Walk through of some key features of the sheets in the Enterprise SaaS financial model

There is just a crap tonne in this model. I can't possibly explain all the details involved, and neither do you want to read it ;). I've whacked in 1/2 screenshots per sheet so you have an idea what is going on. If you want to see me explain it in more detail watch the videos. This should give you an idea of the magnitude of how much there is in this model and the time I put into making it.

Table of Contents (Click to section)

- Saas Model Architecture

- Formatting Sheet

- Detailed Profit And Loss Statements

- Annual Calculations Sheet

- Depreciation And Tax

- Payment And Tech Expenses

- Detailed KPI Sheet

- Runway Calculator

- Lots Of Charts

- Staff And General Costs

- Sales Automation Sheet

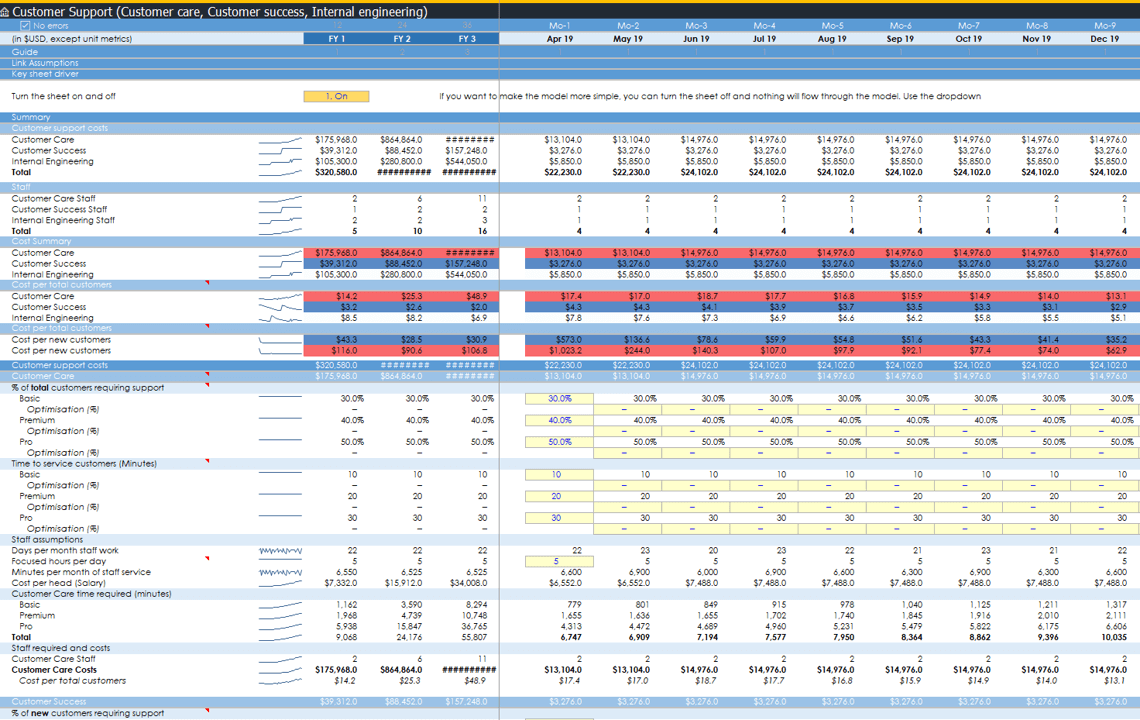

- Customer Care, Success And Internal Engineering Automation

