Tl;dr: A direct to consumer landscape overview and an excel you can download.

Dollar Shave Club. We all saw the video. In 4 years this direct to consumer company got $240m in revenue (2016) and flipped to Unilever for $1bn. Seriously, joining the 3 comma club with razor blades? Yup. They aren’t the only company killing it though, in the fuddy duddy world of physical ecommerce, but in the direct to consumer model for FMCG, they’ve certainly made a name for themselves and banked.

You can download it here

Just because this video is awesome

Direct to consumer?

So what’s the direct to consumer model. Well, it’s an innovation in the supply chain which typically involves skipping out the middleman, so the stock goes from factory to consumer. Traditional retailers being skipped out, which is just music to their ears. Not. This theoretically results in better prices for consumers and higher margins for startups.

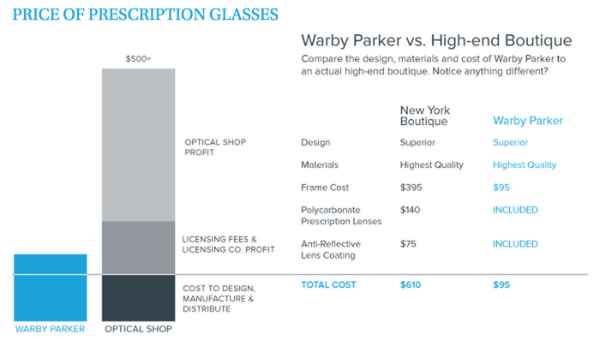

Have a look at how Warby Parker describes it:

Most of the heaviest funded payers all pick something everyone is already using, but didn’t know could be better and or cheaper. So there’s typically some innovation in terms of either quality or pricing. Sure, there are some cool innovations being sold direct to consumer, but creating a market is hard with a d. Market education is very expensive. It’s often far smarter to be a fastish follower than a leader (See Rocket Internet spending millions to educate Asia, Latam etc only for all sorts of new players crop up).

A point to be made here is that the market size is pretty huge. Every vertical you want to have a go at is $10bn+ (often). So it’s worth a fight.

Check out: The Definitive SaaS Financial Model Template for Startups

Why will we get an exit here?

If you’re thinking of starting up here, you want to know there is someone minted to buy you right? So are there really a pool of acquirers?

Yeah, dude. Retail is big and they have issues. Heard of Heinz? Ask a normal person about Airbnb and they might still say who, let alone remember eating gross tomato like soup with deformed alphabetical characters as a child?

Look at the world of retailers- a triple threat:

- Competition has gone nuts over the past few decades. So if something looks like a winner, jump on it so it can sustain your existence. In 1980 USA, there were six brands of blue jeans; now there are over 800

- Assortments are mushrooming, exacerbating and up bidding the battle for shelf space. In 1968, Pringles had one flavor of crack, I mean chips. Today, it has 33

- Shelf space is becoming even more precious, as many major big-box retailers migrate to smaller footprints in urban areas. Brands can’t get a break

The world is changing and the big boys are still waiting for the bus while everyone’s ordering a diverse and inclusive Uber. In short, they need to stay relevant and buying kids is a safer strategy.

In retailer language:

- Brands need to understand customer behavior, to like, sell them stuff. You can track customers online way easier than offline. Online you can figure out when and what people are buying online so companies can attempt to control the consumer journey with Monty Burns like glee

- Profit margin. Buy low sell high is how retail works. Without the cost of dealing with already struggling retailers, the big brands can invest more heavily in online efforts and concentrate on building consumer loyalty. That’s the theory anyway

- Online facilitates a more streamlined strategy without the usual rules. Deleting the concept of the supermarket shelf means no competitor brands to deal with and massive kick backs for placement. Companies care about how their brands are marketed, so more control is yummy

- Customer touch points. Fundamentally as a brand without direct sale, you have no direct relationship. It’s like a long distance relationship through a website- you sort of know the mail order bride, but you don’t really know.

Put another way, retailers are starting to get they need to change. But we both know they aren’t going to execute anything 😉 Let’s face it, whilst you go and execute, they’re going to call in a consultant and talk about feelings, positioning and stuff. Example:

So anyway, we have established that big retail haz issues and they might buy you. So all good to go.

Who else is doing well? Where are the opportunities?

