I have only ever come across one broker note, or super in depth ecommerce analysis on Asia. This is it. It’s a 64 page deep dive into the prospective eCommerce market in ASEAN put together by an acquaintance of mine, and all-round super nice chap called Raymond Maguire, who left UBS just after it was composed. A year or so later, I hope they don’t mind me sharing it 😉

For anyone in, or looking at the market, there is a wealth of information to be consumed. A number of smart, ‘local’ friends were involved in supporting this research, and thought I would put it out there so that more people can benefit from the great work UBS and others made.

The Executive Summary

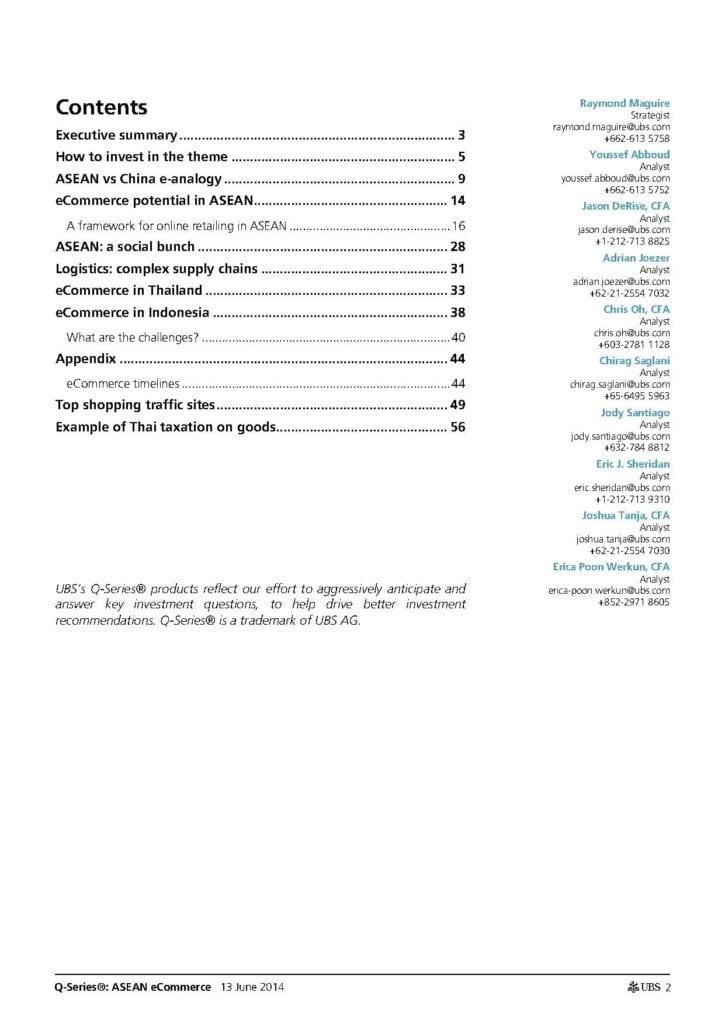

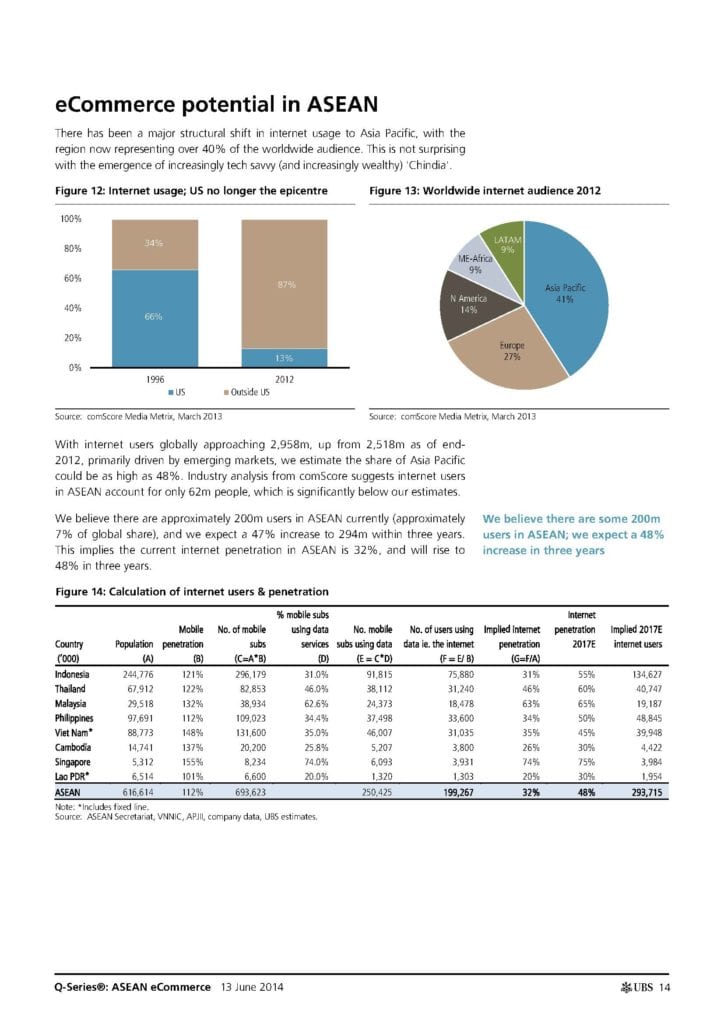

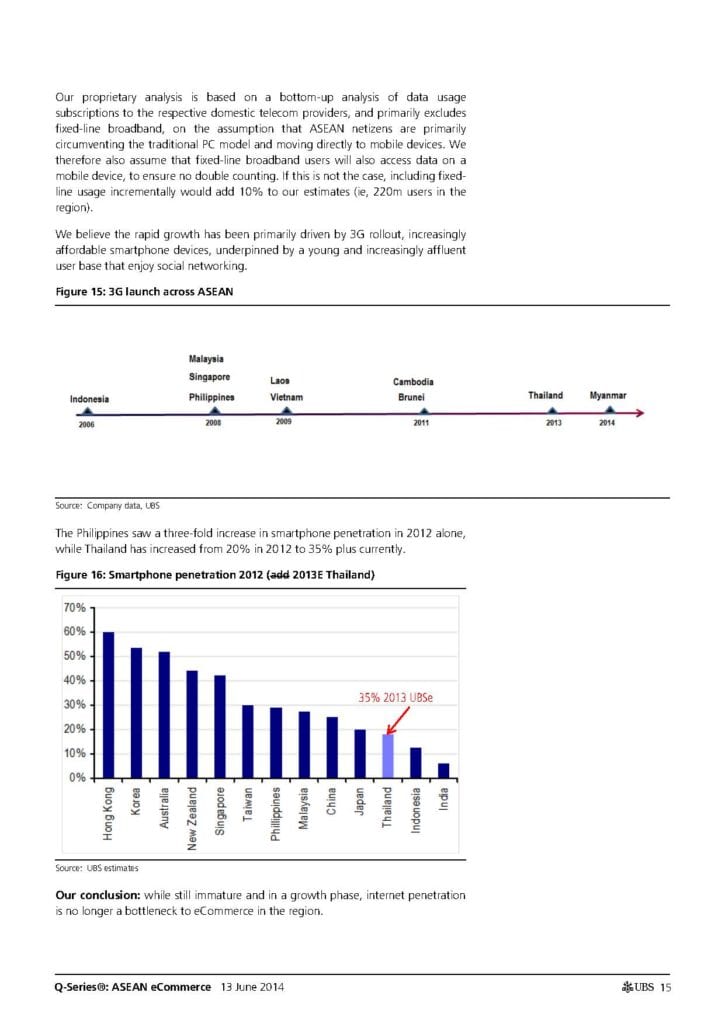

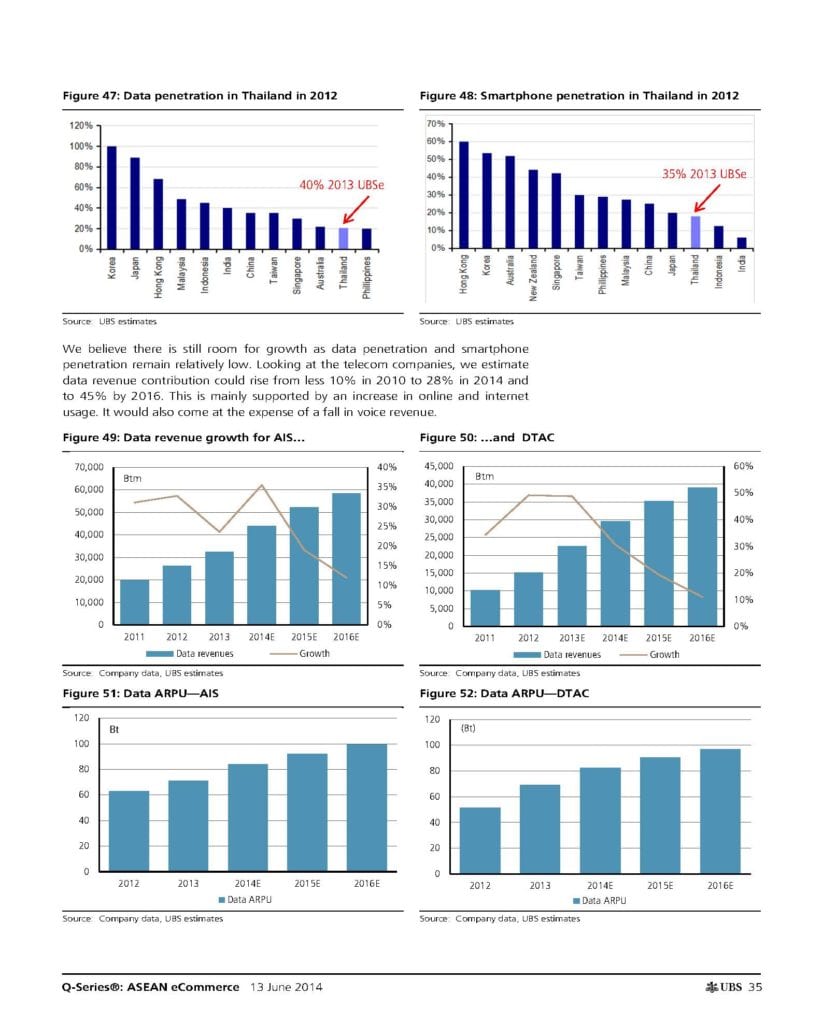

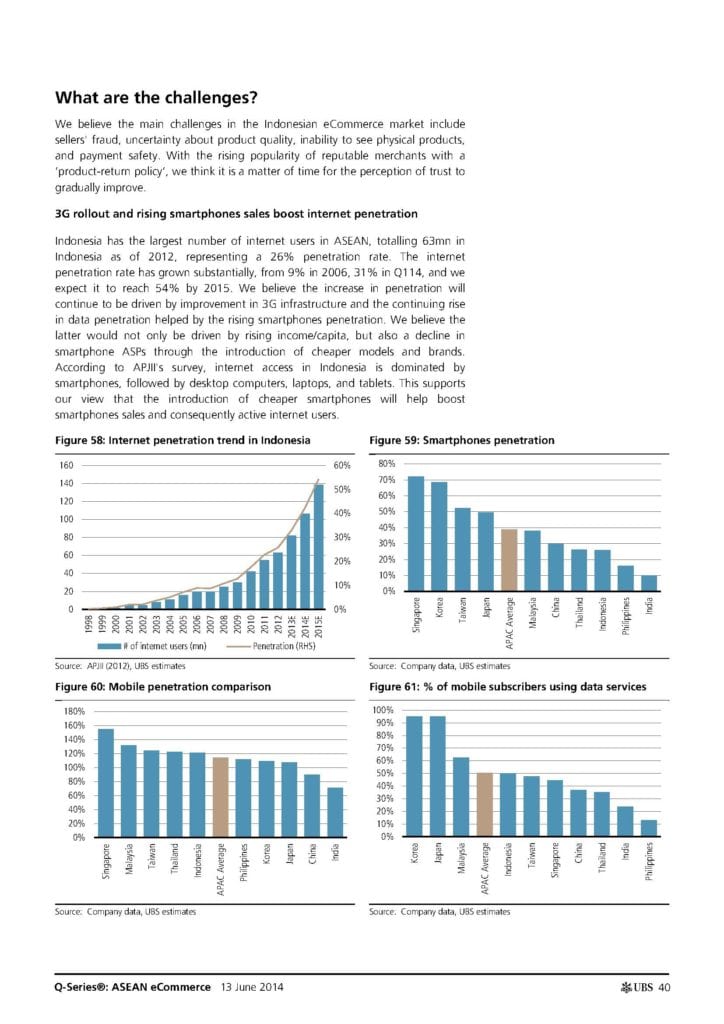

- ASEAN has reached its ‘mobile moment’, with the majority of internet traffic coming from mobile devices; the traditional PC model has been circumvented with the rollout of 3G and more affordable devices, in our view. Smartphone sales volume in Q114 in Indonesia, Vietnam and Thailand increased 45-68% YoY.

