For those of you that have my extensive marketplace financial model, I wanted to set out benchmarks you can use for the model to calibrate your calculations.

In this blog I’ve tried to set out:

- Benchmarks: All the ones so you know you haven’t done anything silly!

- Metrics: What metrics matter?

- What investors look for: I’ve made a reading list with comments

- Reading list: I started so I may as well finish it…

Benchmarks

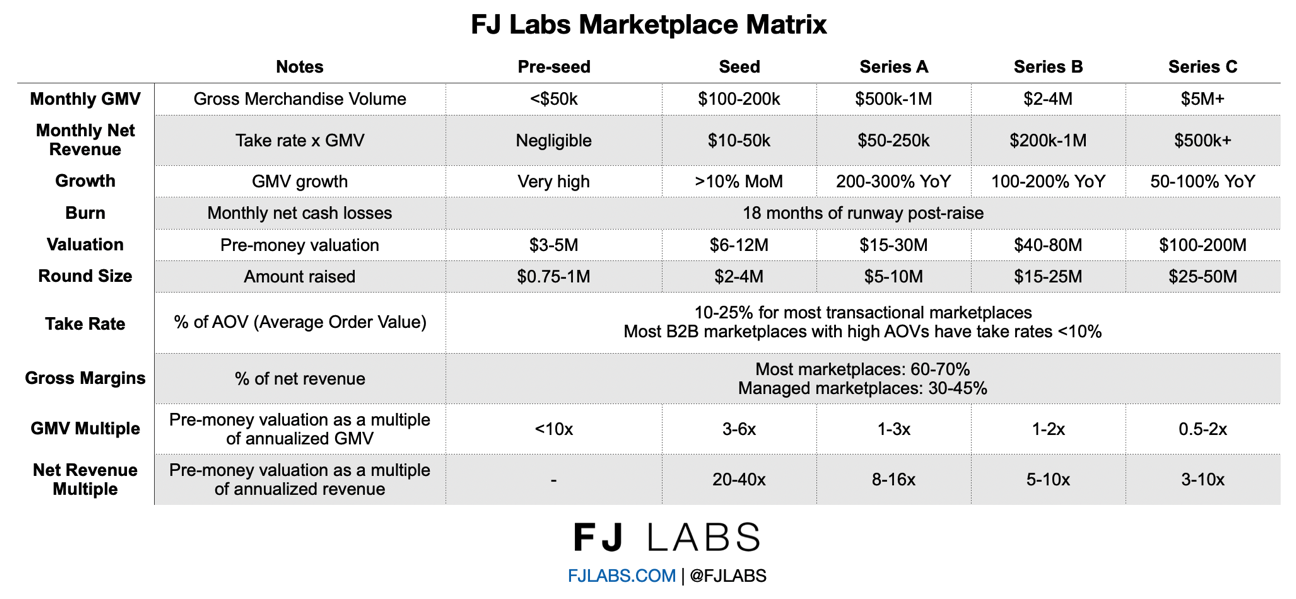

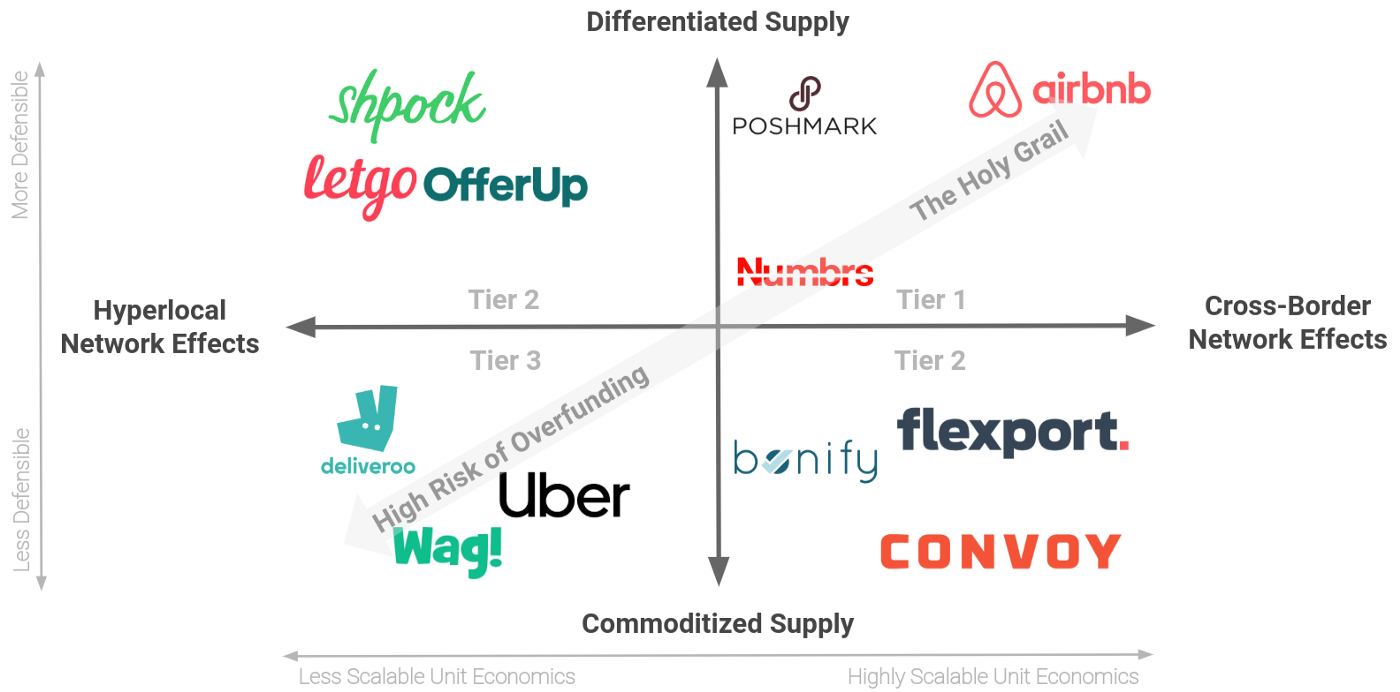

FJ LABS put it together in a useful matrix

Fabrice Grinda (Founder of OLX) shared the benchmarks he looks at to invest in marketplaces. This is one of the most recent shares, being in 2020.

To help marketplace founders, we put together the following matrix. Like all such charts it’s reductionist in nature and is meant to represent 25-75% percentiles. It does not capture outliers.

Point9 Capital / Version One

Given that marketplaces are also a strong focus area for us, we immediately thought that it would be great to have a fundraising napkin for marketplaces too. After thinking about it for a bit, we came to the conclusion that this might be a bit more tricky, due to marketplaces being a less homogenous group than SaaS startups. Here are a number of areas in which the differences are visible:

- Geography – SaaS startups tend to be global from day one, frequently go after the US market and raise funding from the same group of international SaaS investors. Marketplaces, on the other hand, are frequently multi-local, scale country by country – and have to raise funds, especially in the early stages, from local investors – who might vary in standards.

- B2B vs B2C – when we talk about SaaS we typically talk about startups selling software to businesses. In contrast, marketplaces can be B2B, B2C, B2B2C..

- Business model mechanics – marketplaces can have varying take rates, some own some do not own the transactions that happen on them, some are platforms for trading products versus others are about services and may or may not involve a SaaS component.

Nevertheless, we had a shot at it. We teamed up with the great folks at Version One to make it happen – they focus a lot on marketplaces and their input has been very valuable.

2018

| “PRE-SEED” | SEED | SERIES A | SERIES B | |

| Amount | $500k – $1m | $1m – $3m | $5m – $12m | $10m – $30m |

| Valuation | $1m – $5m | $3 – $8m | $10m – $40m | $50m – $200m |

| Investors | Friends & Family, Angels, Pre-Seed Funds | Angels, Micro VCs | VCs | VCs |

| Team | Smart, committed guys / girls with relevant expertise/skills. | No *star* VPs yet.

Often good director-level hires. Proven ability to attract & manage great people. |