Well, now we are getting to the point of this blog. Sure, Warby Parker, Casper (Target just chucked $75m at them) etc are all doing well, but they aren’t the only ones. There is a tonne of people depending on how you look at it, and areas you might not have thought of.

Fortunately, thinking is overrated if you can get someone else to to it 😉

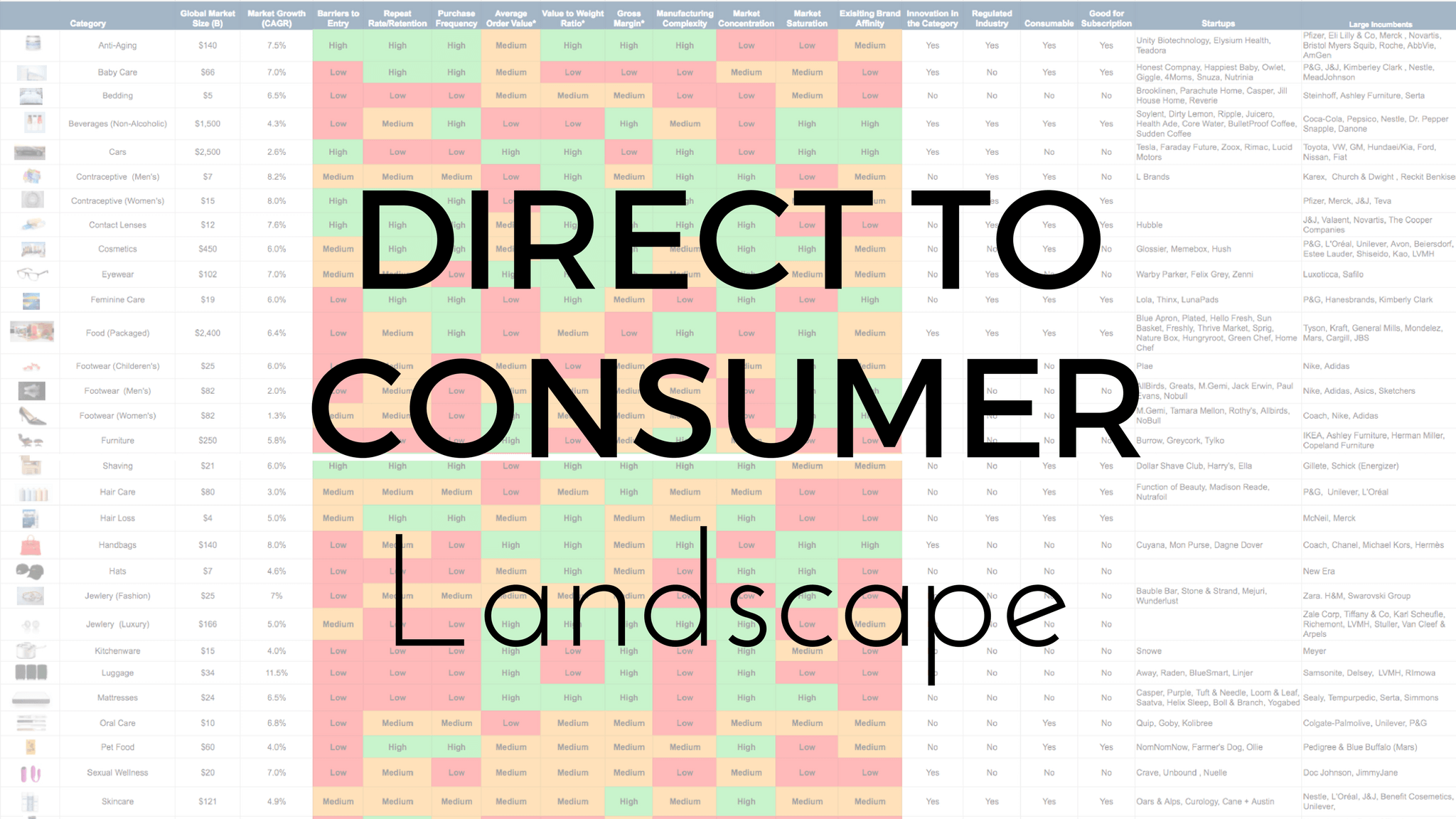

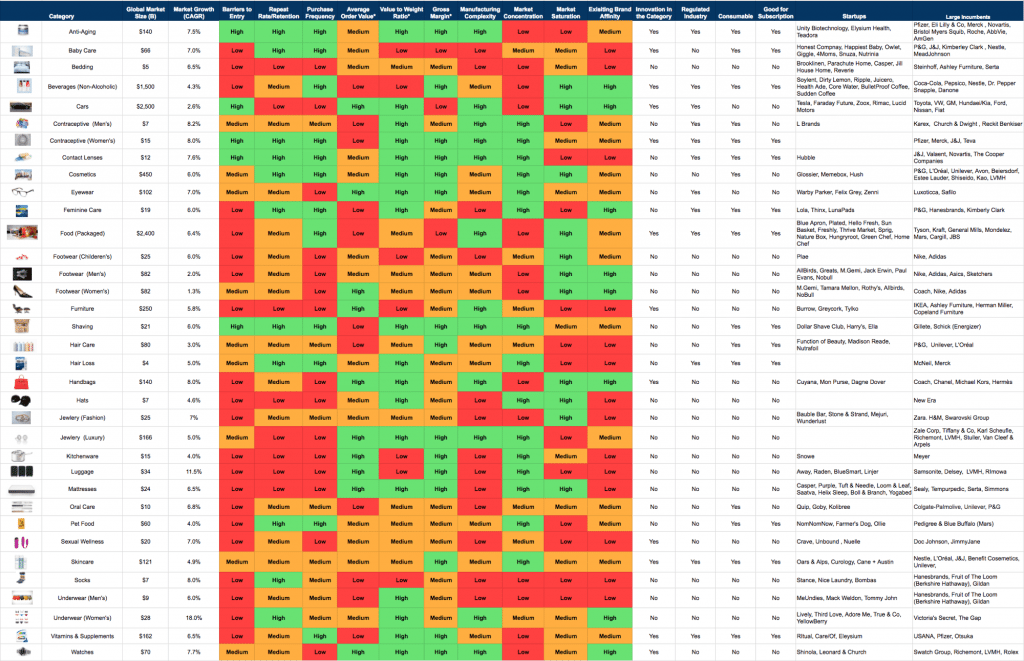

A boffin called Teddy Citrin at Greycroft blew his weekend(s) building this glorious page. Why?

We at Greycroft are very excited about new direct-to-consumer brands. In 2016, only 12% of retail transactions happened online, while eCommerce represented a whopping 42% of all retail sales growth. We believe this growth will continue to accelerate. Meanwhile, legacy brands which have traditionally sold through third parties are realizing that they don’t know their customers and they are getting undercut by new entrants that can improve the value chain and customer experience by going direct.

So, how do you read this thing? Take it away Teddy:

The direct to consumer landscape illustrated above should help illuminate why certain categories are more or less appealing to us than others. Let’s use contact lenses and our recent investment in Hubble as an example of how we would use this landscape to determine why a market could be compelling for a DTC startup.

- Contact lenses represent a $12B global market, not enormous, but big enough to build a billion-dollar business in an expanding category.

- The barriers to entry are high because securing supply is difficult, manufacturing is complex, and it is a regulated industry.

- Contacts lenses are a daily use product, so repeat purchase and frequency are high, which makes it good for a subscription.

- The average order value is in the medium range, but the high frequency/retention makes for a potentially strong customer lifetime value. Contact lenses are light, small, and thus inexpensive to ship.

- A few large incumbents dominate the market, which means pricing could be inflated and traditionally there may be little incentive to provide excellent customer service. Incumbents primarily sell to doctors which impacts the brands they create.

- The category has high gross margins.

- There hasn’t been much product innovation in the category in the last couple of decades which means building a strong brand is the most important objective. Finally, there are many people with poor vision who have traditionally opted just to wear glasses because of cost/convenience and there are not many startups flooding the market, so there is plenty of greenfields.

It’s important to remember that direct to consumer landscape leaves out the most crucial part of each startup which is team and brand.

Yeah, team and brand can be handy.

Have a goggle. If you’re interested in this space it will save you a load of time mapping the landscape. Note: I’m pretty sure the startups are not exhaustive and will only be US focused.

If you need help figuring out your business model and need some consulting, reach out to us.

If you want to get this in excel, download the direct to consumer landscape by clicking on the pretty picture on the right or below: