Walk through of some key features of the sheets in the Marketplace financial model

There is a lot in this model. I can't possibly explain all the details involved, and neither do you want to read it ;). I've whacked in a screenshot per sheet so you have an idea what is going on. If you want to see me explain it in more detail watch the videos. This should give you an idea of the magnitude of how much there is in this model and the time I put into making it.

Table of Contents (Click to section)

- Marketplace Model Architecture

- Formatting Sheet

- Control Sheet

- Detailed Profit And Loss Statements

- Depreciation And Tax

- Detailed KPI Sheet

- Runway Calculator

- Staff And General Costs

- Payment And Tech Expenses

- Sales team

- Support staff

- Automated expenses

- Registrations

- Registration conversion

- Supply revenue

- Demand revenue

- Cohort Power

- Complete marketing

- Paid And Organic Marketing

- Email Marketing

- Blog & Social

- Channel Sales

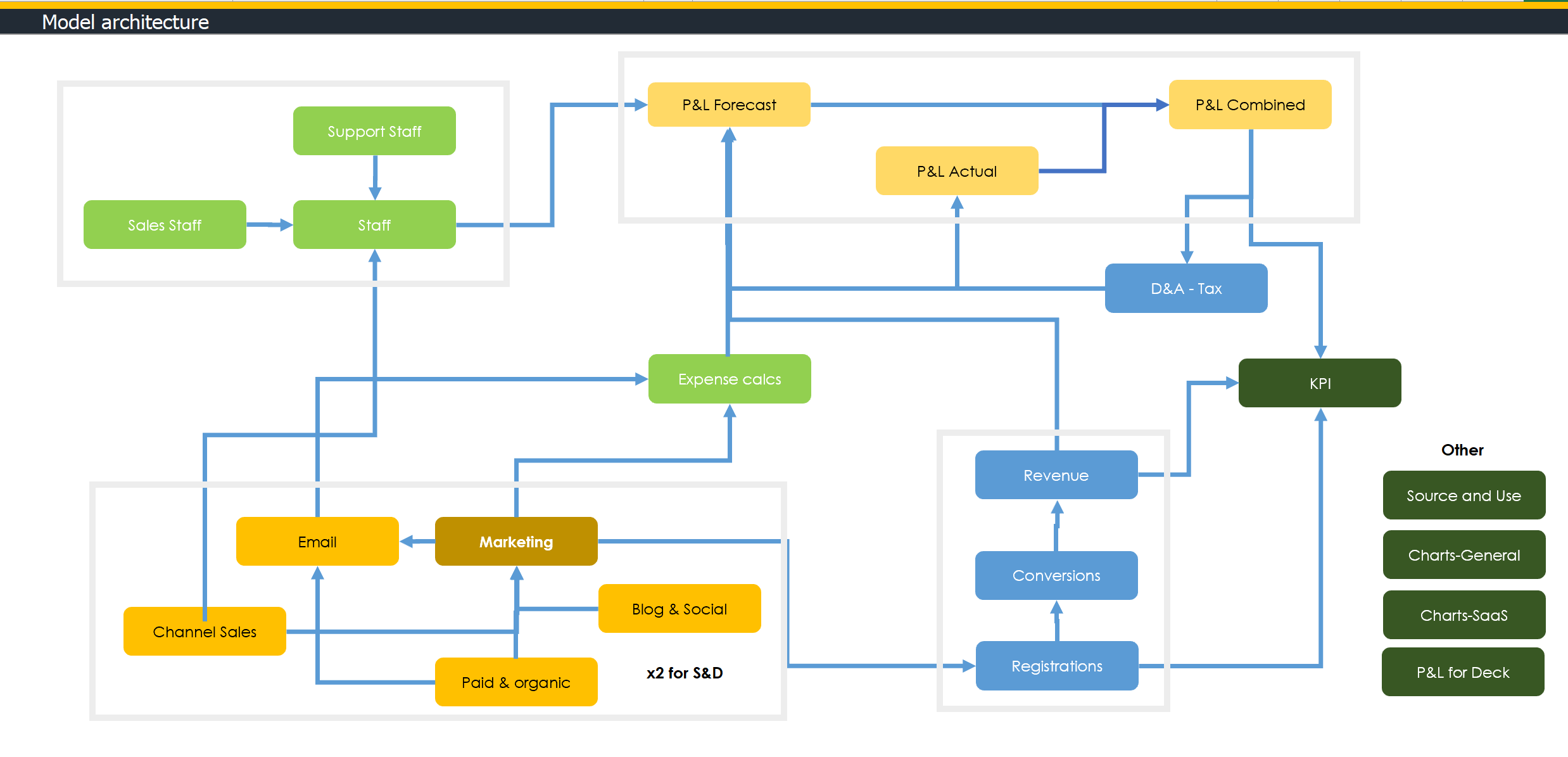

The marketplace model architecture

- Fully integrated model: Changes in one sheet flow through the whole model automatically

- Logical flow: Expenses, marketing and revenue are all segmented so they connect logically

- P&Ls: Actuals and forecasts have their own P&Ls. These are then combined into a 'combined sheet' so you can see the progress month to month

- Other: Charts and KPIs have their own sheets. The key data from the large calculation sheets are presented so you don't have to dive into them

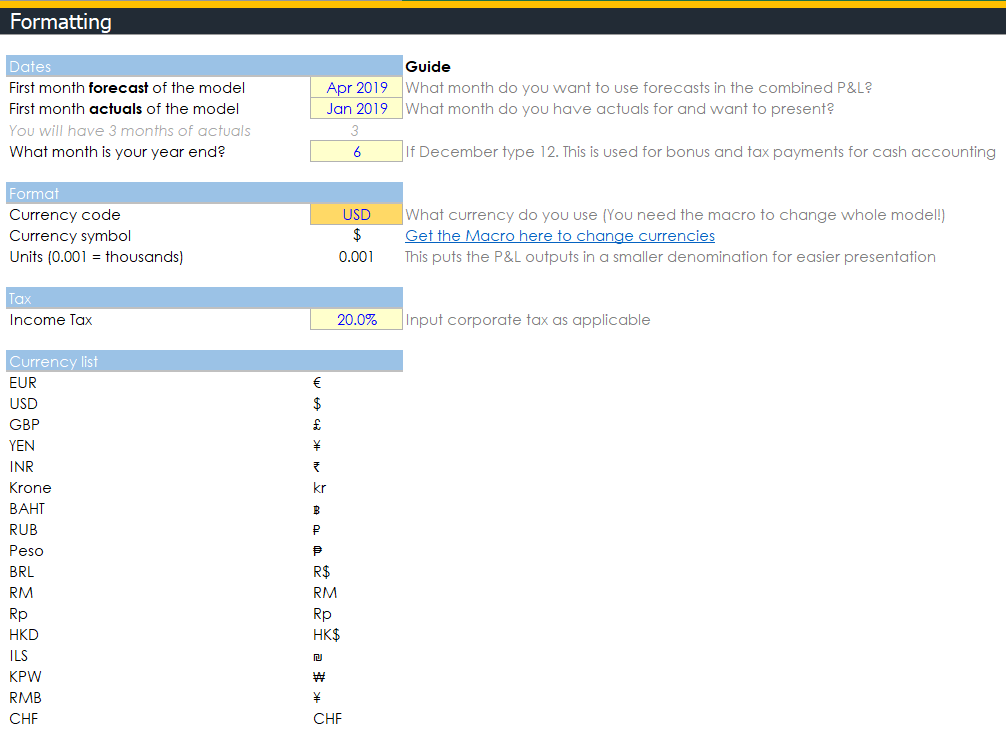

Formatting sheet

- Actual start: You can add up to 11 months in the actual sheet (12m is a historic, right?)

- Forecast date: Forecast sheet has 36 months of forecast

- Constantly update your model: I spent 2 weeks just figuring out a way to constantly update your model. You start with your Actual start date, then you can move your forecast month forward as time goes by. You then add your new actual month in

- Month end: Set your month end. Your annual bonus, tax etc will be paid out that month in the CFS, but accrue in the P&L as usual

- Currency change: With my plugin, you can switch to all the currencies you can see in the list

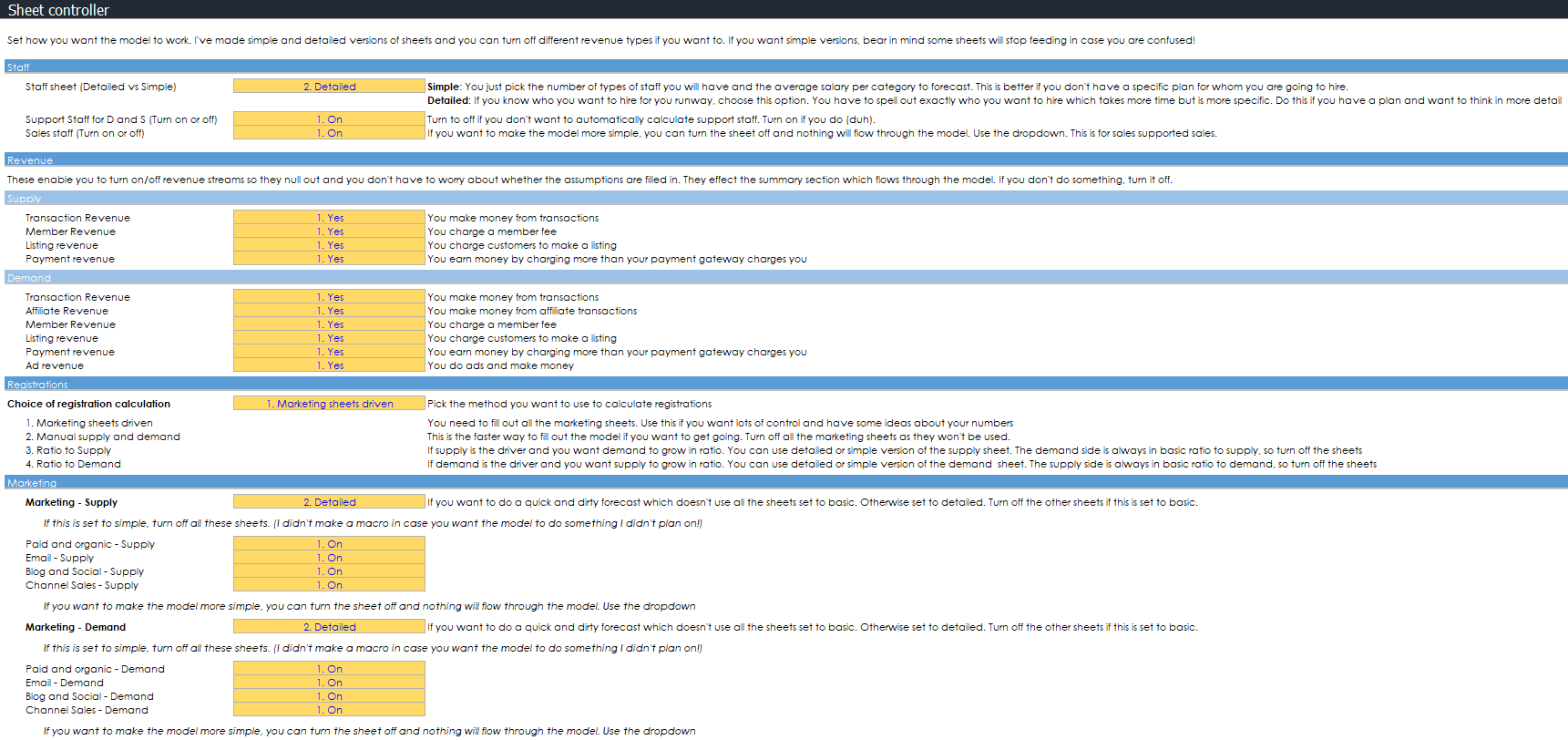

Control the model from one place

- Kill switches: Turn sheets on and off from drop down menus. Don't do channel sales? Just turn the sheet off