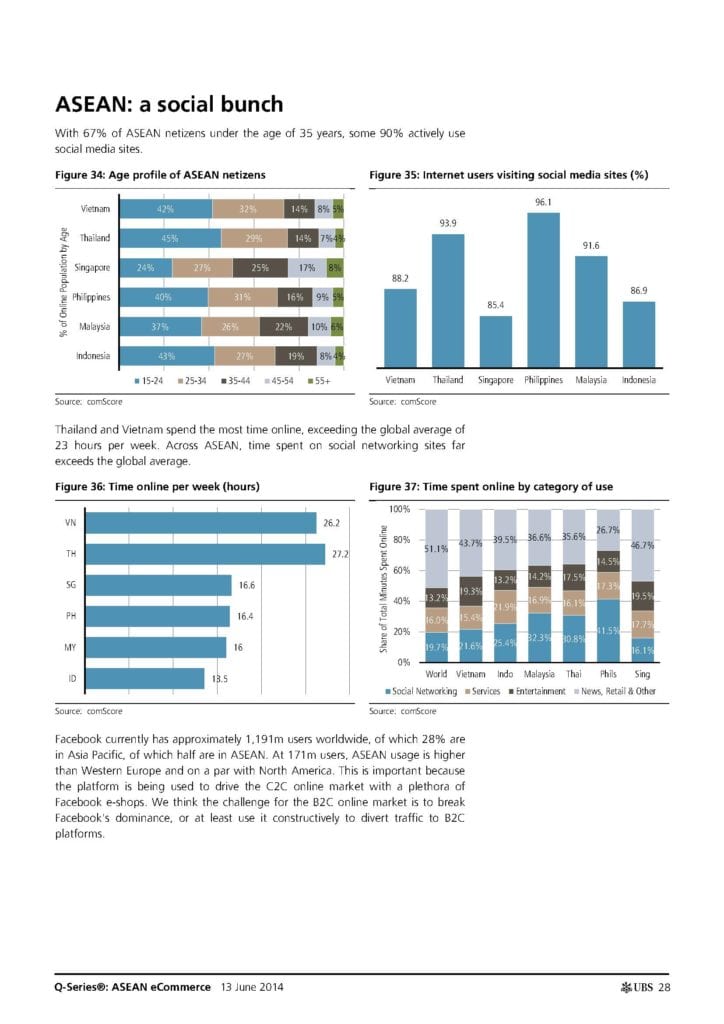

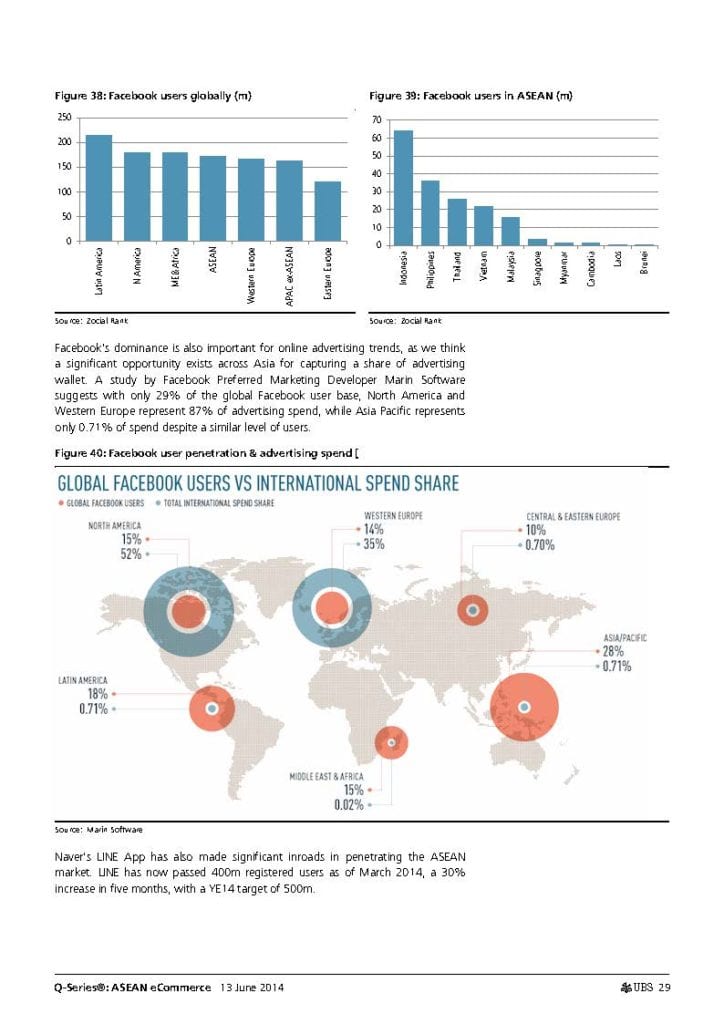

- Our analysis suggests ASEAN has 199m internet users (32% penetration), 177m Facebook users and 180m active social netizens. We expect internet penetration to increase to 48% within three years.