Senior leadership in most functions.

Proven ability to recruit senior people. |

|

| Product/Market Fit | Market research indicates strong need for the product.

Prototype / very basic product with first activity. |

Strong indications of Product/Market Fit from early customers/users.

Initial liquidity on the platform. |

Clear PMF and Increasing evidence of PMF in larger market. | |

| Tech | Stellar growth-hacking co-founder.

Strong tech co-founder with relevant experience is a big plus. |

Proven ability to move fast & break things … with emphasis on moving fast. 🙂

Starting to think about building robust tech with scalability and putting processes in place. |

Proven ability to attract and manage great engineers.

Product scales, but still breaks once in a while. Continued high product development velocity. |

Excellent tech leadership.

Product doesn’t break with scale. Product meets security, and trust and safety standards for all activity transacted on the marketplace. |

| Monthly GMV | – | $50k – $200k | $500k – $1m | $5m – $10m |

| Monthly Net Rev | – | <$50k | <$200k | $200k – $500k |

| Unit Economics | Unit economics should work based on intuitive theory. | Some evidence unit economics work. | Unit economics work and indications they will continue to work at scale. | Conviction unit economics work at scale or they work already. |

| Supply & Demand Dynamics | Demand is enthusiasts and early fans.

Supply is individual sellers, “mom and pop” shops. Customer acquistion is (largely) organic. |

Demand moves towards mainstream buyers.

Supply is professionalized. Customer acquistion is (largely) paid. |

||

| Marketing & Growth | Understanding of best practices; good ideas. | Strong indications of demand (e.g. organic signups). | Strong organic demand.

Success with at least one (not necessarily scalable) customer acquisition channel. |

Excellent understanding of growth/marketing costs and CAC payback times by channel.

Increasing confidence in the scalability of the growth/marketing machine. |

| Market / Potential | Belief in $100m+ of GMV | Conviction that there’s $100m+ of GMV | Increasing evidence of $1bn+ of GMV | Increasing evidence of $1bn-10bn of GMV |

| Defensibility | – | Increasing network effects | ||

2016

| PRE-SEED | SEED | SERIES A | SERIES B | SERIES C | |

| AMOUNT

VALUATION INVESTORS |

$500K – $1M

$1-5M Friends & Family, Angels, Pre-Seed Funds |

$1-3M

$3-8M Angels, Micro VCs |

$5-12M$10-40M

VCS |

$10-30M

$50-200M VCS |

$30M+

$100M+ VCS, PE |

| TEAM | Smart committed guys/girls with relevant expertise/skills |

No “Star” VPs yet. Often good director-level hires.