- Choose revenue streams: Pick the ways you make money and simply turn off the revenue streams you don't use

- Marketing methods: Choose the means you want to do marketing. You can opt to do things in a lot of detail or simply. You can also choose 3 ways do calculate registrations

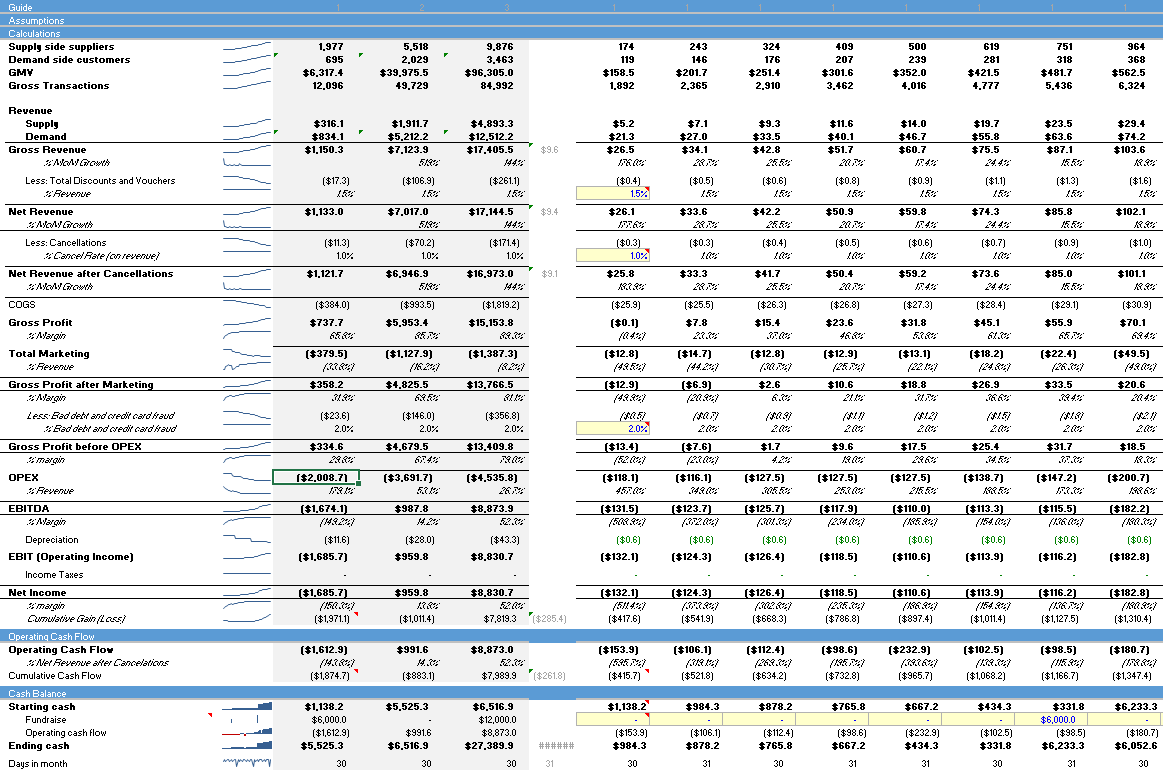

Detailed Profit and Loss statements

- 3 P&L sheets: Actual, forecast and combined

- Non key assumptions in line: If you want to add discounts, cancellations and bad debt, you can easily add in a percentage in line

- Fundraising: When you plan on raising money, you just input the amount into your cash balance

- Accounting and cash flow: Two main parts. The main part follows normal accounting practices (There is a sheet for Tax to manage NOLs as well as depreciation and amortisation following Investment Banking standards). The bottom of the sheet converts accounting to operating cash flow so you know when money is actually going in and out

- Complex adjustments: Bonuses are paid on year end in cash flow, but accrue in the P&L. Same for tax. Accrued bonuses from actuals are factored into your forecast for when they need to be paid

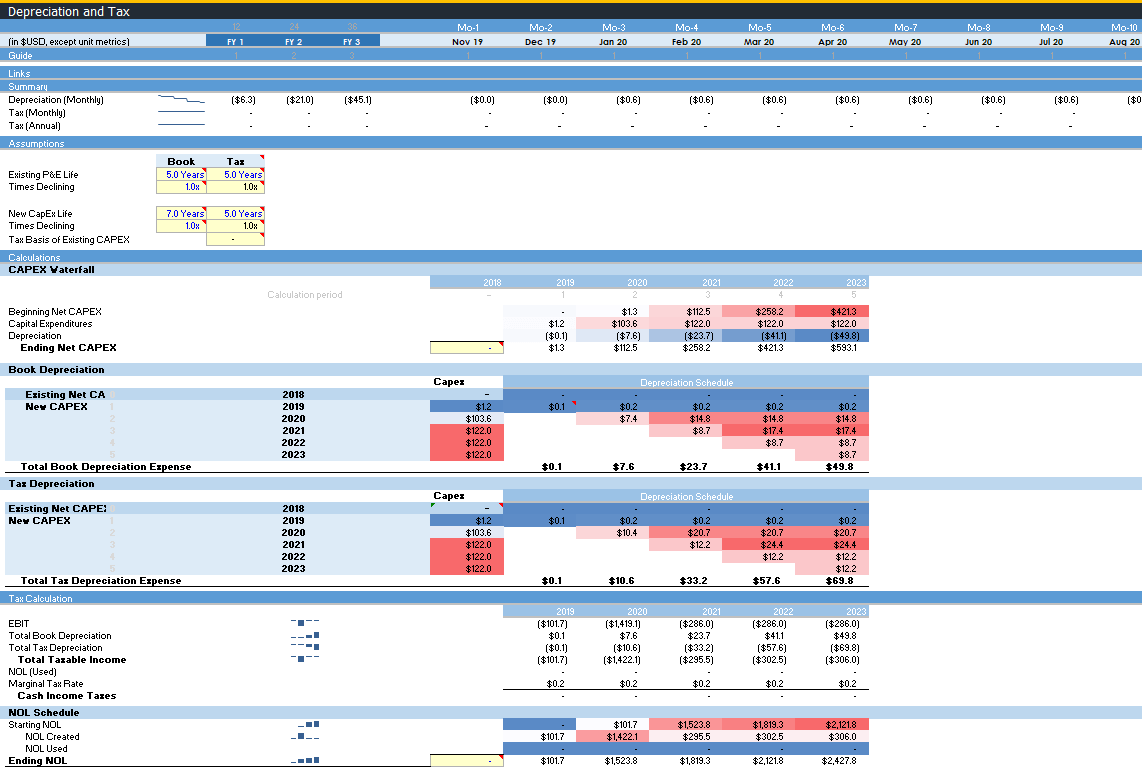

Depreciation and tax

- Control depreciation and tax: Simply manage the boring accounting bits with only a few assumptions like an M&A banker would

- Depreciation: Accounting for depreciation

- Tax: Calculate when you need to actually pay tax. Net Operating Losses (NOL) accounted for

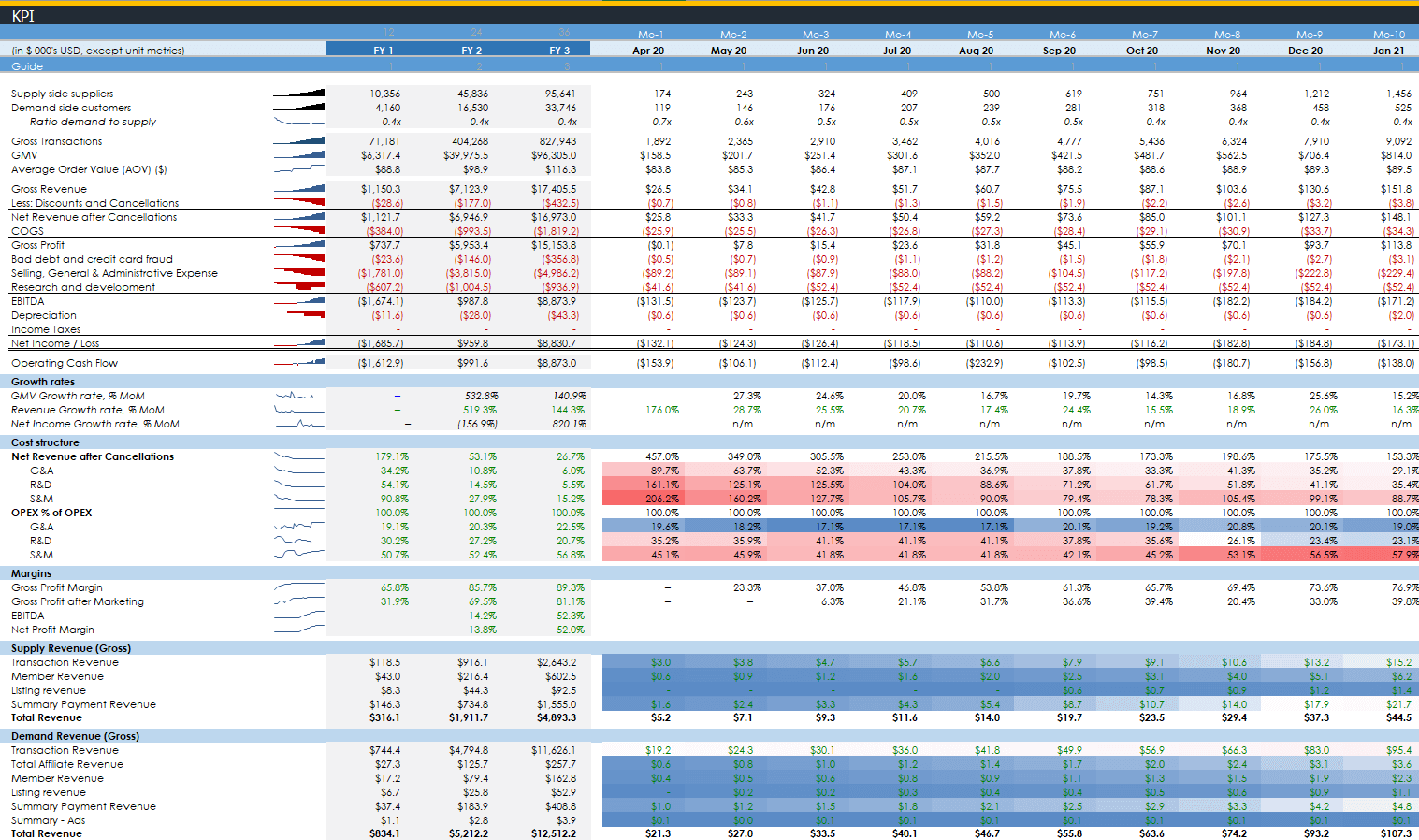

Detailed KPIs (207 rows)