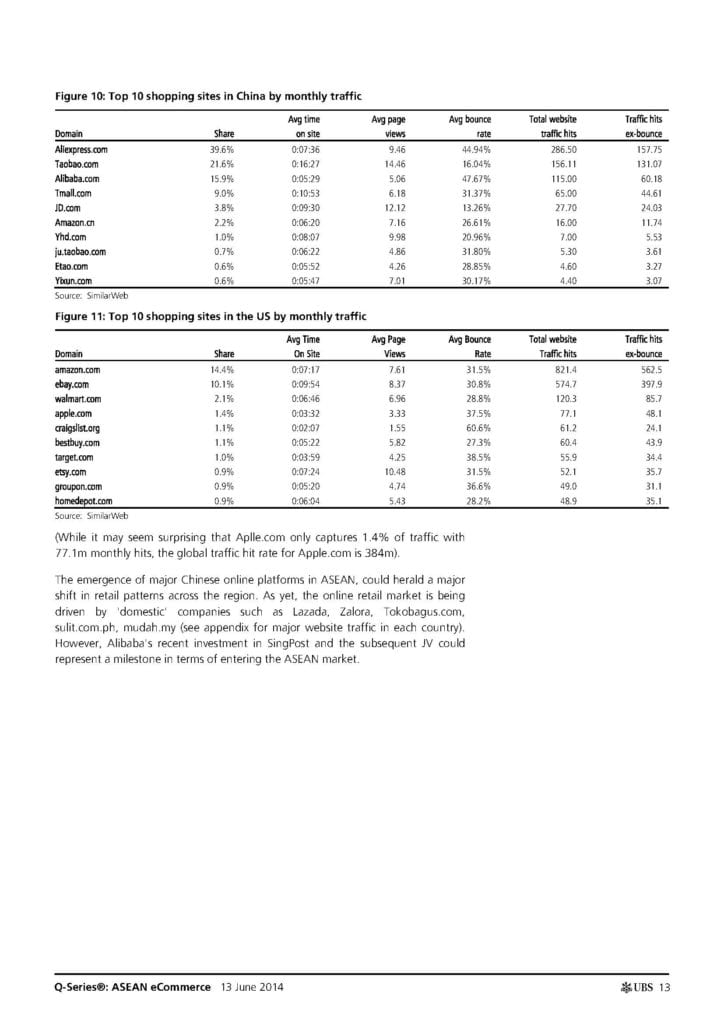

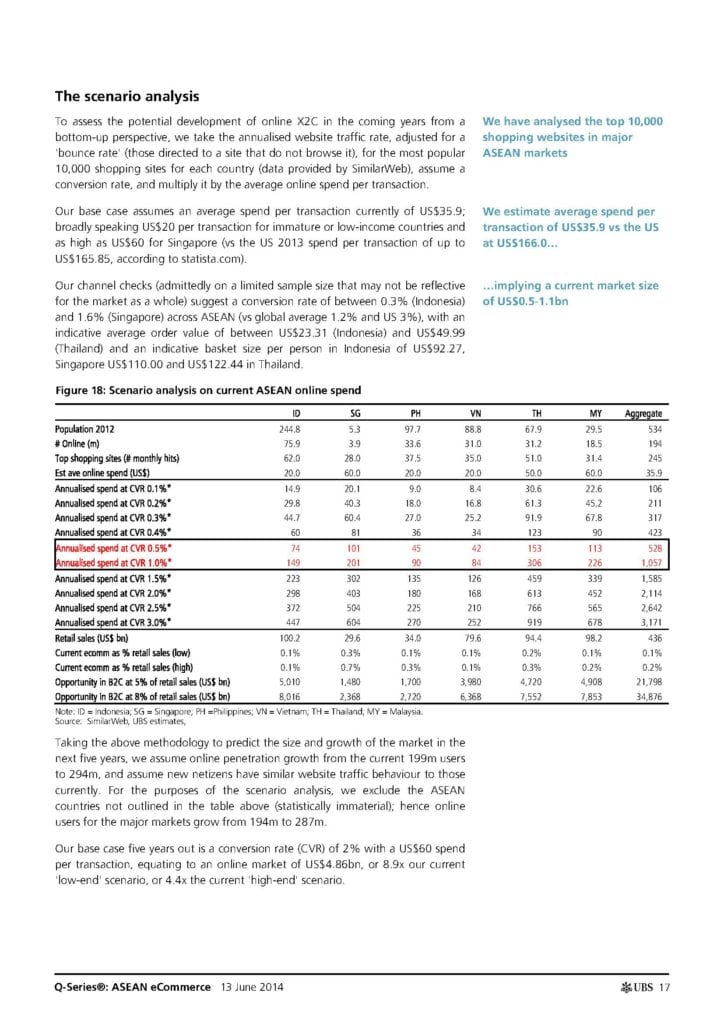

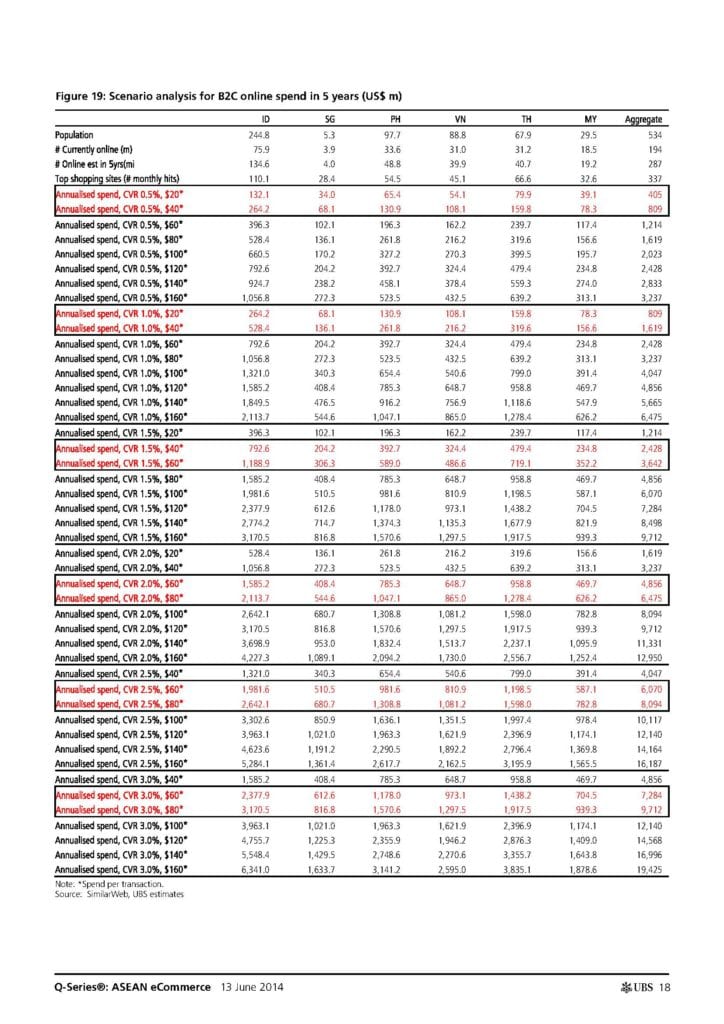

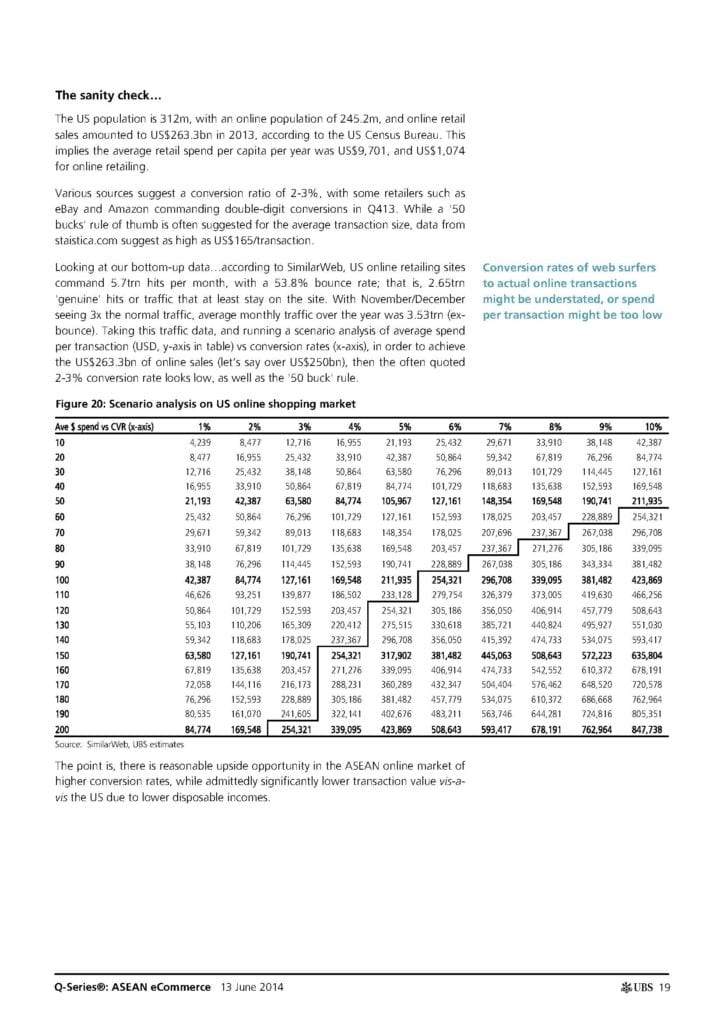

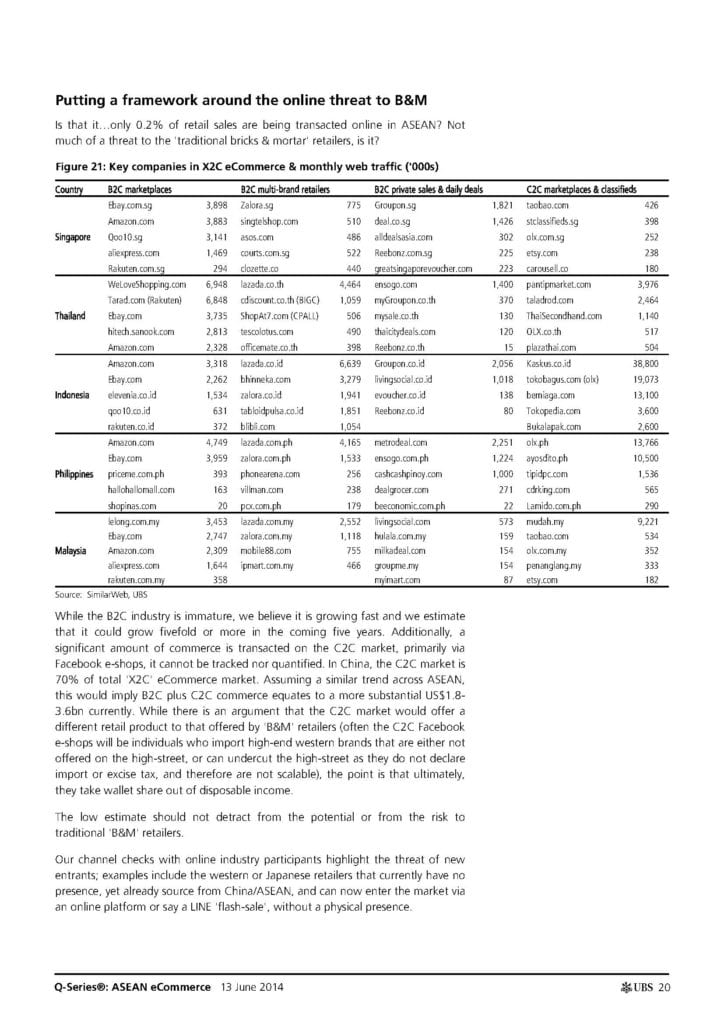

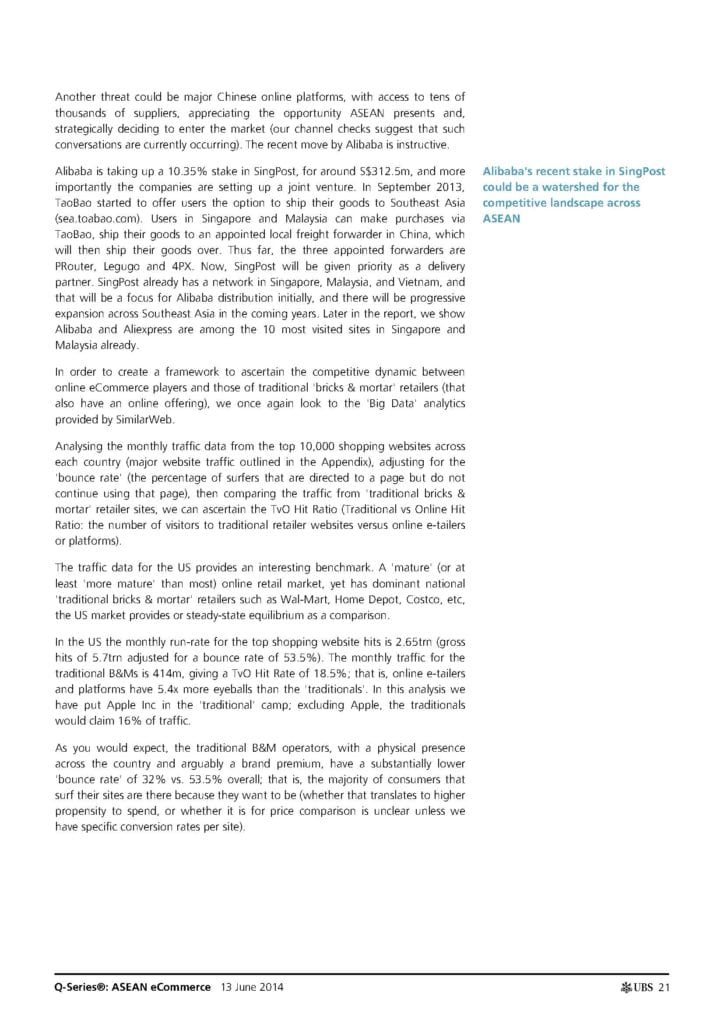

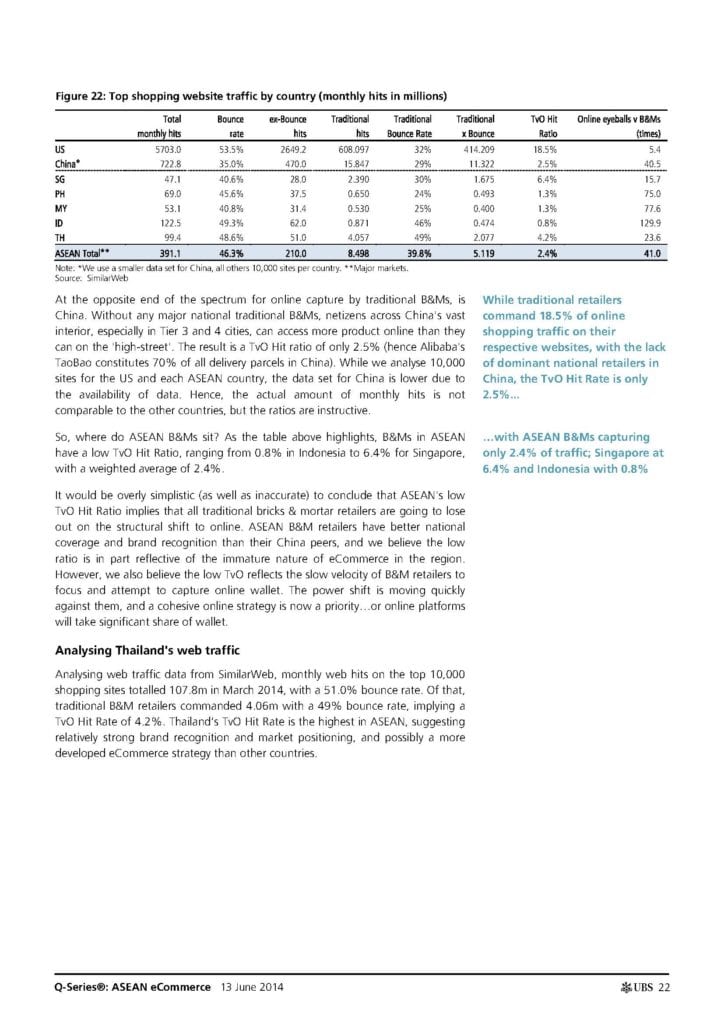

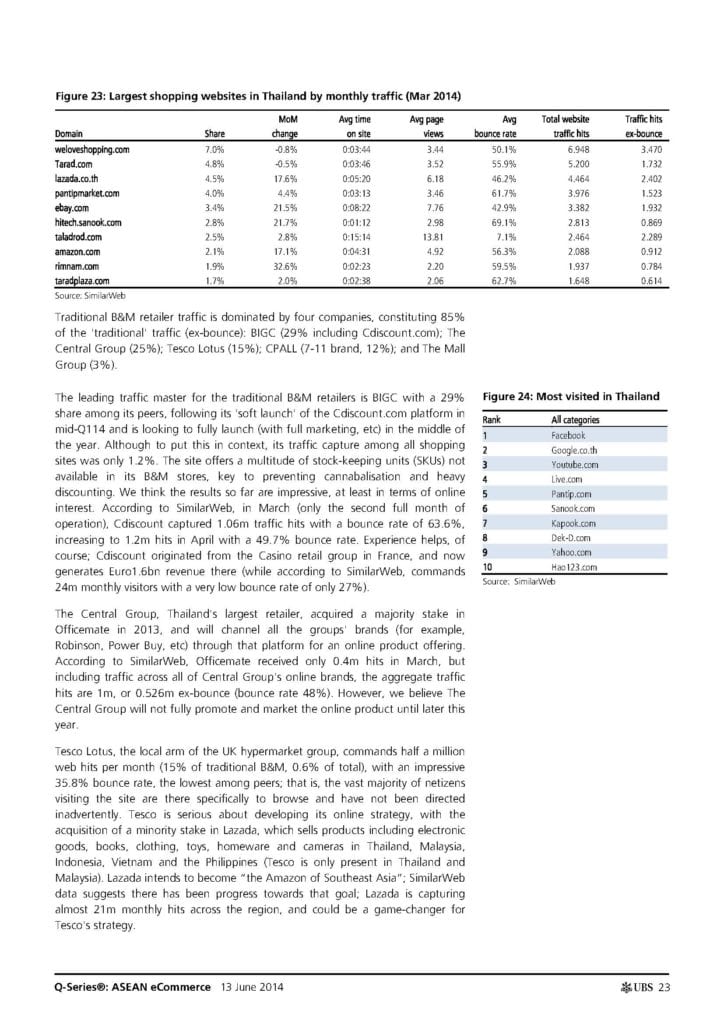

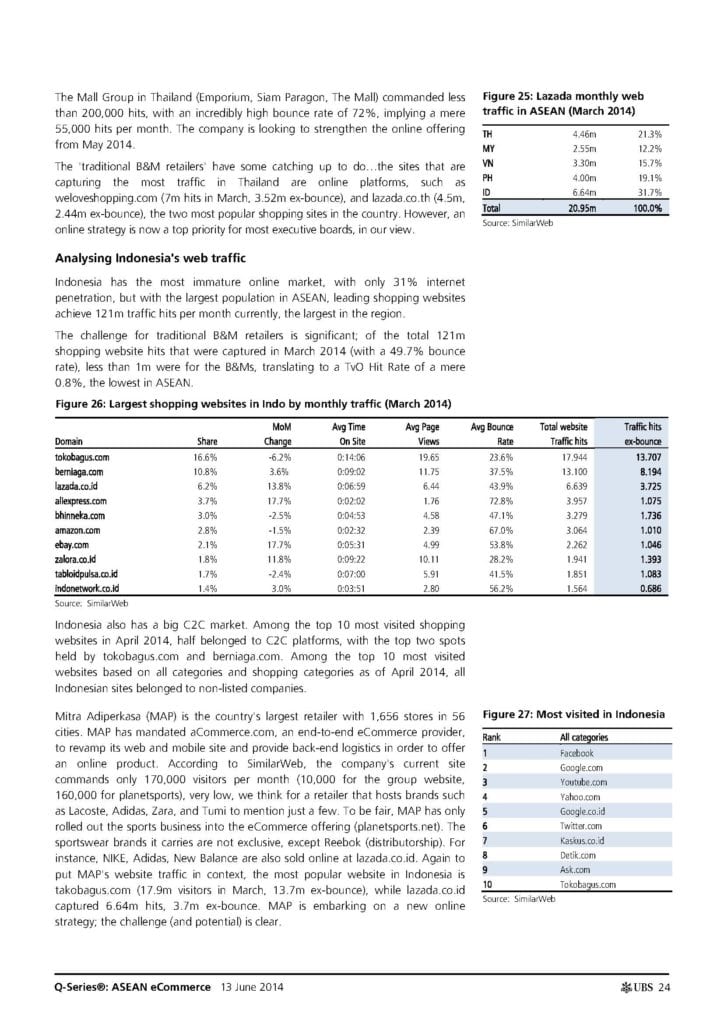

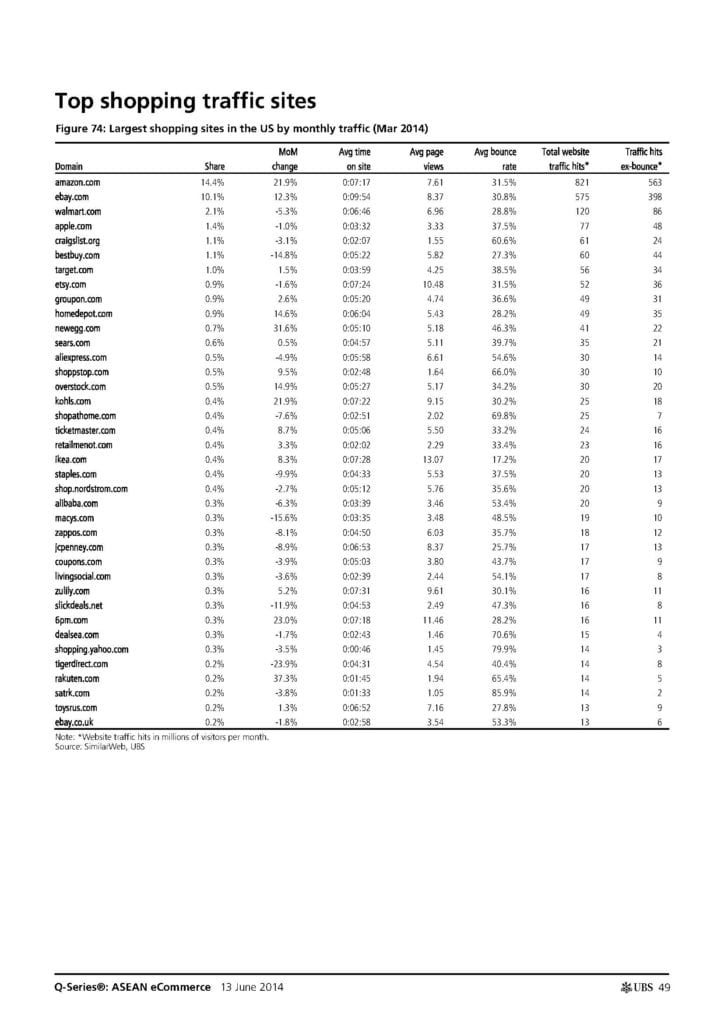

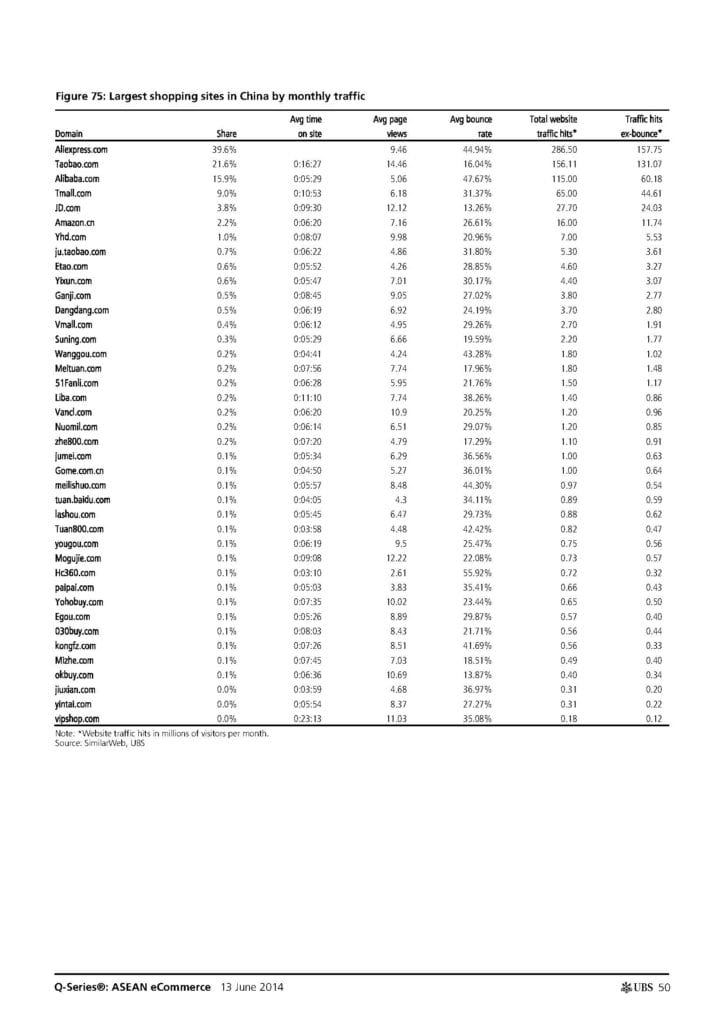

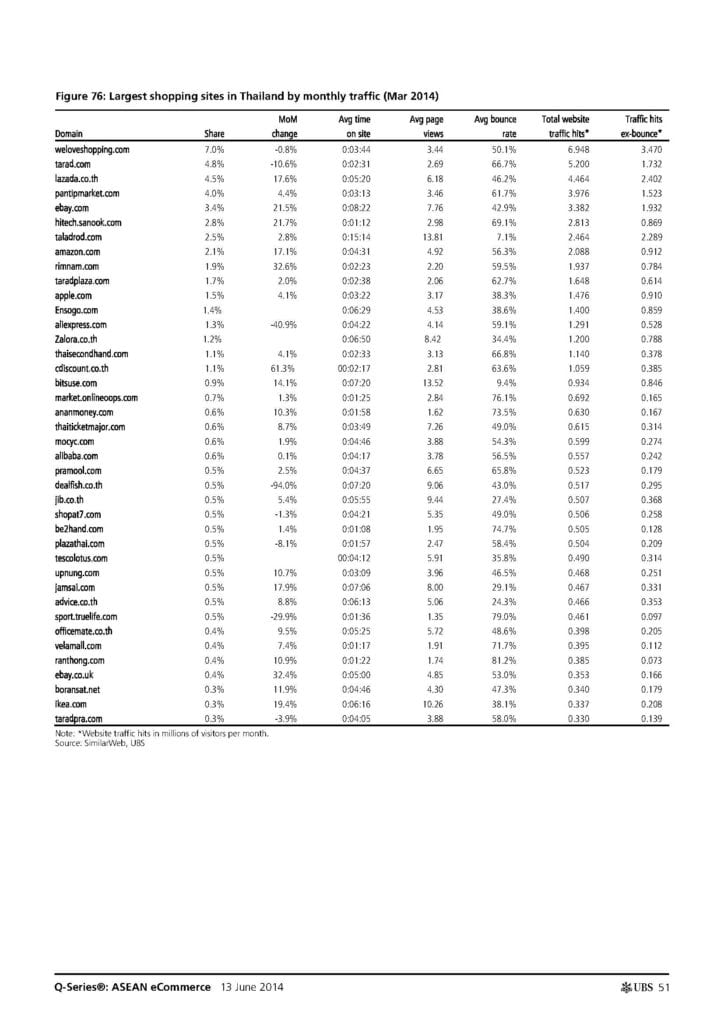

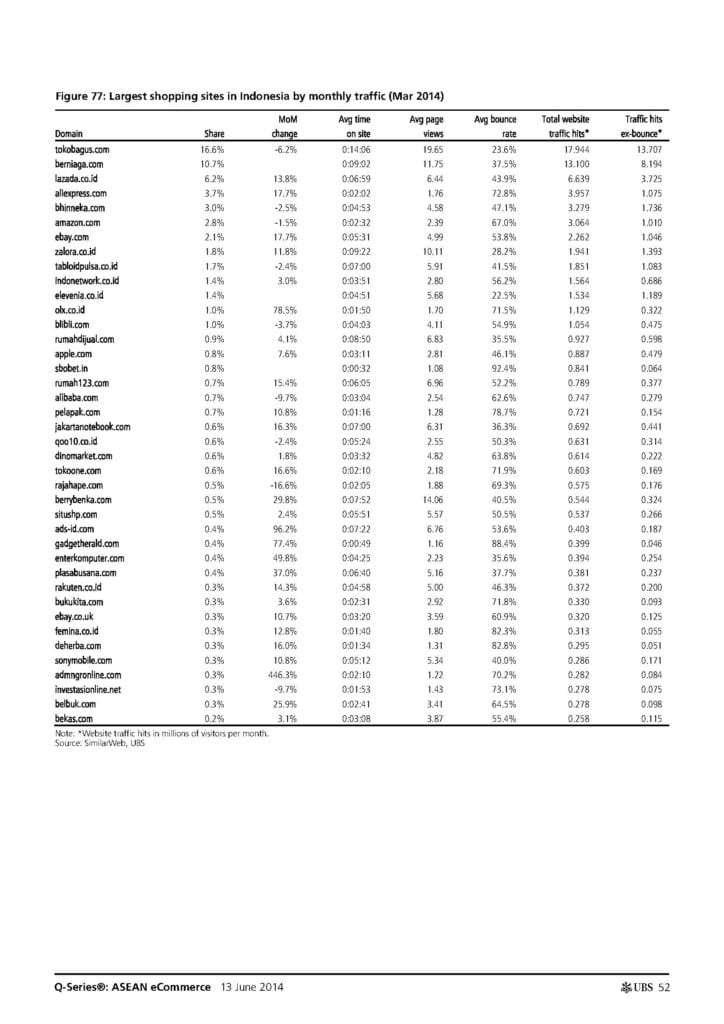

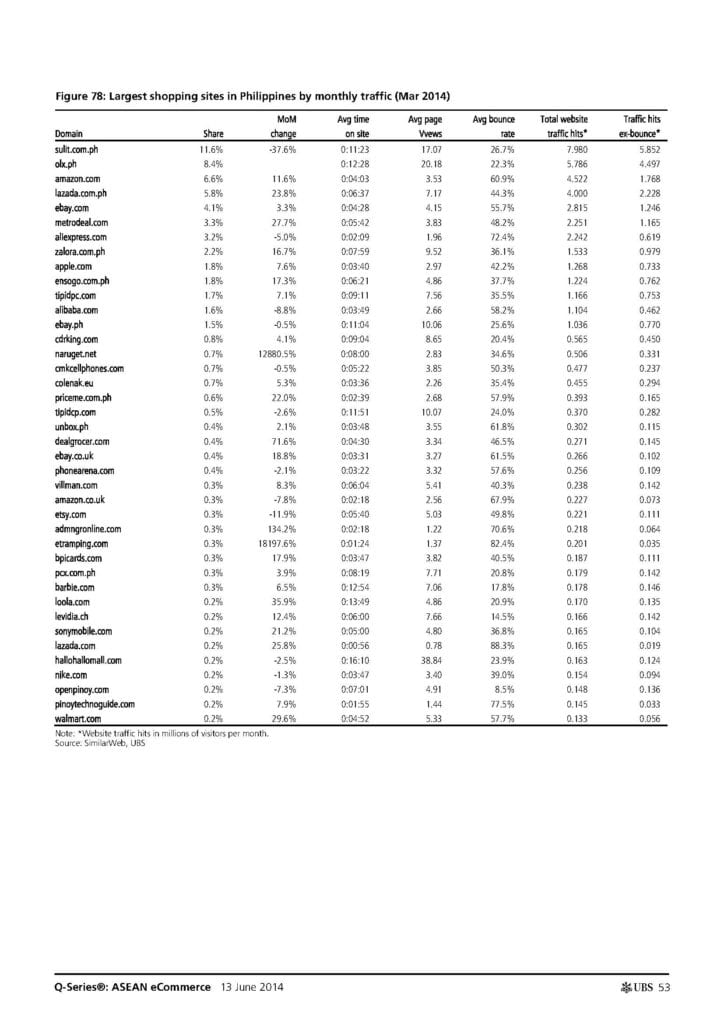

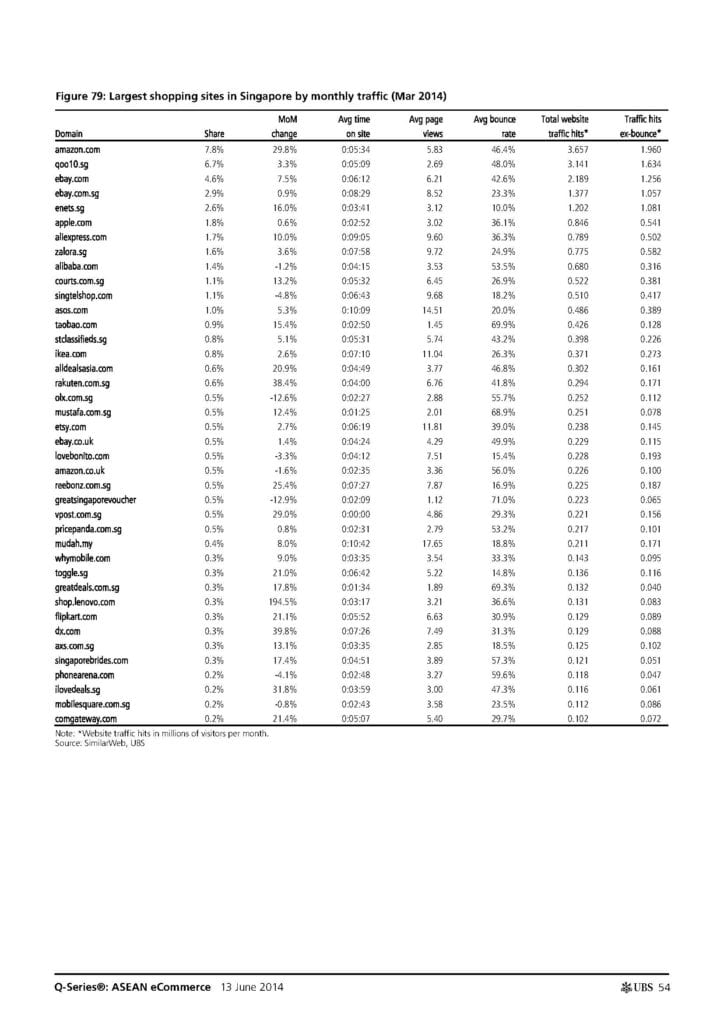

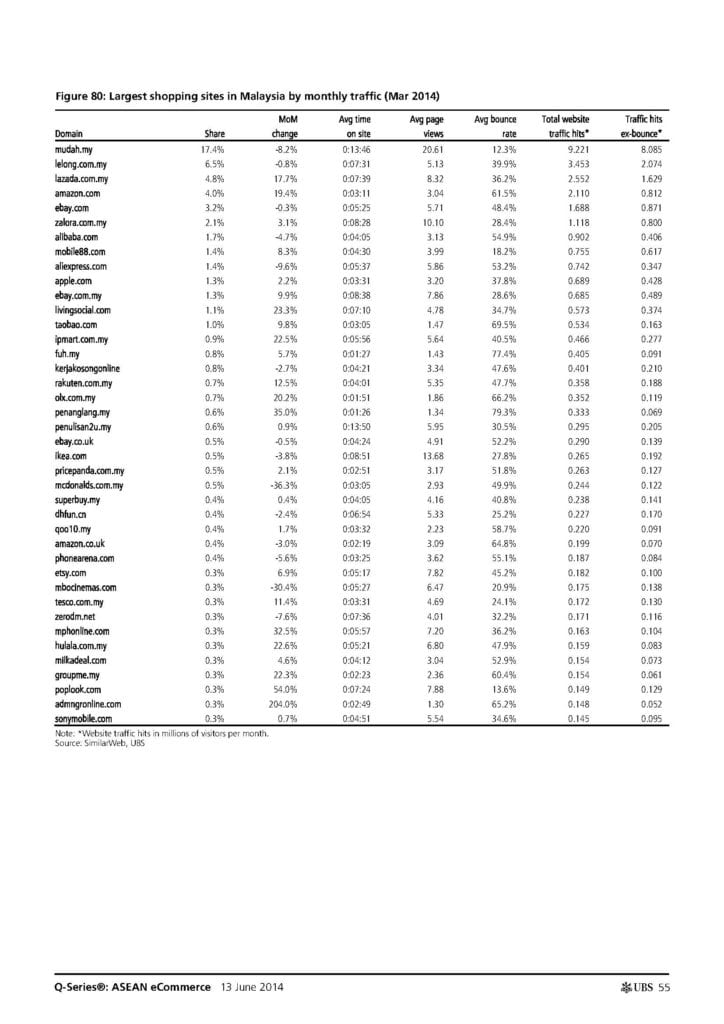

- Based on our proprietary analysis using ‘Big data’ algorithms from SimilarWeb.com, we have been able to assess traffic data from the top 10,000 shopping websites in each ASEAN market. The monthly shopping website traffic run-rate as of March 2014 was 391m hits in ASEAN (vs China 723m), with an average ‘bounce rate’ of 46.3% (US average 53.5%, China 35%), implying browsing traction on 210m hits per month. Traditional ‘bricks & mortar (B&M)’ retailers achieved only 5.1m hits (ex-bounce), implying a ‘B&M’ Traditional vs ‘Online Platform’ Hit Ratio (TvO Hit Rate) of 2.4%; that is, online e-tail platforms achieved 41x the number of browsers relative to B&Ms. The TvO Hit Rate for the US is 18.5%, a benchmark not only reflecting a more mature online ecosystem but also the dominance of B&M retailers such as WalMart. In contrast, in China where no national dominant B&M retailer resides, the TvO is 2.5%. An ASEAN TvO of only 2.4% suggests the balance of power is tilting towards the online platforms, and the traditional B&M companies are ill prepared for the structural shift. It has to be a priority for traditional B&M retailers to have a cohesive online strategy and leverage their superior brand awareness (B&M retailers have a lower bounce rate of 39.8% in ASEAN), …or the platforms will continue to take market share (Aliexpress, Taobao, Alibaba & Tmall constitute 86.1% of all online shopping hits in China).

- Singapore is the richest and has the highest internet penetration in ASEAN. With an easily accessible, quality traditional shopping experience and ‘mall culture’, traditional B&M retailers may feel less risk of online cannibalisation. A TvO Hit Rate of 6.4%, the highest by far in ASEAN, implies a retail model that is more suited to ‘traditionals’, but we think they should not be complacent. Qoo10.sg, the B2C online platform formed between Giosis Pte and eBay, captured an estimated 5m website hits in April alone, a 141% increase monthon-month (ex-bounce), with the average time spent increasing from 5 minutes to 12 minutes. eBay.com.sg traffic increased 45% month-on-month in April.