Proven ability to attract & manage great people. |

Senior leadership in most functions.

Proven ability to recruit senior people. |

Complete senior management team. | |

| PRODUCT/

MARKET FIT |

Market Research indicates strong need for the product Prototype / basic product with first activity | String indications of PMF from early customers/users.

Initial liquidity on the platform. |

Clear PMF and increasing evidence of PMF in larger market → |

||

| TECH | Stellar growth-hacking co-founderStrong tech co-founder with relevant experience is a big plus. | Proven ability to move fast and break things … with emphasis on moving fast. :)Starting to think about building robust tech with scalability and putting processes in place. | Proven ability to attract and manage great engineers.

Product scales but still breaks once in a while. Continued high product development velocity. |

Excellent tech leadership.

Product doesn’t break with scale. Product meets security and trust and safety standards for all activity transacted on the marketplace. |

|

| MONTHLY GMV | ———- | ~$50 – 200k | ~$500k – 1M | ~$5-10M | $20M+ |

| MONTHLY NET REVENUE | ———- | < $50k | < $200k | $200-500K | $1M+ |

| UNIT ECONOMICS | Unit economics should work based on intuitive theory. | Some evidence unit economics work. | Unit economics work and indications they will continue to work at scale. | Conviction unit economics work at scale or they work already. | Unit economics work. |

| SUPPLY & DEMAND DYNAMICS | Demand is enthusiastic and early fans. Supply is individual sellers “mom and pop” shops.

Customer acquisition is (largely) organic. |

Demand moves towards mainstream buyers.

Supply is professionalised. Customer acquisition is largely paid. |

|||

| MARKETING

& GROWTH |

Understanding of best practices; good ideas. | Strong indications of demand (e.g. organic trial signups). | Strong organic demand.Success with at least one (not necessarily scalable) customer acquisition channel. | Excellent understanding of growth/marketing costs and CAC payback times by channel. Increasing confidence in the scalability of the growth/marketing machine. | Predictable, profitable, scalable growth/ marketing machine. |

| MARKET / POTENTIAL | Belief in 100M+ GMU. | Conviction that there is $100M+ of GMU. | Increasing evidence of $1B of GMU. | Increasing evidence of $1-10B of GMU. | Increasing evidence of $10B of GMU. |

| DEFENSIBILITY | ———- | Increasing network effects → |

|||

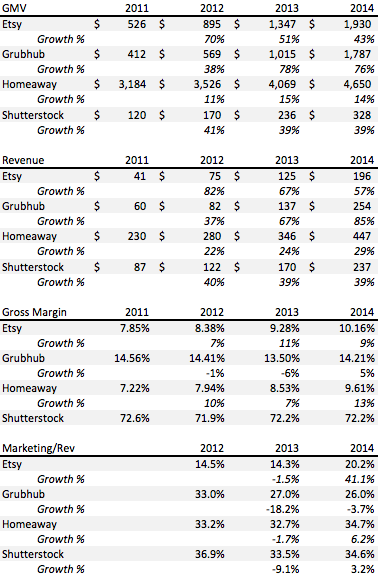

Unpacking Etsy’s S1

You can learn quite a lot by looking at the S-1 filings of marketplaces. You can then check out their investor section for presentations and their annual filings. If you are an early stage startup, the metrics won’t be super useful to benchmark yourself, but you can see what they focus on and any management commentary.

This blog on TC by Ezra Galston at Chicago Ventures is an example of one analysis when Etsy filed for their IPO.

You can read the blog here.

Y-combinator

Not a lot but they wrote a blog for a bunch of verticals.

“we’ve aggregated a set of business-model specific benchmarks from Series A’s raised by YC companies in the past 5 years. Again, these are guidelines, not surefire indicators of whether you are ready to raise a Series A. We’ve kept these intentionally broad to demonstrate that the process of raising an A differs for every company”

Based on 6 companies

- Core metric: $4.8-63.2M GMV

- Growth: >20% m-o-m

- Round Size: $5-12M

- Dilution: 20-32%

- Post Money: $15-60M

That’s it. If you want to check out the blog you are free to do so. Duh.