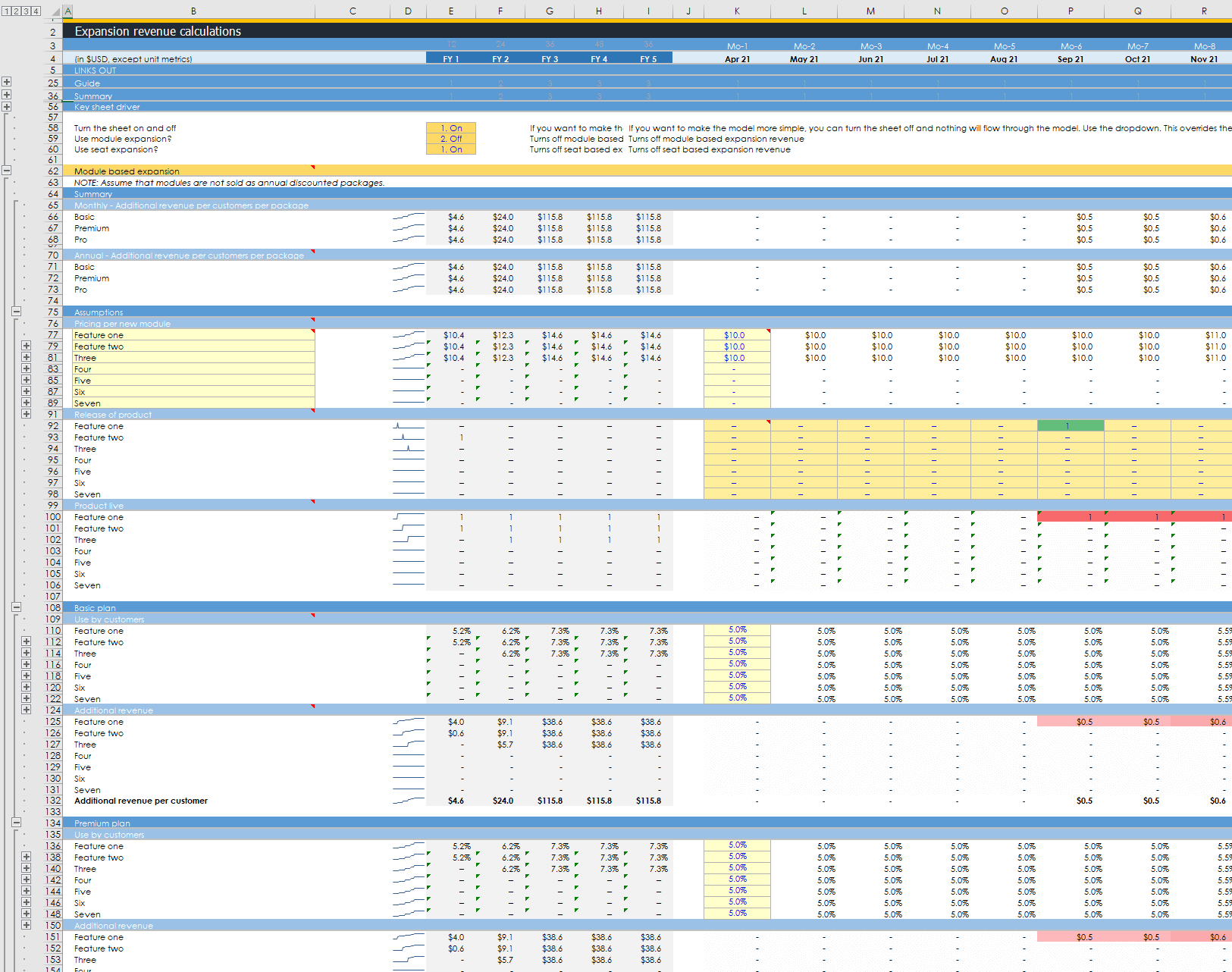

- Expansion Revenue

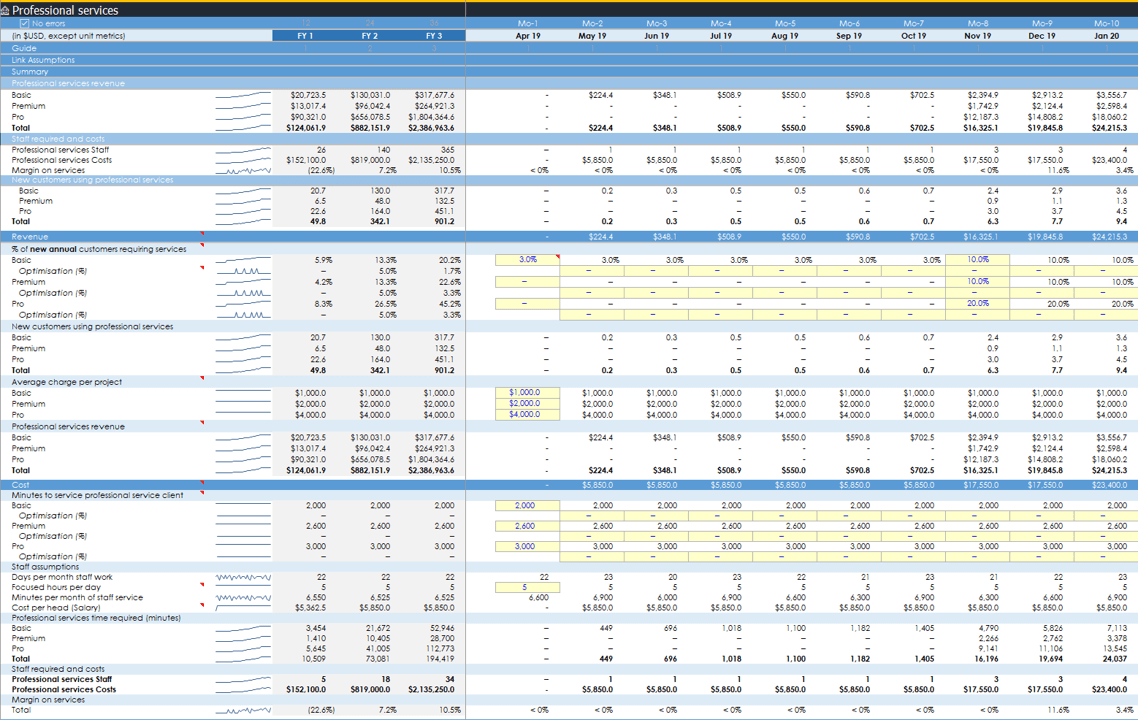

- Professional Services

- SME Pricing Sheet

- Cohort Modelling

- Conversion Assumptions

- Marketing Traffic To Trial

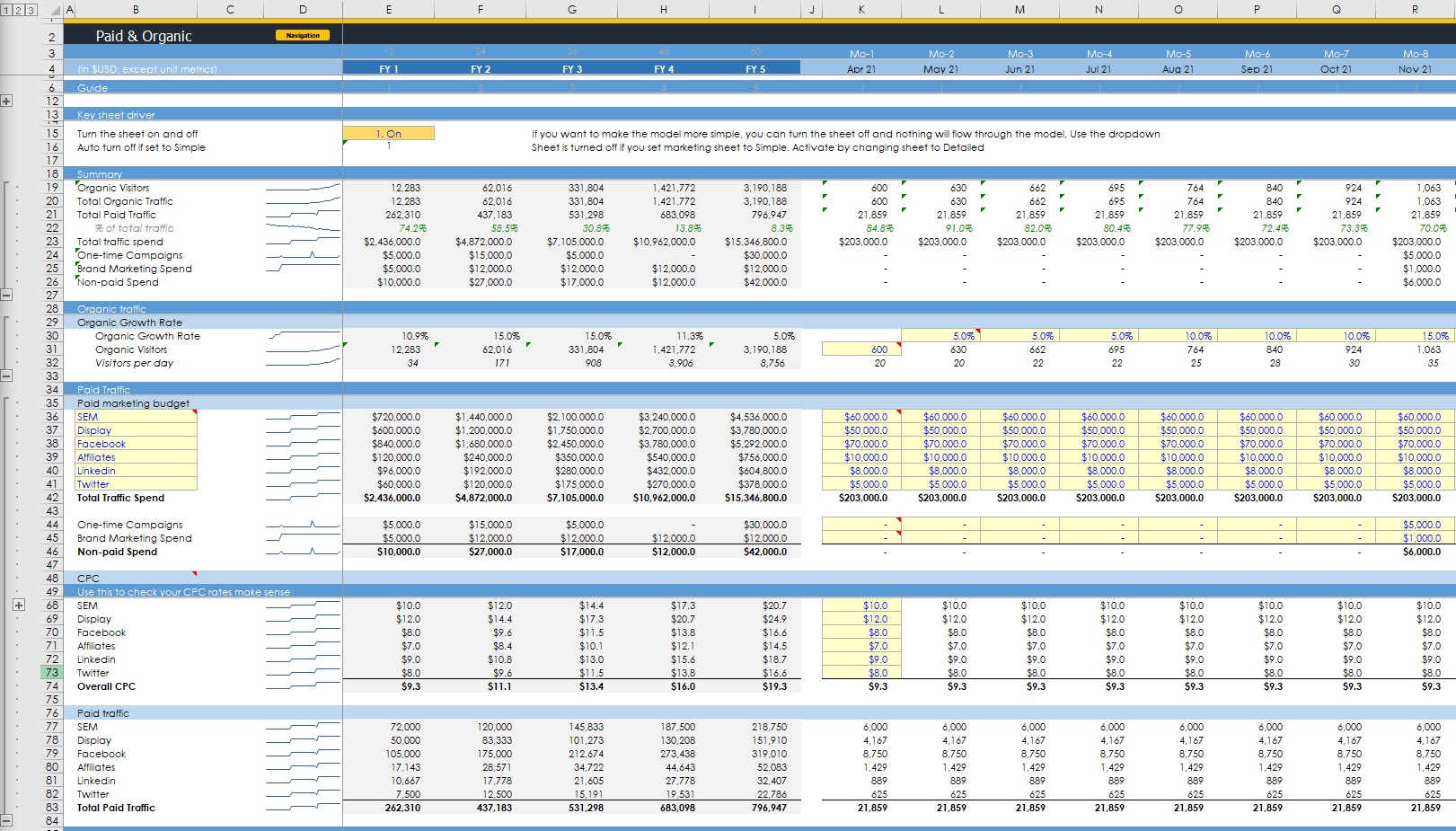

- Paid And Organic Marketing

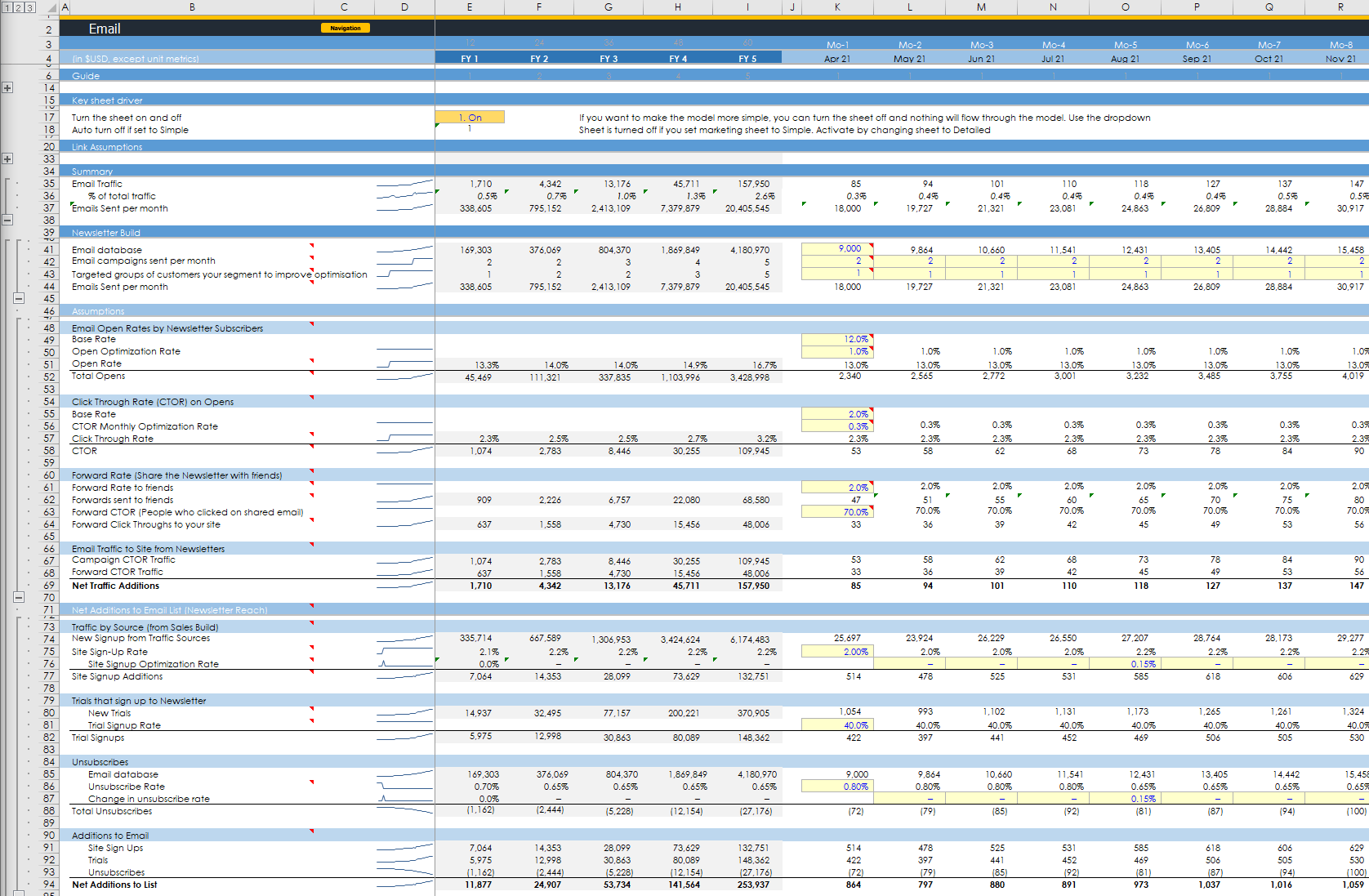

- Email Marketing

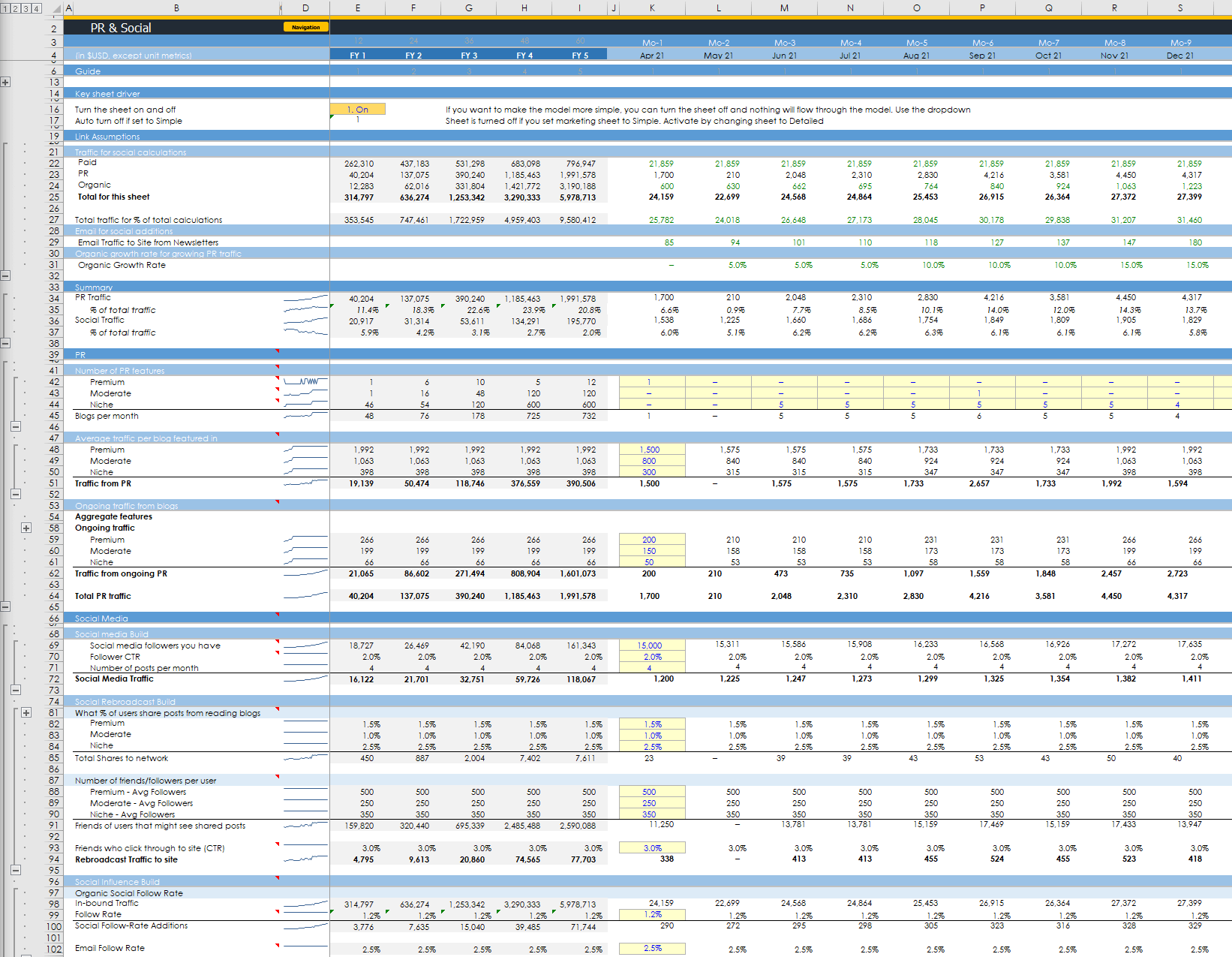

- PR & Social

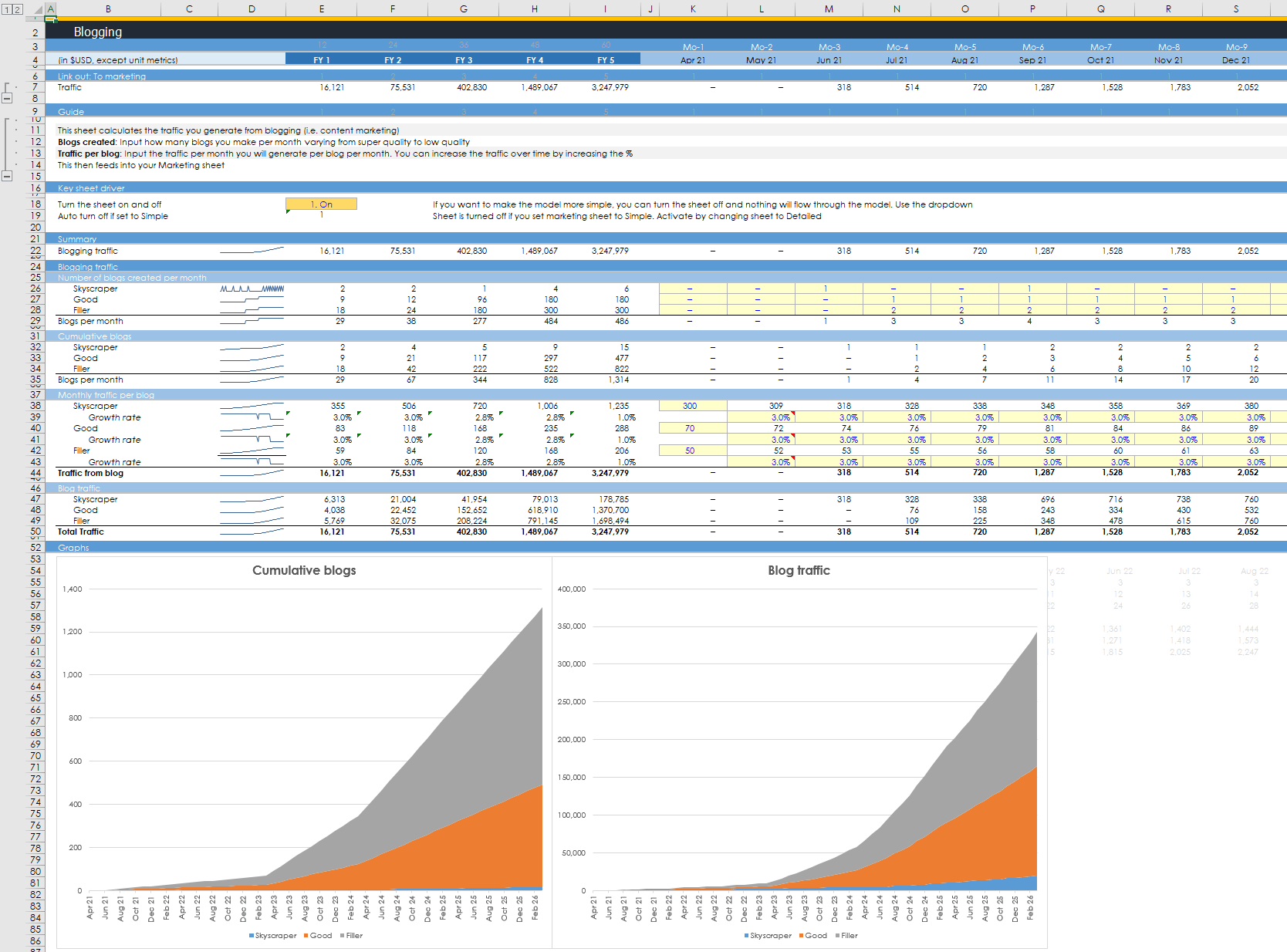

- Blogging

- Channel Sales

- Enterprise Revenue Summary

- Enterprise Revenue Assumptions

- Enterprise Forecast Assumptions

- Enterprise Revenue Forecast Calculations

- Enterprise Charts

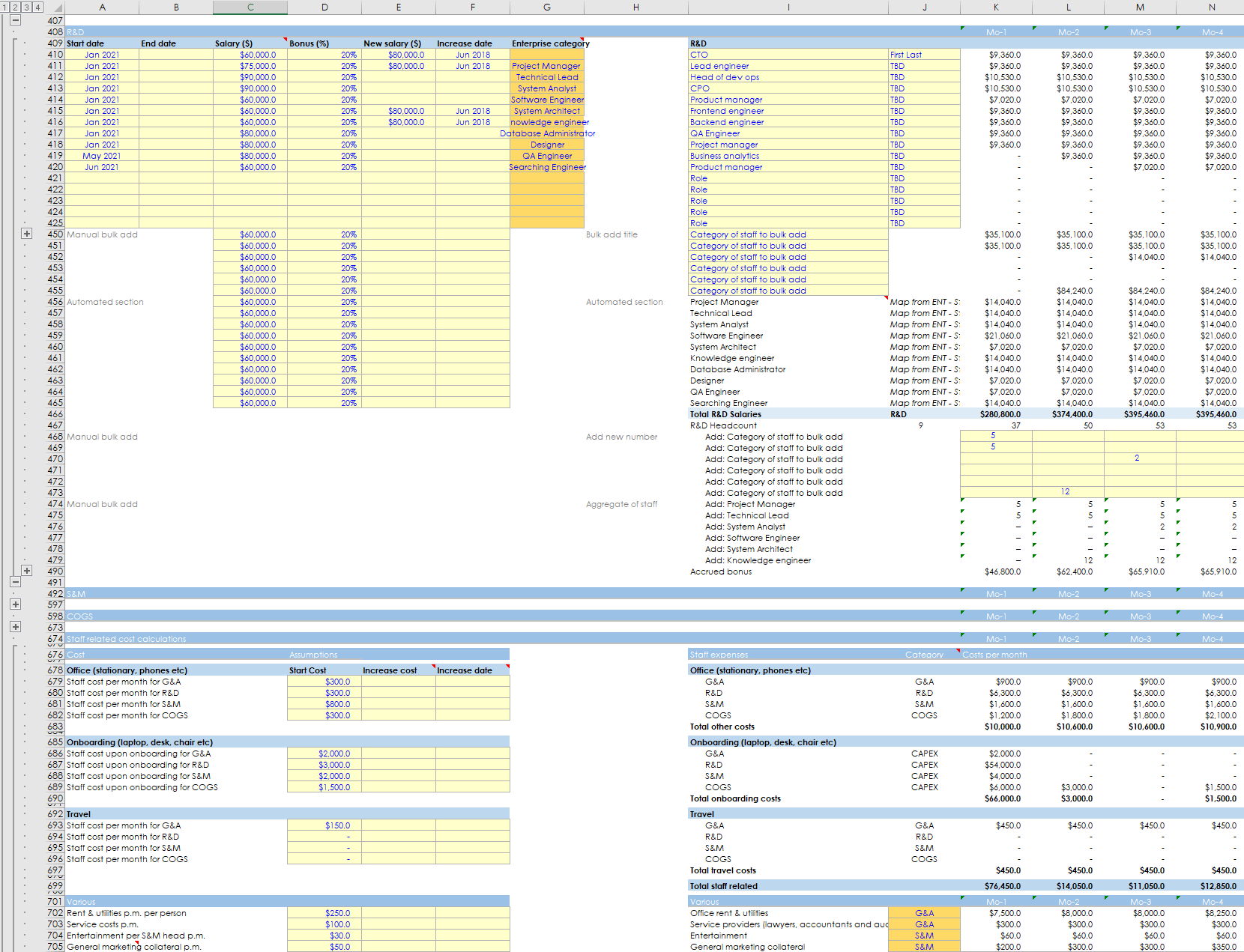

- Enterprise Staff Requirement Automated

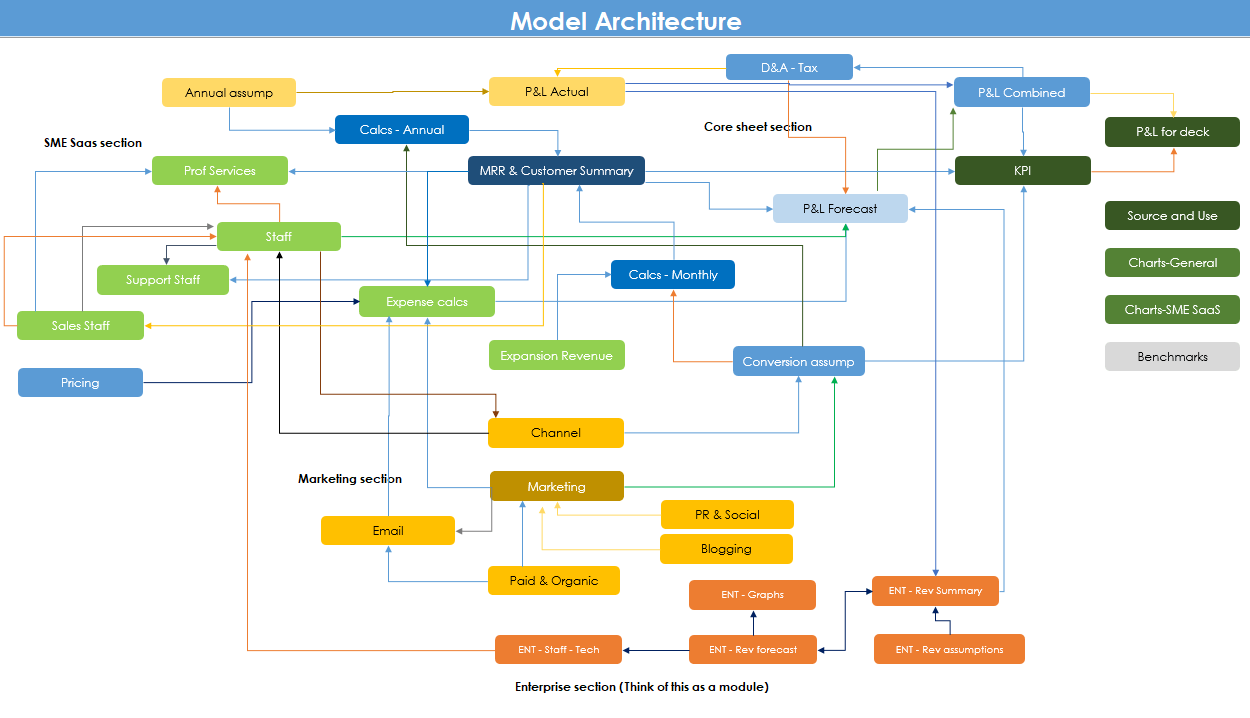

The Enterprise SaaS model architecture

- Fully integrated model: Changes in one sheet flow through the whole model automatically