- Detailed KPIs: 207 rows of every KPI I could think of

- CAC/LTV: See your key KPIs calculated with based on both supply and demand side. There are also basic and fully loaded variants

- Segments: KPIs for key financials, margins, cost structures, cash burn rate, churn, unit economics, registrations, funnel metrics, and headcount

- Dates: Both monthly and annual KPIs

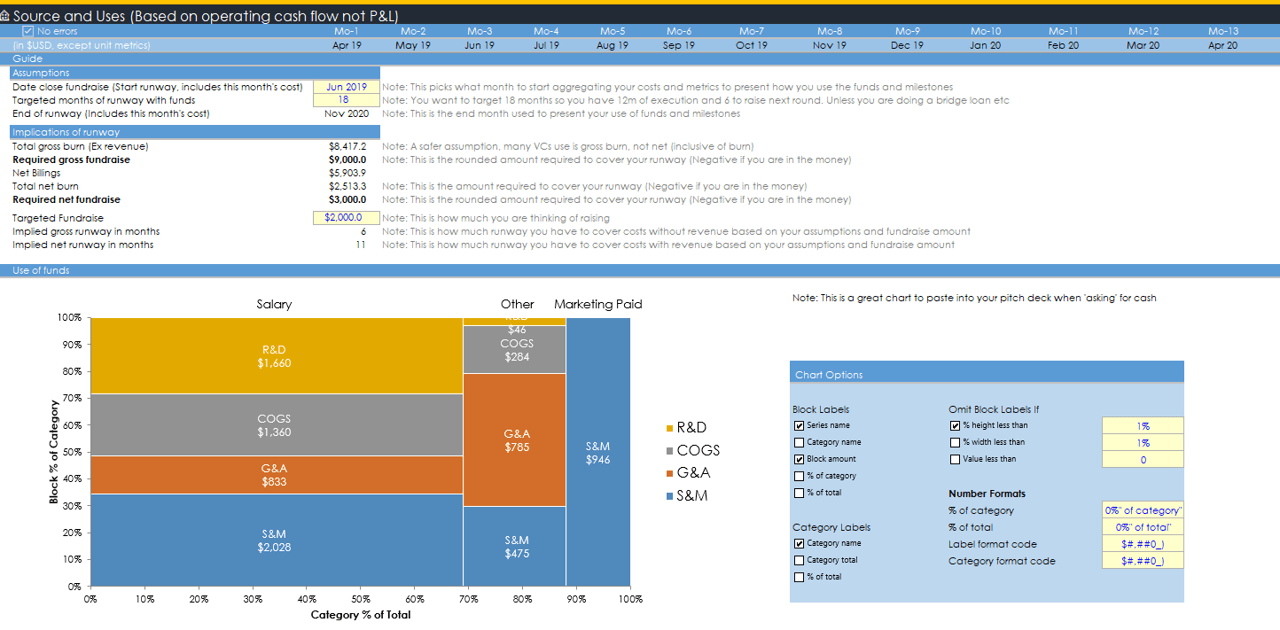

Runway calculator

- Runway calculations: Understand your gross and net burn over your defined runway (in months). See how many months your planned fundraise will last based on your model forecasts

- Detailed operating expenses: See exactly where money is being spend per department over your runway

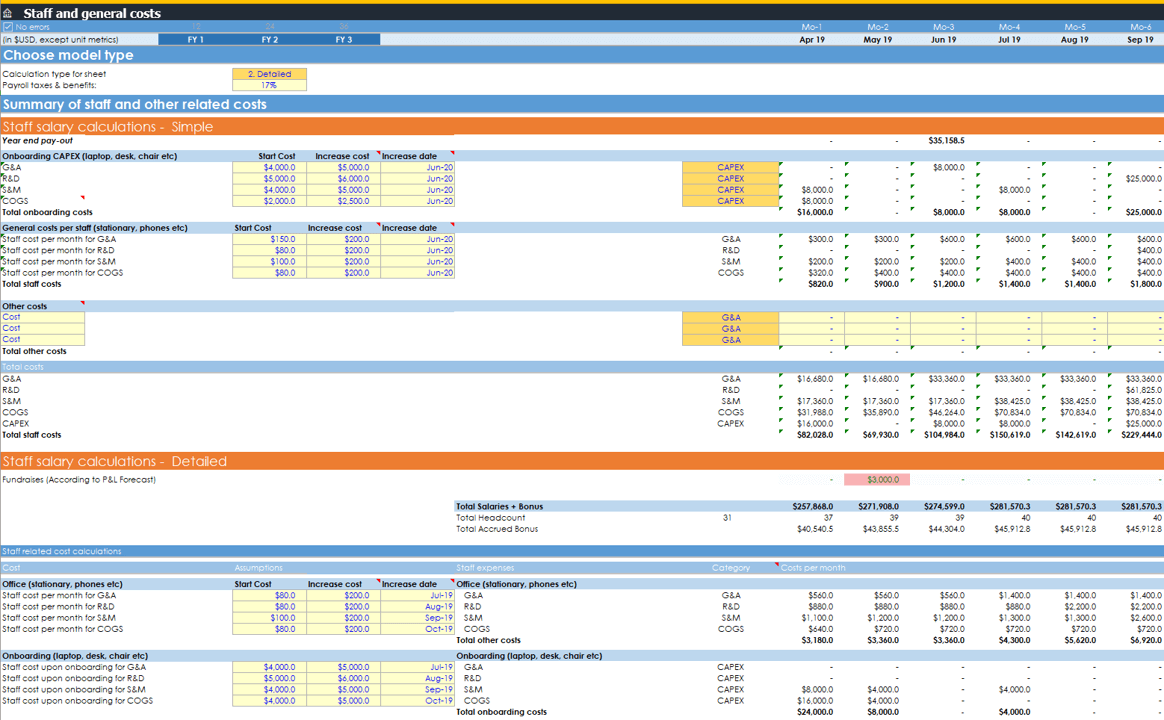

Staff and general costs can be detailed or basic

- 2 methods for forecasting staff: Switch between the basic and detailed method for forecasting your staff requirement. If you want to fill in the model faster, choose the basic option. If you have a detailed hiring plan, pick the detailed version

- Automatic forecasting: Sales staff, customer care etc can automatically be calculated in other sheets. These feed into both the basic and detailed version so you can choose how detailed you want to be with a flick of some switches.

- Scale recruitment as you need: Opt to hire recruiters when you hire [5 or more] new people a month so you don't have to think about how many recruiters you need

- Granular control over hiring: Easily add benefits/tax, choose the date you hire/fire staff and the date you want to increase their salary (say at Series-A)

- Other costs: Quickly add all the 'other' costs you need like rent, onboarding costs (e.g. laptops) of staff, and whatever costs you need without having to over think it. Most costs are calculated my multiplying the average cost be the number of staff you have