Metrics

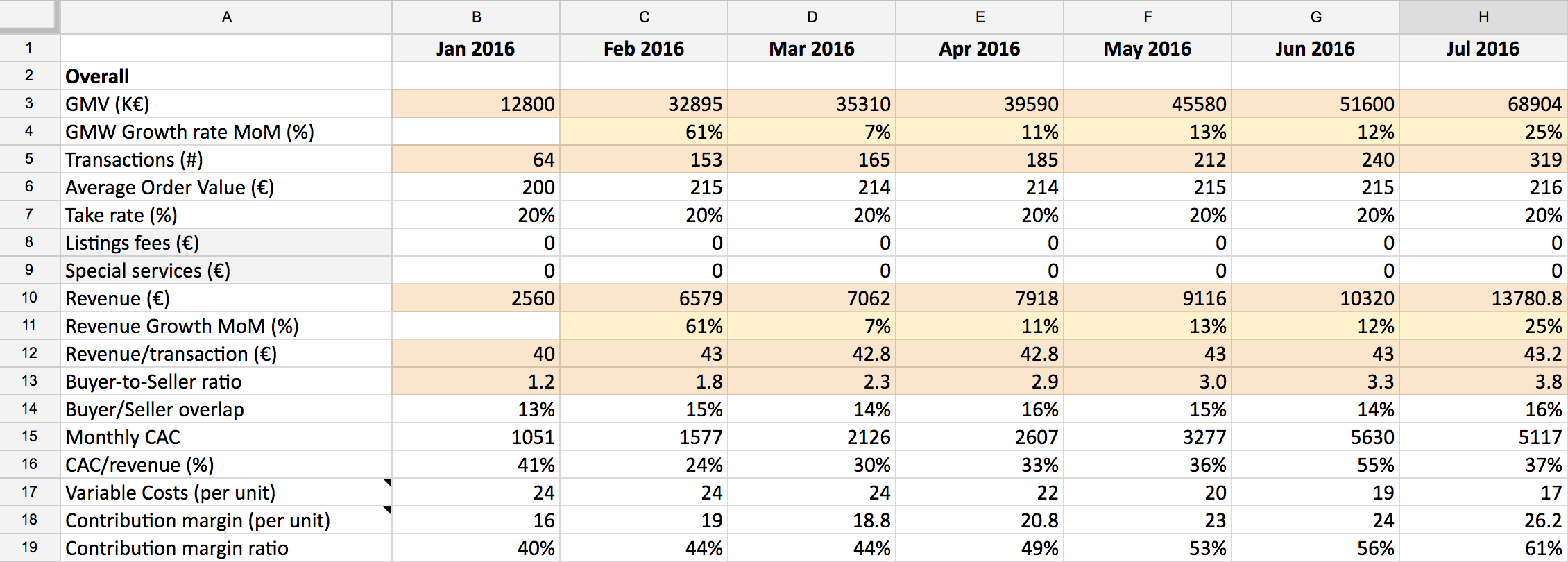

Version One Marketplaces KPI tool

Version One made a useful Google Sheet to set out the KPIs that you should be tracking and showing to investors when fundraising. Even if you plan on bootstrapping (good for you), these are the basics you should be tracking.

We recognize that every marketplace is different, but each one is also similar at its core: each marketplace has a seller (supply) and buyer (demand) side, and acts as an intermediary to bring them together.

We hope that our version of a Marketplace KPI dashboard helps founders manage their business and pre-empt those due diligence questions in a fundraise.

These are the metrics they say matter:

| Overall Marketplace Metrics |

| Gross Merchandise Volume (GMV) ($) |

| # of Transactions |

| Average Order Value (AOV) ($) |

| GMV Growth Rate, M-o-M (%) |

| GMV Growth Rate, Y-o-Y (%) |

| Take Rate (%) |

| Revenue ($) |

| Revenue from transaction fees ($) |

| Revenue from listing fees ($) |

| Revenue from supplier or seller services ($) |

| Buyer-to-Seller Ratio |

| Total CAC as a percentage of Revenue (%) |

| Seller / Supplier Metrics |

| Total # of Sellers or Suppliers |

| # of New Sellers or Suppliers |

| Seller or Supplier Growth Rate, M-o-M (%) |

| Seller or Supplier Growth Rate, Y-o-Y (%) |

| Percentage of Sellers or Suppliers still active after 1 month (%) |

| Percentage of Sellers or Suppliers still active after 1 year (%) |

| Average revenue generated per Seller or Supplier ($) |

|

Average percentage of Month 1 GMV generated by Sellers or Suppliers in Month 12 (%)

|

| Percentage of revenue generated by Top 20% Sellers or Suppliers (%) |

| Seller or Supplier NPS |

| Seller or Supplier CAC (paid and organic) ($) |

| Seller or Supplier CAC (paid) ($) |

| Percentage of Sellers or Suppliers acquired through paid acquisition (%) |

| Total # of Listings |

| # of New Listings |

| Listings Growth Rate (%) |

| Average Listing Price ($) |

| Sell-Through Rate (%) |

| Buyer Metrics |

| Total # of Buyers |

| # of New Buyers |

| Buyer Growth Rate, M-o-M (%) |

| Buyer Growth Rate, Y-o-Y (%) |

| Percentage of Buyers who have purchased more than once (%) |

| Percentage of GMV from Buyers who purchased in previous months (%) |

| Percentage of Buyers whose second purchase is in a different category (%) |

| Average amount purchased per Buyer ($) |

| Average # of Orders per Buyer |

| Average Order Growth per Buyer, Y-o-Y |

| Average percentage of Month 1 GMV generated by Buyers in Month 12 (%) |

| Percentage of revenue generated by Top 20% Buyers (%) |

| Buyer NPS |

| Buyer CAC (paid and organic) ($) |

| Buyer CAC (paid) ($) |

| Percentage of Buyers acquired through paid acquisition (%) |

You can access the sheet here. Also, there are some comments on this page.

The (Ultimate) Guide for Marketplace Analytics

Willy Braun at daphni made a template dashboard for marketplace metrics. He shares some thoughts on metrics. You can read the blog here.

Presentation of the metrics here.

And here is a snapshot of the dashboard template he made. You can see it here.