- Logical flow: Expenses, marketing and revenue are all segmented so they connect logically

- P&Ls: Actuals and forecasts have their own P&Ls. These are then combined into a 'combined sheet' so you can see the progress month to month

- 2 main sections for revenue: The enterprise and SME are effectively modules. If you don't care about the SME revenue, don't use it. It's there in case you have smaller customers, annual contracts etc

- Other: Charts and KPIs have their own sheets. The key data from the large calculation sheets are presented so you don't have to dive into them

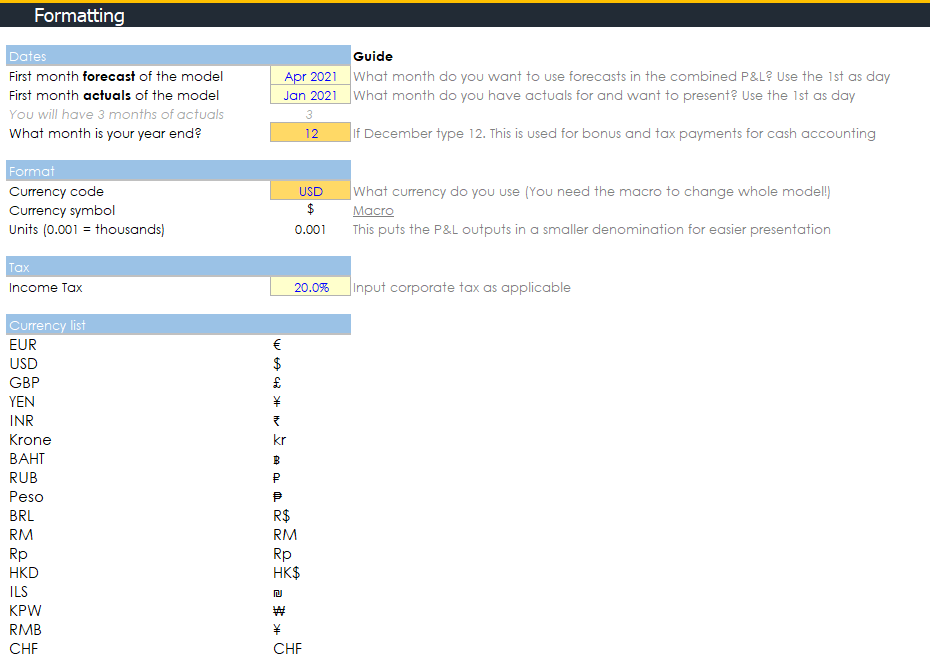

Formatting sheet

- Actual start: You can add up to 11 months in the actual sheet (12m is a historic, right?)

- Forecast date: Forecast sheet has 60 months of forecast

- Constantly update your model: I spent 2 weeks just figuring out a way to constantly update your model. You start with your Actual start date, then you can move your forecast month forward as time goes by. You then add your new actual month in

- Month end: Set your month end. Your annual bonus, tax etc will be paid out that month in the CFS, but accrue in the P&L as usual

- Currency change: With my plugin, you can switch to all the currencies you can see in the list

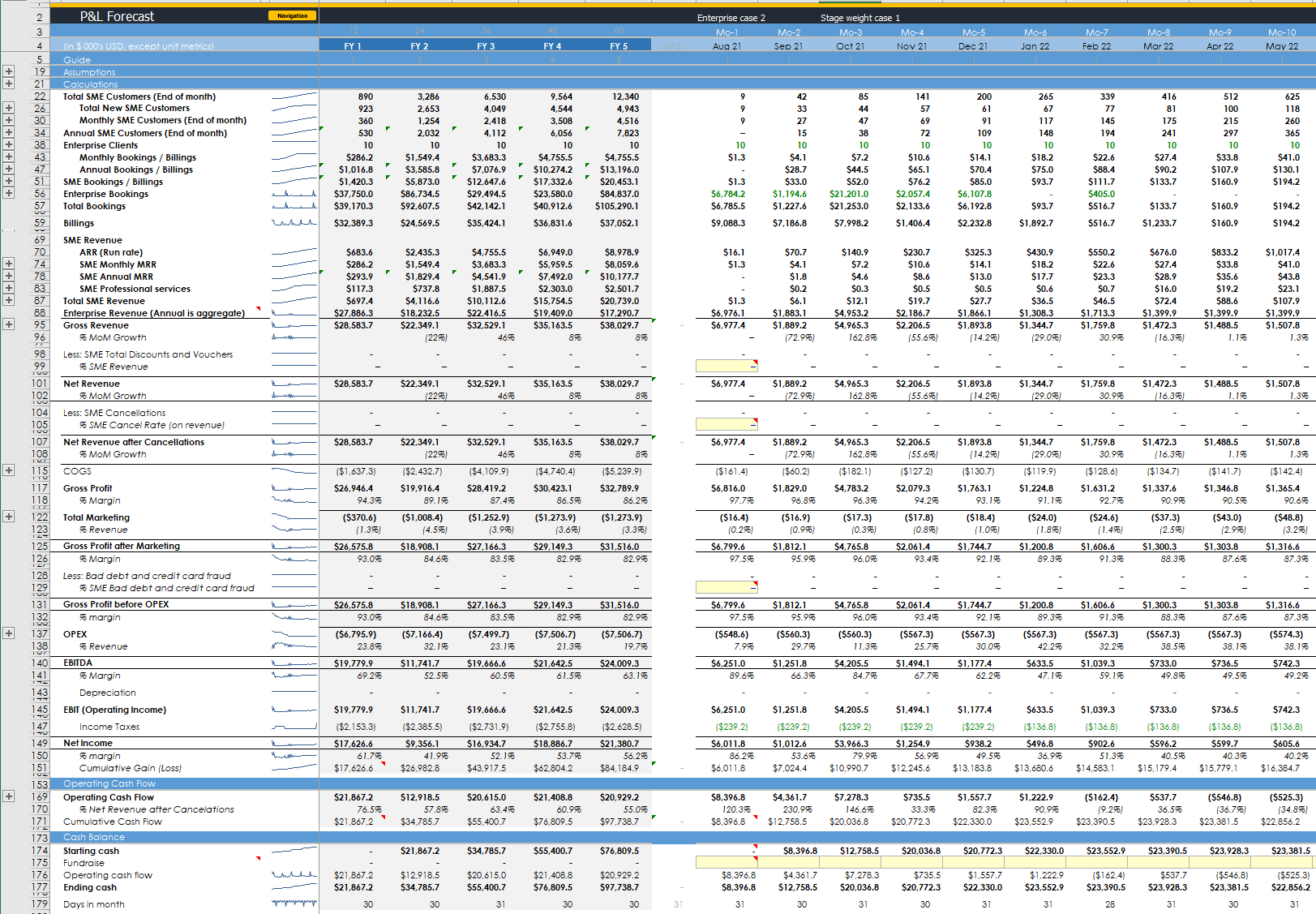

Detailed Profit and Loss statements

- 3 P&L sheets: Actual, forecast and combined. The combined presents actual to forecast together

- Non key assumptions in line: If you want to add discounts, cancellations and bad debt, you can easily add in a percentage in line. These relate to SME revenue not enterprise revenue

- Fundraising: When you plan on raising money, you just input the amount into your cash balance

- Accounting and cash flow: Two main parts. The main part follows normal accounting practices (There is a sheet for Tax to manage NOLs as well as depreciation following Investment Banking standards). The bottom of the sheet converts accounting to operating cash flow so you know when money is actually going in and out. There will be an update with an integrated Balance Sheet and CFS the guys are working on, but you don't really need it as you aren't a bank

- Complex adjustments: Bonuses are paid on year end in cash flow, but accrue in the P&L. Same for tax. Accrued bonuses from actuals are factored into your forecast for when they need to be paid

- Bookings, billings and revenue: All revenue types are 'accounted' for

- Grouping: Note the + buttons on the left. There's 179 rows you can group and ungroup like all of the sheets. The image above is the grouped one

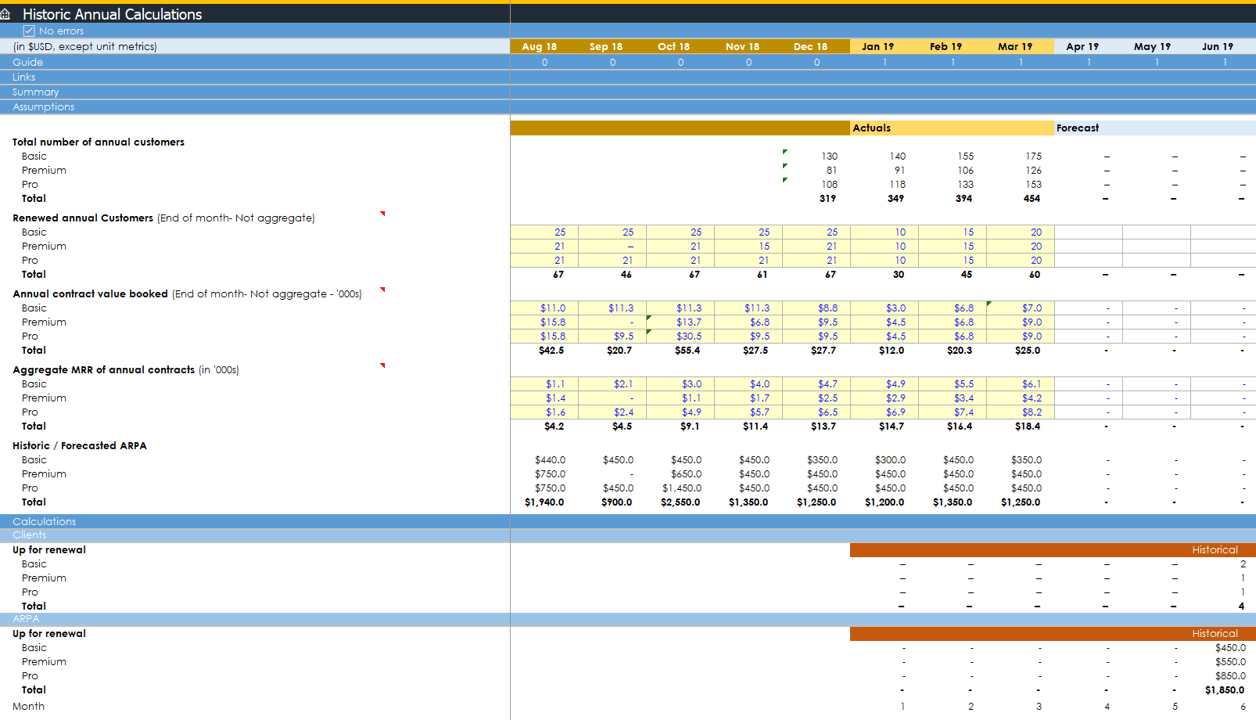

Historic SME annual contracts renew on time

- Scheduled contracts: If you have a lot of historic annual SME SaaS payments, then they need to renew at the right month in the future. This sheet ensures annual contracts renew on time

- Renew at new prices: If your old contracts were at $450 per year, but you have increased prices to $1000 a year, the model increases your ARR/MRR by the new prices

- Churn at old prices: When clients churn in the model, you lose MRR at the original ARPA, just like you should

- Simple: If you know how many clients you have each month and the ARPA, that's all you need to account for your historic revenue

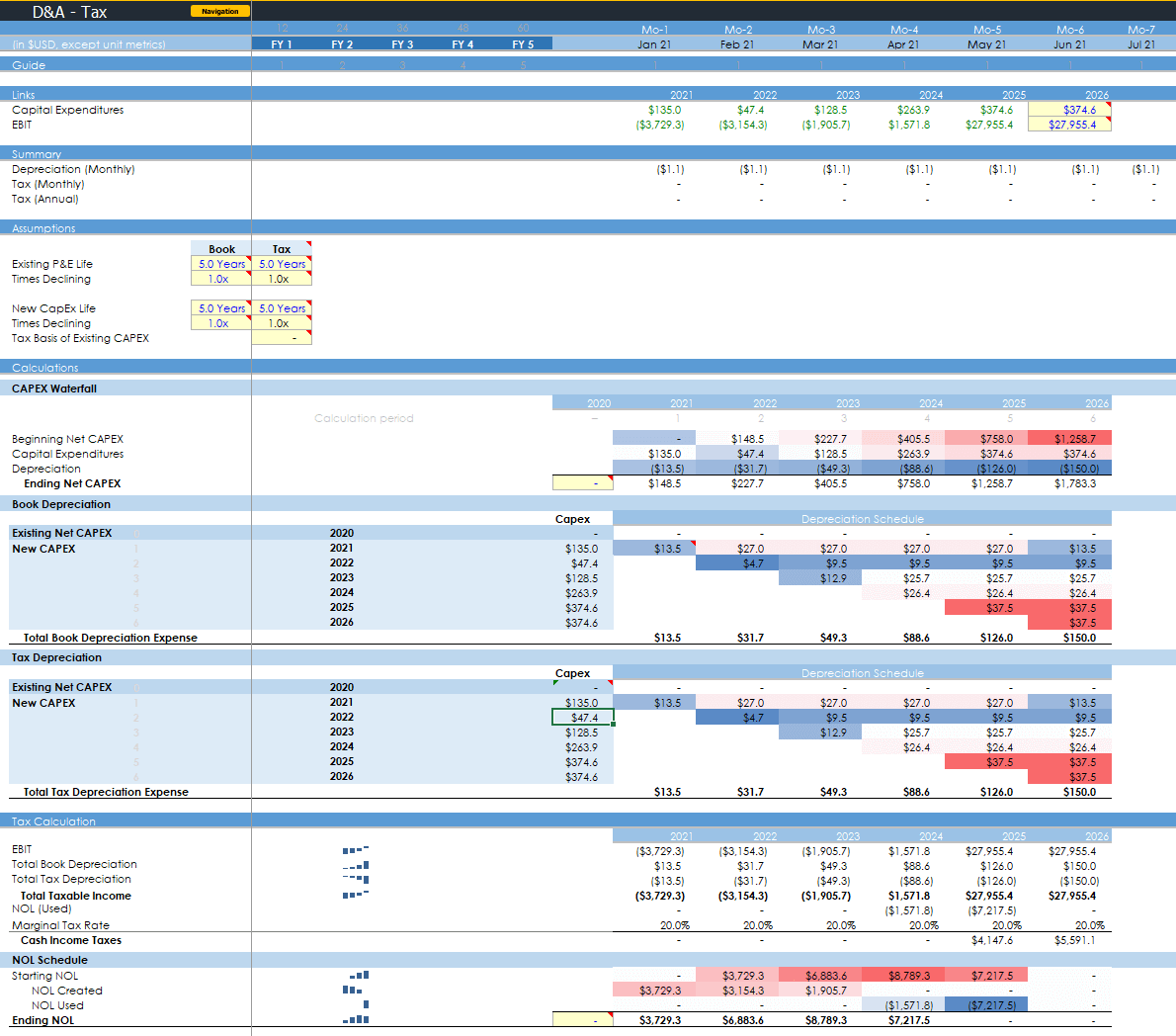

Depreciation and tax

- Control depreciation and tax: Simply manage the boring accounting bits with only a few assumptions like an M&A banker would