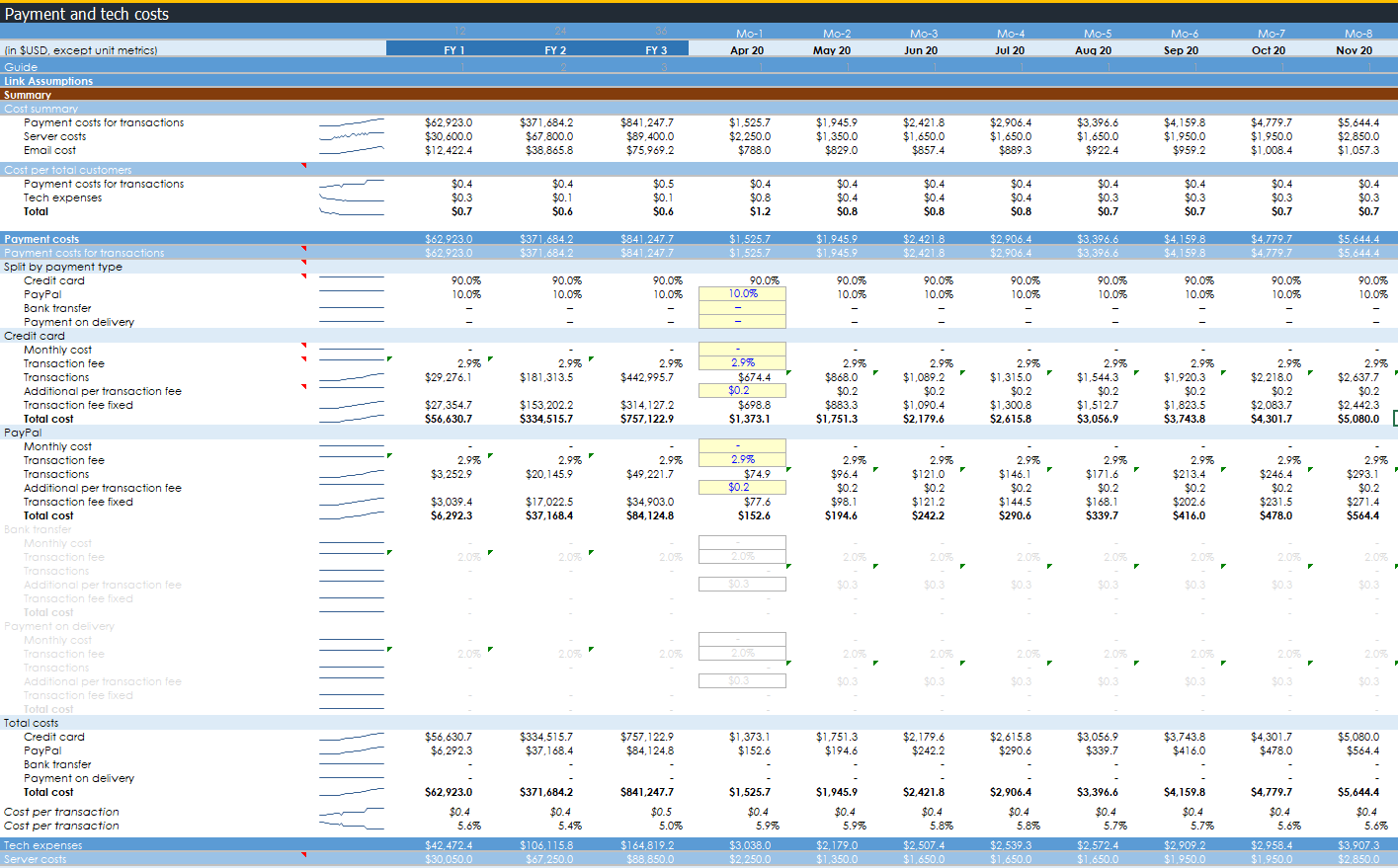

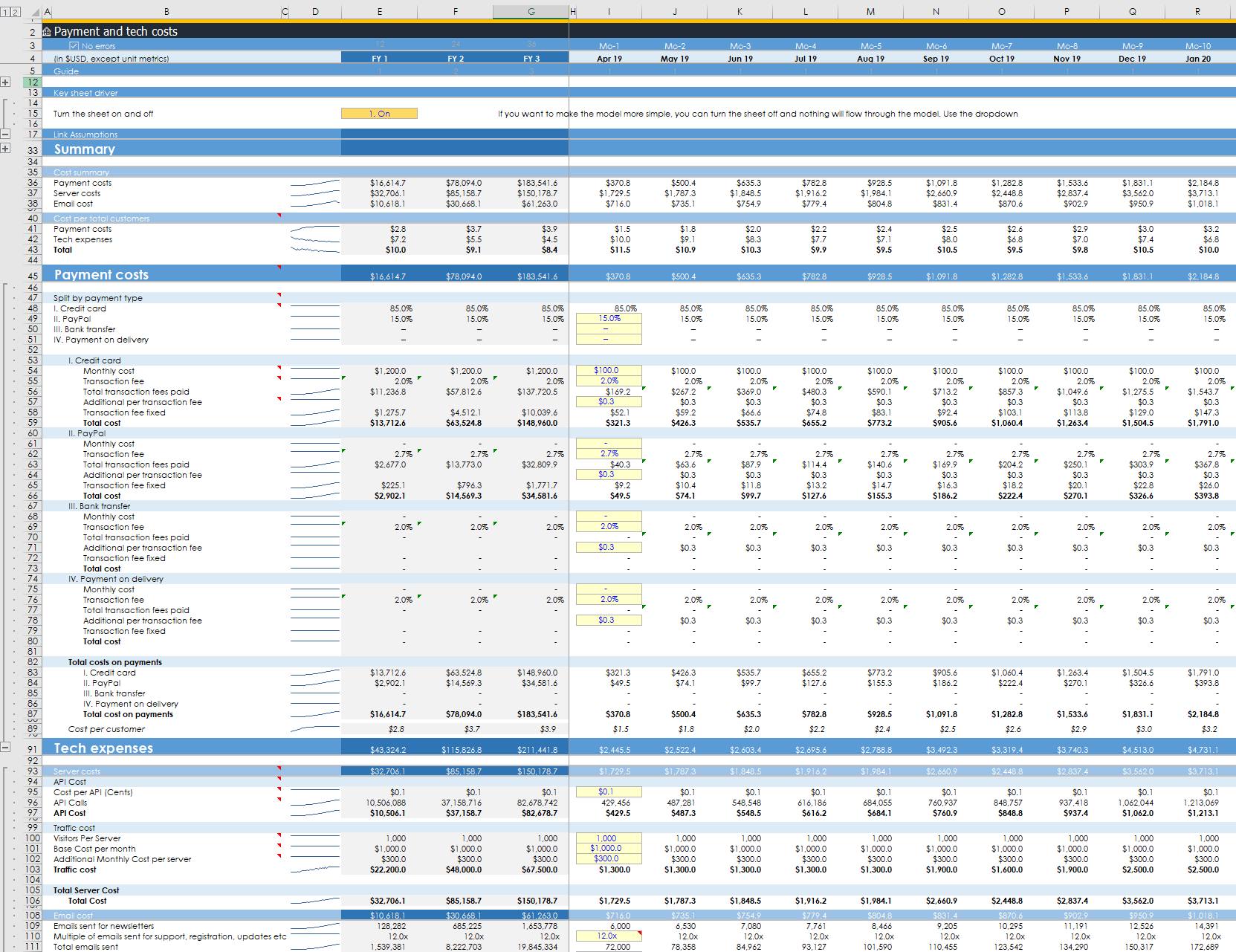

Payment and tech costs

- Payment costs: Simply manage your payment costs with credit card, PayPal, bank transfer and payment on delivery

- Tech costs: Automate server and email costs

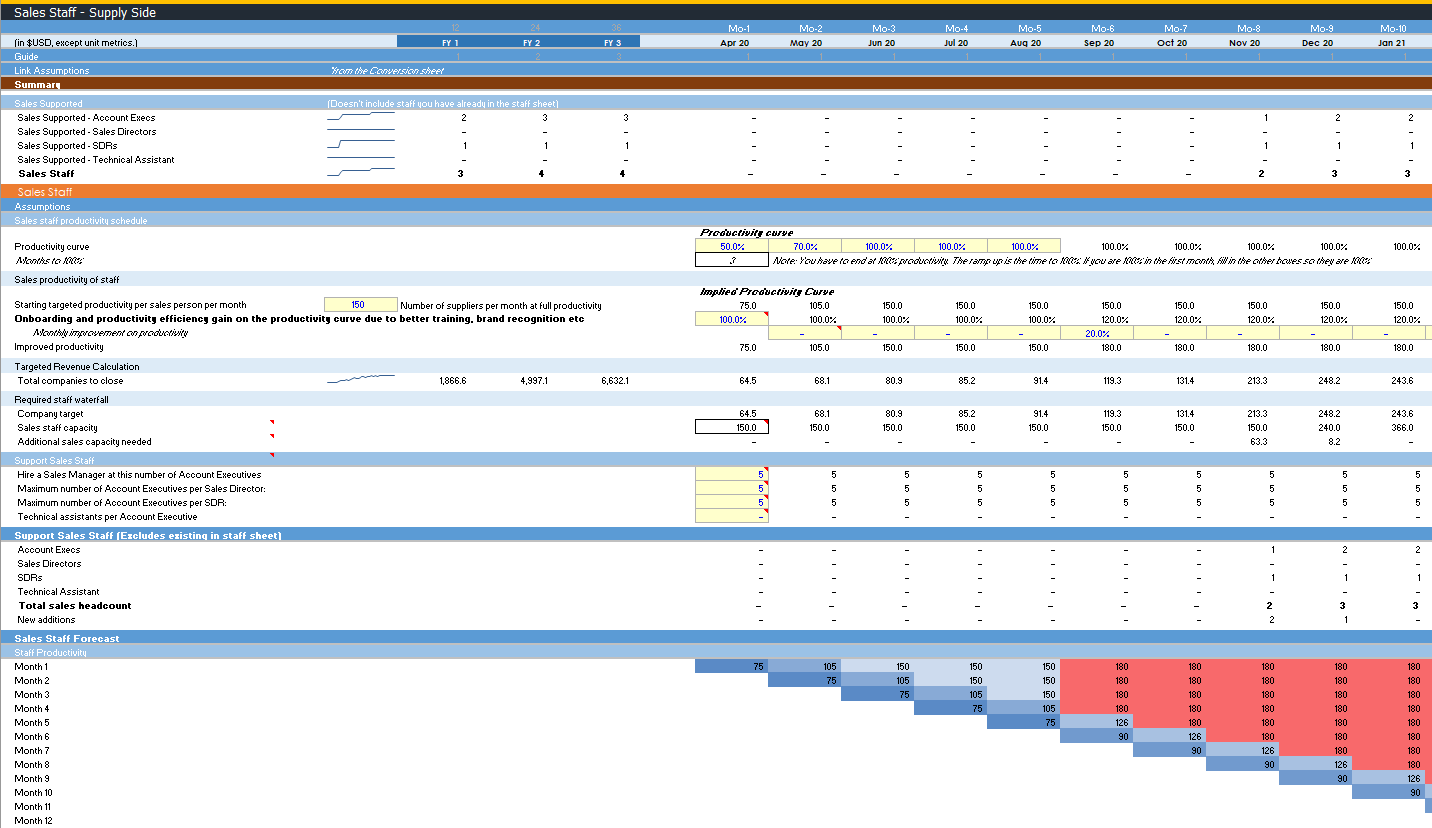

The sales team ramps up to productivity

- Build a sales team: Easily build a sales organisation with account execs (AEs), sales directors, SDRs and tech assistants. They scale by the number of AEs you need to hire to hit your targets. You only need to make 6 assumptions to make this all work

- Productivity ramps: Define how many months it takes for new AEs to hit their quota

- Hiring based on supplier listing targets: You define what % of your revenue is sales supported and what the revenue target of an AE is, and the model knows your existing capacity and tells you how many people you need

- Integrated into the staff sheet: Sales staff are fed into the main staff sheet so everyone can be seen in the same place

- Cohorts: Cohort modeling knows what is required on a monthly basis. You can't get more detailed and accurate than that