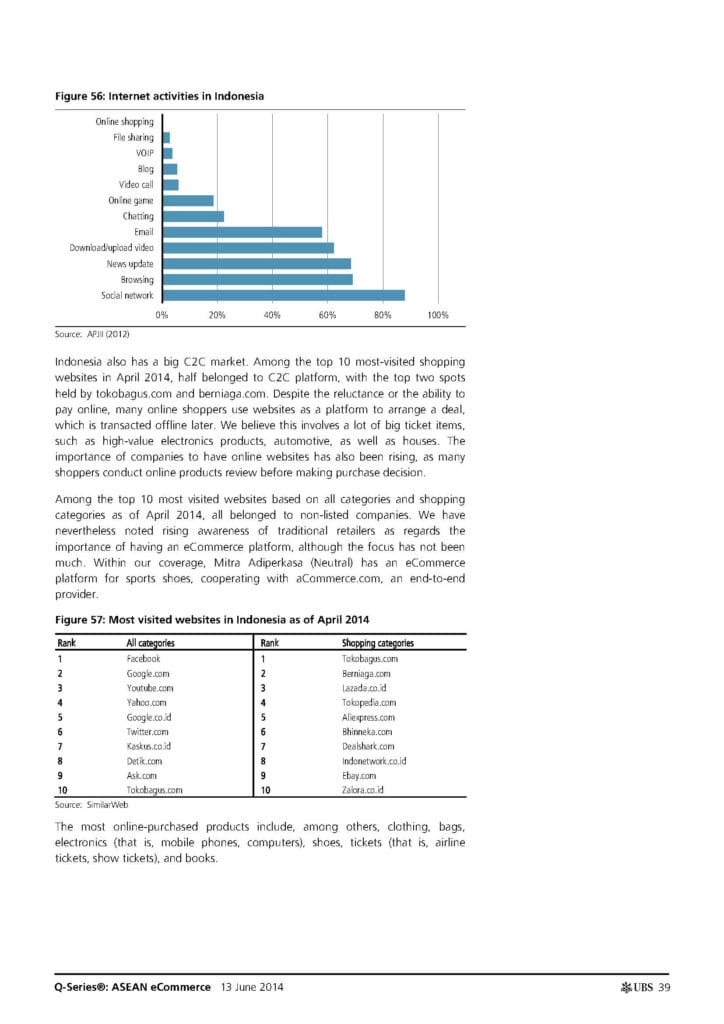

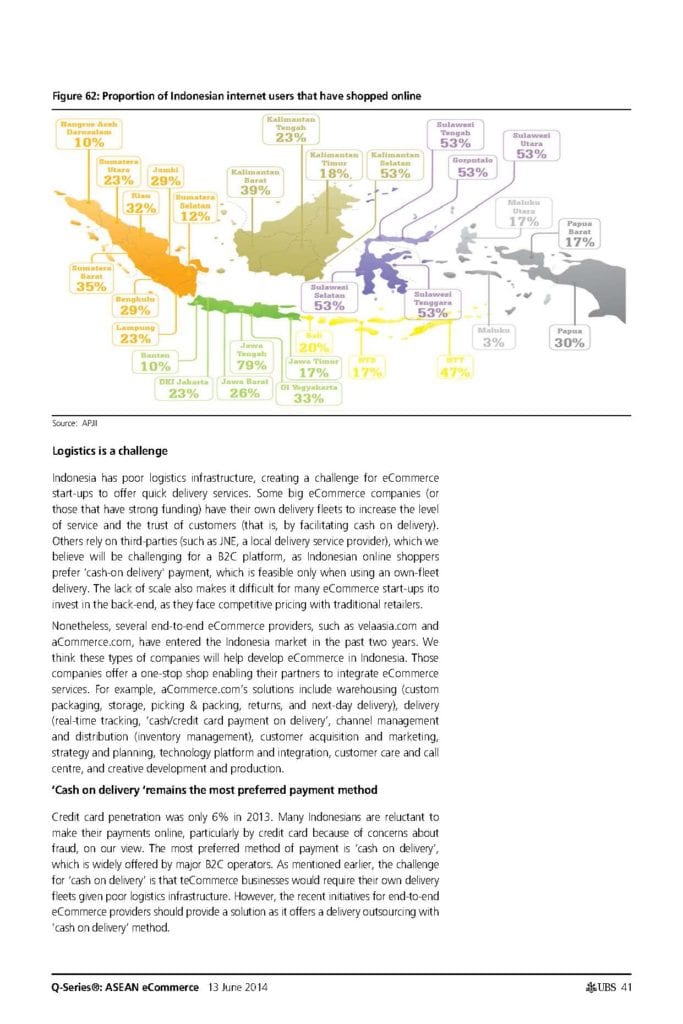

- Indonesia has the most immature online market, with only 31% internet penetration, yet has the most growth potential. Traditional B&M retailers received less than 1m hits vs 62m for online platforms in March 2014. Mitra Adiperkasa (or MAP), the country’s largest retailer, recorded only 170,000 hits in March, according to SimilarWeb, very low for a retailer that hosts brands such as Lacoste, Adidas, Zara, and Tumi to mention just a few. To put this in context, the most popular shopping website in Indonesia is takobagus.com (monthly run rate 19.2m), while lazada.co.id had 6.7m per month.

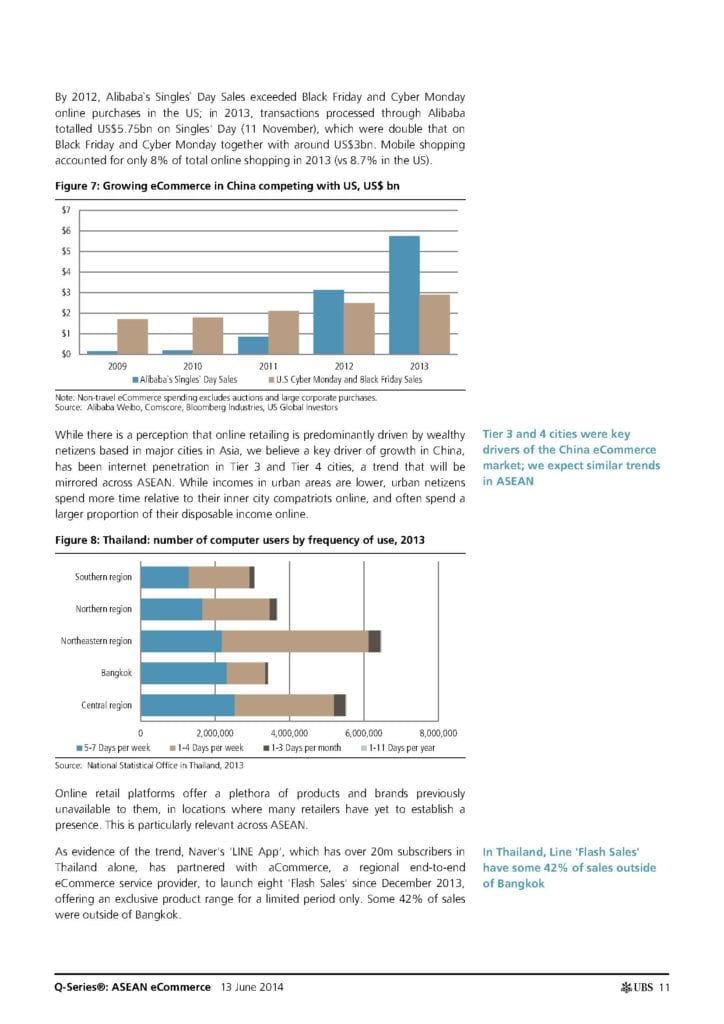

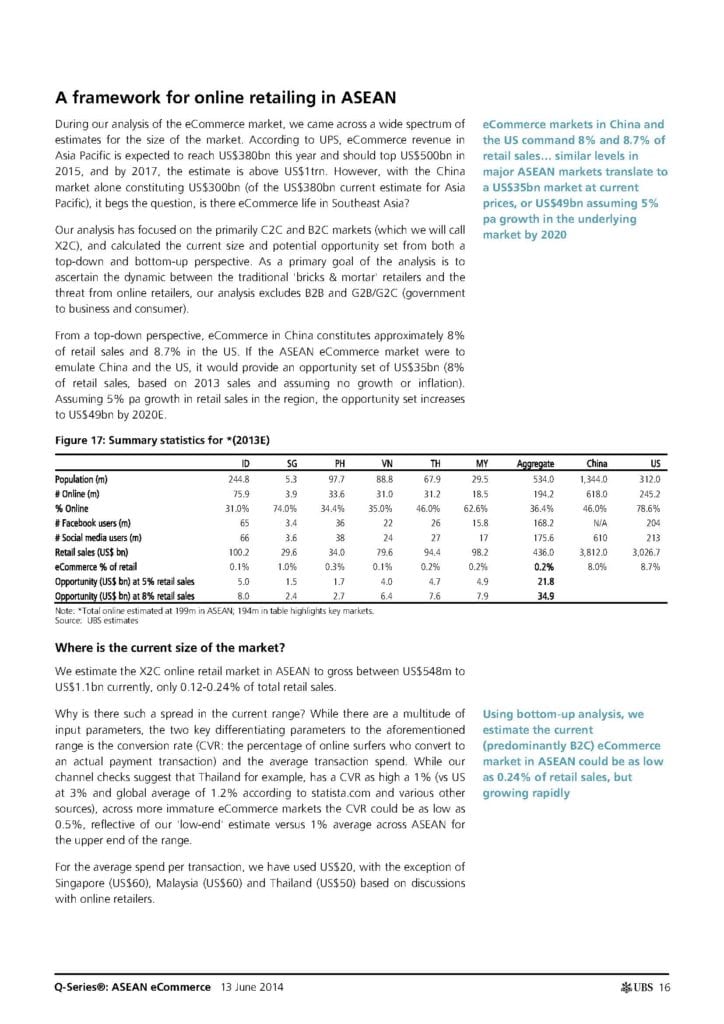

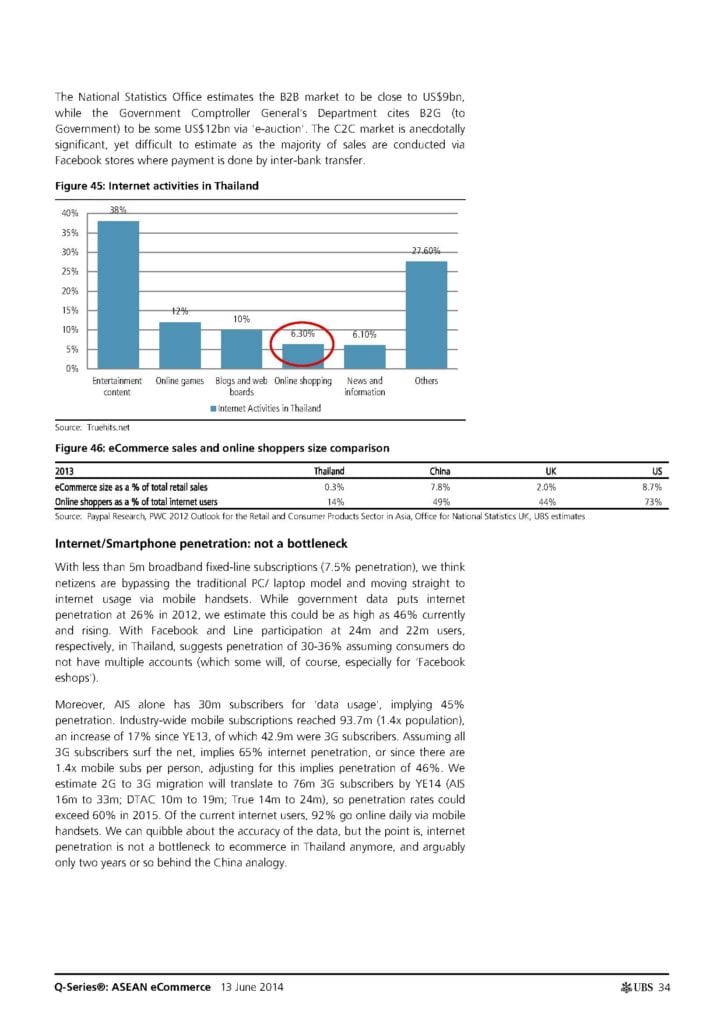

- What is the eCommerce opportunity in ASEAN? Online shopping constitutes 8.0% and 8.7% of retail sales in China and the US, respectively. A similar level of penetration implies a US$35bn market (UBS estimates eCommerce in the US could reach 15.7% of retail sales by 2018, or US$566bn).

- ASEAN, with an indicative average order value of between US$23.31 (Indonesia) and US$49.99 (Thailand) and an indicative basket size per person in Indonesia of US$92.27, Singapore US$110 and US$122.44 in Thailand.