- Depreciation: Accounting for depreciation

- Tax: Calculate when you need to actually pay tax. Net Operating Losses (NOL) accounted for

- UPDATE COMING: I hired an accountant to add more boring nerd stuff to include R&D capitalisation etc. I'm not adding amortisation of intangibles because you're not a big corporation... I purposefully only add what might be useful

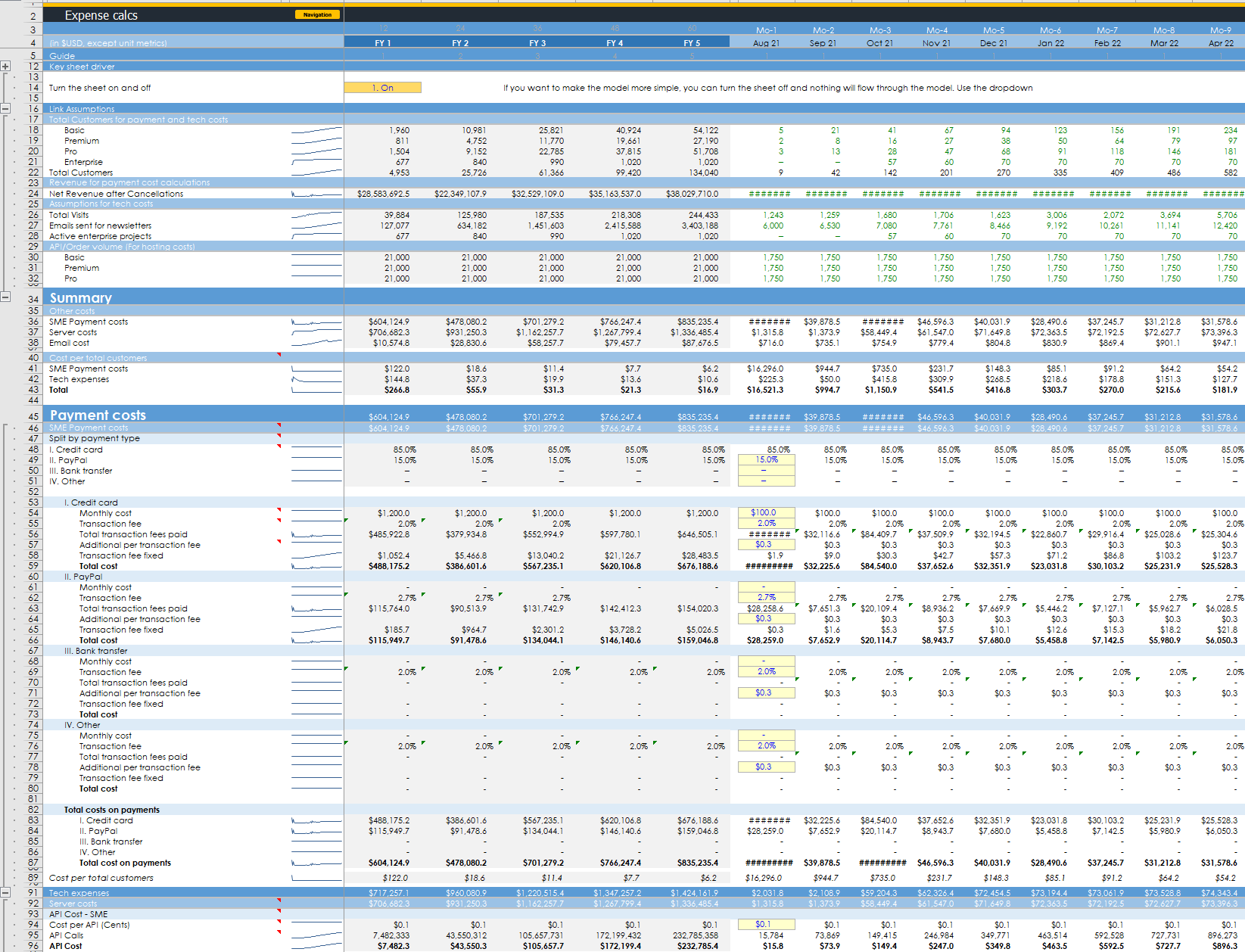

Payment and tech expenses

- Payment costs: Simply manage your payment costs with credit card, PayPal, bank transfer and payment on delivery. There are two sections for the SME and Enterprise revenue to calculate separately. I assume all SME incurs payment fees but that this can vary for Enterprise in caser clients wire cash and incur the costs themselves

- Tech costs: Automate server and email costs. You can build this out if it is a big deal to you. I've kept it fairly simple with sections for both SME and Enterprise

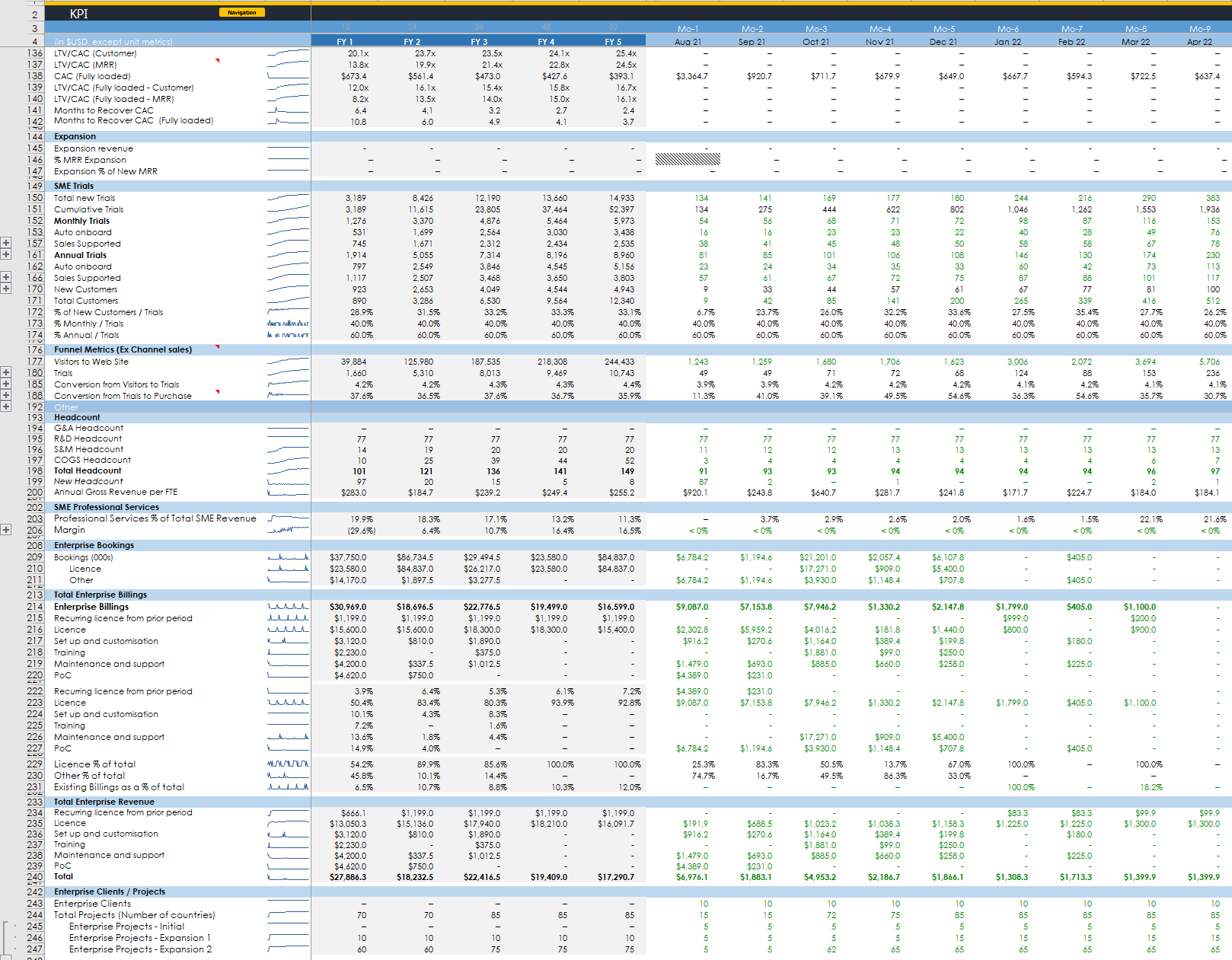

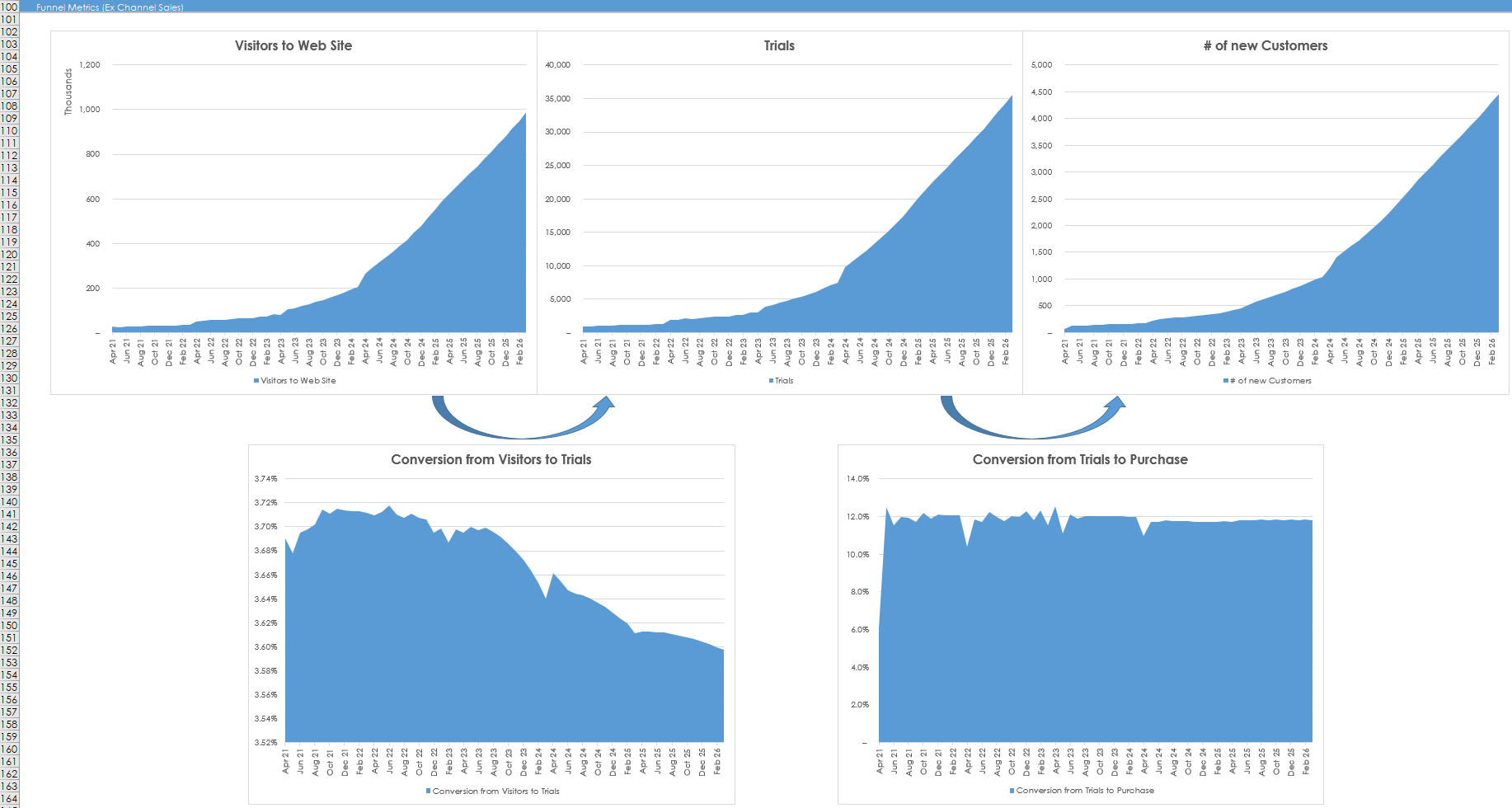

Detailed KPIs (269 rows)

- Detailed KPIs: 269 rows of every KPI I could think of that is meaningful. I break out calculations in the rows so you can see how the calculations are made, and what adjustments I've included

- Editable: Nothing is linked to this sheet. You can add whatever KPIs you like if you want to

- Lots of details such as CAC/LTV: See your key KPIs calculated with based on both customer and MRR churn. There are also basic and fully loaded variants

- Segments: KPIs for key financials, margins, cost structures, cash burn rate, bookings, MRR, churn, unit economics, expansion revenue, trials, funnel metrics, headcount, and professional services

- Dates: Both monthly and annual KPIs

- Sectioned: There are parts for Enterprise and SME metrics

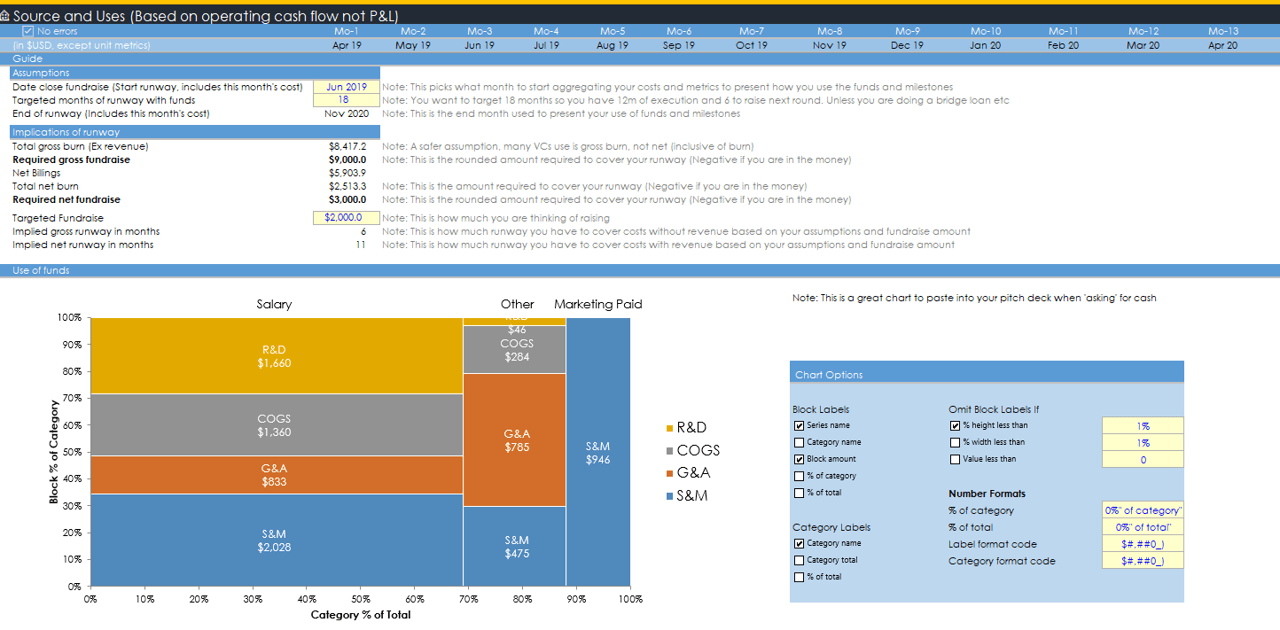

Runway calculator

- Runway calculations: Understand your gross and net burn over your defined runway (in months). See how many months your planned fundraise will last based on your model forecasts

