MRR, an acronym for Monthly Recurring Revenue, is income a startup can reliably anticipate every 30 days (monthly period). MRR lets companies operate under a subscription model, as opposed to one based on one-off transactions. It is used by SaaS companies as a measure of your predictable revenue streams (You don’t include unpredictable revenue in it like one-off professional services). MRR enables you to create a common metric for revenue performance reporting regardless if you have dissimilar subscription terms, such as contract lengths.

The recurring, subscription nature of MRR is, in fact, one of the key determinants for being a SaaS business, the other aspect is the use of software to deliver a service. Direct-to-consumer businesses such as Dollar Shave Club technically have MRR as a subscription business, but they don’t deliver a software service, they ship razor blades (a product). D2C companies are therefore subscription commerce.

The key points about MRR are:

- It is subscription-based and it is recurring

- It is expressed as a $ amount (or whatever your currency is). Read: Use Dollars in your startup

- It is paid monthly or converted into a monthly amount (if you have an annual contract)

- It does not include one-off transactions

- It is a key metric that all investors expect founders to know and track

- It is critical for founders to use to understand their cash situation

- It is not the same thing as accounting revenue

What companies have Monthly Recurring Revenue?

If you are in any way tech-savvy and have a business, you are paying for a SaaS company already. Almost every software service imaginable has been turned into a SaaS offering, all of which generate MRR. Here are examples of subscription businesses:

- LeadPages: They make it easy to set up landing pages, particularly useful for making custom pages for lots of advertising campaigns

- Xero: If you need to manage your accounting, this is one of the best accounting platforms around

- Slack: Team communication with a lot of APIs built-in

- Salesforce: Manage your sales team

How do you calculate MRR?

A simple calculation of MRR for subscription businesses

MRR = ARPU x Number of customers

- ARPA: Average Revenue per User is the average of the monthly fees you charge customers

- Number of customers: How many customers do you have in a time period

Let’s assume you have two pricing packages:

- Basic: $50 monthly revenue

- Premium: $100 monthly revenue

And you have 10 customers, 50% subscribing to each package:

- Basic: 5

- Premium: 5

5 x $50 plus 5 x $100 = $250 + $500 = $750 MRR

You have a MRR of $750.

Introducing monthly and annual recurring contracts

Your calculations will get more complicated if you have a business that offers a term subscription (User committed to a set period of time. I.e. an annual package) and you have a monthly subscription business (Where users are only committed on a month-to-month basis and you know they are only a ‘sure thing’ for that month).

If you offer annual packages (Monthly and annual contracts are the norm. I rarely see 3m or 6m packages) then you will need to do a little bit of math, right? With an annual package, you will book one year of revenue. That’s ARR (Annual Recurring Revenue. Read: ARR Monthly Recurring Revenue explained for SaaS startups). You need to normalize the ARR to MRR. This is easy though. You just divide ARR by 12 to make it monthly. To convert MRR to ARR you just times by 12. Easy!

Let’s cover all the contract terms to make sure you are clear:

- Annual: Divide by 12

- Semi-annual: Divide by 6

- Quarterly: Divide by 3

Let’s do another example on Monthly Recurring Revenue.

- Annual: One customer at $120

- Semi-annual: One customer at $100

- Quarterly: 5 customers at $60

- Monthly: 10 customers at $12

These normalize into MRR as follows

- Annual: One paying customer at $120 / 12 = $10

- Semi-annual: One paying customer at $100 /6 = $16.7

- Quarterly: 5 paying customers at $60 /3 = 5 x $20 = $100

- Monthly: 10 paying customers at $12 – $120

The total MRR is $246.7

Exclude one-off fees in MRR

Next, MRR excludes one-time or adjustable fees, as well as one-time product sales. Remember, MRR is about recurring, right?

Professional services, support, and maintenance contracts are only MRR if they recur. If they are one-offs they are not recurring.

Let’s do another example (Basically the same as above).

- Annual: One customer at $120

- Semi-annual: One customer at $100

- Quarterly: 5 customers at $60

- Monthly: 10 customers at $12

- Professional services to the annual customer: $1000

These normalize into MRR as follows

- Annual: One customer at $120 / 12 = $10

- Semi-annual: One customer at $100 /6 = $16.7

- Quarterly: 5 customers at $60 /3 = 5 x $20 = $100

- Monthly: 10 customers at $12 – $120

The total is $246.7 MRR. It’s the same. You just ignore the one-off $1k.