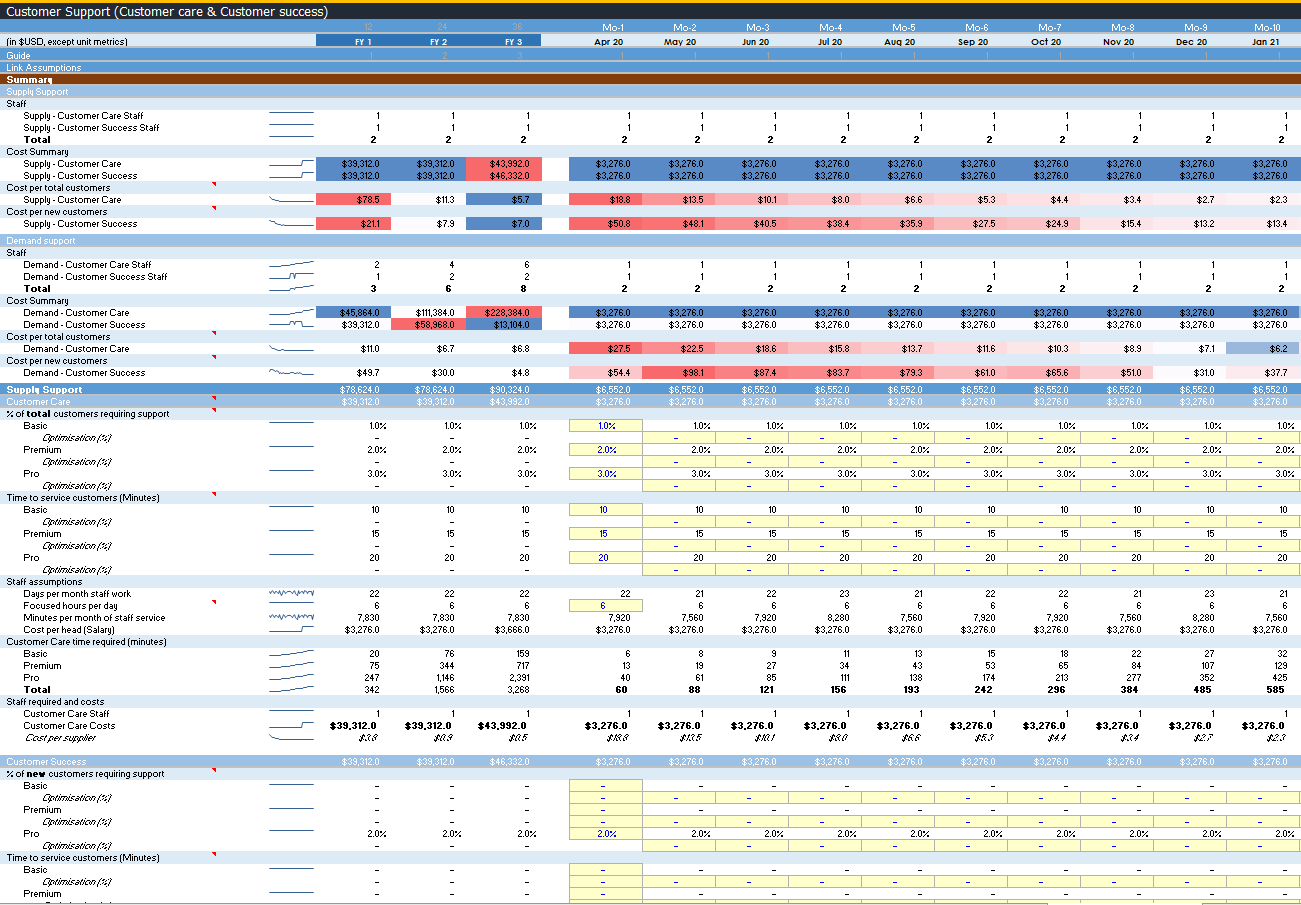

Customer care and success automated

- Integrated with staff sheet: Flows into the staff sheet automatically

- Switch on and off: Turn the sheet on or off with a flick of a switch if this is too detailed for your stage

- All support staff covered: 2 sections for customer support and customer care for both demand and supply. Customer support covers your ongoing needs and customer success covers on-boarding of new customers

- Simple but detailed: Defined what % of customers need help and how many minutes they need on average, and the model tells you how many staff you need

Automated expense sheet

- Payment costs: Simply manage your payment costs with credit card, PayPal, bank transfer and payment on delivery.

- Tech costs: Automate server and email costs. You can build this out if it is a big deal to you

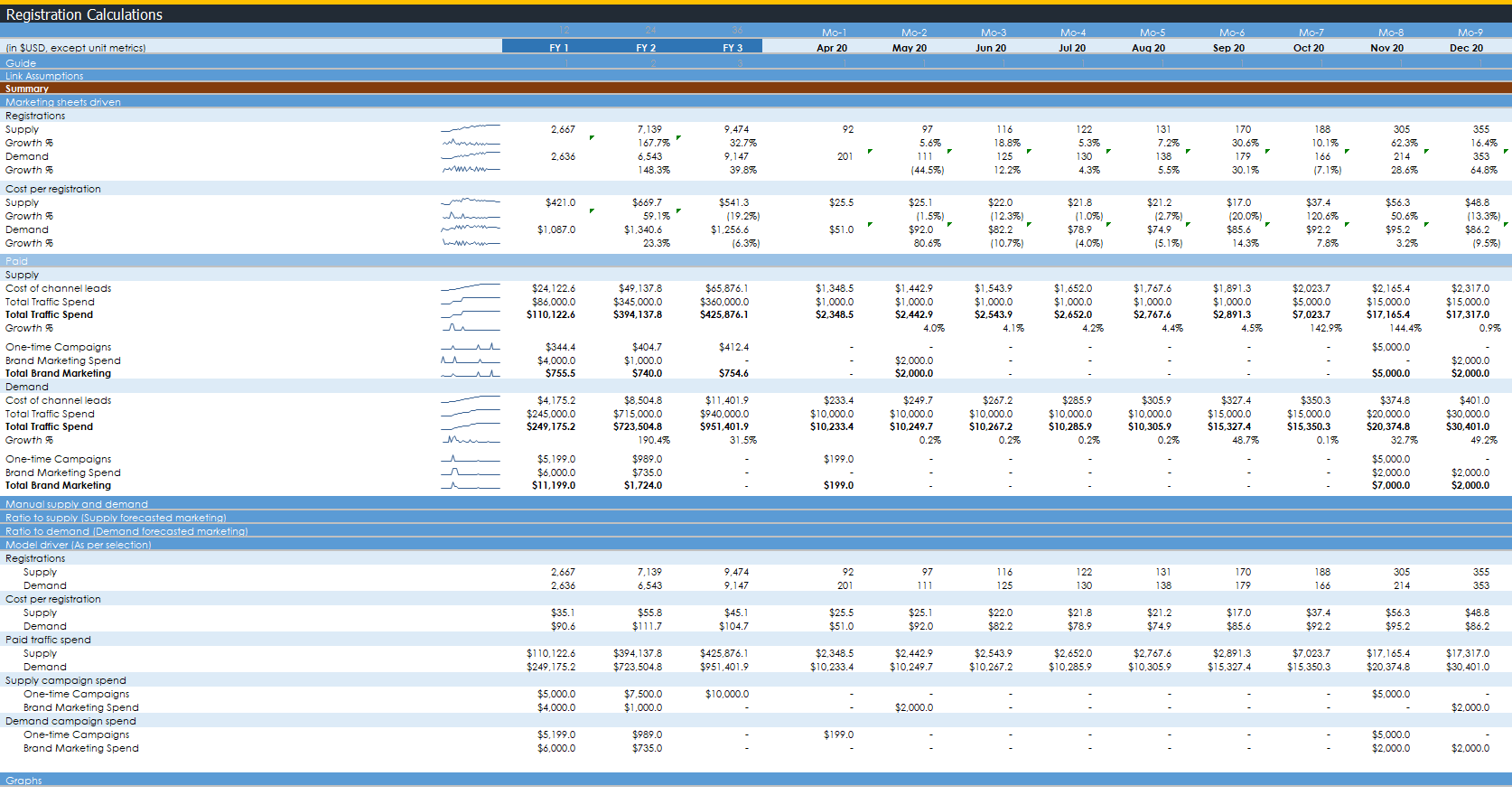

4 ways to forecast registrations

- 4 ways to forecast registrations: I kept being asked to make simpler and faster ways to do forecasts so I made them here

- Marketing driven: Detailed with 5 sheets on both of the supply and demand side. Get into a lot of nerdy detail

- Manual supply and demand: The simplest way to forecast where you just pick a number for both sides and grow it with a %

- Ratio to supply: You do detailed forecasts for the supply side and the demand is simply done as a ratio

- Ratio to demand: You do detailed forecasts for the demand side and the supply is simply done as a ratio