- Detailed operating expenses: See exactly where money is being spent per department over your runway

- Charts: Pre-made fancy charts to use in your deck if you want

Charts

- Each sheet has charts: I've stuck in relevant charts to check trends at the bottom of every sheet

- Charts in one place: I have two sheets with all the charts in one place for the SME section. Enterprise has it's own fancy page built on pivot tables

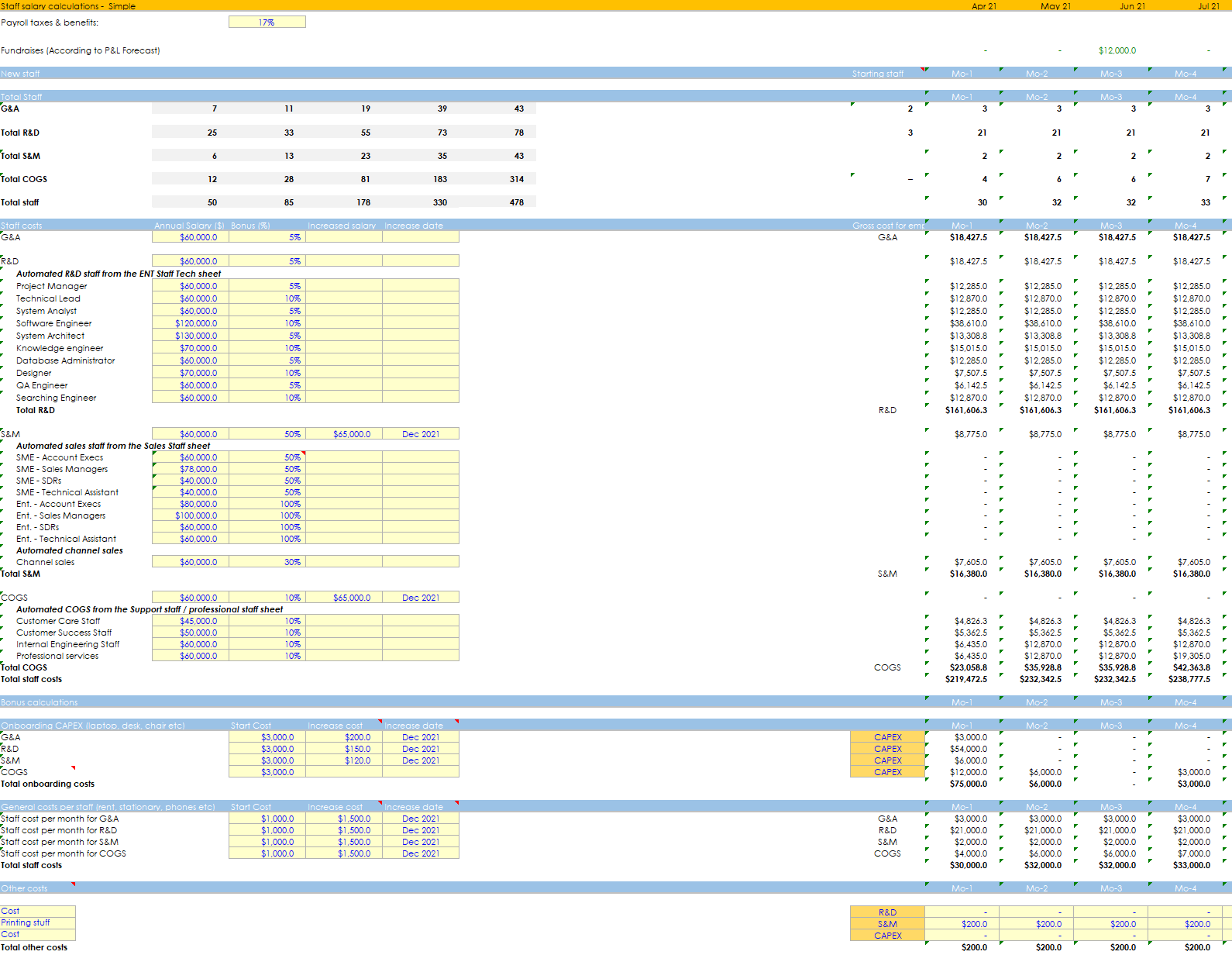

Staff and general costs can be detailed or basic

Basic staff sheet version

Detailed staff sheet version

- 2 methods for forecasting staff: Switch between the basic and detailed method for forecasting your staff requirement. If you want to fill in the model faster, choose the basic option. If you have a detailed hiring plan, pick the detailed version

- Automatic forecasting: Sales staff, customer care, developers etc can automatically be calculated in other sheets. These feed into both the basic and detailed version so you can choose how detailed you want to be with a flick of some switches. I'll explain the developers' sheet for Enterprise seperately

- Scale recruitment as you need: Opt to hire recruiters when you hire [5 or more] new people a month so you don't have to think about how many recruiters you need

- Granular control over hiring: Easily add benefits/tax, choose the date you hire/fire staff and the date you want to increase their salary (say at Series-A)

- Other costs: Quickly add all the 'other' costs you need like rent, onboarding costs (e.g. laptops) of staff, and whatever costs you need without having to overthink it. Most costs are calculated by multiplying the average cost be the number of staff you have

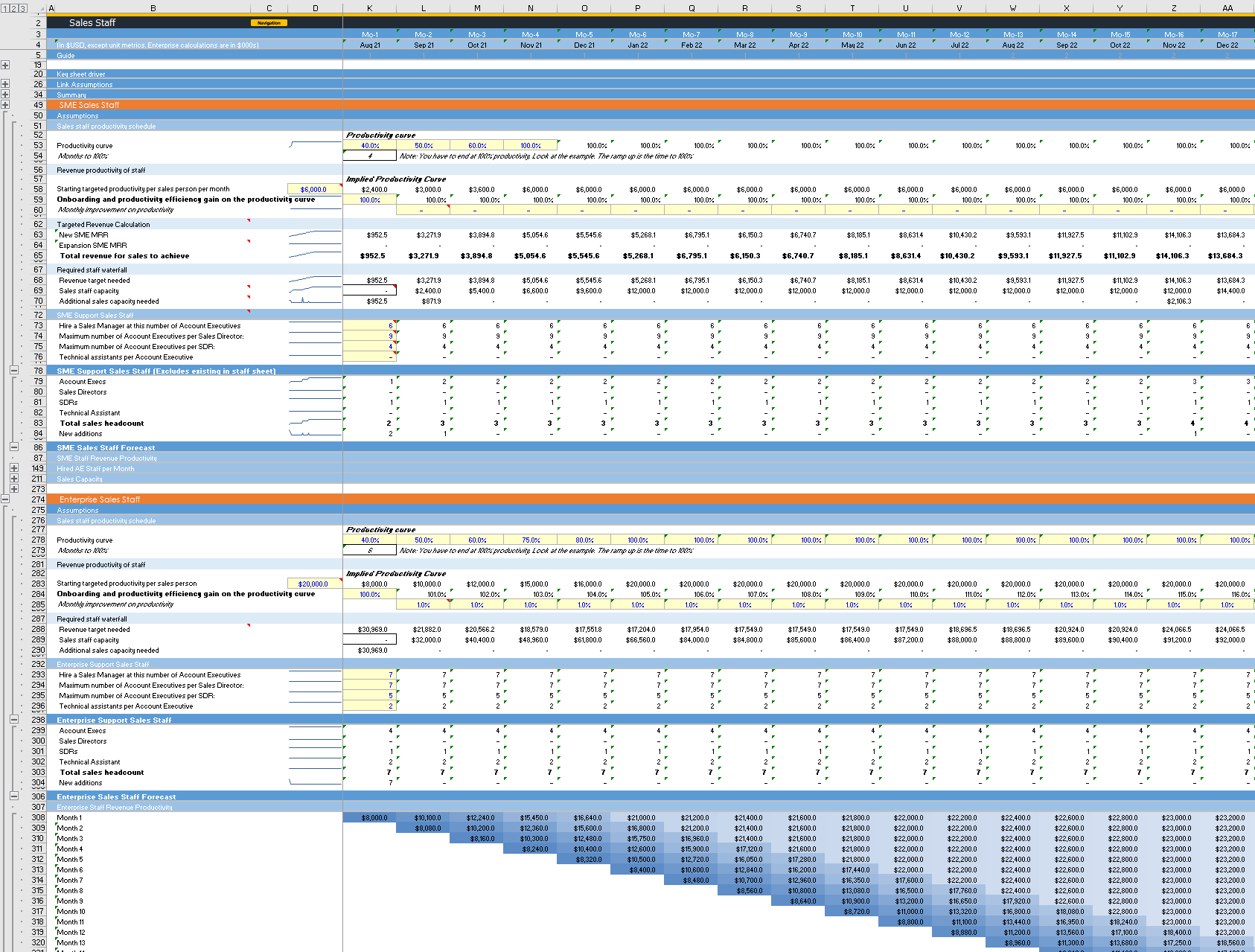

The sales team ramps up to productivity

- Switches: Turn the sheet on off as well as the SME/Ent sections. You can also opt to include expansion SME MRR into sales targets

- Build two sales team: Two sections to model SME and Enterprise sales teams

- Build a sales team: Easily build a sales organisation with account execs (AEs), sales directors, SDRs and tech assistants. They scale by the number of AEs you need to hire to hit your targets. You only need to make 6 assumptions to make this all work

- Productivity ramps: Define how many months it takes for new AEs to hit their quota. You can also set what % of staff hit their OTE (one study says this is 65%) to factor in your staff not performing - this can be adjusted to improve over time

- Hiring based on revenue targets: You define what % of your revenue is sales supported and what the revenue target of an AE is, and the model knows your existing capacity and tells you how many people you need.

- Integrated into the staff sheet: Sales staff are fed into the main staff sheet so everyone can be seen in the same place

- Cohorts: Cohort modelling knows what is required on a monthly basis. You can't get more detailed and accurate than that

Customer care, success and internal engineering automated

- Integrated with staff sheet: Flows into the staff sheet automatically so your need scales with how you forecast

- Switch on and off: Turn the sheet on or off with a flick of a switch if this is too detailed for your stage

- All support staff covered: 3 sections for customer support, customer care, and internal engineering. Customer support covers your ongoing needs and the other two cover on-boarding of new customers

- Simple but detailed: Defined what % of customers need help and how many minutes they need on average, and the model tells you how many staff you need

Got expansion revenue? 2 ways to do it built in

Module based expansion

Seat based expansion

- 2 ways to calculate expansion revenue: Add two pre-built expansion revenue based modules: Module based and seat based

- Modules: Modules are new features you ship customers pay for. Pick when you launch them, what you charge and what % of customers buy them

- Seats: Seats are just more users at a firm. Define how many seats, the price per seat and what % of customers take them. I allow you to set a schedule for how users adopt new seats over time. For each cohort your clients will adopt new users on the schedule

- Integrated: Automatically feeds into other sheets to add to your MRR build

Professional services included

- New revenue and costs: If you offer professional services to new clients, you can add in the revenue you generate and cost cost to service them and it will feed into the sheets they need to be in

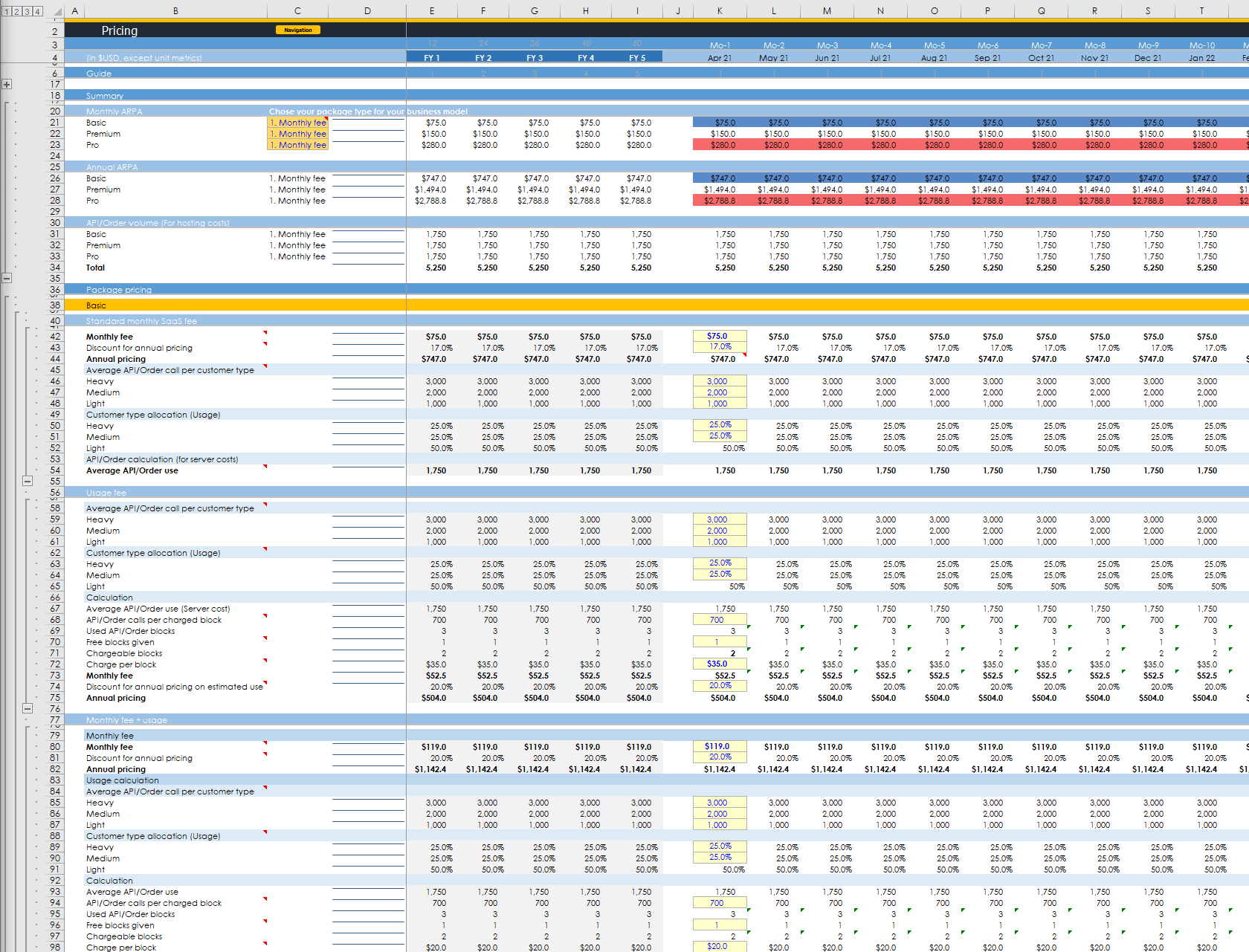

3 ways to set your pricing based on your business model

- Switch between 3 pricing models: Charge a monthly fee (normal), usage (such as for API calls) or a combination (monthly fee + usage fee)

- Discounts for annual: If you offer discounts for annual subscriptions you can simply add the discount and the model does the thinking for you

- Usage integrated with tech costs: If you involve a lot of API calls (or change to whatever suits you), the API calls are linked to your tech expenses to make costs easier to calculate