Understanding how complicated it all can get

There are some key concepts we haven’t talked about here. These are bookings, billings, and deferred revenue.

If you only have a monthly offering, then this is all simple as cake. MRR, bookings, billings, revenue, and deferred revenue are all the same.

The moment you have a contract length longer than a month, or offer other services, suddenly the pain is brought and it’s not simple anymore.

You need to understand these to be a SaaS master. You can get a free tool and read all about it here: Decipher key top line SaaS revenue terms like bookings, billings and revenue

Mistakes in calculating MRR

We covered how to calculate MRR, here are some things to avoid messing up when calculating MRR.

Include discounts

If you have special offers of 50% in the first year, then your customers are not paying full price, are they? You add in MRR of $50 per month, not $100. Only when they start paying the full price do you get to add in the full value when calculating MRR.

Don’t include trials

Ahrefs, for example, has a special offer of $7 for a week. You are a client for only one week. That is not recurring revenue, it is one-off revenue so there is no future revenue. If you were to include it, you would see a small increase in MRR, a large increase in customers and a high churn rate a week later.

No professional services and other one-off revenue

We went through this already. You only include recurring revenue in Monthly Recurring revenue. Duh 😉

Normalize different contract lengths

You know this already. An annual contract is 12x MRR. Make sure everything is apples to apples.

Include late payments

If you have ‘delinquent’ payments, you should have a dunning process to get the client back on track (Typically their credit card expires). The client hasn’t churned yet, so don’t treat them like they have.

Don’t include fees like transaction costs

Payment processing fees go in COGS not revenue.

Are there different types of MRR?

Explaining the types of Monthly Recurring Revenue is going to be one of the more pointless things I am going to share with you, but I’ll include it briefly for completeness.

Your MRR is what you are currently doing and sure, you might want to forecast your MRR for planning purposes, right? Well in future land there is a term (with two names) I’m going to introduce you t.

CMRR, or Contracted MRR / Committed MRR.

Firstly, contracted MRR and committed MRR are the same fricking thing! So don’t go Googling to see if there is a difference between MRR calculations like I once did. They are the same.

Now, CMRR assumes you know what your customers are going to do in future, which implies you either have a contract, or your sales guys are pretty sure about something (and you trust them. Contracts are more reliable in general). Clients can do three things:

- They can dump you as churned MRR (Wine and chocolate time)

- They can give you more money (Party in Ibiza time)

- They can take money away from you as contraction MRR (to watch you cry like a fat kid losing their candy)

CMRR is a projection of what your MRR looks like in future periods by taking your current MRR and adding any guaranteed revenue expansion, or anticipated contraction and churn in the period.

CMRR is really only relevant to enterprise businesses. So if you are early-stage and SMB focused, you don’t give a toss about CMRR.

How do you break MRR down?

MRR is not a static number. It is a composition of a number of changes which are both positive and negative and these things will happen every month till you sell or shut down ;).