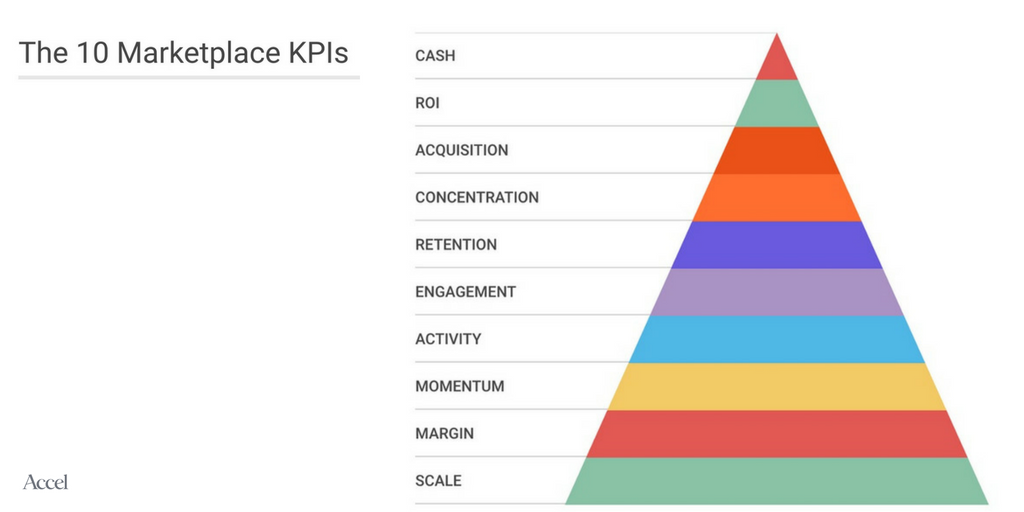

Accel metrics that matter

Accel wrote a blog on “10 Marketplace KPIs That Matter”. There are no benchmarks, but it might be useful for you to understand what matters to investors who like marketplaces.

You can check it out here.

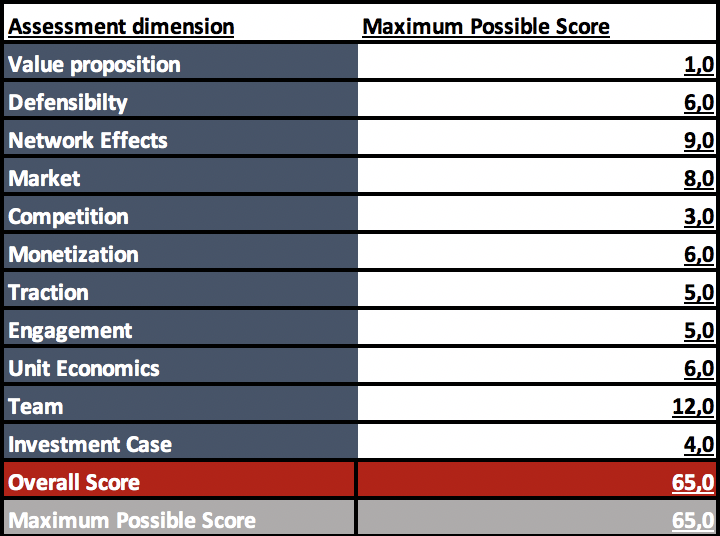

Speedinvest Scorecard

Speedinvest wrote a scorecard to evaluate startups. It is an attempt to:

- align our approach of evaluating marketplaces deals

- come up with a holistic and balanced assessment

- base the assessment on as many objective and measurable criteria as possible

- make deals more comparable

- track and optimize our investment decisions alongside our own investment hypothesis

The blog has some solid detail in it, again no benchmarks, but some solid reading to:

- provide you with transparent insights into our thinking

- to give all aspiring marketplace founders a tool to challenge the attractiveness of their idea (from a venture capitalist’s point of view)

- inspire your vision of how you can further develop your marketplace business

You can read the blog here.

Measuring B2B Marketplaces: Key Metrics for Success

Bowery Capital share 5 categories of metrics that they look at for B2B marketplaces.

You can read the blog here.

What investors look for

Four Questions Every Marketplace Startup Should Be Able to Answer

Jonathan Golden (Ex-Airbnb) shares

I identified four key factors that shape every marketplace: network effects, type of supply, incentives, and size and frequency of interaction.

Understanding those factors — and structuring your platform accordingly — can make the difference between a wildly successful marketplace and one that never gets off the ground.

The four questions are:

- Type of Network Effects: How will your marketplace grow?

- Homogeneous vs. Heterogeneous Supply: Is your startup a search marketplace or a matching marketplace?

- Two-Sided Incentives: How will you keep both buyers and sellers in the marketplace?

- Size and Frequency of Interaction: What are the unit economics of your marketplace?

You can read the blog here.

What investors look for

Bill Gurley’s “10 Factors To Consider When Evaluating Digital Marketplaces”

Bill Gurley (Founded Benchmark Capital) wrote a great blog on marketplaces in 2012 that is pretty much required reading. It is a solid walkthrough of parameters to consider when creating platform startups.

His 10 points are:

-

New experience v/s status quo: Great marketplaces do not simply aggregate a market; they enhance it

-

Economic Advantages vs. the Status Quo:

-

oDesk enables companies to easily provision programming talent from all corners of the globe.

-

Another interesting example of this bi-directional advantage is AirBNB. For the property owner, the income is “found money” that simply didn’t exist prior to the marketplace.

-

-

Opportunity for Technology to Add Value

-

High Fragmentation: fragmented supplier base is extremely beneficial

-

The friction of Supplier Sign-Up: In some markets signing up for suppliers is relatively easy. In others, it can be a painfully slow process that requires lots of touches and local presence.