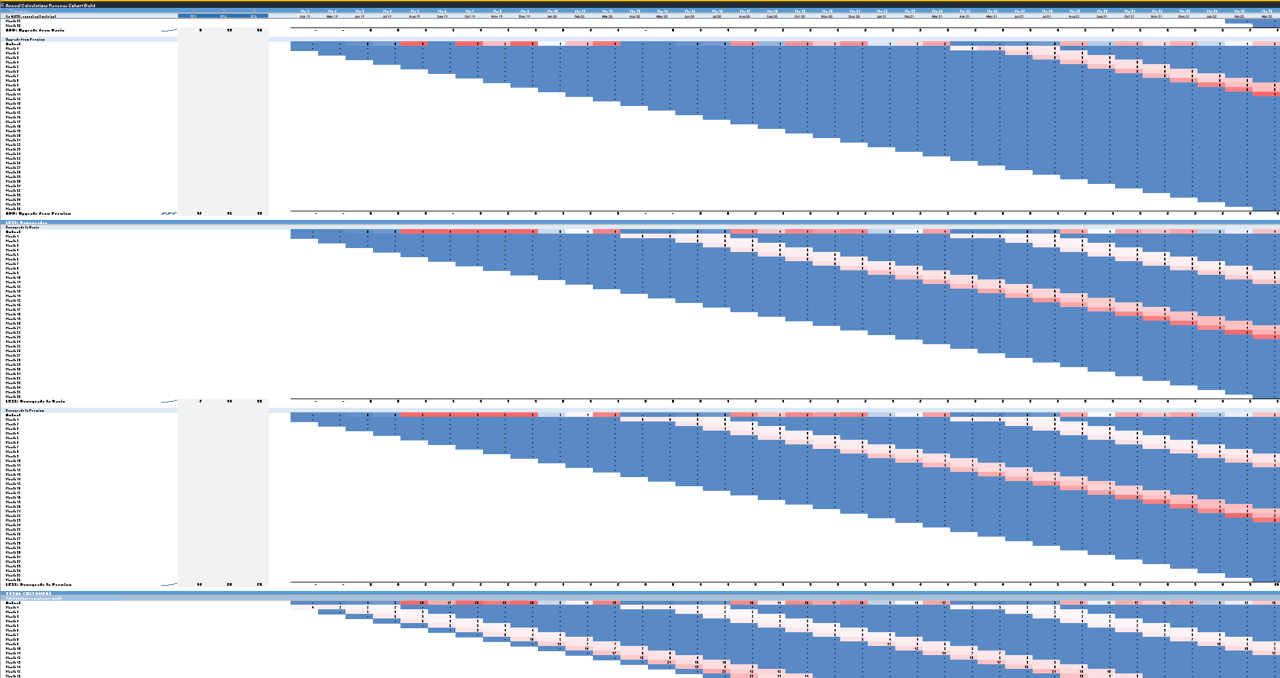

Cohort power

- Granular modelling: The entire model is based on monthly cohorts. This is complicated to build but enables you to do a lot of things you couldn't without them. The SME annual calculation sheet is 5,999 rows long and has 185k formulas. The Enterprise calculation sheet has 131k formulas. Yes, this is not the level of detail anyone in the world does and why you're paying for the best. The whole model has 619k cells with data.

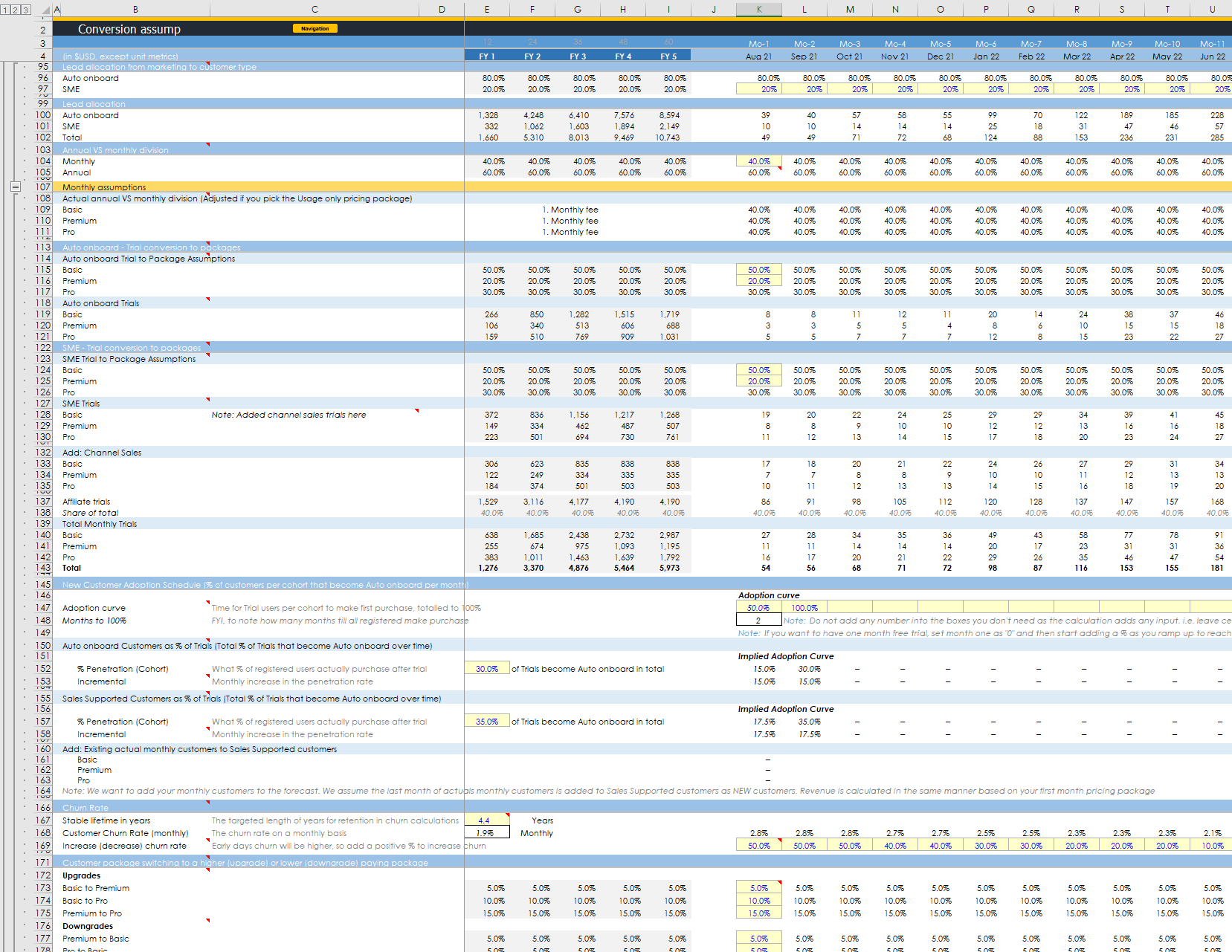

Control over customer and revenue forecasts

- Annual vs monthly: Define what % of your customers are annual or monthly. Each have their own assumptions. No investor is going to say you haven't thought about your business again

- 3 avatars: Customers have three profiles throughout the model: basic, premium, and pro

- Auto onboard vs sales supported: If you have a low ARPA you are going to have customers on board themselves. Alternatively you need a sales team? Define how large a sales team you need by allocating customers to them here

- Funnel: Traffic to trial to customer. We define how trials convert into customers and over what time period

- Adoption curve: Define how long it takes for trial customers to become customers

- Churn: Set churn rates for both monthly and annual assumptions

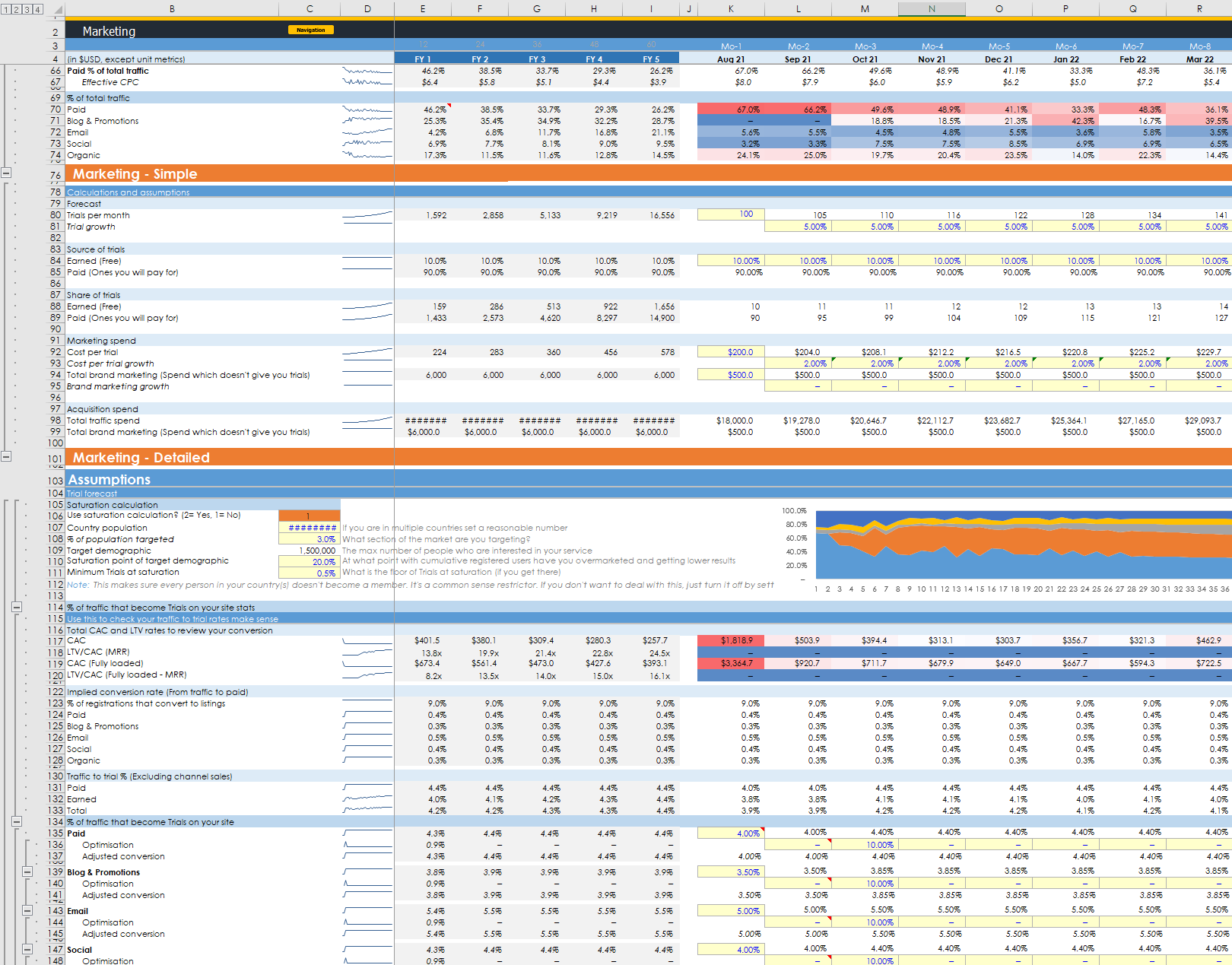

Complete SME marketing

- Two ways of modelling trials: Basic just generates trials and a basic CAC. Detailed let's you go all out

- Granular assumptions: Control how traffic turns into trials by setting conversion rates

- Conversion: Convert your traffic to trials

- 5 marketing sheets: Main marketing sheet gets fed by 4 marketing activity sheets which are all integrated. Paid, organic, email, blogging, social and channel sales.

- Growing too large?: In built calculations to stop you growing larger than your defined market. Turn it on and off... if you want that level of nerdy- ignore and hide it otherwise!

Paid and organic marketing

- Switches: Turn sheet on and off

- Organic growth: Simply add an organic growth rate of people going to your site

- Paid growth engine: Set your spend per month across up to 6 channels. Set your CPCs to generate traffic to your site. In addition you can add non-paid spend which doesn't attribute traffic (one-time campaigns and brand marketing) but will still contribute to your marketing costs and metrics

- Supporting metrics: See supporting conversion rates and metrics to check things make sense

Email marketing

- Switches: Turn sheet on and off

- Earned growth: Support sheets effectively help you to reduce your paid CAC

- Fancy assumptions: There's a load of assumptions built-in from open rates, click through, forward rates, rebroadcasts, unsubscribes, etc.

PR & Social

- Switches: Turn sheet on and off

- Earned growth: Support sheets effectively help you to reduce your paid CAC

- PR: Get press, featured in TechCrunch etc and get earned traffic to your site. Simple to follow and understand.

- Social: Build a social following with lots of detailed assumptions as the email sheet. How many times you post, follow CTR, follower shares, rebroadcast rate and CTR, as well as builds to your email list

Blogging

- Switches: Turn sheet on and off

- Earned growth: Support sheets effectively help you to reduce your paid CAC

- Blog: Write blogs and get traffic. Assume that you will get initial traffic and then residual traffic which aggregates over time

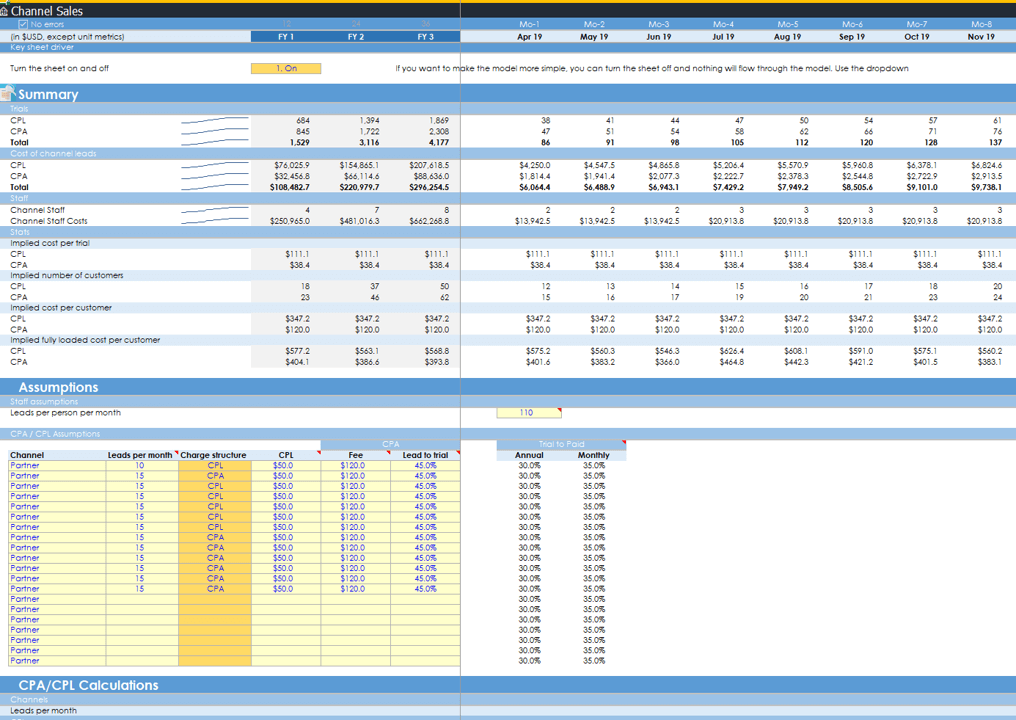

Channel sales as well

- Channel sales: Add a new acquisition channel, or turn it off with the flick of a switch

- CPA and CPM: Pay your channel partners on a CPA or CPL basis

- Staff included: Channel sales staff are automatically calculated based on how many leads a month they can handle

