Tl;dr: Social Capital Hedosophia V, the blank-check company associated with investor Chamath Palihapitiya, announced that it will merge with SoFi, taking the personal financial services company public in the process.

$IPOE is merging with @SoFi to take them public. This is an incredible company in banking and fintech that has the potential for a winner-take-most outcome. Watch @cnbc now or listen to call at 1pm ET bit.ly/397GAD5) to hear from me and @anthonynoto. 1-pager below.

Investment memo for SoFi SPAC

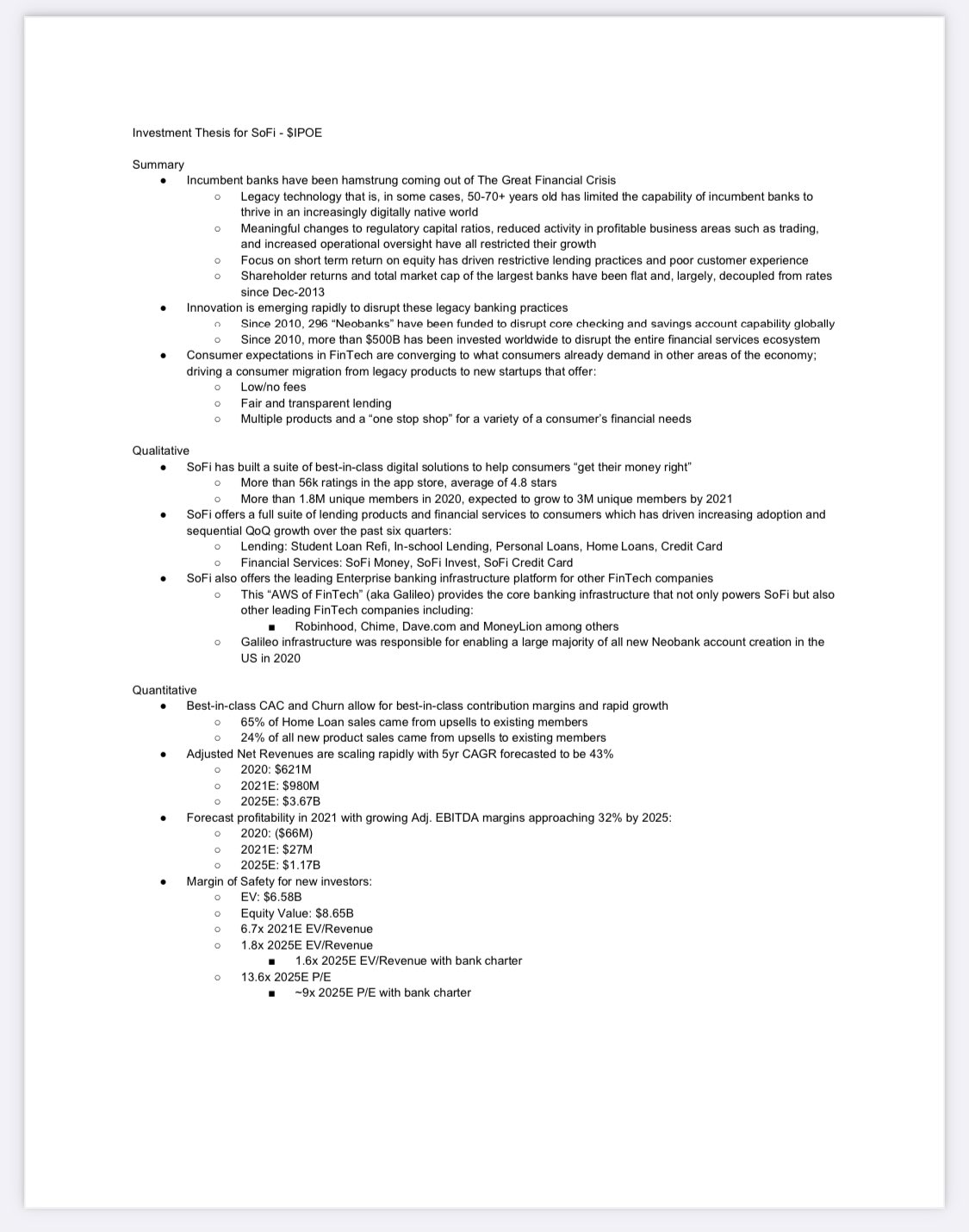

Investment Thesis for SoFi – $1POE

Summary

- Incumbent banks have been hamstrung coming out of The Great Financial Crisis

- Legacy technology that is, in some cases, 50-70+ years old has limited the capability of incumbent banks to thrive in an increasingly digitally native world

- Meaningful changes to regulatory capital ratios, reduced activity in profitable business areas such as trading, and increased operational oversight have all restricted their growth

- Focus on short term return on equity has driven restrictive lending practices and poor customer experience

- Shareholder returns and total market cap of the largest banks have been flat and, largely, decoupled from rates since Dec-2013

- Innovation is emerging rapidly to disrupt these legacy banking practices

- Since 2010, 296 “Ne-obanks” have been funded to disrupt core checking and savings account capability globally

- Since 2010, more than $500B has been invested worldwide to disrupt the entire financial services ecosystem

- Consumer expectations in FinTech are converging to what consumers already demand in other areas of the economy: driving a consumer migration from legacy products to new startups that offer:

- Low/no fees

- Fair and transparent lending

- Multiple products and a “one stop shop” for a variety of a consumer’s financial needs

Qualitative

- SoFi has built a suite of best-in-class digital solutions to help consumers “get their money right”

- More than 56k ratings in the app store, an average of 4.8 stars

- More than 1.8M unique members in 2020, expected to grow to 3M unique members by 2021

- SoFi offers a full suite of lending products and financial services to consumers which has driven increasing adoption and sequential QoQ growth over the past six quarters:

- Lending: Student Loan Refi, In-school Lending, Personal Loans, Home Loans, Credit Card

- Financial Services: SoFI Money, SoFi Invest, SoFi Credit Card

- SoFi also offers the leading Enterprise banking infrastructure platform for other FinTech companies

- This “AWS of FinTech” (aka Galileo) provides the core banking infrastructure that not only powers SoFi but also other leading FlnTech companies including:

- Robinhood, Chime, Dave.com and Moneylion among others

- Galileo infrastructure was responsible for enabling a large majority of all new Neobank account creation in the US in 2020

- This “AWS of FinTech” (aka Galileo) provides the core banking infrastructure that not only powers SoFi but also other leading FlnTech companies including:

Quantitative

- Best-in-class CAC and Churn allow for best-in-class contribution margins and rapid growth

- 65% of Home Loan sales came from upsells to existing members

- 24% of all new product sales came from upsells to existing members

- Adjusted Net Revenues are scaling rapidly with 5yr CAGR forecasted to be 43%

- 2020: $621M

- 2021E: $980M

- 2025E: $3.67B

- Forecast profitability in 2021 with growing Adj. EBITDA margins approaching 32% by 2025:

- 2020: ($66M)

- 2021E: $27M

- 2025E: $1.17B

- Margin of Safety for new investors:

-

- EV: $6.58B

- Equity Value: $8.65B

- 7x 2021E EV/Revenue

- 8x 2025E EV/Revenue

- 6x 2025E EV/Revenue with bank charter

- 13.6x 2025E P/E

- 9x 2025E P/E with bank charter

-

You can read the rest of the memo collection here.