-

Size of the Market Opportunity: You must combine a TAM analysis with the likelihood of marketplace success and penetration.

-

Expand the Market: oDesk’s presence increases the number of first-time software outsourcers.

-

Frequency: Another repeated mistake is attacking verticals where a satisfactory supplier “match” end’s the customer’s need to re-enter the market in search of an alternative.

-

Payment Flow: All things being equal, being part of the payment flow is superior to not being a part of the payment flow. The supplier not only looks to you as a provider of revenue, but they receive that revenue “net of the fee.”

-

Network Effects: Can the marketplace provide a better experience to customer “n+1000” than it did to customer “n” directly as a function of adding 1000 more participants to the market?

You can read the blog here.

Reading list

13 questions for your marketplace

Relatively short blog, but raises some questions for you to consider.

- How successfully can the two sides of the marketplace find each other?

- Is there enough supply? Does it fit users’ needs?

- How long does it take for supply and demand to match?

- How concentrated is the marketplace on the supply and demand sides?

- How valuable is the marketplace?

- How is the business doing?

- How many of your users also use other similar services? How many users are active on similar services?

- How easy is it for users to join a new (or even nonexistent) network? How much value can users get as a new user from joining a different network?

- Is your user retention improving for newer cohorts?

- Is retention, as defined by users taking a core action for the product, improving for newer cohorts?

- Are newer cohorts retaining better on a dollar basis, for every given time period, than older cohorts?

- Are participants in the oldest markets—for businesses with local network effects—better retained than those in newer markets?

- Are users becoming more engaged over time?

You can read the blog here.

Version One Marketplace Guide (3rd edition)

Version One creates some great content on marketplaces. One of their flagship content is a guide. Whether or not you are a n00b or expert, this is a read for you to really get into details.

[pdf-embedder url=”https://wordpress-153384-440792.cloudwaysapps.com/wp-content/uploads/2021/12/Guide-to-Marketplaces-Third-Edition.pdf” title=”Guide to Marketplaces-Third Edition”]Jeff Jordan at a16z video on marketplaces (network effects)

Jeff Jordan has a video for your viewing pleasure on network effects, and how they’re different from ecommerce products.

What makes marketplace business models so attractive, especially as compared to classic ecommerce and retail? (Hint: network effects.) From the classic unbundling of Craigslist to entirely new marketplaces enabled by smartphones and mobile, he shares examples, drivers of profitability/margins/moats, and what makes marketplaces superior for consumers as well: identity, reputation, payments, trust and safety, frictionlessness, and transparency. This video is based on a talk given in 2015.

NFX

NFX are focused on startups with network effects, which you frankly need in marketplaces. They’ve written a long guide you want to read to understand them.

Network effects have been responsible for 70% of all the value created in technology since 1994. Founders who deeply understand how they work will be better positioned to build category-defining companies.

They cover:

- Why Network Effects Are Important

- How Networks Work

- Properties of Networks

- Building and Maintaining Network Effects

- Related Concepts

Read it below:

[pdf-embedder url=”https://wordpress-153384-440792.cloudwaysapps.com/wp-content/uploads/2021/12/The-Network-Effects-Bible-eBook.pdf” title=”The Network Effects Bible (eBook)”]There is a presentation here:

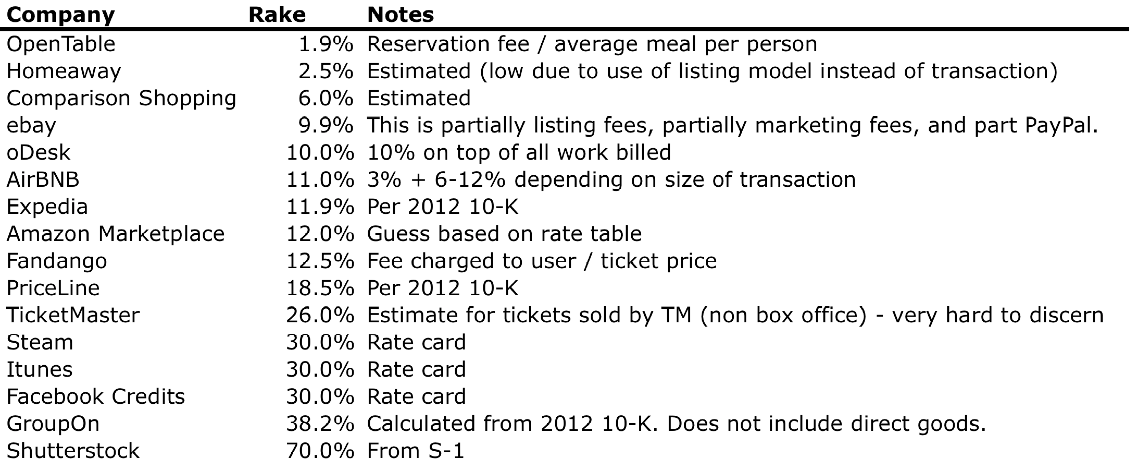

Bill Gurley’s A Rake Too Far

Bill talks about the rake platforms charge, specifically charging too much. This is particularly apt presently with Epic vs. Apple etc.