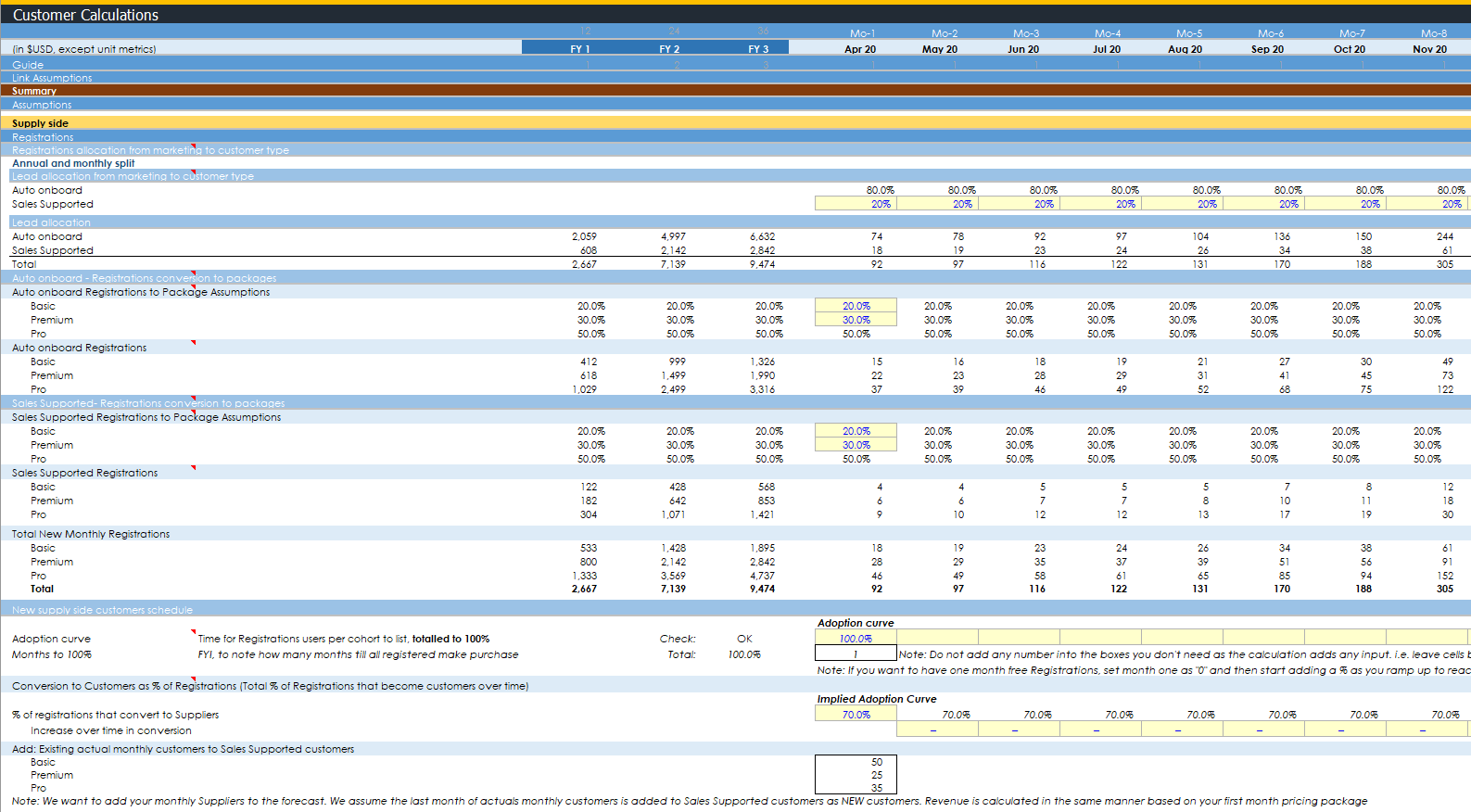

Convert registrations to customers

- Allocate registrations to 2 customer types: Choose whether your registrations convert to customers automatically or are sales supported

- Allocate registrations to 3 customer types: Create three avatars: basic, premium, and pro who have their own profiles

- Adoption curve: All registrations can convert to customers in the first month or over time

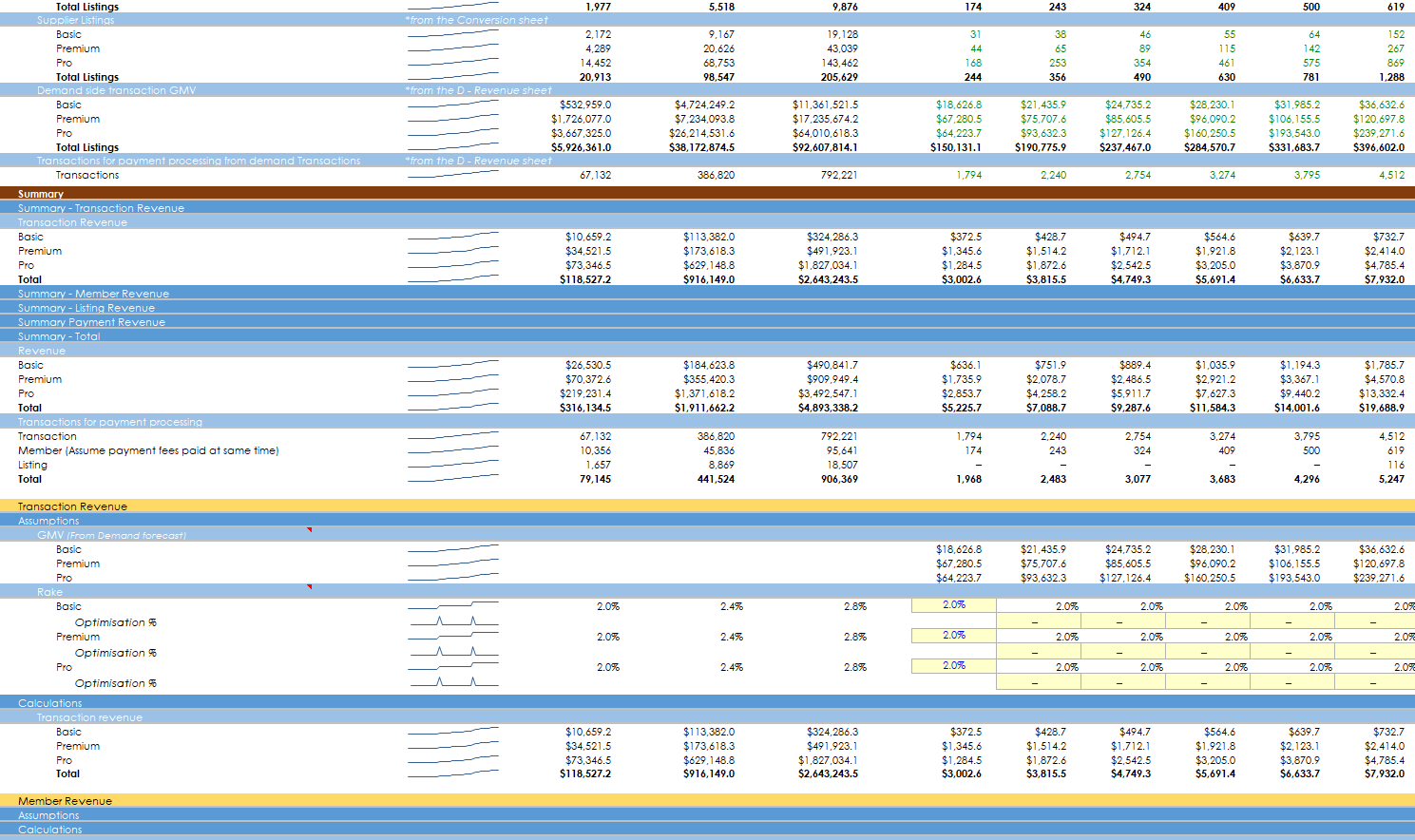

4 revenue streams on the supply side

- 4 revenue streams built in: Turn revenue streams on and off at a flick. Basic assumptions get you the results you need

- Transaction revenue: Normal stuff. You make money when transactions happen

- Member revenue: If you have members that pay each month, they are members

- Listing revenue: you charge suppliers to make listings. Normally for later stage companies

- Payment revenue: You charge suppliers for payments. This will be a delta to the COGS in the expense sheet

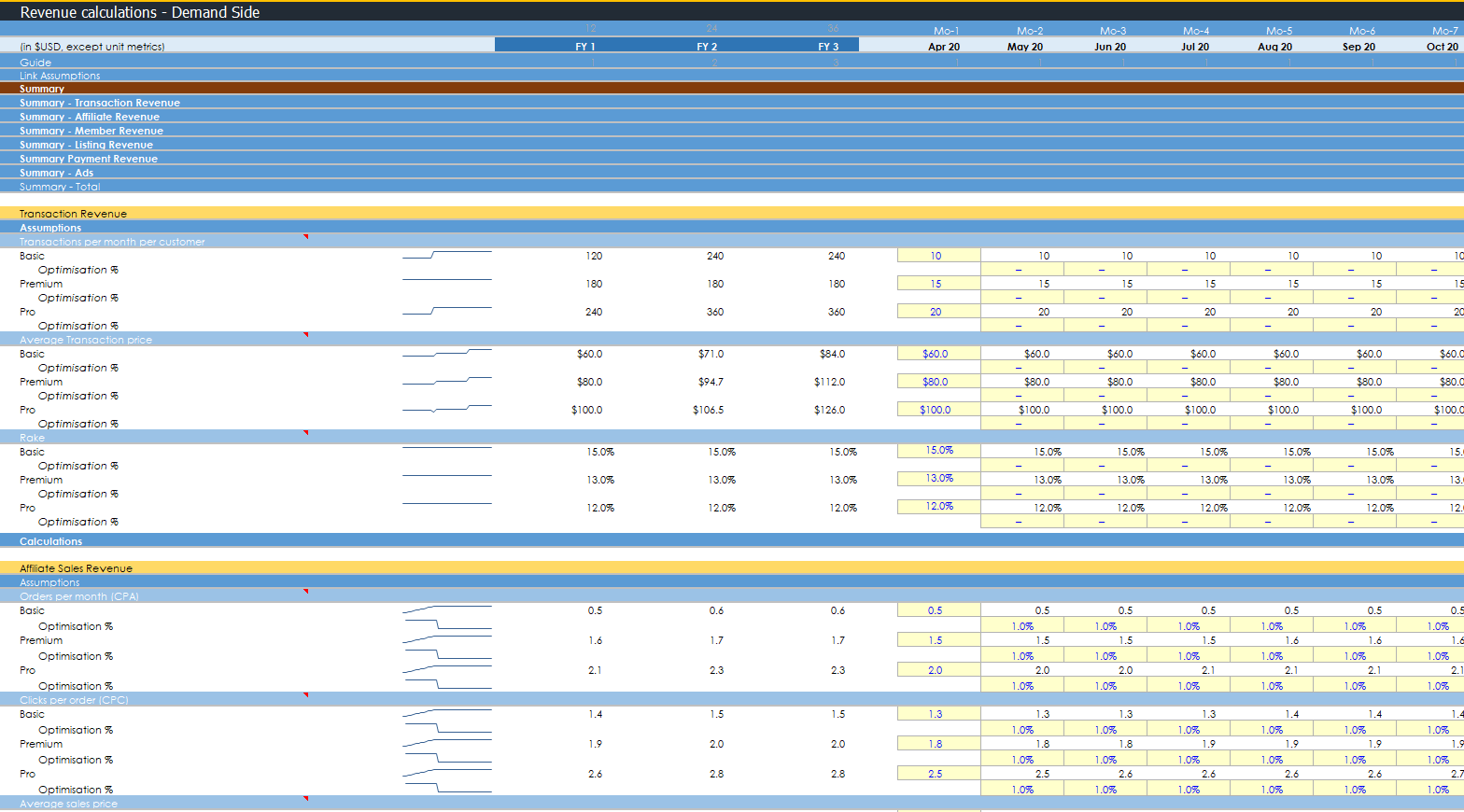

6 revenue streams on the demand side

- 6 revenue streams built in: Turn revenue streams on and off at a flick. Basic assumptions get you the results you need

- Transaction revenue: Normal stuff. You make money when transactions happen

- Affiliate revenue: Some startups are pass through to other platforms.I allow you to do CPA and CPL on these. They add into GMV but you need to consider your model here as accounting can vary (I assume you don't take payment on these)

- Member revenue: If you have members that pay each month, they are members

- Listing revenue: you charge suppliers to make listings. Normally for later stage companies

- Payment revenue: You charge suppliers for payments. This will be a delta to the COGS in the expense sheet

- Ads: You make money from ads. You can be simple or detailed with assumptions around banner, interstitial, reward, offer wall, notification and native.

