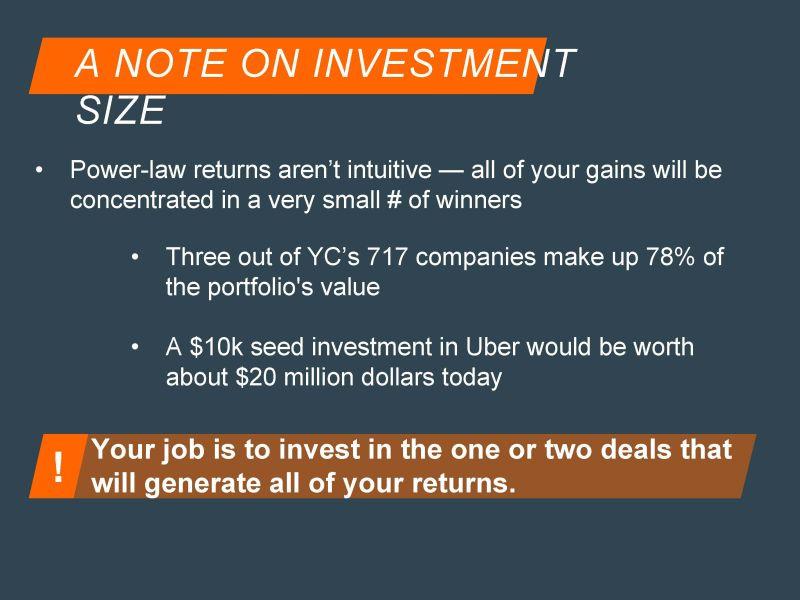

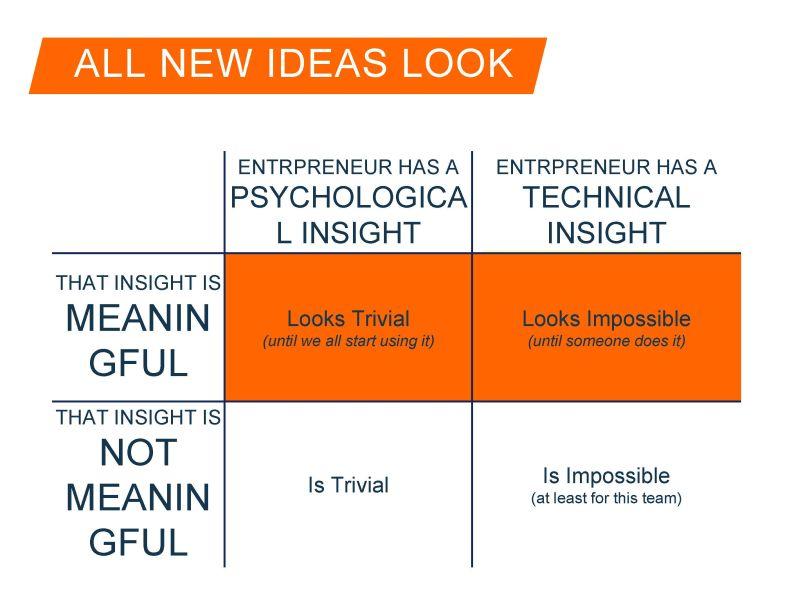

- Power-law returns: Make sure every deal has large potential upside (You will lose most of the time, so winning deals need to be big!).

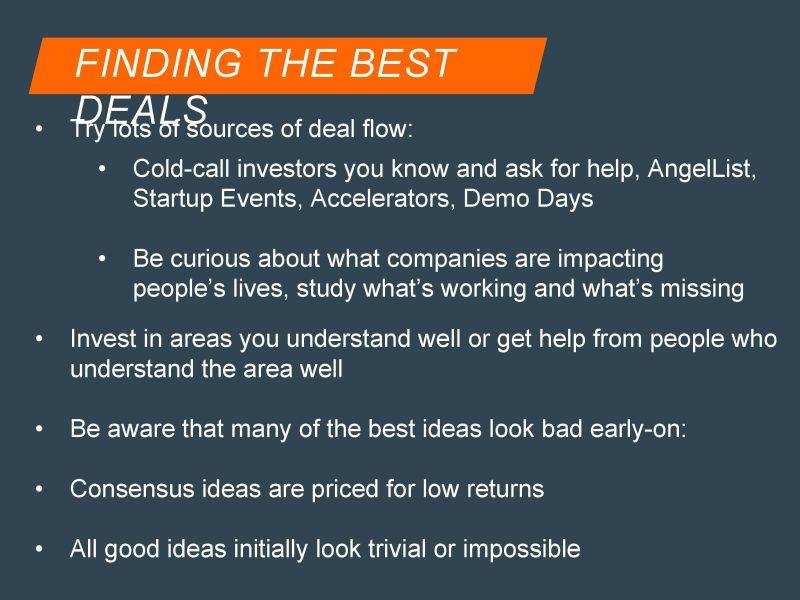

- Branding Know: why a great entrepreneur would take your money over someone else (Key for getting into the best deals).

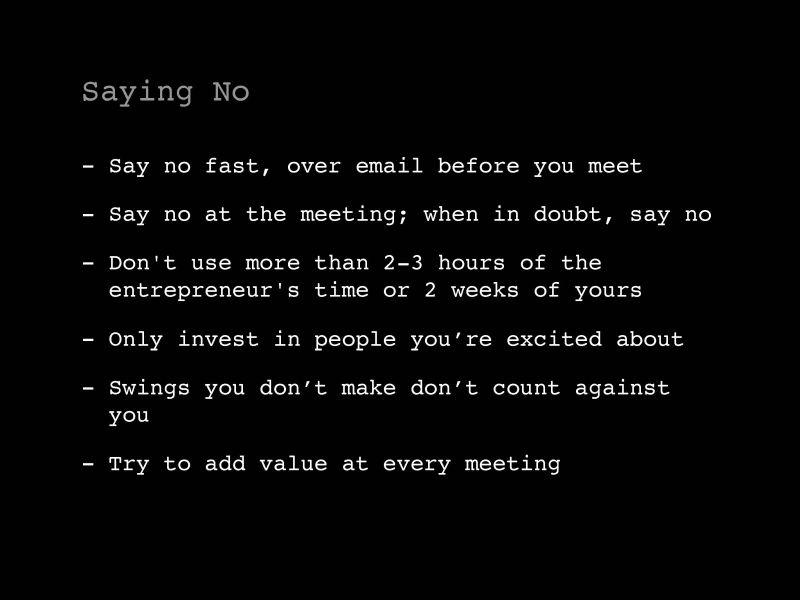

- Reputation Focus: on improving your reputation at almost any cost (Again to get deals).

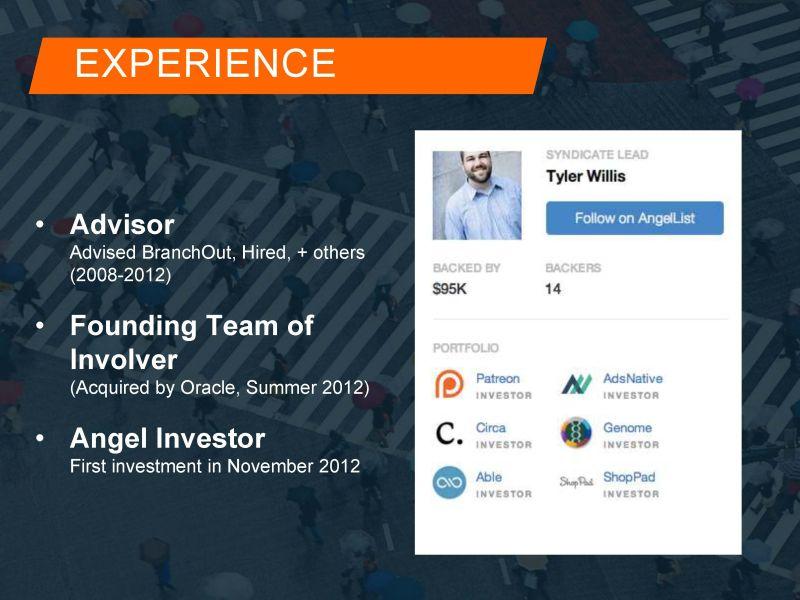

The deck was written by Tyler Willis and you can read the original article post here.