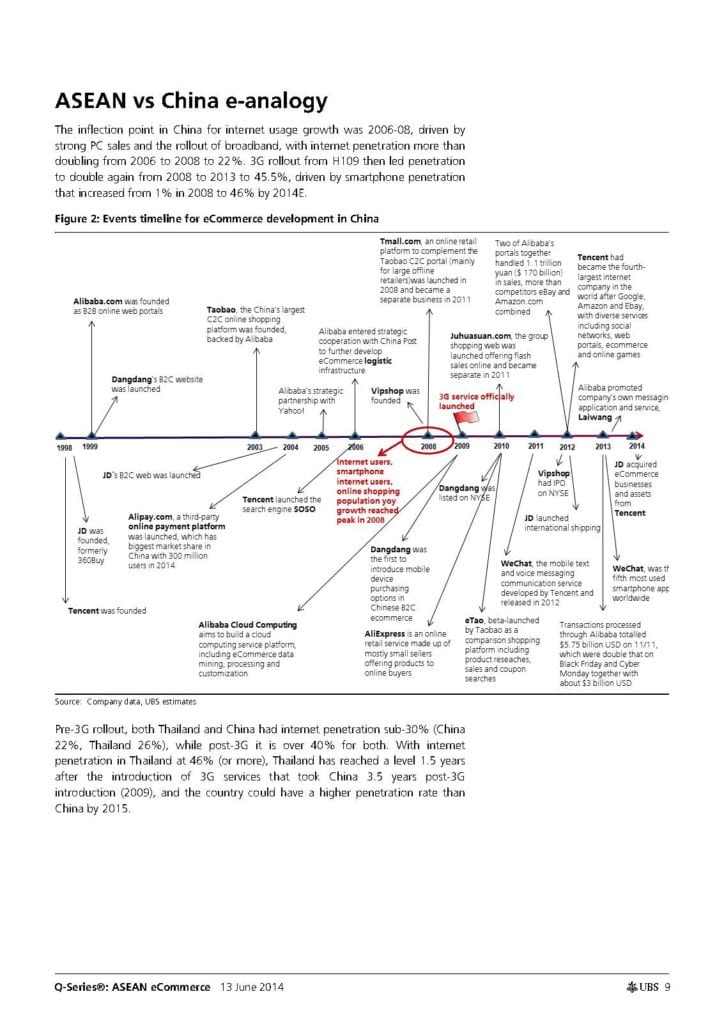

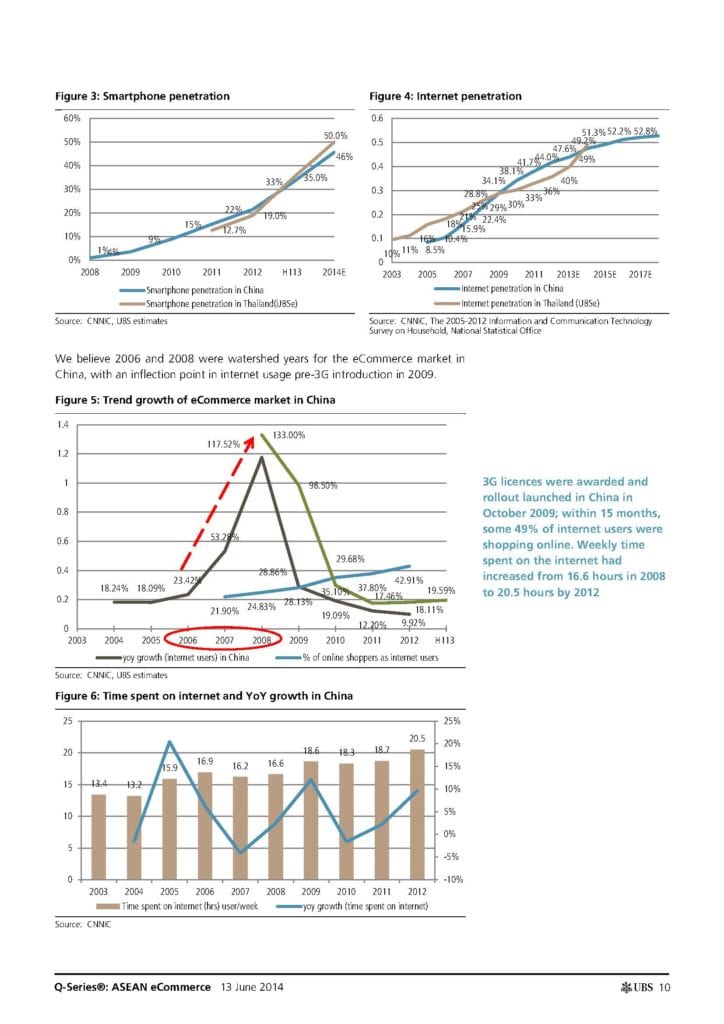

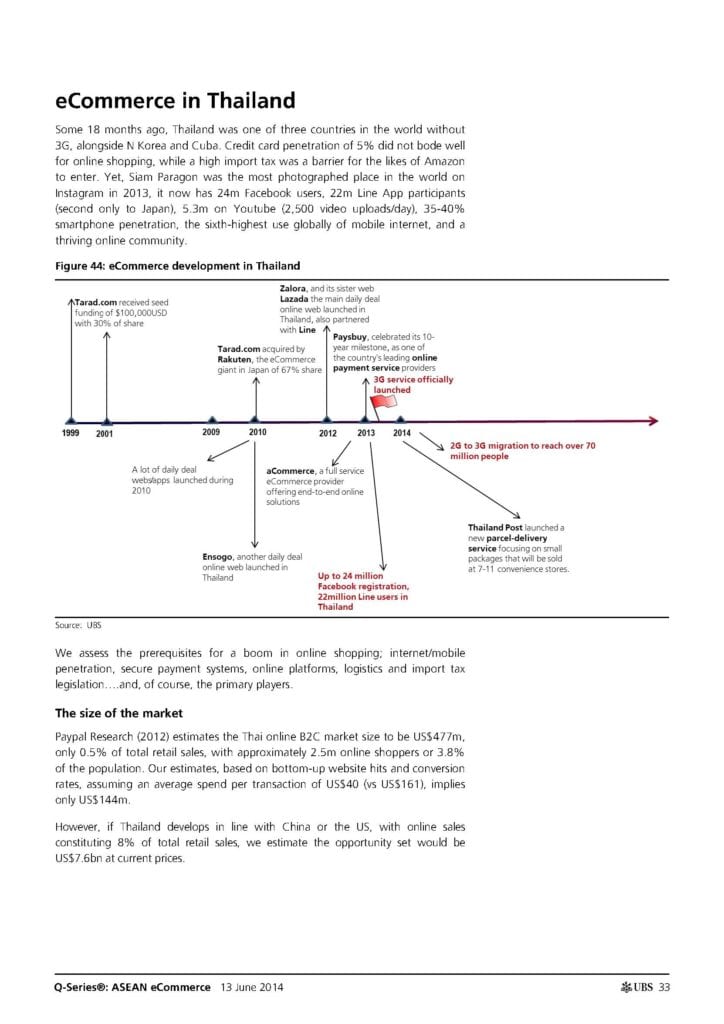

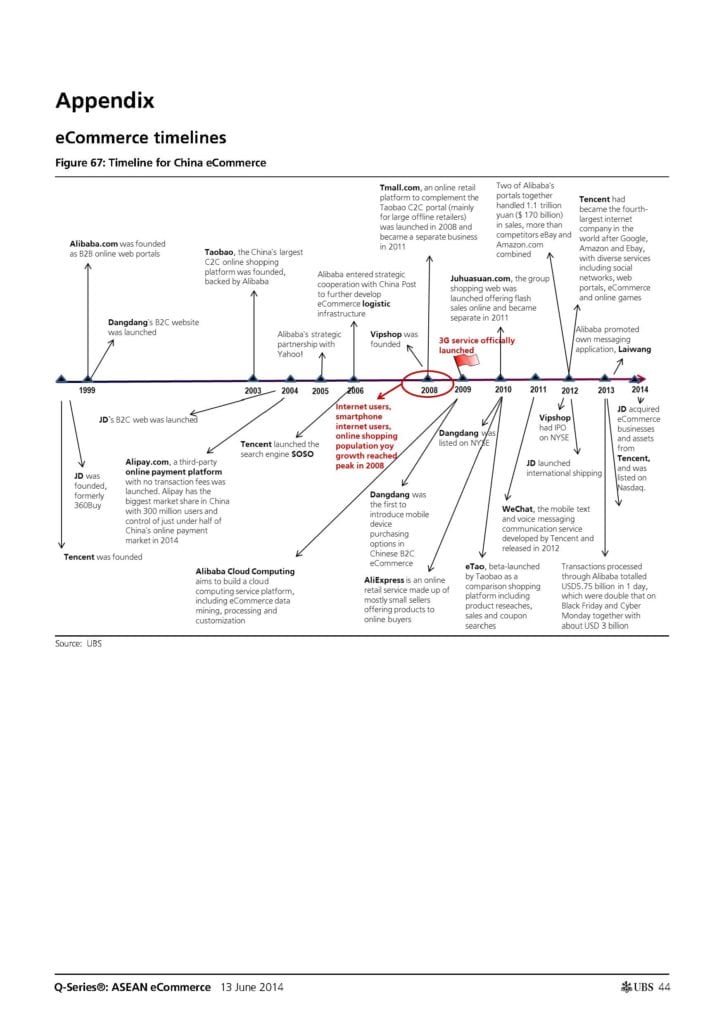

- Analogy with the China e-trend: some 18 months ago, Thailand was one of three countries in the world without 3G, alongside North Korea and Cuba. Now, Thailand has reached a level of internet penetration one-year after the introduction of 3G services, that took China 3.5 years post-3G introduction (2009), and the country could have a higher penetration rate than China by 2015. Of the China e-tail market, 70% is C2C, anecdotally we suspect similarities at this stage with ASEAN.