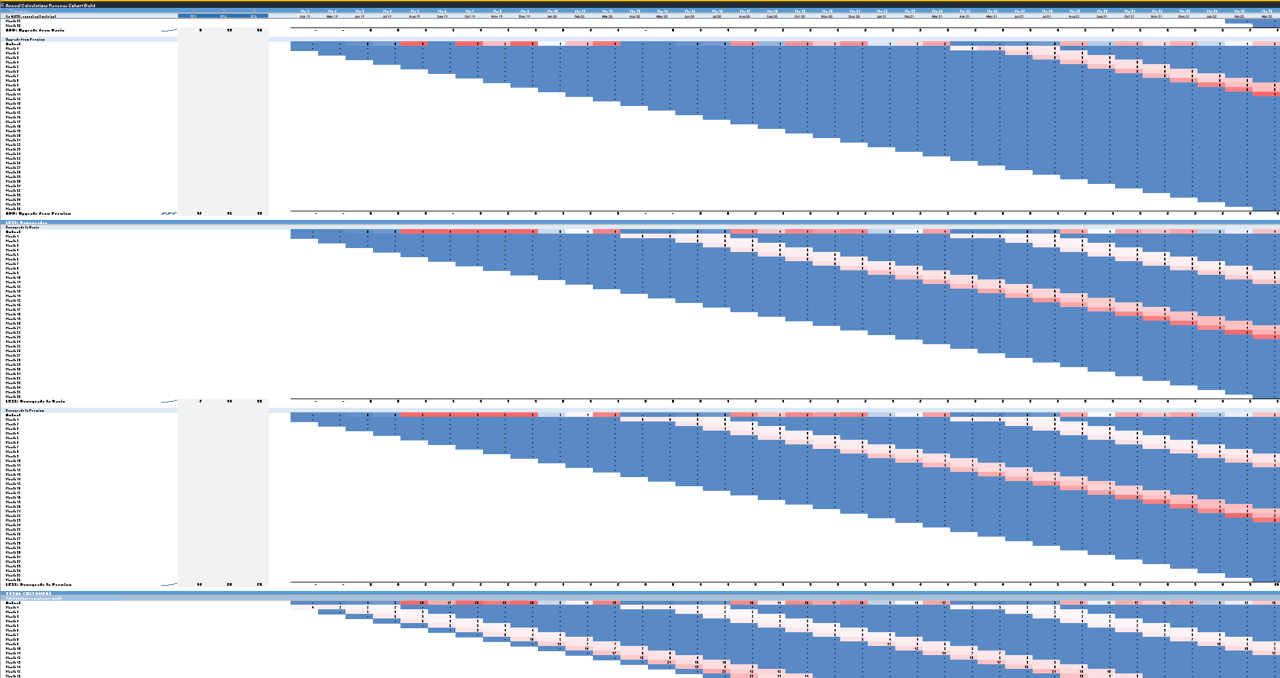

Cohort power

- Granular modelling: The entire model is based on monthly cohorts. This is complicated to build but enables you to do a lot of things you couldn't without them.

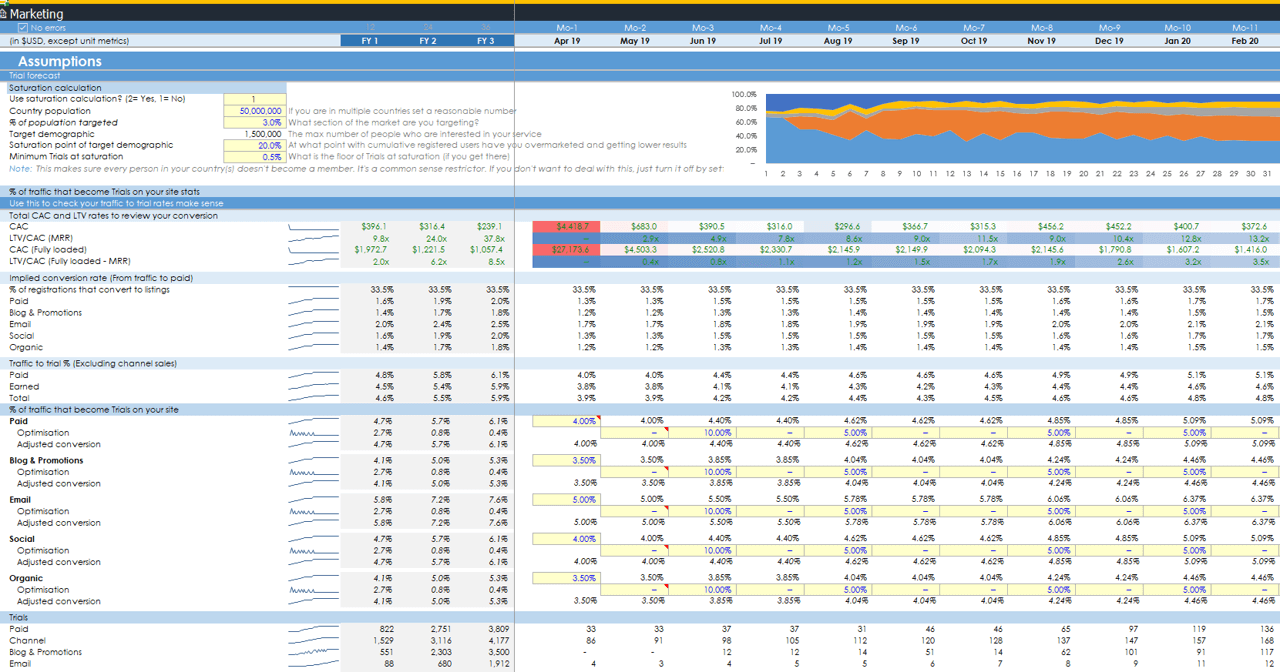

Complete marketing

- Granular assumptions: Control how traffic turns into trials by setting conversion rates

- 10 marketing sheets: Main marketing sheet gets fed by 4 marketing activity sheets which are all integrated. Paid, organic, email, blogging, social and channel sales. Duplicated for both supply and demand side

- Growing too large?: In built calculations to stop you growing larger than your defined market. Turn it on and off

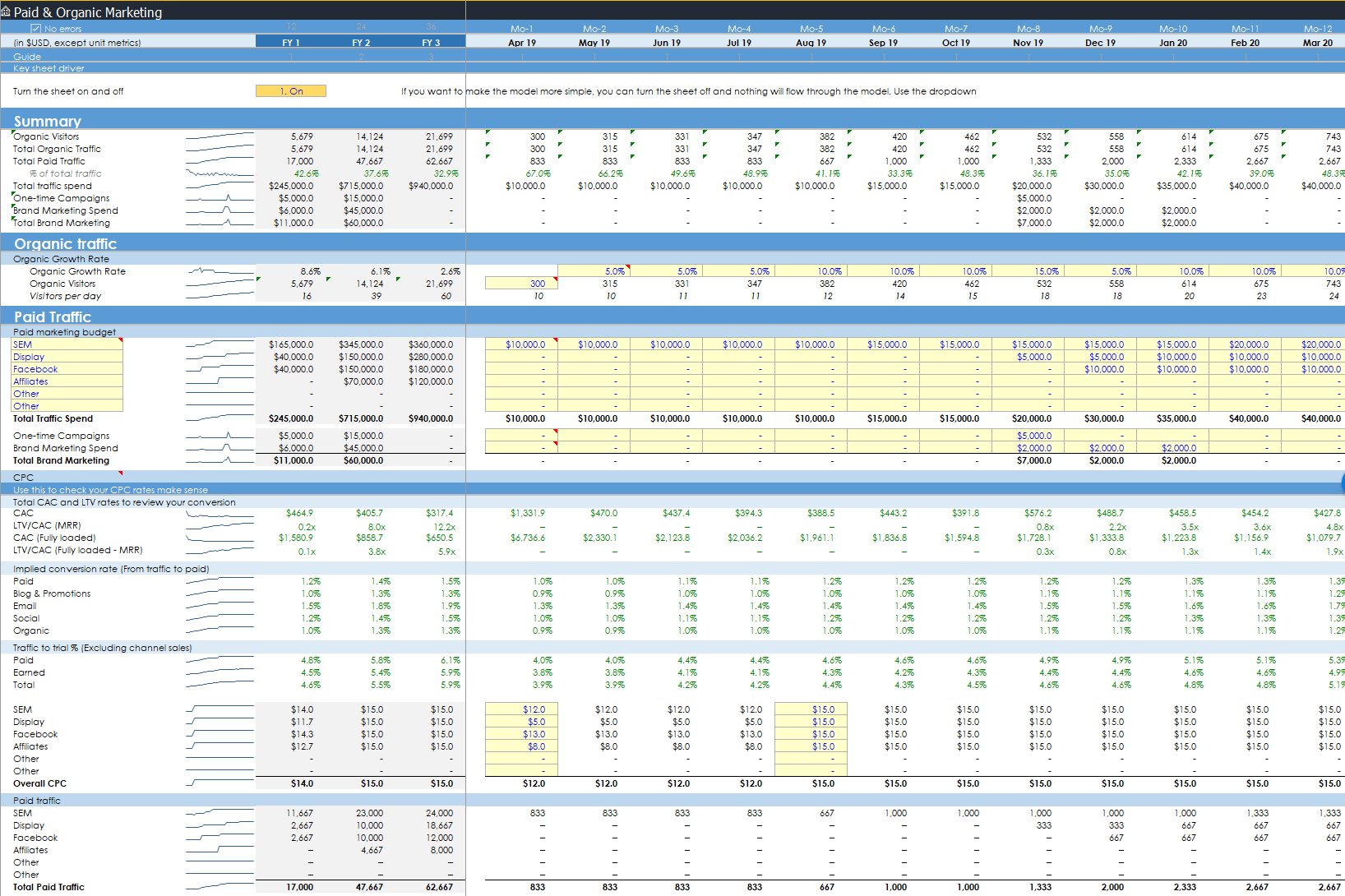

Paid and organic marketing

- Organic growth: Simply add an organic growth rate of people going to your site

- Paid growth engine: Set your spend per month across up to 6 channels. Set your CPCs to generate traffic to your site. In addition you can add non-paid spend which doesn't attribute traffic (one-time campaigns and brand marketing) but will still contribute to your marketing costs and metrics

- Supporting metrics: See supporting conversion rates and metrics to check things make sense