In a casino, the term “rake” refers to the commission that the house earns for operating a poker game. With each hand, a small percentage of the pot is scraped off by the dealer, which in essence becomes the “revenue” for the casino.

Many Internet marketplaces also have a rake or vig.

You can read the blog here.

Liquidity Hacking by Josh Breinlinger

My friend Josh talks about how to solve the chicken or the egg problem.

Every founder I meet who’s building a marketplace business basically says the same thing: “It’s so much harder than I thought to build a two-sided marketplace.

But of course it can be done. There are plenty of examples of success. EBay did it. We did it at oDesk. OpenTable is famous for doing it, and AirBnB is killing it. What I’ve noticed in the success stories is the basic theme that I call “liquidity hacking.”

How?

- Provide value to one side: offer portfolios, community, tools.

- Find aggregators: Physical aggregators (like campuses), enterprise clients, supply aggregators, or scrape listings.

- Narrow the problem: geo, niche, vertical.

- Curate one side.

How to Kickstart and Scale a Marketplace Business

Lenny Rachitsky, former supply growth lead at Airbnb, synthesizes insights from 17 marketplace businesses, including Doordash and Etsy into a series of blogs.

“Everyone’s always looking for the hack – what’s the channel that will unlock something big? But every time we looked for a reason we weren’t growing, it always came back to the basics –– selection, delivery quality, pricing. That’s it. Always come back to first principles. Whenever we made a mistake, we forgot this.” – Micah Moreau (DoorDash, VP of Growth)

I’ve been advising founders for a long time and the funny thing is my best advice is always obvious boring crap they don’t want to hear. They probably know it already, they just don’t do it. The basics are what matters.

You can read the blogs here.

Starting and Scaling Marketplaces

Building an enduring marketplace is a near impossible feat. Marketplace founders are often challenged by the “chicken and egg” problem. How can you create demand for your platform when there is no supply, or vice versa?

Eventbrite VP & GM Brian Rothenberg and Greylock Growth Advisor Casey Winters have a 50 minute podcast on the “chicken and egg” problem for marketplaces.

You can check it out here.

How the 100 largest marketplaces solved the chicken and egg problem

Eli Chait (ex-OpenTable) also talks about the ways to bootstrap with a chicken and egg problem.

- Single player mode

- Offering to Fill Empty Seats for suppliers

- Create a marketplace where Buyers are Sellers

You can read the blog here.

How Modern Marketplaces Like Uber and Airbnb Build Trust to Achieve Liquidity

Anand Iyer, former Head of Product at Threadflip writes about using trust throughout the product to get liquidity.

As head of product for fashion marketplace Threadflip, it’s remarkable to me how much of this is based on our ability to inspire and maintain trust. And while “trust” sounds like a subjective term, building it is highly tactical.

It’s a solid read with a lot of specific examples. He covers:

- CREATE A MANAGED ENVIRONMENT

- Actionable rating systems.

- Carefully curated content.

- A human system that learns like a machine.

- Focus on supply.

- INVEST IN YOUR INTERFACE

- The Mobile Imperative

- Frictionless Payment

- A Good First Impression

- PROVIDE SOCIAL PROOF

You can read the blog here.

Lessons Learned Scaling Airbnb 100X

Jonathan Golden (ex-Airbnb) shares his 5 lessons as the first product manager at Airbnb.

On my first day at Airbnb, in early 2011, I walked in to see cofounder Joe Gebbia building my desk. I had spent three months slowly convincing the fledgling startup that they needed what was called a product manager.

These are the 5 points.

- When jumpstarting a marketplace, set super specific goals — then do whatever it takes to get there.

- Be willing to take a risk to serve your community.

- When competition appears, move faster than you think you possibly can.

- When it comes to edge cases, understand your tipping point (because they’ll bury you at scale!).

- When the fires are out, don’t rest. Focus on streamlining the user experience.

Read the blog for the details.

The ingredients for a successful marketplace

Josh Breinlinger talks about what makes a marketplace work.

People look at the success of an oDesk or and Uber and think, “I’m going to build the Uber of _______” and they fill in the blank with any category from construction rentals to lactation consultants. But, not all marketplaces will work. You need certain ingredients in an industry to have the potential for a successful marketplace.

He sets out 5 factors.

- Ingredient #1 – Recurring Usage

- Ingredient #2 – Irregular Usage

- Ingredient #3 – Standardized Work

- Ingredient #4 – Little Trust Required

- Ingredient #5 – Non-monogamous Relationships

You can read the blog here.

The Three Stages of Online Marketplaces

A little dated given it is from 2015, but if you are a “marketplace nerd” as Casey Winters, Chief Product Officer at Eventbrite processes in his blog, understanding the evolution of marketplaces can help you to understand building your startup. History may not repeat itself, but it does rhyme.

He saw the evolution as:

- Phase 1: Connect buyers and sellers

- Phase 2: Own the delivery network

- Phase 3: Own supply

Read the blog here.