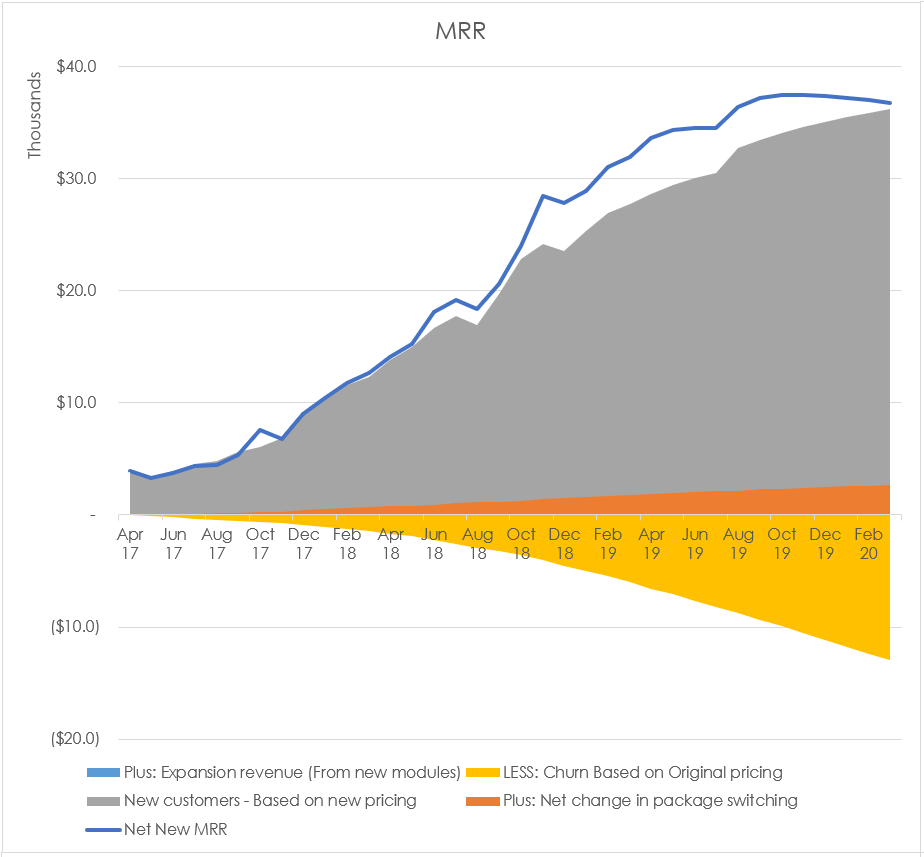

Here is a graph from the SaaS financial model breaking down what MRR looks like for a company I made up. You can see things going up and down from the baseline.

Note: I’m going to include a few details here which aren’t typically mentioned, being the basis upon which pricing affects new and lost revenue. Note the ‘original pricing’ and ‘new pricing’.