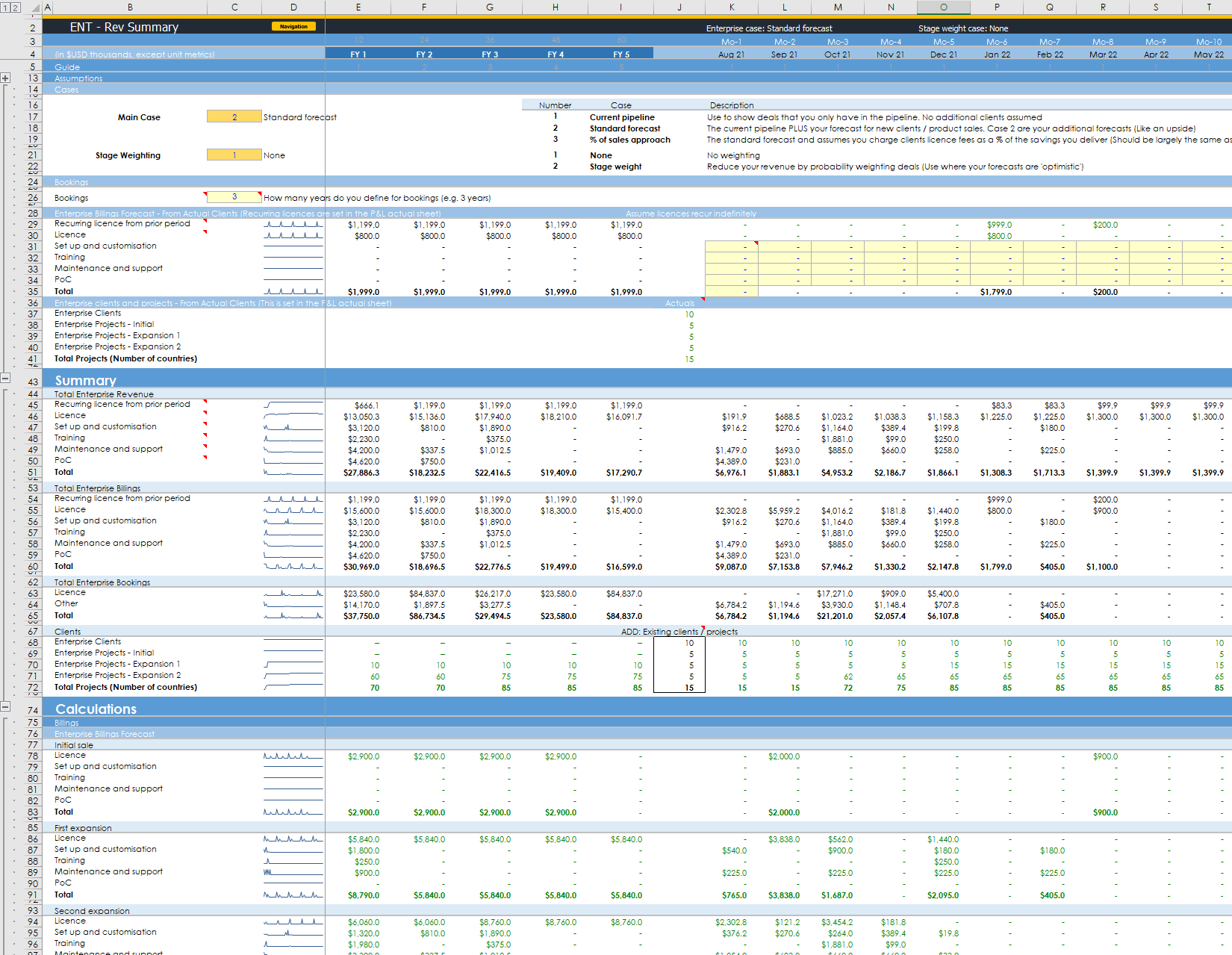

Enterprise revenue summary

- Three cases: I allow you to make three scenarios for your forecasts. The current, standard pipeline, and value based pricing. If VCs start calling BS on your forecasts, you can flick the scenario and show them new outcomes, as well as the hope and rainbows outcome

- Stage weighting: Also, on the topic of VCs calling BS on your forecasts... what about applying your funnel %s to probability weight your pipeline? I explain the stage weight as "Reduce your revenue by probability weighting deals (Use where your forecasts are 'optimistic')". Cool, huh?

- Set your average booking period: Rather than getting too complicated, set your bookings to 3 years in one cell

- Add in your historic revenue: Build off your existing recurring licence fees (or whatever else) simply. Cohorts do the math to give you the outputs so you get the cash when you expect it. Your client base is added here too

- Summary stuff: Have a quick look at all your revenue streams to make sure it makes sense. See your billings and bookings by phase

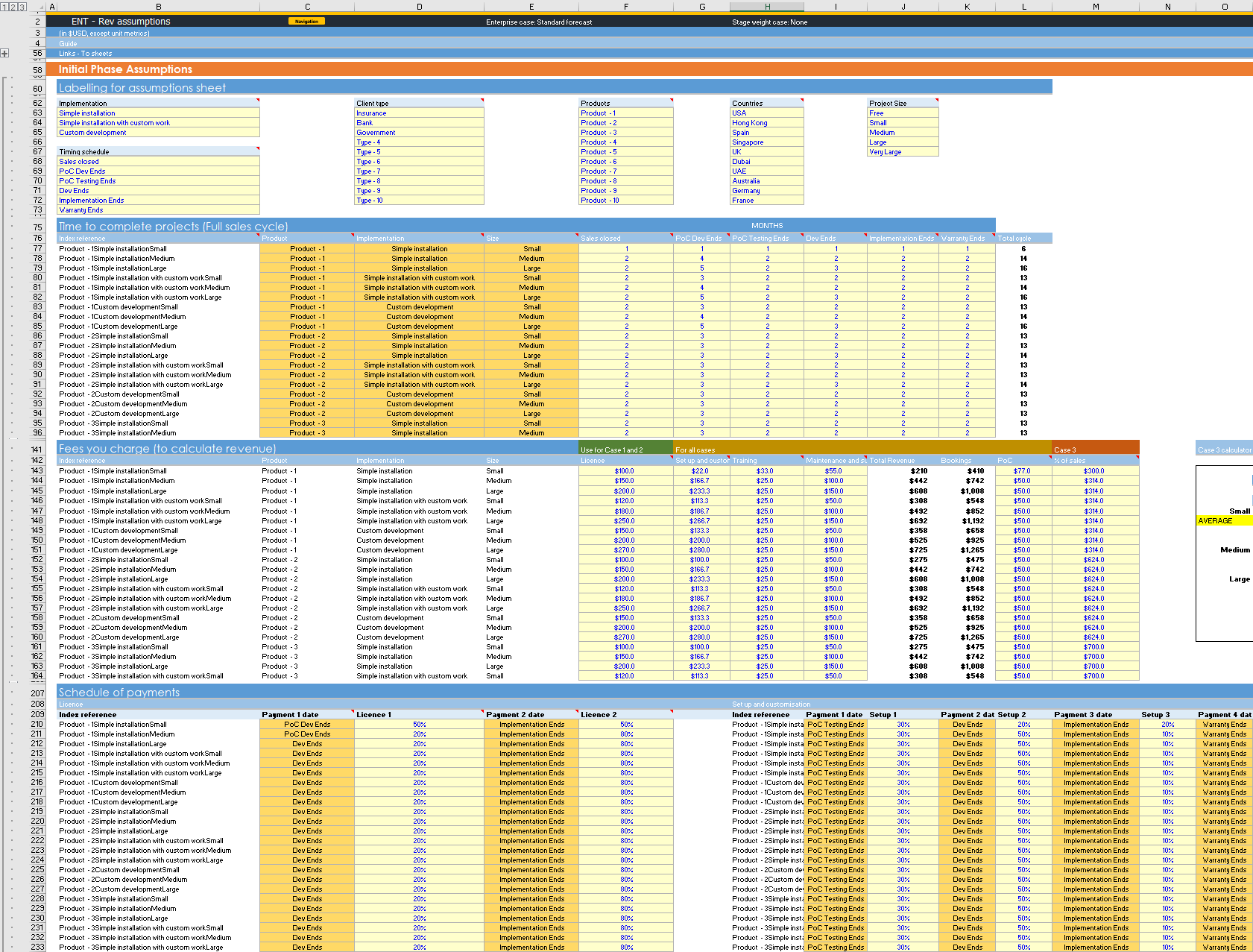

Enterprise revenue assumptions

- Label everything: Term your implementation types, timing schedule points, client types, product names, countries and project sizes if you don't like all my examples and have your own (Especially client type, products and countries)

- Set your full sales cycle with 6 numbers: I made this model for myself and then pimped it out. We had a 13-month sales cycle which is a nightmare to do... You set months for sales to close, PoC development and testing, when custom development ends, when implementation time ends and finally when warranty ends. If you do custom work like this, you will know how cool it is to be able to do this! It took me forever to figure out ;(

- Set full revenue fees by exact offering: You set your product, implementation and deal size for every variation. So could be 3x X 3x X 3x would be 17 possible variations. Then you can set your average price for licence, setup and customisation, training, maintenance and setup, PoC, and the moon shot... Value-based pricing is hard to pull off, but can be lucrative. If you can do it, great. I built it as I was trying to do it so there is even the table I actually made for myself to figure out the pricing.

- Set a schedule of payments: You want cash and clients want milestones. So you are doing to get licence fees in say two tranches on delivery dates. You get setup fees, PoC etc at different points. You just use drop downs (the orange boxes) to pick the payment milestone and the % of the payment and that's it. Now yeah, that may sound tedious, but dude... all the calculations are done for you! I have PTSD just writing this

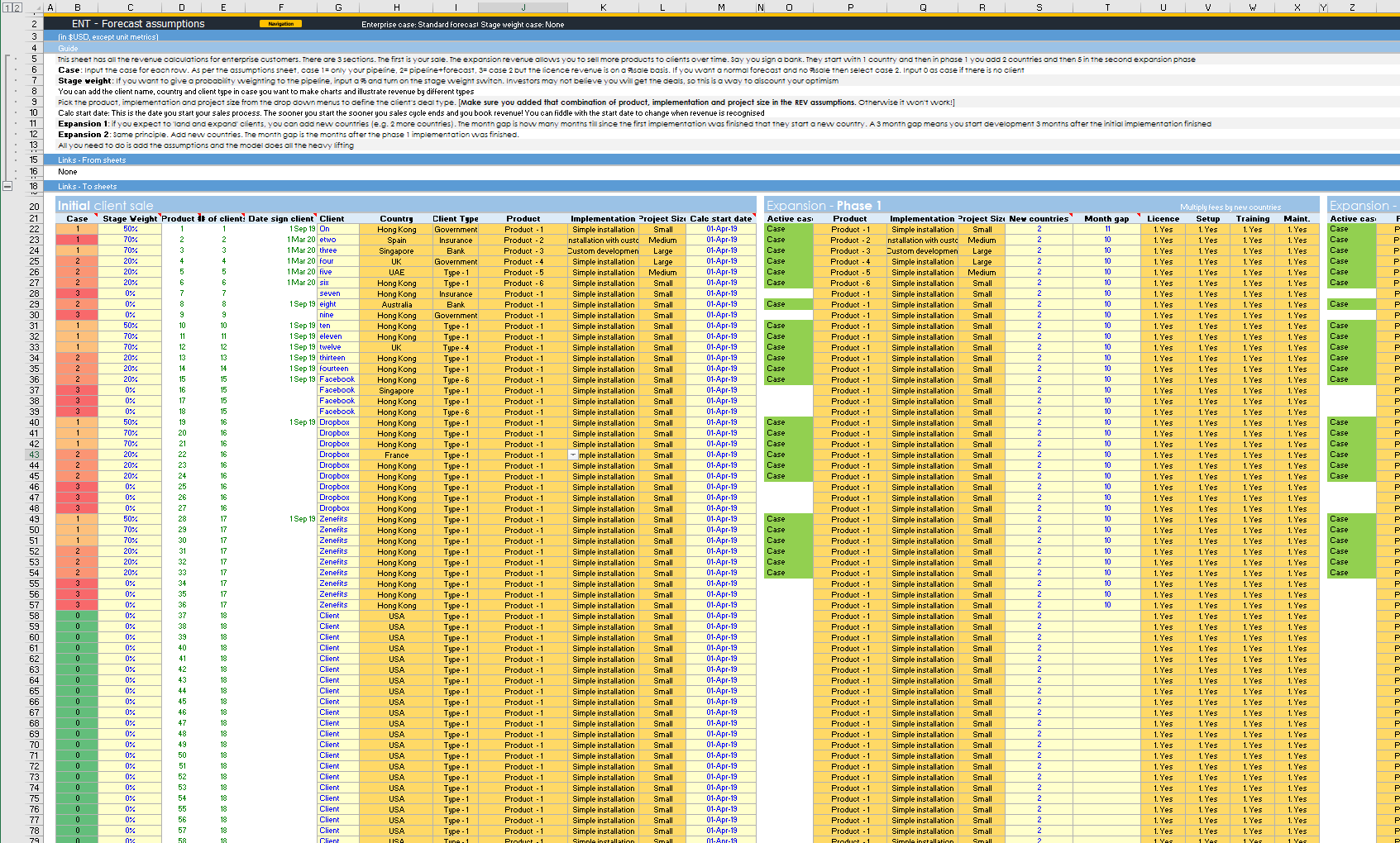

Enterprise forecast assumptions

- Forecast in a sheet: All the assumption inputs to forecast your enterprise revenue are in a sheet, with initial sale and expansion phases 1 and 2 are in line (I updated the model to make this easier to see)

- Granular assumptions: The orange boxes are all drop-down menus linked to the assumptions sheet. Every time you want to make a forecast of adding your pipeline, you just add through the dropdowns and the model indexes the ranges to do calculations for you. Again, may seem like work, but you can literally do everything you can (Meaning I) can think (thought) of.

- Set cases: Run up to 3 cases if you want to. Just use the drop-down in the first column to duplicate scenarios and change the assumptions. The way it's done if you have the current pipeline as the baseline, then you have scenario 2 as a 'hopeful' pipeline and scenario 3 is if you charge on a % of sales. I don't do a bear, base, and bull because that's way to much work for you to figure out.

- 3 phases: I approach enterprise sales as you get a client and they don't go all in. You do a country or a product in Hong Kong office of that bank. Then they test and you expand ("land and expand") to more. Then there are two more phases of growth - phase 1 and 2. Here I add two more columns for the number of countries and the month gap. The new countries mean HK likes it, goes to HQ and you get to launch 5 more offices with that product. The month gap means it takes time for them to test so the whole sales cycle kicks off again once someone says let's do more and you start sales again to get into more countries. I was selling to banks and insurance companies, so I built it with this paradigm.