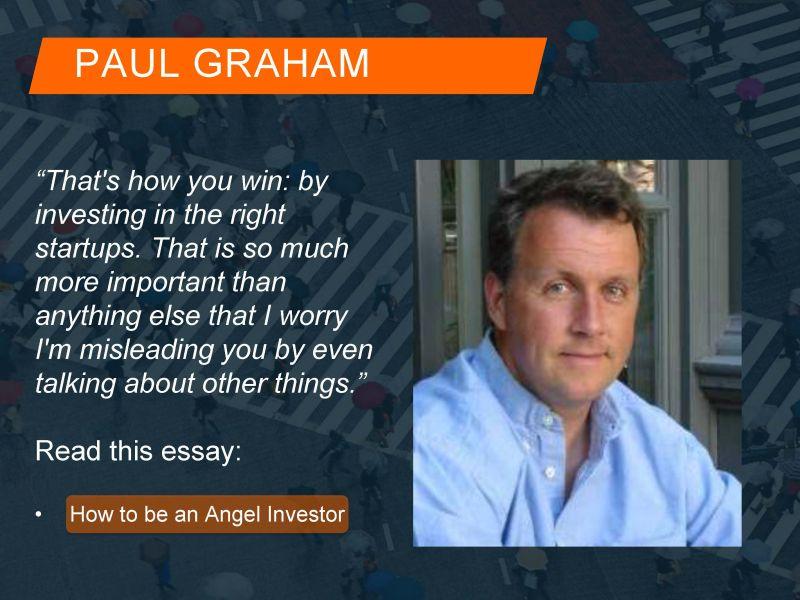

How to be a startup angel investor #1

Paull Graham’s advice on angel investing.

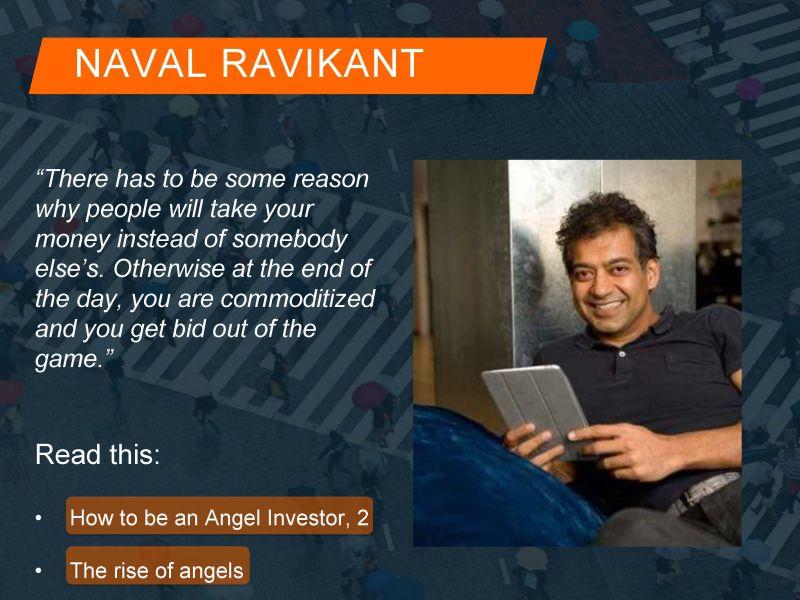

How to be a startup angel investor #2

Previously, Nivi and Naval of venturehacks wrote their own new angel investor presentation. Around the deck is a decent conversation, you can read the transcript here.

You can listen to the audio recording here.

How to be a startup angel investor #2

Comments 1

Great post. It’s really helpful to me. Thanks for sharing!