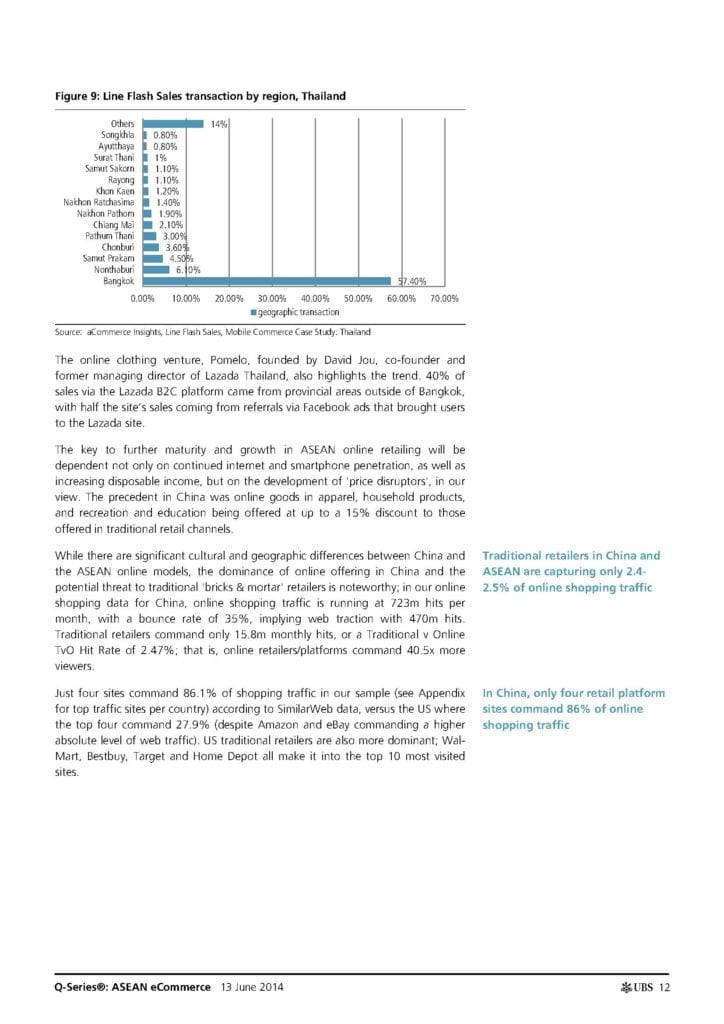

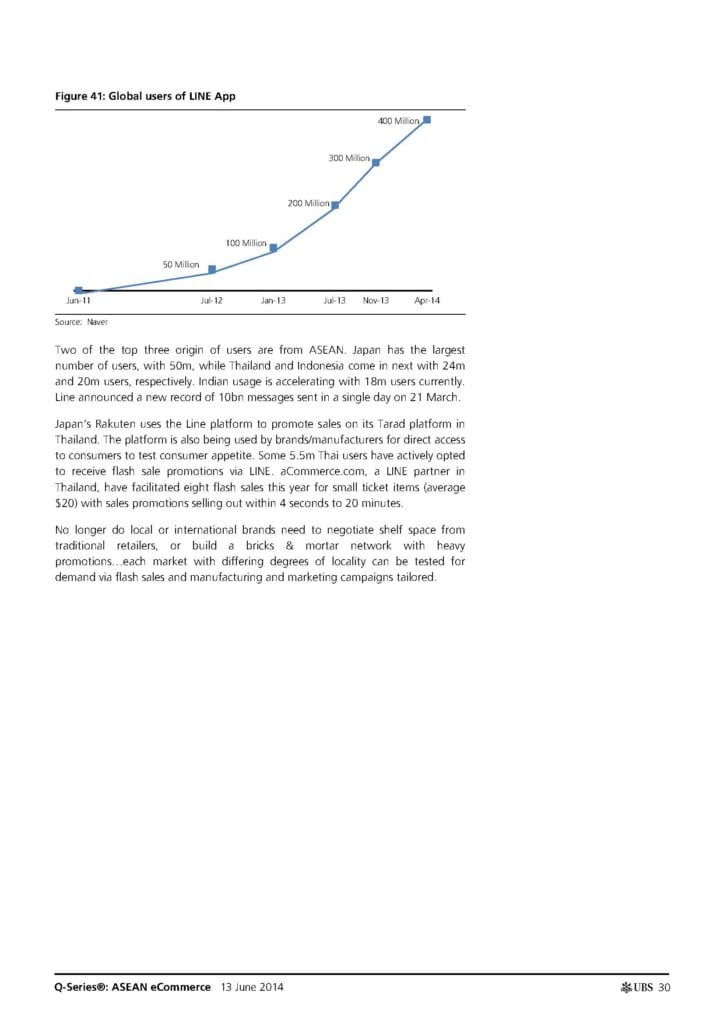

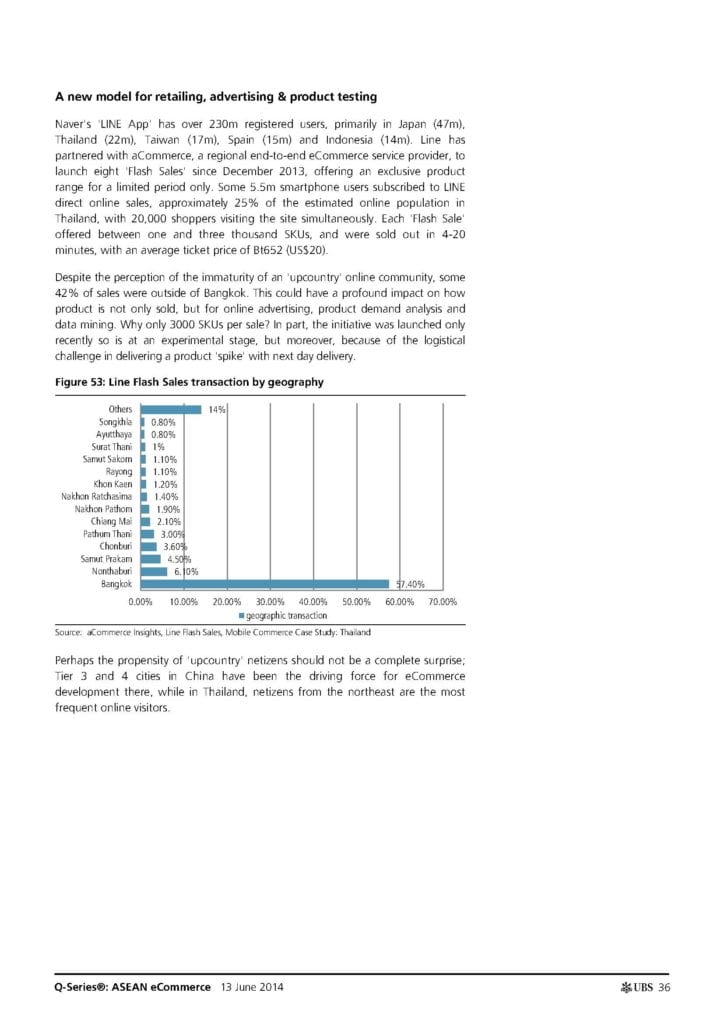

- A key driver of eCommerce growth in China was penetration of Tier 3 and 4 cities that did not have access to products via the traditional bricks & mortar stores. Similar trends are evident in ASEAN. A recent ‘flash sale’ in Thailand via LINE App and facilitated by aCommerce.com, had some 42% of sales outside of Bangkok, despite the perception of the immaturity of an ‘upcountry’ online community. We believe B2C opportunity outside metropolitan areas in ASEAN is significant, and could provide a headwind to the mass expansion plans of traditional ‘bricks & mortar’.

- 67% of the ASEAN online population is under 35 years old; a sociable group, 90% of ASEAN netizens visit social networking sites. Facebook dominates the region. Online retail ‘price disruptors’ will drive conversion.

- Significant potential in advertising share: Marin Software research suggests that 52% of ad spend still takes place in North America, despite the region only accounting for 15% of Facebook users. Conversely, 28% of Facebook users are located in Asia Pacific, but only 0.71% of the overall Facebook ad spend is dedicated there. Internet-based adex in Thailand grew 53% YoY in 2013 against overall market growth of +0.4%, but only accounts for 0.8% of adex.

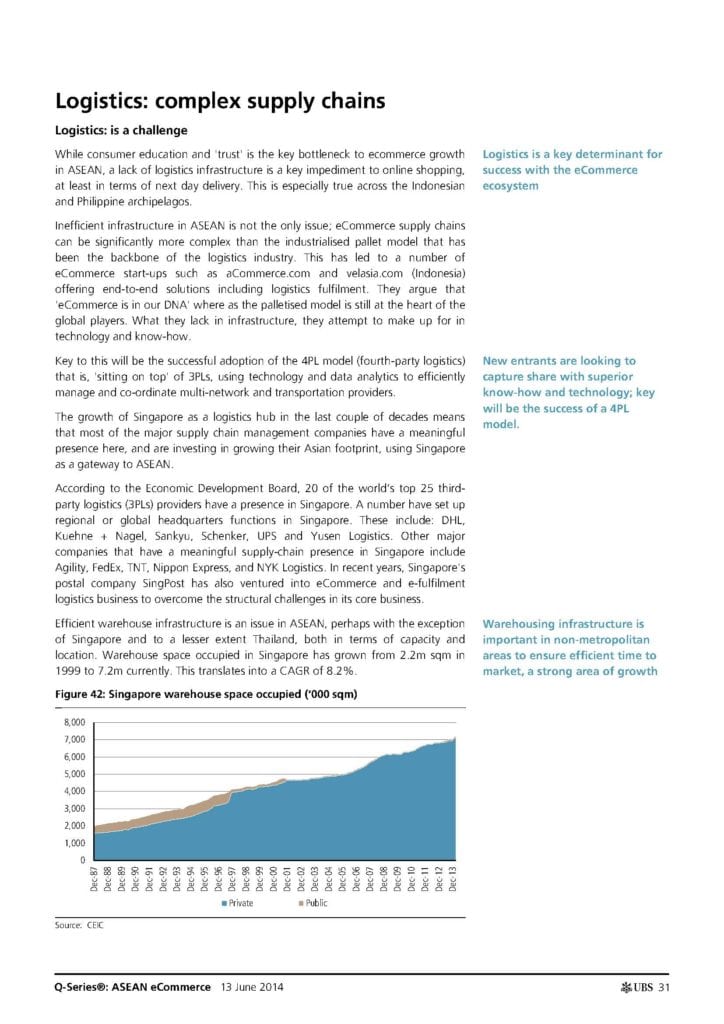

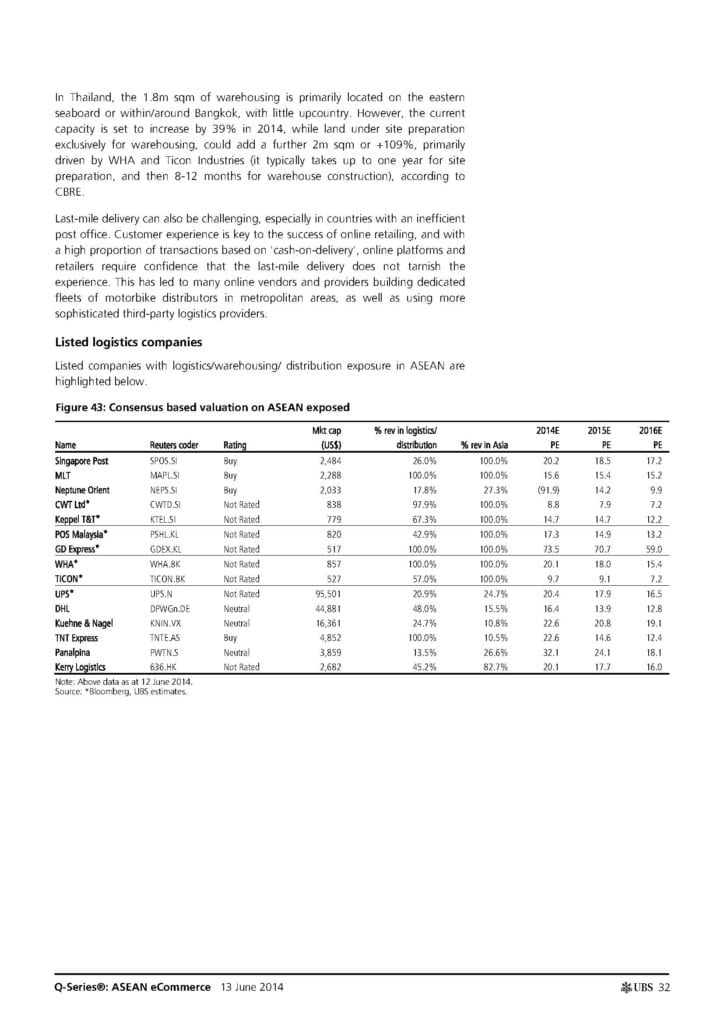

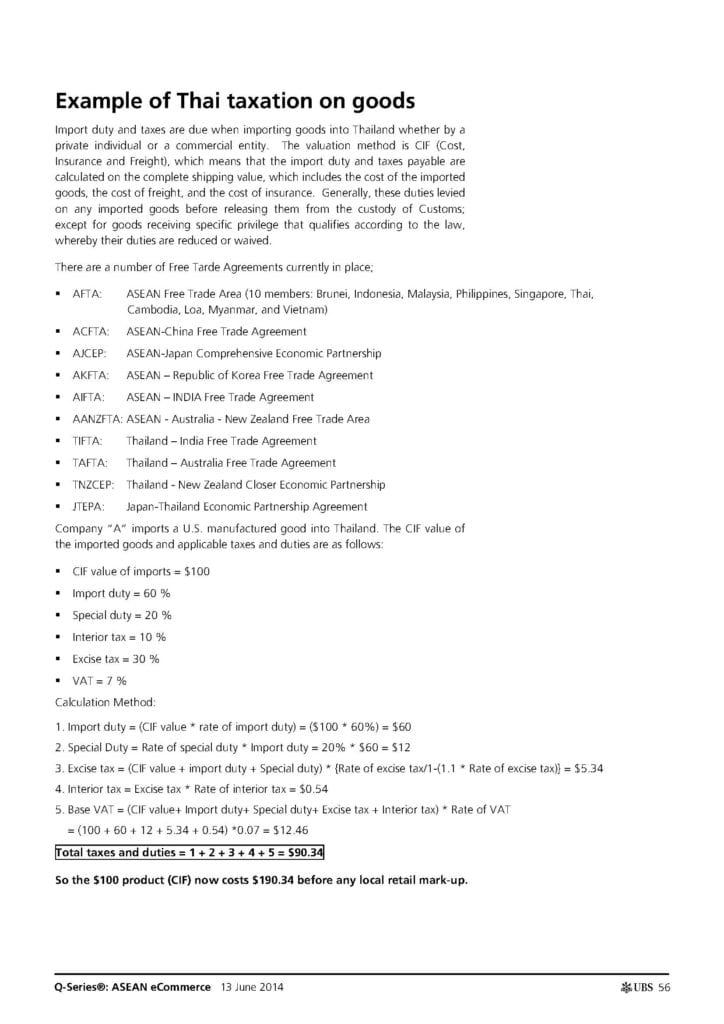

- The ASEAN Economic Community 2015 (AEC 2015) initiative could be an additional boon for online retailing: while trade tariffs are essentially zero within ASEAN, additional legislation aims to create a national single window to support efficient and electronic customs clearance, policies to support crossborder transportation, and liberalisation to encourage a more competitive logistics industry. The OECD estimates that customs barriers in ASEAN add 1015% to the price of goods sold.

UBS ecommerce analysis report