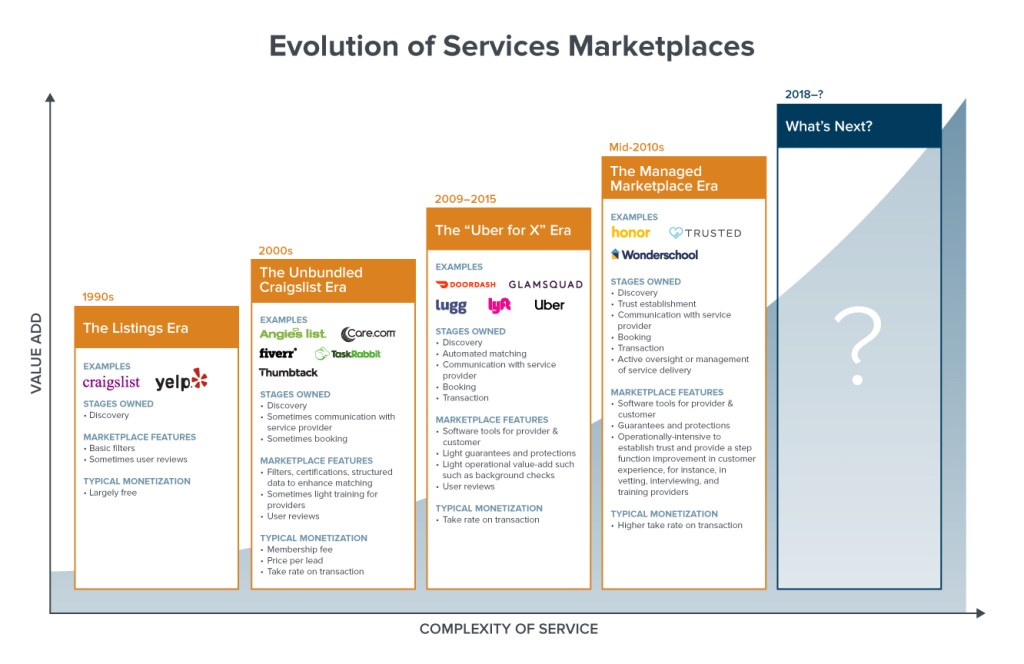

The Evolution of Managed Marketplaces

Back in the day, using the Yellow Pages directory, we found a business and called them over the phone. While Yelp has helped discovery of local businesses tremendously, how you interact with these businesses is still evolving.

5 years from now, do we still expect to be interacting with a business over the phone like we did in the days of Yellow Pages?

Anand Iyer (Trusted) shares his thoughts on the evolution from search-based to full-stack marketplaces where the platform helps manage:

- Customer UX

- Supply software tools

- Retention/frequency

- Transactional model

- Trust/safety/risk

- Pricing, management, and guidance

The Next 10 Years Will Be About “Market Networks”

James Currier at NFX defined the term “market network”.

Market networks will produce a new class of unicorn companies and impact how millions of service professionals will work and earn their living.

He covers 7 points.

- Market networks target more complex services

- People matter – complex services mean each client is unique and not interchangeable

- Collaboration happens around a project

- There’s unique profiles of people involved

- Long term relationships between participants

- Referrals flow freely

- Increases transaction velocity and satisfaction.

You can read the blog here.

What’s Next for Marketplace Startups?

In 2018, Li Jin and Andrew Chen at a16z share how services marketplaces have evolved.

They end with 5 strategies to unlock industries:

- Making discovery of licensed providers easier

- Hiring and managing existing providers to maintain quality

- Expanding or augmenting the licensed supply pool

- Utilizing unlicensed supply

- Automation and AI

Defining market liquidity

When we started Delivery Hero, naturally the sales guys just wanted to sign any and all restaurant to hit their targets. But that makes no sense at a company level. We had to have an approach to be efficient in our efforts.

I created min/max number of restaurants and category types within catchment areas. I thought of it as distributed value density.

Defining these are not always simple as you build a marketplace.

Liquidity is a crucial metric for all marketplaces. But how can we truly evaluate this liquidity? The three keys to answering this question are density, appropriately balanced demand and supply and category concentration.

Read thoughts on defining marketplace liquidity here.

Four Strategies to Win Big with Low Frequency Marketplaces

Casey Winters, Chief Product Officer at Eventbrite shares thoughts on how to make a marketplace work when you have low purchasing frequency.

So, if you’re building a low frequency business, do not dismay. There are many paths to still becoming a very large and differentiated business. These strategies are difficult but very rewarding if they are executed well.

The four strategies are:

- The Expedia Model (AKA SEO)

- The Airbnb Model (AKA Better, Cheaper)

- The HotelTonight Model (AKA Insurance)

- The Houzz Model (AKA Engagement)

You can read the blog here.

Key learnings from TaskRabbit

Well, many have heard of TaskRabbit, but it was a bit of a dumpster fire, albeit acquired by IKEA.

This blog on some learnings.

- Fixed pricing improves conversion by increasing purchase frequency & volume

- Faster transactions win in the world of on-demand labor

- Vertical-specific platforms enable scale-based efficiencies & improved user experience

- Margins are pressured from both sides, so a VC buffer helps

- Reputation systems (reviews, star ratings) are key to marketplaces, but work best on tasks where success is clear cut

- Gig economy verticals follow a power law

You can read the blog here.

54 questions on marketplaces, from 0 to €100m GMV

Marie Brayer at Serena Capital has written an extensive series of blogs on questions founders should ask themselves.

You can read the blog here.

Defensibility x Scalability = The Marketplace Matrix

Sameer Singh writes about network effects. You might like to check out breadcrumb.vc. In this blog he sets out how some marketplaces have structural advantages which drive a higher valuation multiple.

You can read the blog here.