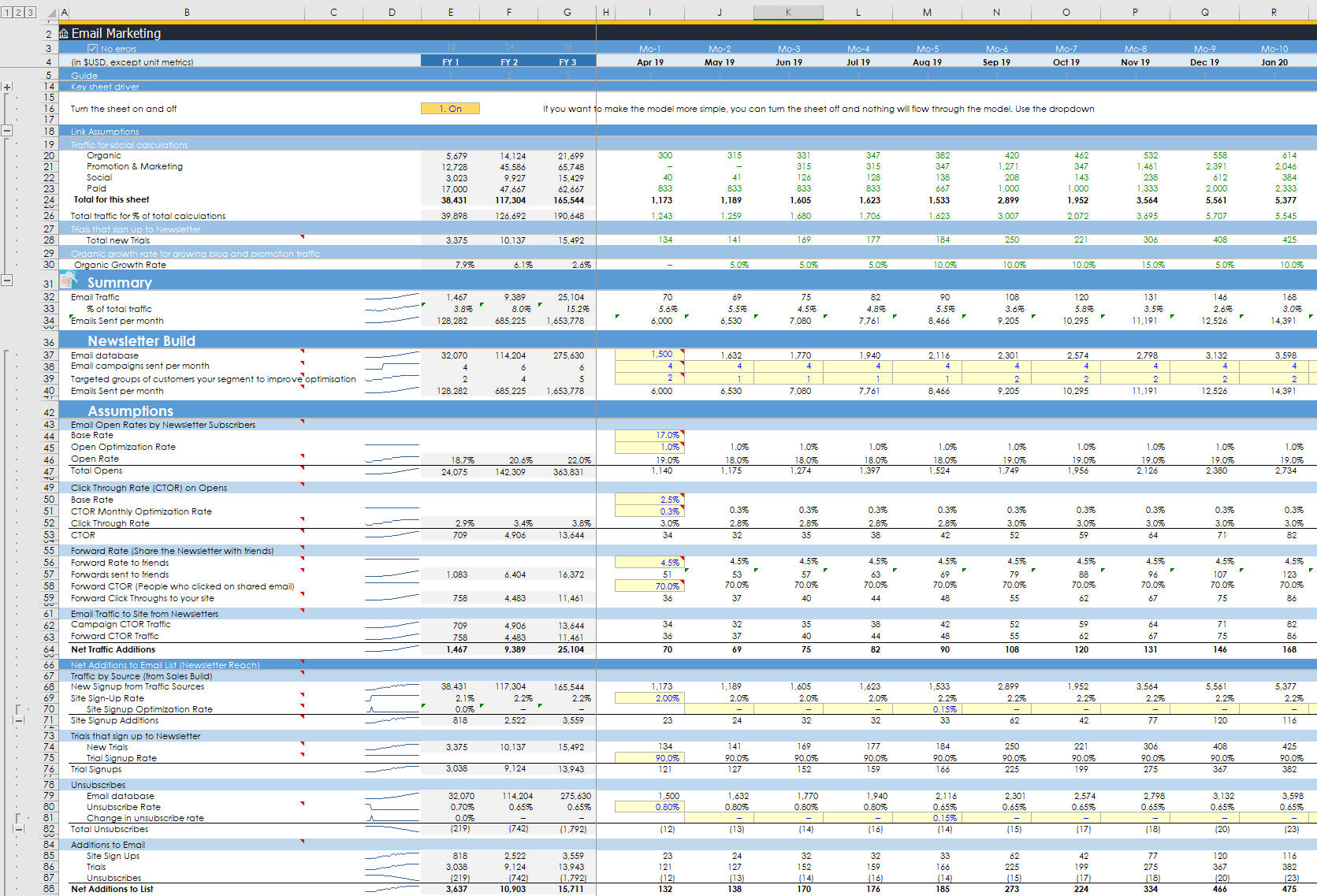

Email marketing

- Earned growth: Support sheets effectively help you to reduce your paid CAC

- Fancy assumptions: There's a load of assumptions built-in from open rates, click through, forward rates, rebroadcasts, unsubscribes, etc.

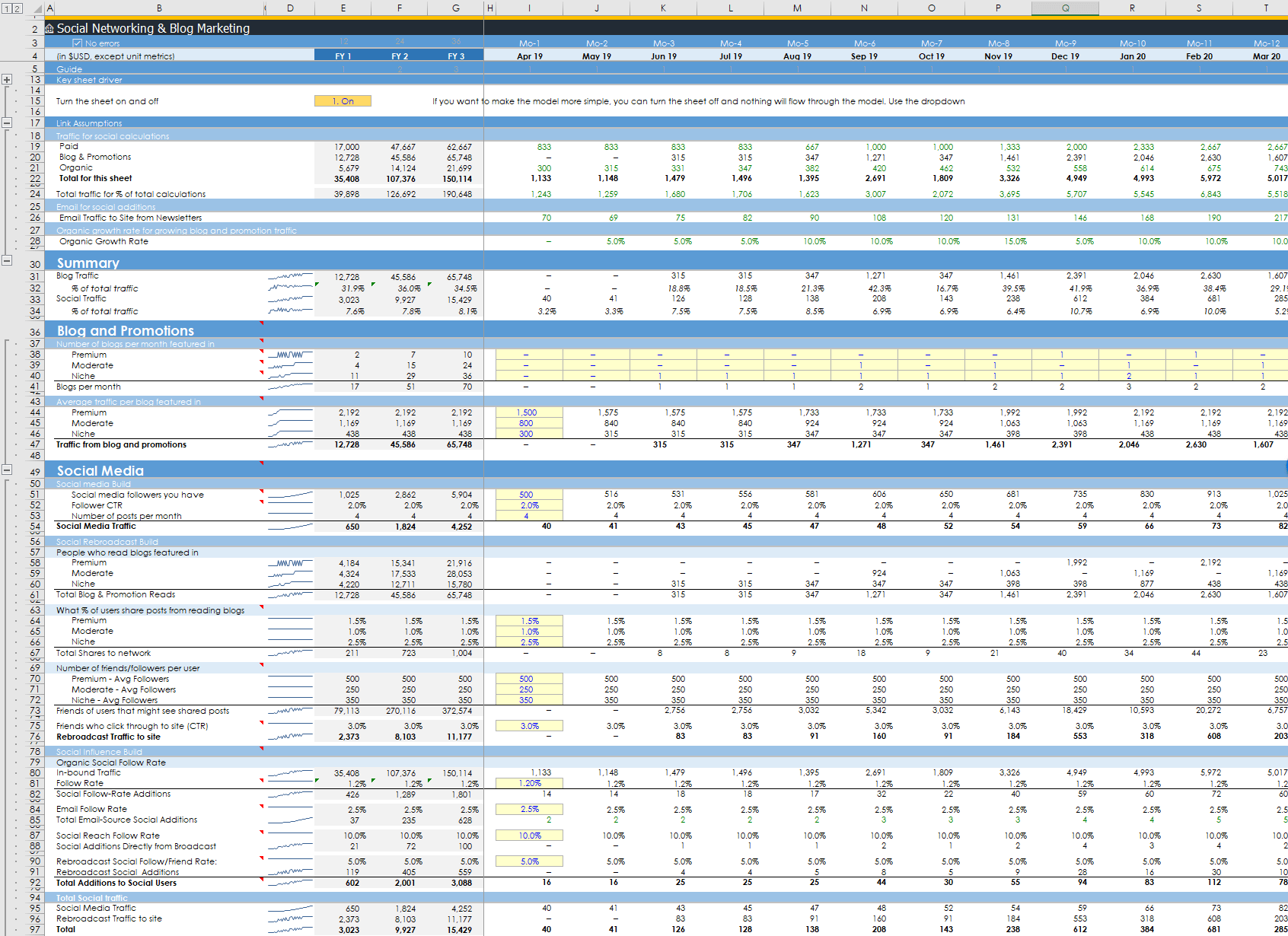

Blog & Social

- Earned growth: Support sheets effectively help you to reduce your paid CAC

- PR: Get press, featured in TechCrunch etc and get earned traffic to your site. Simple to follow and understand.

- Social: Build a social following with lots of detailed assumptions as the email sheet. How many times you post, follow CTR, follower shares, rebroadcast rate and CTR, as well as builds to your email list

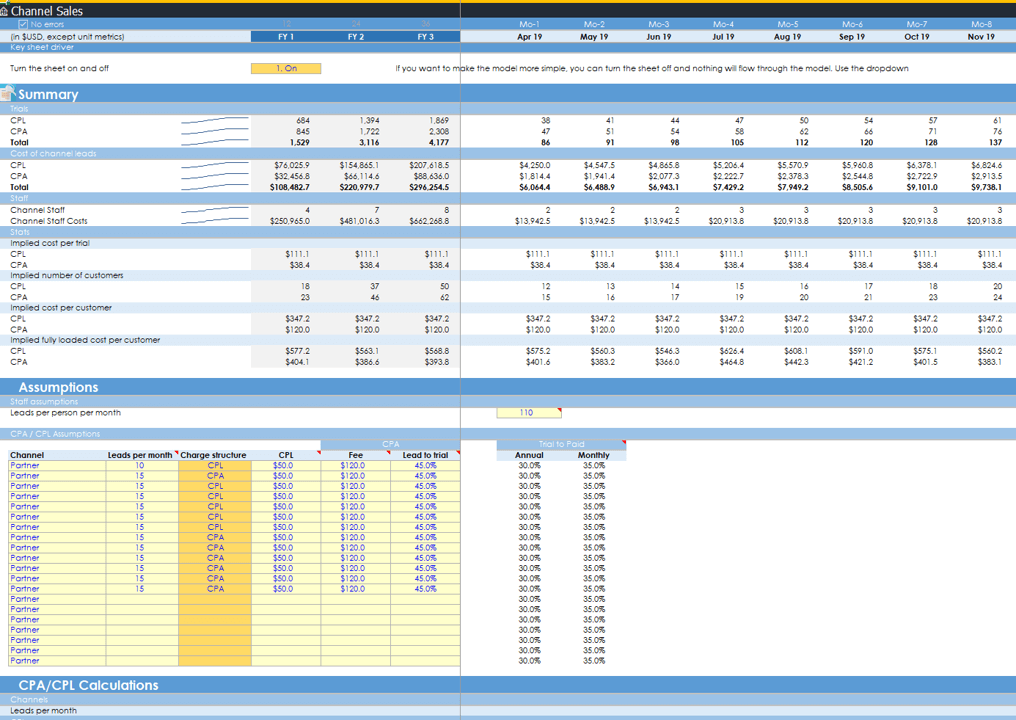

Channel sales as well

- Channel sales: Add a new acquisition channel, or turn it off with the flick of a switch

- CPA and CPM: Pay your channel partners on a CPA or CPL basis

- Staff included: Channel sales staff are automatically calculated based on how many leads a month they can handle