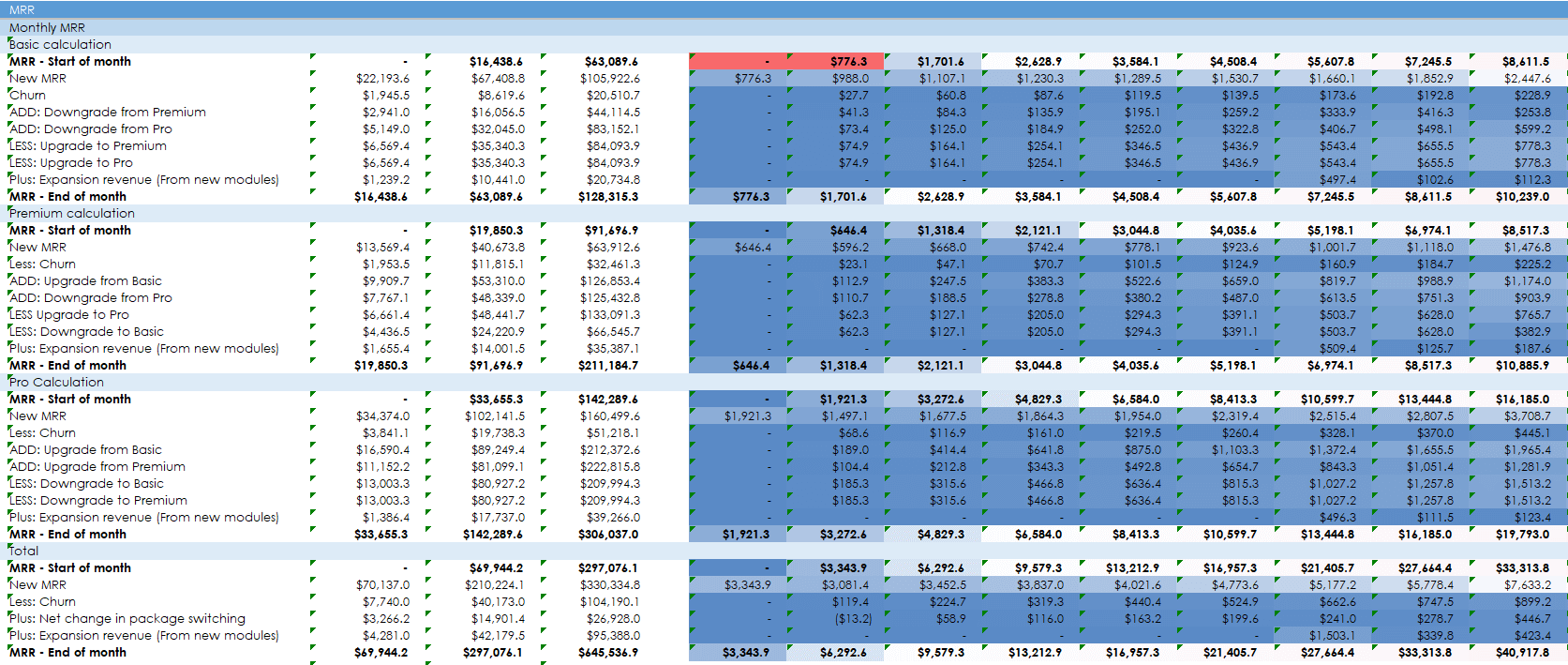

Ok, now here are the numbers behind the graph (Well, a few months anyway). This spells out exactly what happens numerically, which is more useful for comprehension.

Note: This is for the BASIC plan, which is the lowest pricing plan.

The starting MRR in the next period is just the ending MRR in the prior month.

- MRR – Start of month: This is the MRR you start off with. If you are just starting, then the MRR is zero

Here we have new customers pay and lost customers from monthly subscriptions

- New MRR: This is new customer MRR. You have added new customers to your Monthly Recurring Revenue

- Churn: Customers have left with their money. You have lost clients from Monthly Recurring Revenue

This section is what I call package switching. The sum is the net new MRR change.

- ADD: Downgrade from Premium: You increase your Monthly Recurring Revenue in the basic plan (But you lose overall) as a client downgraded from the premium to basic

- ADD: Downgrade from Pro: Same as above for new MRR, but a downgrade from pro

- LESS: Upgrade to Premium: You lose money from basic MRR but you increase overall MRR as the client upgrades to premium

- LESS: Upgrade to Pro: Same as above, but to pro

Here we have expansion MRR from existing customers. In my SaaS model, I assume customers expand only and don’t contract. It’s too hard to assume contraction without a trading history. And you would like to be a little optimistic, though reasoned!

- Plus: Expansion revenue (From new modules): Existing clients buy more services from you for expansion MRR. This net new MRR can include adding new seats.

The ending MRR is the sum of all the other numbers from recurring revenue generated.

- Starting MRR

- PLUS new MRR

- LESS churn MRR

- Plue net package switching

- Plus expansion MRR

- = Total / Ending MRR

MRR – End of month: This is the MRR you have at the end of a month

In the screenshot, you can see that I have modelled three packages for monthly payments: Basic, premium, and pro. Then at the end, there is the total. The total MRR you have is the sum of your three packages. The three packages could be your bronze, silver and gold customers, or it could be 3 avatars you have which numerically characterize them.

Impact of changes in prices on MRR

I mentioned the pricing before. I’m going to explain these now regarding how they impact future Monthly Recurring Revenue.

The easiest way to increase your MRR and profitability is to increase pricing. If you have a robust model with which to forecast, you will be able to change your pricing over time. But if you have a contract period greater than a month, this makes the model very complicated. You are going to have customers paying you different prices over time and when it comes to churning, they won’t be churning at the current price. They will be churning on an older price, which could be from 12 months prior.

Less: Churn MRR based on original pricing

If you have an annual customer churn at the end of their term, then you will lose MRR equal to the pricing they were paying when they entered the contract, not the price you may have increased (or decreased) a year later.

Users churn at the price at which they joined. Since you are more likely to increase your pricing, not decrease it, the $ churn will be less than your current pricing.

New customers – based on new pricing

New customers join or renew, at your new or current pricing affecting Monthly Recurring Revenue.

For monthly customers, you may not honour their original price, so they will be paying the new price as and when you increase it.

For annual customers, they will renew at your new price and not their old price (Unless you agree to do so, for some reason).

How do you increase MRR?

If you want to make more money, you need to increase your MRR. But how do you do that in your MRR calculation? Well, there are more levers than you might think. Let’s run through the MRR components to increase your Monthly Recurring Revenue.

Increase your pricing

Increasing your ARPU is the most obvious way to increase your MRR. The truth though, is that most SaaS startups are underpricing their product. If you mainly have monthly clients, you can see that upside immediately. The only downside you need to consider is the potential number of clients who will churn due to the price increase. If the price increase is minimal, you are unlikely to lose many customers. If you have a lot of customers the net new increase in revenue should easily offset the loss of customers.

If you’re pricing is very low compared to value, it may still make sense to dramatically increase your price even if you will lose a number of customers as you will come out net positive.

Increase the number of customers

Just get more customers to add new MRR! It’s easier to make and keep your existing customers, but who says no to new customer acquisition? They just come at an acquisition cost.

Get your customers back as reactivation MRR

If you lose customers you churned MRR which impacts your financial health. Feel free to reach out to them again with an offer, or just a better product (when you do) and ‘reactivate’ them so they become clients again.

Expand the amount one customer pays through expansion revenue

Increasing your price is a no-brainer if you can. What’s even better is to get more money out of every customer, but increasing their share of wallet allocated to you.

You can make more Monthly Recurring Revenue by:

- Selling more modules: Get them to buy another service. Some other features you have released

- Increasing the number of seats: Get them to add more users from their company. Maybe execs get a dashboard, you add a new department or a new country from a client.

There are variable fees you might charge customers, say via API calls. Yes, that will increase your revenue, but it won’t increase your MRR as it’s not recurring.

Get the client to pay for a more expensive package

If you have most of your clients on the Basic package, get them to the Premium or Pro one! They pay more money that way. Similarly, make sure that clients aren’t downgrading to lower-priced packages.

You will likely see this if clients start seeing little difference between the packages you offer. Maybe basic does most of what premium does, and they can live without the features premium affords? They’ll downgrade. You want to upgrade them.

Not all businesses have pricing tiers. Convertkit, which I use on this site to email you the goodies, charges by users. So the more of you feckers who sign up, the more money I pay! I don’t technically upgrade, you upgrade for me. It’s gone for about $50 to the hundreds now. Thanks… That’s an example of a SaaS startup scaling by usage. And yes, it’s recurring as they have bands for the number of users. So they know, at least, how much they’ll be taking out of my bank account each month.

This usage-based offering is effectively uncapping your earning potential from a client. Never set a maximum price for a service or unlimited offering. It reduces your revenue potential.

Offer differentiated prices to price discriminate

Price discrimination is charging different amounts to different people. The simplest example is having pricing plans on your site. Different prices for different levels of features.

The more advanced application is having enterprise pricing and not listing the price on the website. Then the sales guys will figure out how much flesh they can extract one-on-one.

Get rid of freemium

Yes, freemium can work, and it can do wonders as a marketing strategy. It worked pretty well for Dropbox, but it hasn’t worked well for Evernote.

A free product anchors your pricing to $0. Why should someone spend more when presented paid pricing plans? If you are offering a consumer product, freemium may be the way to go, but if you are offering a business product, there’s no reason to have a free product lasting forever. Set a free trial period. If trial users churn out, they weren’t going to pay anyway and you save server costs (Which improves your COGS, a part of LTV calculations). I’ve found 14 days is the ideal number for B2B trials.

Reduce churn

Leaky buckets aren’t terribly effective. If you have a monthly churn rate of 3%, that might not sound like that much. But you are losing 36% of your entire customer base each year through subscription cancellations! That’s huge! The lower your churn rate, the faster you will be able to grow your Monthly Recurring Revenue.

If you encourage your clients to convert from a monthly to an annual package, you will not actually increase your MRR. You will only increase your bookings and billings (If you charge upfront). It’s only when you increase how much they are actually spending on an annual or normalized monthly basis will your MRR increases.

Offer contracts

If you can get people to pay for annual contracts, you have them tied into paying for a year. They may, during the year, find no value in your product. With an annual contract, it’s tough. They have to keep paying (Typically upfront). With a monthly package, they could churn out the next month. This is, of course, delaying the inevitable, but your MRR in the short term will be higher, and you can use that money to make the product better so that maybe they don’t end up churning at the end of the year after all.

Why do startups like MRR?

Everyone uses MRR. If you hang out with your cool SaaS mates, they’ll ask you what your MRR is to know how you are doing. Investors will ask the same. Journalists will ask too, perhaps to see if you are worth writing about.

Here are more reasons to like MRR:

- Normalize: Normalize for subscription terms of different lengths for MRR metrics

- Timely: It’s a clear, normalized term that gives you a view of how you are performing on a monthly basis. As opposed to an annual amount, it’s something you can more readily track and address. You will want to see how your MRR is growing on a month-to-month basis.

- Forecasts: MRR is a predictable number. It’s an easy way for you to forecast your future cash flow and make a budget. MRR allows you to plan and control your growth. You can measure new contract growth and churn

- Customer payments are made on time: It’s not variable, and you don’t have to bill customers each month. As opposed to offering consulting services by the hour, you don’t have to fill in timesheets, invoice the customer and hope to heck they actually pay on time. If customers don’t pay, they don’t get to use your service. Simple.

- Data-driven: It’s great when you are metric-focused and data-driven. You can use MRR to calculate key metrics like LTV (Customer Lifetime Value) and ratios like CAC (Customer Acquisition Cost)/LTV. This also lends to being able to benchmark yourself against other companies (if you get your hands on data) to compare MRR growth.

- Cohort analysis: You can do an analysis on MRR Cohorts (how customers acquired in each month perform) to assess how best to optimize revenue

Why do customers like MRR?

Well, SaaS businesses don’t like MRR, they like the subscription aspect of it. Simply put, current customers know how much they are going to pay each and every month. There aren’t going to be variable surprises. If they are under pressure, they know how much they save by decreasing the service they take from you. If they have a monthly contract, they are flexible.

On the other hand, if clients love your product, they can easily scale up (as they do down). This beats the crap out of the legacy software install model.

Why do investors like MRR?

Investors like predictability and the recurring nature of tracking MRR. Subscription business typically doesn’t suffer from seasonality and a lot of operational headaches as one has in ecommerce.

MRR tells investors a lot about your successful business, especially if you break it down.

“In the end, MRR doesn’t lie. It encapsulates everything — what’s the ARPA? What’s your ability to expand with a certain customer and add an upsell? And on the negative, it shows your ability to retain your customers and where you have unhealthy churn.” – Pietro Bezza

It’s not just static MRR that is important to investors. Even more important are the trajectory and the velocity of your company’s recurring revenue.

“The pace of growth matters more than the number.” – Mike Chalfen

Investors use MRR measures to compare you to other companies. It’s a great leveller. And frankly, venture capitalists love the idea of MRR because it makes it much easier to value a business. A multiple of MRR is a great yardstick.

What is the difference between MRR and ARR?

ARR (Annual Recurring Revenue) is sort of the same concept as MRR. It’s just the total amount of money we get per year from our MRR. That’s 12 x monthly revenue. We talked about this above.

How is MRR different to accounting revenue?

It’s not the same thing. As far as anyone other than you and investors, MRR is made up as ACSOI was with Groupon.

MRR is not recognized by the Financial Accounting Standards Board (FASB) or the U.S. Securities and Exchange Commission (SEC). It is not reportable GAAP revenue, and should not be confused with or incorporated into revenue recognition. In other words, MRR can’t be reported to anyone legally.

Accounting revenue is a lot about revenue recognition. Though if you only have monthly contracts, it’s pretty much exactly the same as revenue.

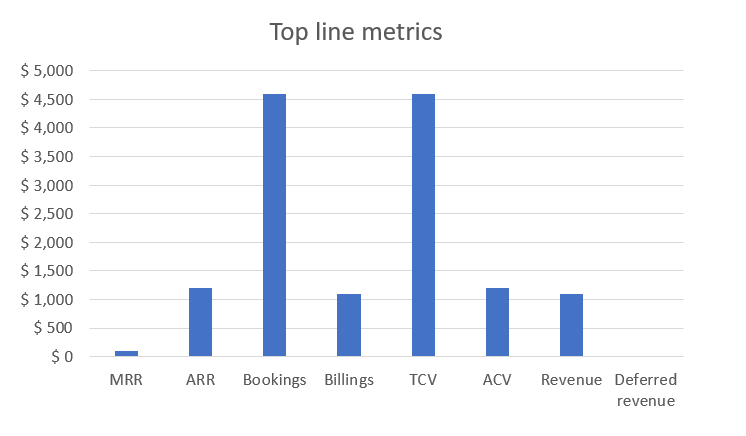

Understand all the key top-line SaaS metrics

If you want to understand all the key revenue terms in SaaS, you can download a free Excel model and see how all the numbers are calculated, as seen below.