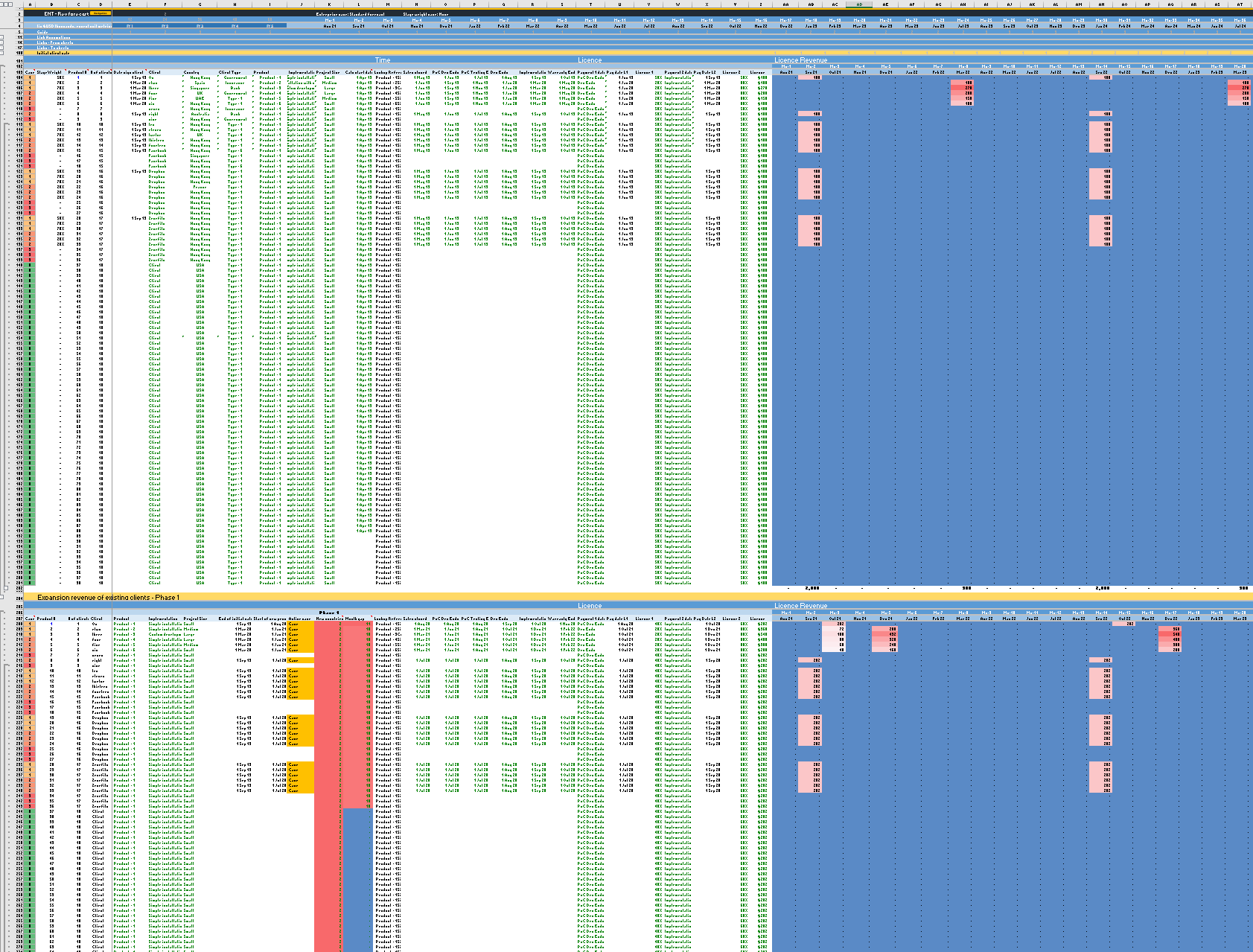

Enterprise revenue forecast calculations

- A lot of calculations: Ok, the image above is a car crash. It goes all the way to column PL (That's a lot...). I just want to illustrate it's big.

- Per month detail: The sheet is so fricking wide (Ends at column PL) because I do timing calculations on a monthly basis so every payment type is billed exactly when it is meant to (hence all the fricking input assumptions). Each revenue type from licence to PoC has 60 columns for each of initial and phase 1 and 2. Ok, the only thing I don't do is assume clients don't pay on time. I presume they like, hopefully do... I stop modelling when "Jesus takes the wheel" as I've warped your fragile mind already, so why do more?

- Big picture detail: There's a lot of logic put in. If you have 3 year bookings, they will be repeated and presented at the right time in summaries. Your billings come at the right point. We aggregate three phases of client revenue etc. Honestly, I have to look at formulas to remember all the things I built

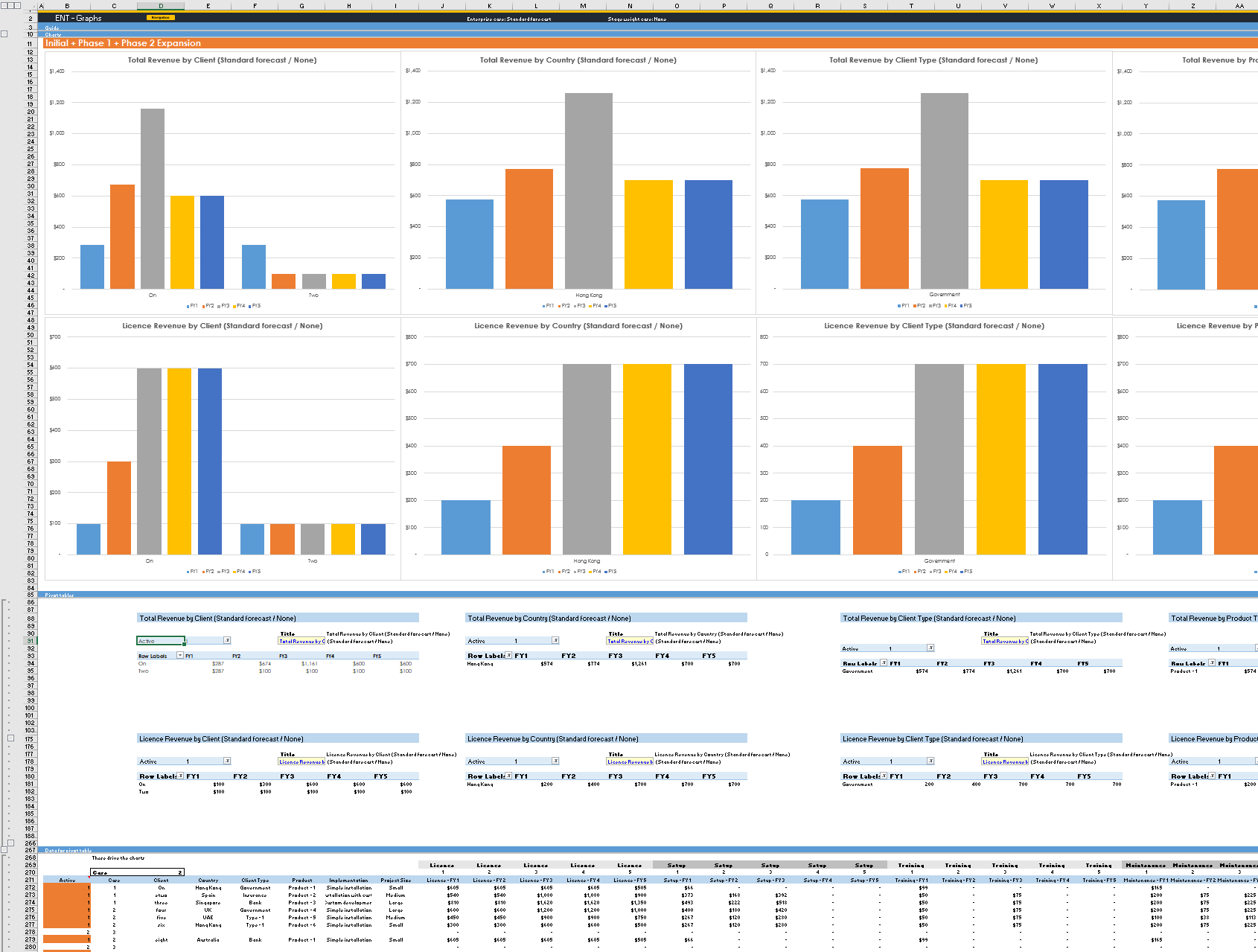

Enterprise Charts

- Pivot table charts: I made a smart chart structure to make the charts you want and to make them work with multiple scenarios automatically. The prior version you had to change scenarios in each pivot, but I figured out how to automate it... yay. This is one of the reasons I don't have a girlfriend...

- Macro button: I added a button which you can press to update the sheet so you don't have to think

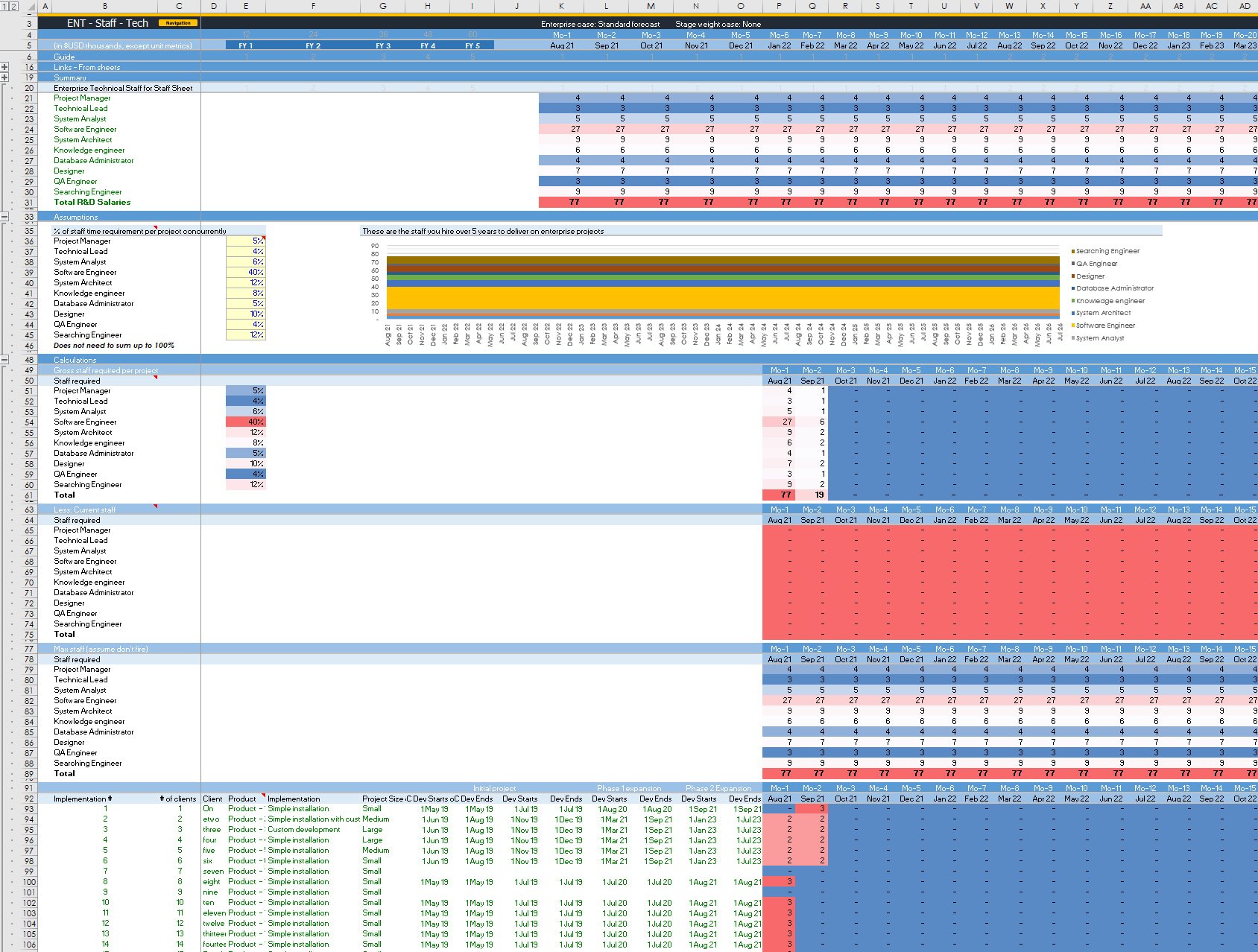

Enterprise staff requirement automated too

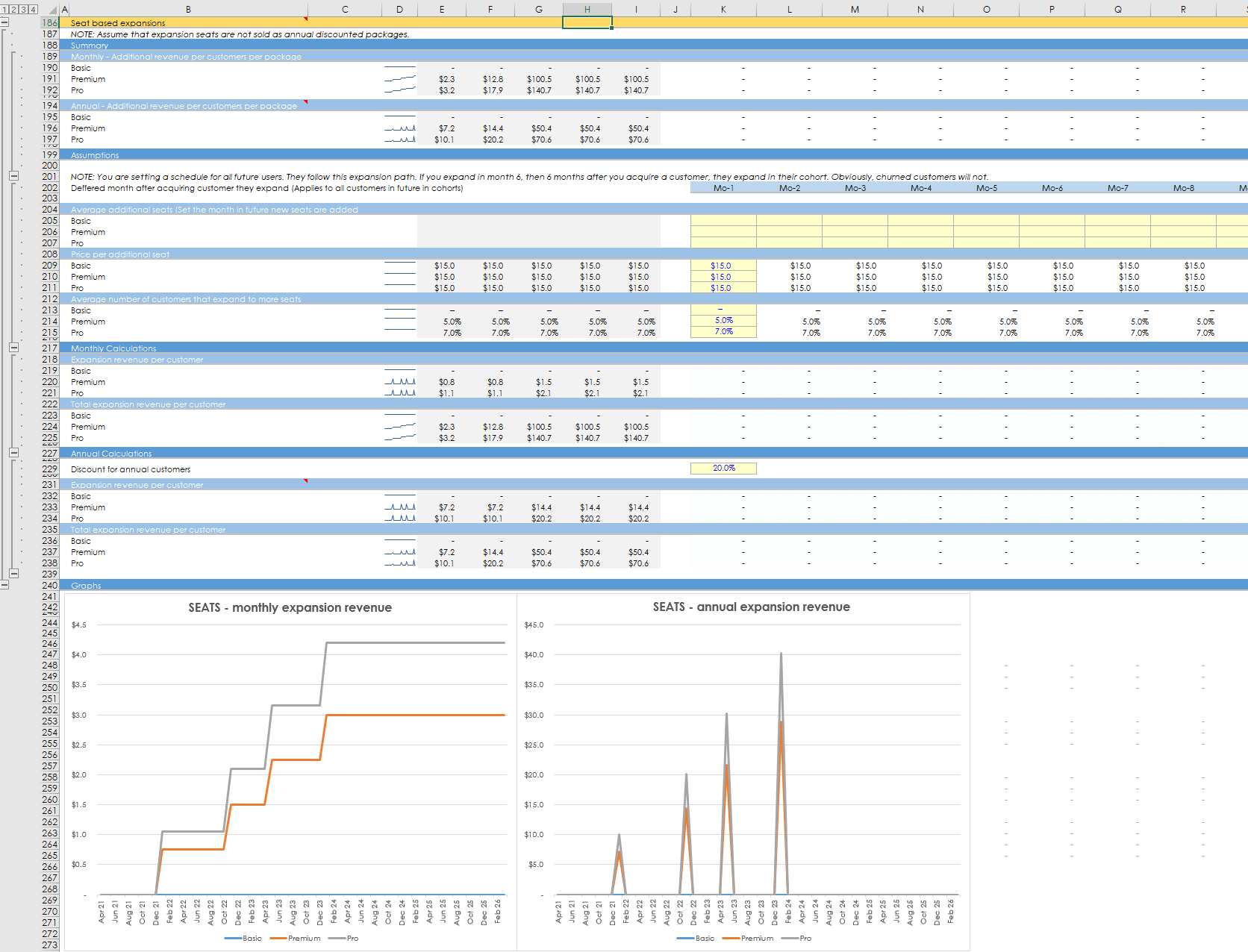

- Automated tech staff calculation: When I build this for myself, I was like... "what the feck am I going to do if I actually hit my targets? I mean holy crap, what is my staff requirement to deliver to clients?" So I made this sheet to help myself. All you need to do is set the % of time of a person you need to deliver on a client at peak, and the model does the math. We had 10 types of AI related engineers (set the titles and average cost in the staff sheet to your need) and based on forecasts the model will tell you. It changes for your scenarios too for case 1 and 2. This feeds into the staff sheet